Sean Short

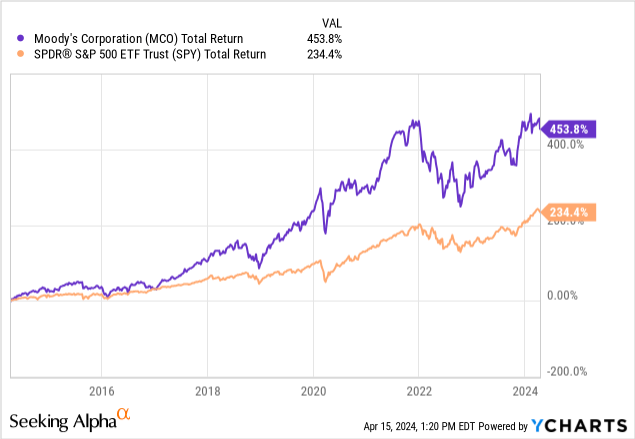

When many people hear this name Moody’s Corporation (NYSE:MCO), they typically think of a company whose business model is limited to joint ventures with a handful of private players. However, the company is much more than that.In fact, Moody’s is extending With a comprehensive business model covering components such as credit ratings and analytics platforms, its operations reach most corners of the world.

Our analysis here conveys some of our latest findings on Moody’s cyclical and long-term outlook. let’s start.

basic research

Moody’s ratings business is perfectly positioned

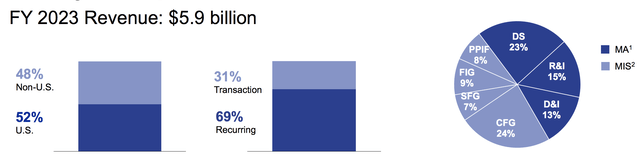

Moody’s Investors Service provides ratings on debt issued by companies and governments. The unit accounts for more than half of Moody’s revenue portfolio, meaning its performance is critical to Moody’s stock performance.

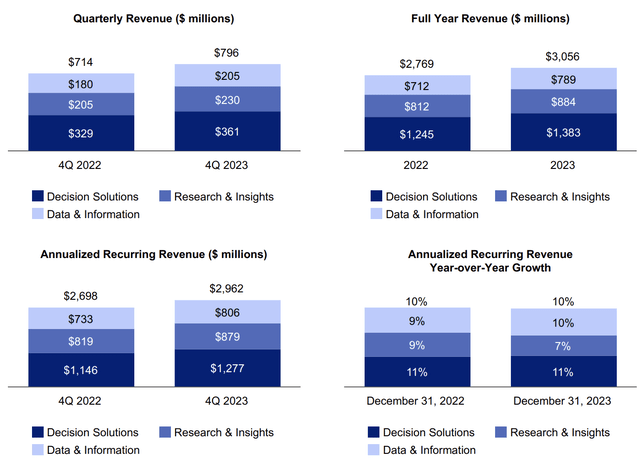

The chart below depicts Moody’s segment revenue.

Moody’s

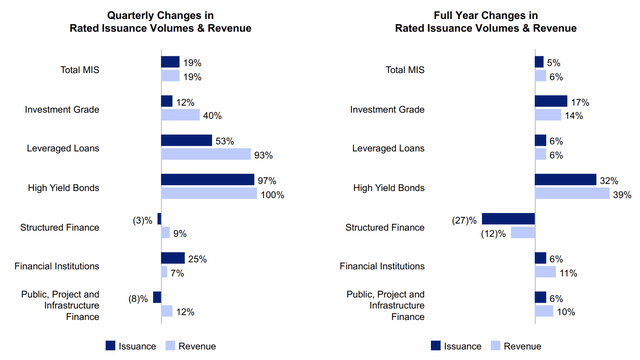

Moody’s announces fourth quarter results Weaker than expected as the company missed its EPS target 13 cents. However, we found some positives in the company’s quarterly results, which we think will return in the coming quarters.

Moody’s

Why do we believe better days are ahead for Moody’s Management Information Systems division?

First, we believe the outlook for global interest rates will be lower for the remainder of 2024 and early to mid-2025 as inflation weakens.Of course, as the United States has shown March CPI reportWe still see some happening, such as higher-than-expected U.S. inflation over the medium term; however, the year-over-year trend line for global inflation is lower, and we believe this trend will continue due to natural economic cycles.

Narrator: This is a third-party reference to the outlook for interest rates. click this link.

Lower interest rates may lead to higher investment-grade corporate issuance, as high-quality companies may be able to lower the cost of capital by issuing debt. Moody’s has experienced a 12% increase in higher investment grade corporate issuance business in the fourth quarter and a 13% increase in revenue.

