Tzido/iStock via Getty Images

paper

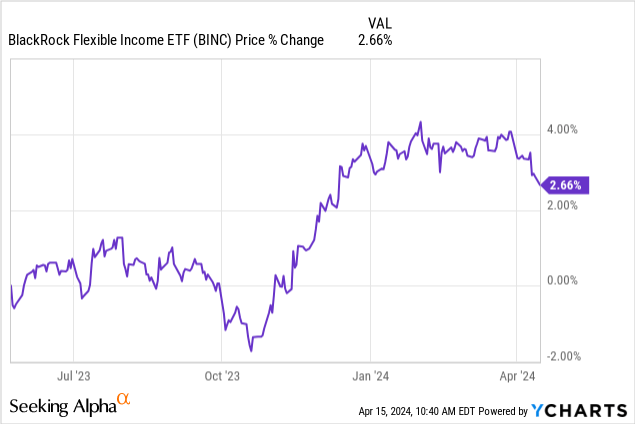

We cover the BlackRock Flexible Income ETF (NYSE: pink) shortly after its founding about a year ago.In our original article we described the intentions of the new fund and asset manager The macro environment is favorable for fixed income funds. Against the backdrop of a sharp rise in interest rates over the past few weeks, we’ll be revisiting this name as it approaches its one-year anniversary.

In our article, we will highlight why today’s environment is ideal for taking a long position in BINC.

Market digests expectations of Fed rate cut

Over the past few weeks we have seen a dramatic repricing of rates:

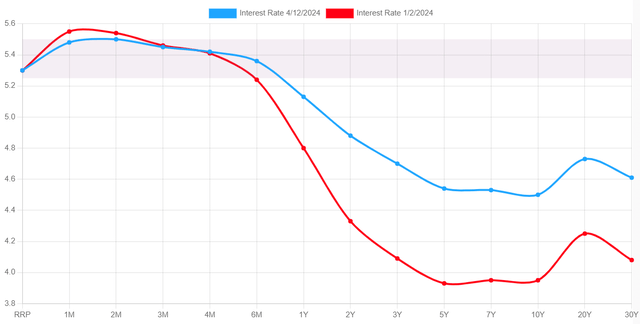

Yield Curve (ustreasuryyieldcurve.com)

The blue line in the above figure represents the current yield curve, and the red line represents the current yield curve. The beginning of the year. Note that above the 4-month horizon, all points in the curve are much higher, especially in the so-called “belly” of the curve, which is the 2- to 10-year horizon.

Why is the yield curve shifting upward? simple. The data was much stronger than expected, with inflation rising slightly rather than falling. Markets have priced in six rate cuts in 2024 to just one or two, depending on which investment bank made the forecast.

It’s fascinating how quickly market participants can swing from one extreme to the other in a short period of time. While six cuts at the start of the year may seem like a lot, we believe no cuts in 2024 also represent the other extreme. Oddly, we also see participants starting to talk about rate hikes and the 6% yield number again. We are in the camp of not raising rates further, the Fed has been very clear on that, and the political impact of further raising rates in an election year is difficult to overestimate. Our base case is for one rate cut in the summer, and if data remains strong, the Fed will leave it unchanged for the rest of the year. Under this basic scenario, the Fed showed its intention to cut interest rates while still maintaining high interest rates and overall restrictive policies.

Bond funds are attractive, especially active funds

In today’s environment, bond funds are attractive, especially for long-term buy-and-hold investors, given the significant movements in interest rates. BINC stands out given its multi-sector portfolio and active positioning strategy. Active funds can easily trade among specific issuers and names as corporate actions evolve, and large asset management platforms like BlackRock can provide the best foundation.

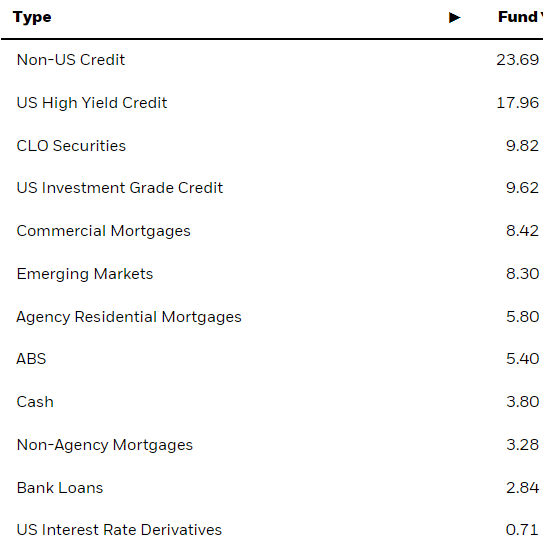

In addition to traditional U.S. high-yield bonds, the fund currently has a large chunk dedicated to emerging market credit and mortgage bonds:

