RobertDupuis/E+ via Getty Images

paper

Geopolitical volatility continues to intensify. Businesses that thrive in such an environment are the shipping, energy and defense industries. I discuss shipping extensively in my article.Now, it’s time to venture into two of my favorite Industry: Energy and Defense. Today’s article discusses General Dynamics (NYSE:GD), one of the major U.S. defense contractors.

GD is one of two companies building nuclear-powered submarines for the U.S. Navy (the other is Huntington Ingalls (HII)). It also has interests in aerospace, combat systems and technology. Gulfstream, the business jet manufacturer of the same name, is also part of GD’s portfolio.

The defense business is one of the toughest. It’s hated, heavily regulated, and dependent on one customer: the government. Moreover, it requires a highly skilled workforce, and without significant R&D spending, sooner or later it will cease to exist.

GD, Lockheed Martin (LMT) and Northrop Grumman (NOC) are the three giants in the US defense industry. GD is one of my favorite defense industry companies because of its excellent balance sheet, diversified business portfolio, and solid dividend. Today, I will analyze the results of GD 2023, review the geopolitical situation, and discuss the valuation of GD.

Geopolitical volatility and the defense budget

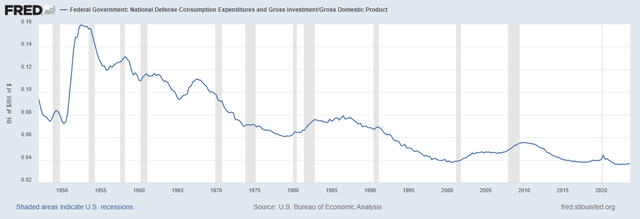

The world is moving from unipolar to multipolar, which means an increasing number of conflicts and rising defense spending. U.S. defense spending as a share of GDP has dropped below 5%.

fred

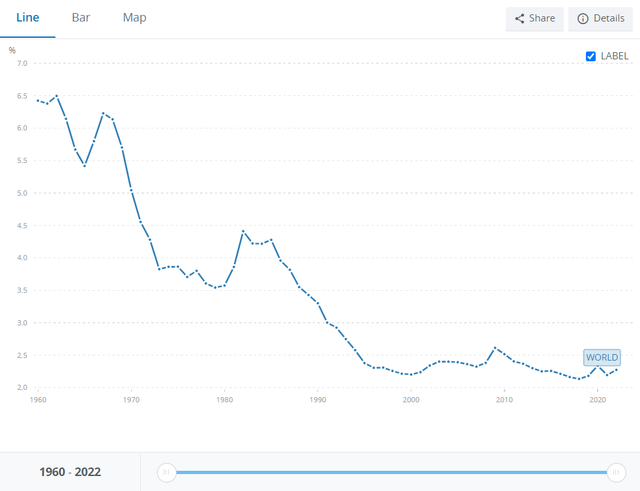

This compares with more than 10% during the Cold War. The World Bank’s chart below paints a similar picture of world defense budgets versus gross domestic product.

world bank

The number of agency conflicts has increased significantly over the past few years. I believe this is the new normal for great powers to project power into third countries and use them as war zones. In short, I expect the defense budget to double between now and the end of the decade. This means defense companies will become cash machines.

operations

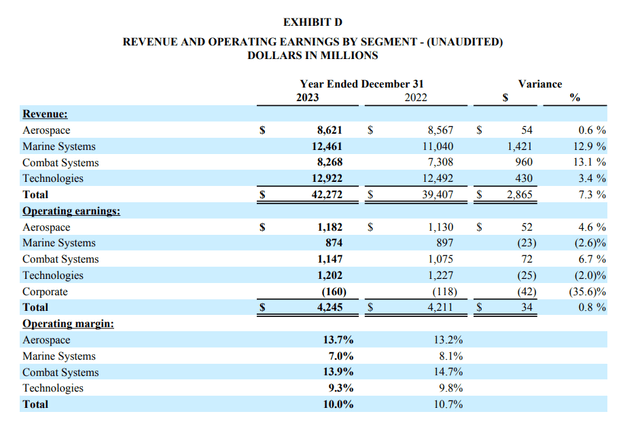

GD has four operating segments: Aerospace Systems, Combat Systems, Marine Systems and Technology. The technology segment accounted for more than a third of the company’s revenue for the second year in a row, closely followed by the marine segment. Aerospace and combat systems each contribute about 20% of annual revenue.

