Justin Paget

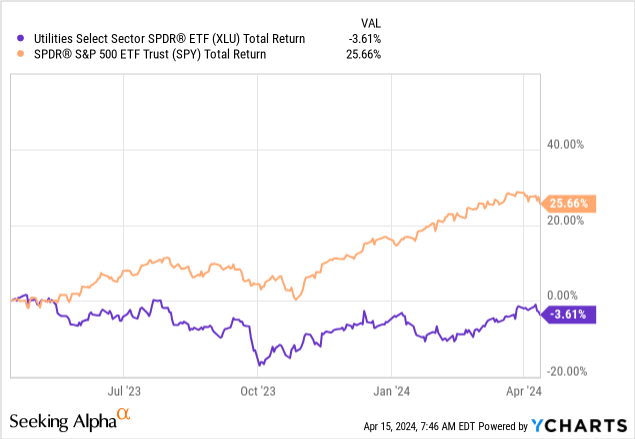

Since I last covered the Utilities Select Sector SPDR Fund ETF (NYSE:XLU), the fund’s performance was essentially flat.However, the near-term outlook does not look promising, and with this article, I am downgrading XLU to Hold Rating, consistent with lower upside potential. Last time, I suggested that the utilities sector could catch up with the performance of the S&P 500 as inflation slows and the high interest rate environment ends. But thanks to the outperformance of technology companies, the sector is still far from meeting investor preferences. In turn, utilities posted unexpectedly negative earnings growth last quarter, and this is likely to be the case in the first quarter of 2024 as well.

Investment negotiation

XLU provides contact Utilities Select Industry Indexwhich primarily includes leading U.S. utility companies engaged in distribution Electricity, gas, water and steam.

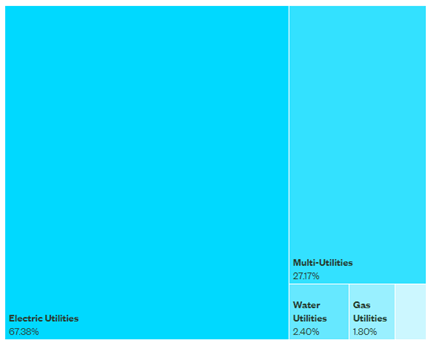

Fund Industry Allocation (SSGA)

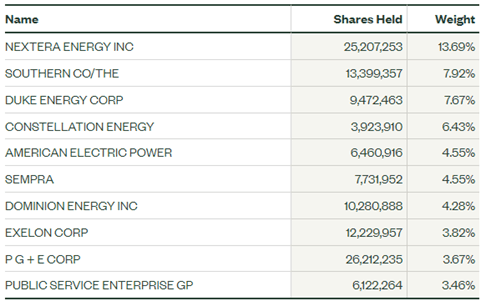

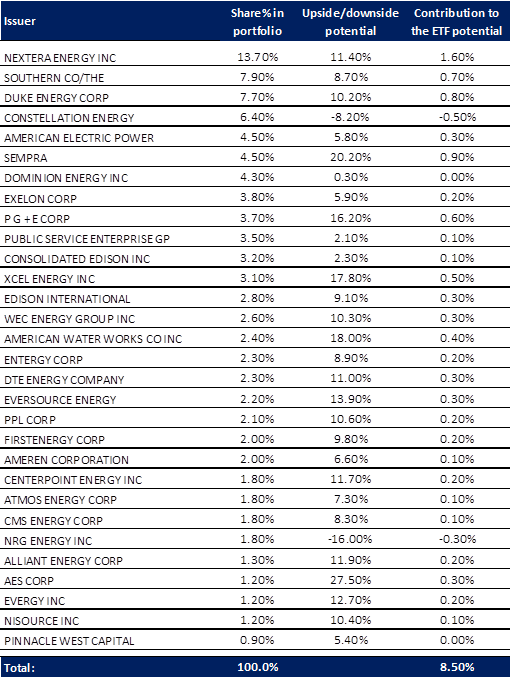

The fund’s sector allocation has remained almost unchanged since the last report, with a primary focus on electric utilities, which saw its share rise slightly to 67.4%, followed by mixed utilities at 27.2%. The ETF remains highly concentrated in the top five positions, accounting for 40% of the portfolio, with the following distribution: NextEra Energy (NEE), accounting for 13.7%; Southern Company (SO), accounting for 7.9%; Duke Energy (DUK), accounting for 7.7%; Constellation Energy (CEG) has 6.4%; and American Electric Power (AEP) has 4.5%.