Holdings (Fund website)

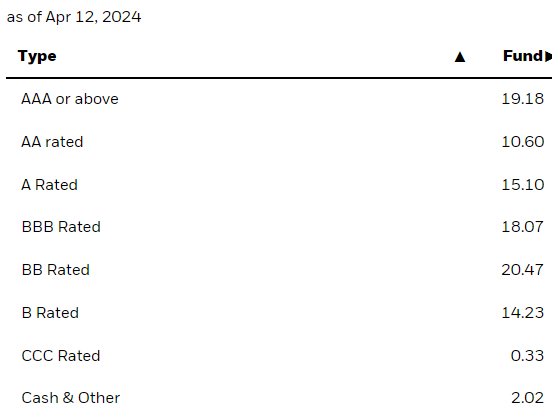

As a true multi-sector ETF, this instrument takes positions across the entire credit spectrum, with a quasi-uniform distribution:

Rating (fund website)

The AAA designation represents 19% of the fund (mainly MBS bonds), with the remainder of the credit rating range alternating between 10% and 20%. Note that approximately 35% of holdings are below investment grade.

The fund has a broad mandate to change its focus and positioning as the portfolio managers see fit.

High total return, low risk

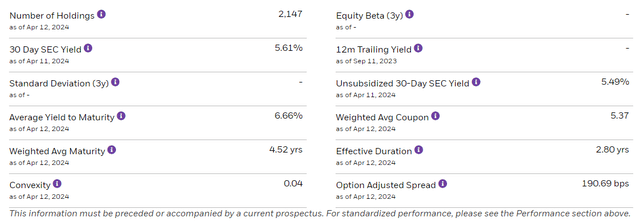

The beauty of actively managed bond funds is that they don’t need to deliver eye-watering yields to achieve their goals. BINC’s SEC yield is 5.49%, but its total return last year was over 7%:

BINC Total Return (Seeking Alpha)

Interestingly, BINC has outperformed another most popular bond fund, the JPMorgan Chase Income ETF (JPIE), since its inception. We have a buy rating on JPIE. Despite the recent surge in yields, BINC has achieved almost 2% “alpha” through the trading wisdom of its portfolio managers.

The fund has a shorter duration of 2.8 years and an OAS of 190 basis points:

Yield and Duration (Fund Website)

After almost a year of performance history, we can say that BlackRock’s management team has done an excellent job and the fund will deliver market alpha in addition to yield and duration.

On the risk side, BINC also performs well:

If we chart its performance, we’ll note that BINC is down a very small -2% since inception. The fund thus generated a total return of more than 7%, with a drawdown of just 2%. Those risk/reward numbers are enviable, while many bond funds perform much worse. Active fund management is key to risk management, with portfolio managers able to direct funds to invest in the most viable assets at any point in time.

When considering fixed income, investors must be aware of drawdowns. There is no point in buying an asset that yields 8% but has a drawdown of -25%. The risk/reward is non-existent. Conversely, an asset with an 8% yield but a -10% drawdown is attractive, and BINC’s risk/reward analysis is a home run.

What does the future hold for BINC?

We like the fund, its construction, and its active management. From a pure bond math perspective, investors should expect a yield of 5.5% plus a duration of 2.5% over the next 12 months. Given the huge active management performance, we would add another 1.5% to Generation Alpha, thus projecting total returns of over 9.5% over the next 12 months, with limited drawdowns.

Our expectations above are based on our rate base case, which was outlined in Part I of this article. If we see a sudden deterioration in economic data, the Fed will be forced to cut rates faster and deeper, and BINC will benefit. However, some of the duration impact in this scenario would be offset by wider credit spreads.

in conclusion

BINC is a fixed income ETF. This fund comes from the BlackRock platform and represents a positive approach to multi-asset bond ETFs. Despite the recent surge in yields, the instrument still delivered total returns of more than 7% last year. As a result, BINC successfully generated alpha from its active management and outperformed JPIE. We expect BINC to continue to outperform and generate market alpha exceeding its yield and duration components. Given the recent surge in yields, we find the current macro environment to be ideal for a long position in BINC, with a projected total return of 9.5% over the next 12 months.