The GD Aerospace division produces Gulfstream jets and was acquired in 1999. The business jet industry has also benefited greatly from increasing geopolitical volatility. Unlike the defense industry, it has private clients, allowing the company to diversify its revenue streams.

Electric Boat, a subsidiary of GD Maritime, builds Ohio-class nuclear submarines. In 2020, electric boat construction begins Columbia class Submarine, Successor of Ohio. The goal is to build 12 Colombian submarines. The company’s Land Systems produces the U.S. Army’s M1 Abrams main battle tank. The M1 is widely adopted by militaries around the world: Australia, Saudi Arabia and Poland are just a few examples.

In 2023, GD’s operations face two major obstacles: labor shortages and supply chain disruptions. The company mitigated the negative impact to some extent. During the last earnings call, GD CEO Phebe Novakovic discussed this topic. She mentioned improvements in various departments of the company and emphasized that GD had developed employee training programs.

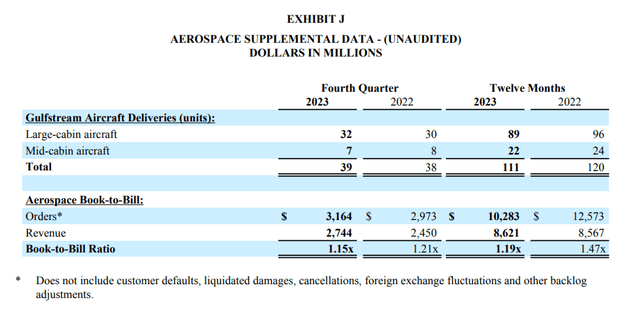

Supply chain issues still persist, but their impact is waning.The aerospace sector remains most affected.gulf stream G280 built at a facility near Tel Aviv. GD expects delays in G280 deliveries, resulting in a reduction in the number of aircraft delivered. Nonetheless, GD reported strong deliveries of 39 aircraft in Q4 2023, compared with 24 in Q3 2023 and 25 in Q2 2023.

The following table comes from Guangdong 2023 The report shows Gulfstream’s annual and quarterly deliveries.

GD 2023 Q4 Report

In 2023, GD’s aerospace segment operating margin was 13.7%, 50 basis points higher than the fiscal 2022 figure. Orders reached US$10 billion for the third consecutive year, with an order-to-bill ratio of 1.2. Air China’s aircraft service revenue increased by 8% compared with the same period last year. As of the end of 2023, the aerospace sector’s order backlog stood at $20.5 billion.

Last month’s highlight was the long-awaited Certification Gulfstream G700. On March 29, 2024, the company announced that the G700 had received FAA (Federal Aviation Administration) type certification.

In 2023, the revenue of the GD combat system department will be US$8.26 billion, an increase of 12% compared with 2022. In the fourth quarter of 2023, Combat Systems signed several contracts: $230 million for the maintenance and modernization of Spain’s Leopard fleet; a $200 million contract to upgrade M1 Abrams tanks; a $230 million contract with the Swiss Army $100 million contract for the Piranha armored vehicle. In February, GD announced Steyr won the award A contract worth $1.3 billion to build 225 Pandur armored vehicles for the Austrian Army.

Marine Systems’ revenue will hit a record yearly increase and will reach $12.4 billion by 2023. The maritime sector reported a backlog of $45.9 billion in the fourth quarter of 2023, accounting for 49% of the company’s total. GD was awarded $840 million to maintain and upgrade two DDG-51 missile destroyers.