Top 10 Holdings (SSGA)

The fund, with total assets under management of $11.69 billion as of April 12, 2024, is offered to investors at a reasonable cost of 0.10% per annum. However, AUM value has declined by approximately $3 billion since my last article due to net investor outflows.

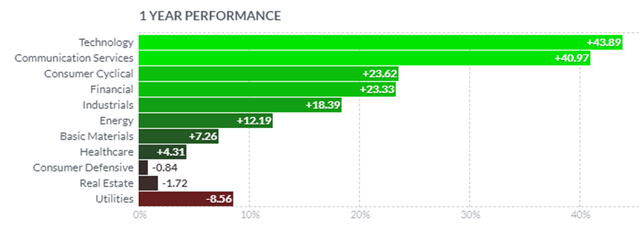

The main reason for this phenomenon is the dismal performance of the Utilities sector over the past 12 months, with the sector down 8.56% and being the main laggard.

Department Performance (finviz)

As I’ve written before, utility stocks continue to lag technology stocks, which have surged on strong performance from major chip makers. XLU’s trailing 12-month total return dynamic recorded a setback of 8.6%, which is better than the industry as a whole, but also well behind the broader S&P 500 index, which has gained 25.7%.

Another point is the utility company’s weak earnings results. The industry’s earnings per share fell sharply in the last quarter of last year, with profits unexpectedly falling 3.9% (according to LSEG).Looking ahead, this past winter was hottest on recordwhich did not provide encouraging first-quarter 2024 earnings results.

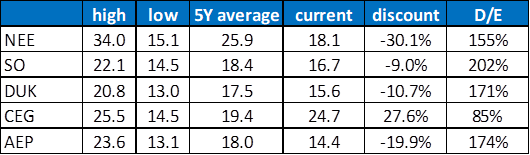

At the same time, judging from the valuations of the fund’s top five positions, except for CEG, their current trading prices are at a significant discount to the five-year average forward price-to-earnings ratio.

Valuation of the top 5 positions of the fund (Seeking Alpha)

Looking ahead, power consumption conditions are likely to benefit power companies starting in the second quarter due to the early start of summer, which is expected to bring hottest temperature. In addition, the transition to green energy is gaining momentum, with the United States setting a goal of reducing carbon emissions by at least 50% below 2005 levels by the end of this decade. In addition, record electric vehicle sales in 2023 and the continued expansion of data centers will provide sustainable growth in power demand in the coming year.

in conclusion

I will use the same model to calculate XLU’s upside potential. Based on the weighted average price target for the fund’s securities, divided by the Seeking Alpha screener, XLU’s upside potential should be 8.5%, nearly half of my previous estimate, which no longer implies a Buy rating.

Valuation model based on consensus estimates (Seeking Alpha)

NEE contributes the largest upside potential among fund positions, at 1.6%. This isn’t surprising, as the company trades at a 30% forward P/E discount to its 5-year average and has a track record of surprising profitability. Aggressive expansion of renewable energy capacity, benefits from the inflation reduction bill, economic growth in Florida, and the development of hydrogen technology are the key drivers of NEE’s growth, making the stock a top pick right now.

To sum up, the utility sector remains far away from the focus of U.S. stock market investors, with attention focused on fast-rising technology stocks. The high-interest rate environment continues to put pressure on utilities as they are heavily indebted. The sector’s earnings surprise turned negative and is likely to do so during the current earnings period, which is why I downgraded XLU to “Hold” from “Buy.” However, there is reason to believe that the start of the Fed’s rate-cutting cycle could have a positive impact on utility companies’ financial performance. Lower borrowing costs will reduce debt burdens, while conservative investors may return to the U.S. utility dividend story after government bond yields fell.

risk factors

Continued concerns about inflation have forced the Federal Reserve to slowly cut interest rates, which would be detrimental to utilities with high debt levels. This could also put pressure on capital spending plans. In addition, there are rumors that potential changes This White House move could have a negative impact on the decarbonization of the U.S. economy and green energy ambitions.