Microcap Center

According to LSEG, only 29 companies have reported Q1’24 earnings so far, with the big banks reporting on the morning of Friday, April 12 not until either Monday, April 15 or Tuesday, April 16 appear in the data.An additional 41 companies are expected to Report this week.

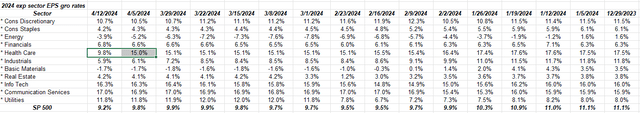

The point of all this is that “expected” Q1’24 S&P 500 EPS growth has fallen to +2.7% as of Friday, April 12 (down from last Friday, April 5 +5%), which may come as a shock to some, but this pattern is pretty typical.

In Q4’23, S&P 500 EPS expected year-over-year growth peaked at +10.9% on September 22, 2023, and then fell to +4.4% as of January 12, 24, while Real S&P 500 EPS growth ends up being +10.1% through late March 2024, which would be % or twice the expected growth rate.

“Expected” quarterly growth rates follow a typical pattern, as shown above. Ed Yardeni has long called this the “fishhook effect.” Quarterly growth starts to trend higher after 3-6 months as the actual quarter is about to be reported (Q1’24 is about to begin), S&P 500 quarterly growth bottoms out (usually before the busiest weeks) and then stabilizes Or move expected growth for the quarter typically 3-5% higher.

In other words, the S&P 500’s final earnings per share growth in the first quarter of 2024 may end up being between 5-7%. However, the “upside surprise” factor is important and has been covered here on this blog.

Here’s what might be interesting:

With the release of the first quarter profit report for 2024, please pay attention to how the expected industry earnings per share growth rate for the full year of 2024 changes.

In the table above, note the sharp decline in “expected” healthcare industry earnings (highlighted). This could be a bad estimate or the first sign of a tough year for the healthcare industry.

The healthcare industry had a tougher year in ’23, returning just 2% despite the impact of weight loss drugs. Healthcare companies including Johnson & Johnson ( JNJ ), Abbott Laboratories ( ABT ) and Intuitive Surgical ( ISRG ) are set to report earnings this week.

Speaking of Johnson & Johnson, this blog’s tech staff member Gary Morrow (at

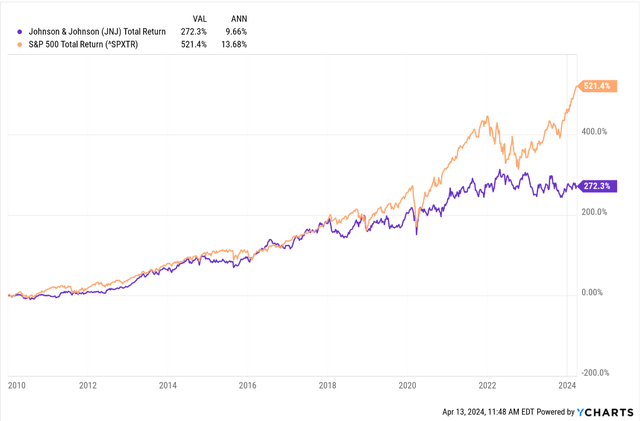

This performance chart shows how JNJ has lagged the S&P 500 over the past 13 years, but has beaten the S&P 500 by a slight margin (i.e., a few basis points) since January 1, 2000.

Johnson & Johnson may be suffering from what’s known as “conglomerate fever.” The company, which survived the Tylenol murder scare in the early 1980s (and became a Harvard case study in crisis management), has declined severely over the past decade.

JNJ’s consumer business has lagged for years while the medical device and diagnostics business grew (pharmaceuticals also lagged), and as MDD slowed and consumer brands began to recover, those segments reversed course, but the blog Stopped following JNJ in 2018, i.e. updating financial and profit forecasts, and not keeping up with the story.

For what it’s worth, I’m surprised this healthcare giant isn’t being broken up. (Still holds 1 JNJ position in an account purchased in 2012.)

In the spreadsheet above, growth expectations for the financial sector have improved since December 31, while expected growth for the industrial sector appears to have been revised down from +12% to +6%.

Goldman Sachs (GS) and Schwab (SCHW) are scheduled to release reports on Monday, April 15, 2024, while Netflix (NFLX) will be the other earnings report this blog will be following.

S&P 500 Index Data:

- Quarter 4 expectations have once again risen to $251.81 from $251.58 last week, with the only unusual aspect being that the pattern is typically a lower correction rather than a higher one.

- This week’s P/E dropped 20.3 times compared to last week’s 20.6 times.

- The S&P 500 earnings yield rose again to 4.91%, rising for the second consecutive year.

- With a handful of companies reporting Q1’24 earnings, upside surprise factors are not yet important. EPS grew 20% last week and 13% this week, but take that with a grain of salt.

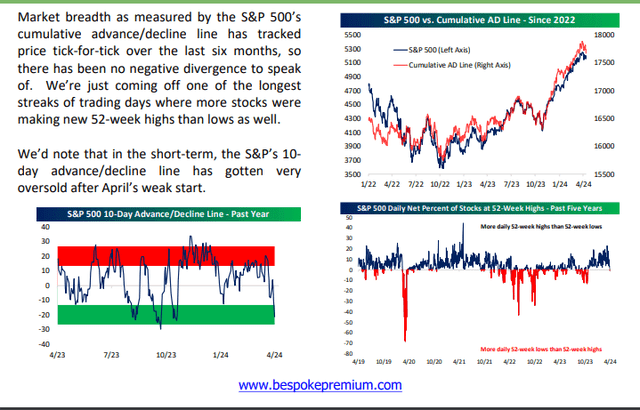

This chart from Bespoke shows the breadth of keeping pace with the market’s rise (always a plus), while the 10-day up/down is now very oversold.

Summary/Conclusion: S&P 500 earnings won’t get really interesting until the week of April 22, but there were some interesting reports this week. The financial sector typically releases reports first, and so it is, by the end of this week, more than 50% of the financial sector will have reported.

Another earnings report will be released tomorrow.

In fact, there’s no reason not to expect another good earnings season, especially given the U.S. economy and inflation.

None of this is advice or recommendations. Past performance does not guarantee or imply future results. Investing may result in a loss of principal, even in the short term. Market volatility can change rapidly. All S&P 500 EPS and revenue data come from the London Stock Exchange Group (LSEG).

thanks for reading.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.