In 2023, the technology sector’s revenue will be US$12.9 billion, an increase of 3.6% over 2022. GD signs contract with Indian Health Services for electronic health records system worth up to $2.5 billion. GD reports a $975 million contract with the U.S. Army to provide mission command training.

finance

In 2023, the order backlog reached a record $93.6 billion, with an order-to-bill ratio of 1.1. In 2023, GD achieved revenue of US$42.2 billion and operating profit of US$4.25 billion. In comparison, in 2022, GD achieved revenue of US$39.4 billion and operating profit of US$4.2 billion. The departments with the best year-over-year performance were marine systems and combat systems, with revenue growing by 12.9% and 13.1% respectively. From the perspective of operating profit margin, the situation is different.

GD 2023 Q4 Report

Only the aerospace segment has higher year-over-year profit margins, rising from 13.2% in 2022 to 13.7% in 2023. Earnings (diluted) $12.02.

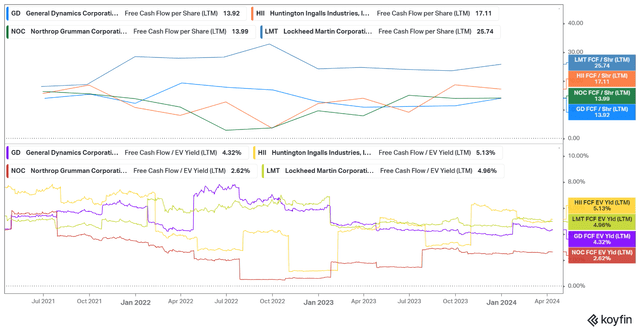

In 2023, GD achieved operating cash flow of $4.7 billion, an increase of $107 million from 2022. , NOC, HII and LMT FCF yields and FCF per share.

coyfin

Although GD still offers an adequate FCF yield of 4.3%, it still lags behind its peers. Free cash flow has been relatively stable, fluctuating in the 4-8% range over the past three years, but I expect stronger performance in 2024.

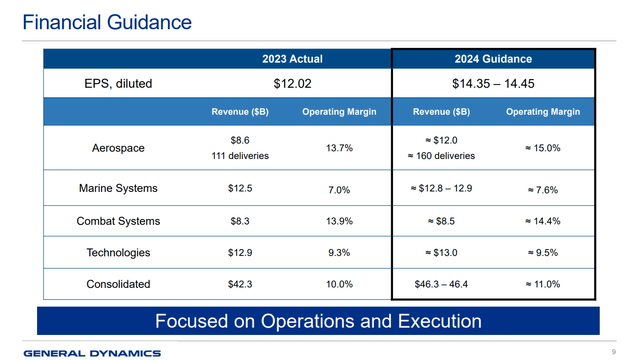

The table below shows forecasts for 2024.

GD 23 Years Season 4 Presentation

Profit margins in each segment are expected to grow, with earnings per share reaching $14.35-$14.45, an annual increase of 20%. Global defense budgets will continue to rise given rising uncertainty in the Middle East and Ukraine. In particular, the United States is funding military operations in Ukraine and Israel.In addition, the United States has also approved a military aid program for Taiwan. All in all, I hope GD delivers on its promises.

dividend

GD payment dividend Yields are mediocre compared to shipping lines. However, the company excels in other areas as well – dividend consistency and safety.

Seeking Alpha

Guodian’s dividend yield is in line with its peers, at around 2%. Only LMT’s FWD yield is close to 2.8%. GD’s dividend yield is 43.9%, similar to LMT but higher than NOC (31.5%) and HII (29.3%).

balance sheet

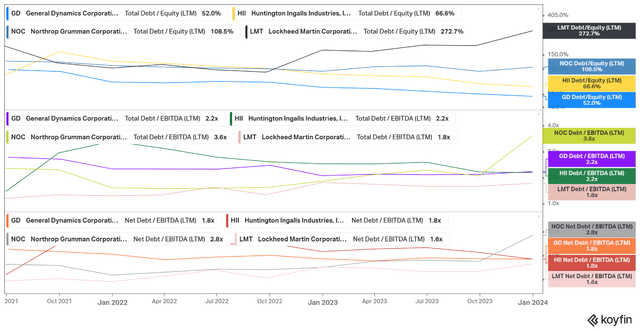

As of December 31, 2023, GD reported cash of $1.913 billion, long-term debt of $8.754 billion, and total debt of $11.083 billion (including $1.497 billion in lease agreements). In fiscal 2023, GD delivered operating cash flow of $4.706 billion and incurred net interest expense of $343 million. GD maintains a superior balance sheet among the three major defense contractors (NOC, LMT, GD).

coyfin

The company’s total debt-to-equity ratio is 52%, the lowest in the group. Its direct competitor Marine Systems HII has similar liquidity and solvency metrics.

Valuation

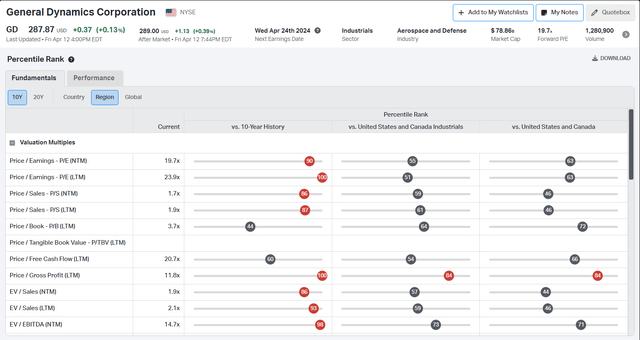

GD’s stock price is up 12% year to date and 29.7% year-on-year. Is it still cheap?

coyfin

At first glance, LMT is expensive. It trades in the higher percentile compared to the 10-year average, US and Canadian industrials, and global equities. However, GD’s prices are reasonable compared to its peers.

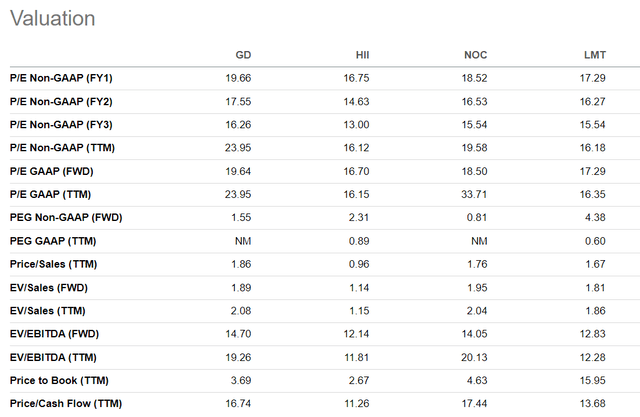

Seeking Alpha

GD is trading at 2.08 TTM EV/Sales and 19.26 TTM EV/EBITDA. HII scores were lower, 1.15 and 11.81 respectively. Looking at the TTM and FWD multiples, we can see that GD is not that expensive. GD’s TTM EV/EBITDA trades at 19.26, while FWD EV/EBITDA trades at 14.7. Considering the forecast for 20% annual EPS growth, this number seems reasonable. To sum up, GD is not cheap. It’s reasonably valued, with ample upside potential and relatively low downside risk.

Important points for investors

GD operates in industries that benefit most from rising global uncertainty. The company is one of two defense contractors that builds nuclear submarines, builds Gulfstream business jets and has a thriving technology sector. What’s not to like about it?

Like every paper, GD has risks. Let’s start with special risks. Judging from capital structure and liquidity indicators, the company’s financial position is good. As a defense contractor, GD has a pretty long moat. Therefore, it is unlikely that a new competitor will suddenly appear and usurp GD’s position. Setting up a defense industry enterprise requires highly trained personnel, takes time, requires large amounts of capital, and has to overcome endless legal hurdles.

The defense industry is recession-proof and relatively indifferent to stock market movements. 24M Beta value is 0.68. G.D. For comparison, TSLA’s 24M beta is 2.44 and AAPL’s is 1.28. Of course, if there is a massive market crash, Guodian stock’s share price will also fall.

Last summer, I started to open a position in GD and used the retracement to increase my position along the way. I expect the stock price to cross the $300/share threshold in the coming quarters, so I give GD a Buy rating.