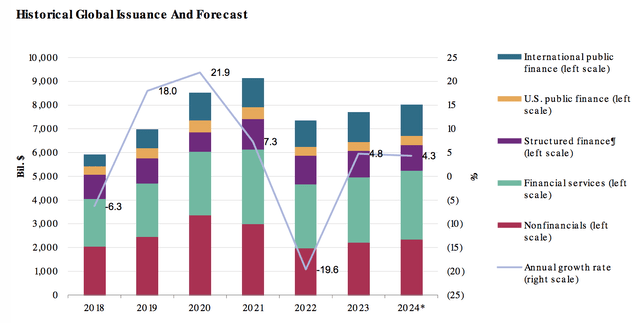

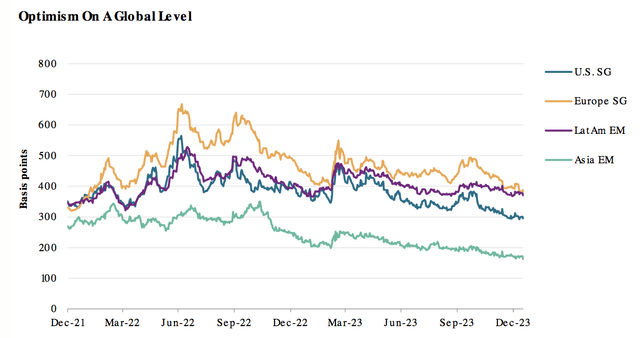

Additionally, as shown below, Refinitiv, Green Street Advisors and S&P Global (SPGI) predict International public finance issuance will increase throughout 2024. This could be a significant contributor moving forward.

S&P Global

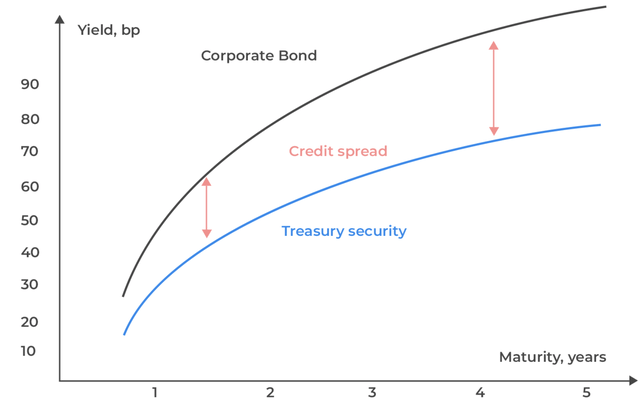

The big thing in the room is like a high-yield bond issuance. Moody’s high-yield bond issuance volume and revenue increased 97% and 100%, respectively, in the fourth quarter, indicating that most of its business comes from the junk bond space. Many, including ourselves, worry that when interest rates shift, credit spreads could spike, causing junk bond yields to rise and the willingness to issue less. However, S&P Global’s sample data shows that selection-adjusted spreads are expected to decrease through the remainder of 2024, providing room for high-yield bonds.

S&P Global

Long-term drivers of analytics

Moody’s ratings business reflects sustainability. However, we believe Moody’s analytics division is fundamental to its long-term growth.

I’ve inserted a chart below illustrating the different features of Moody’s Analytics. It is impossible to explain every function in an article of about 1500 words. So, I would summarize the segment like this: Moody’s Analytics is a non-ratings business that provides a platform, knowledge base, and data to end customers interested in credit ratings. It is a vertically integrated segment that is aligned with modern asset management and assists stakeholders in the decision-making process.

Moody’s Analytics

Adds Moody’s Decision Solutions $361 million Fourth-quarter revenue increased 10% year-on-year. We see great potential for this product as it provides clients with essential risk-based decision-making tools (such as scenario analysis) and integrates into the growing field of quantitative investment management.

In addition, Moody’s fourth-quarter data and information revenue increased 14% year-on-year to US$205 million. This section is incorporated into the decision-making section above as it provides the data for this section. Furthermore, this segment also goes beyond providing scarce data to end customers. Our optimism stems from the difficulty of obtaining data from certain geographies such as emerging markets, frontier markets and thinly traded corporate debt markets – Moody’s has the wherewithal to enter these areas and provide the necessary data to clients.

As for research and insights, we don’t see a significant competitive advantage here, but areas like ESG research can add sustainable revenue in the future.

Moody’s Analytics Revenue (Moody’s)

Finally, I want to make an anecdotal point: money management and financial research are democratizing. The field is more fragmented than it was a few decades ago, so Moody’s deal flow isn’t limited to large financial institutions. Moody’s Analytics will play a key role in the ongoing fragmentation process and may benefit from the broader end market.

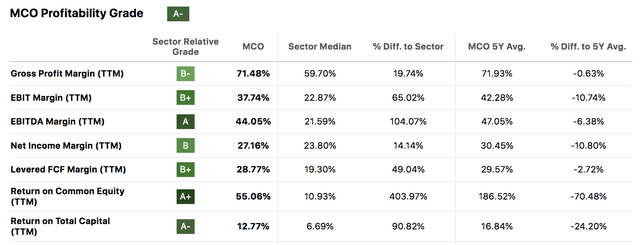

Concentrated market-driven profit margins

Moody’s credit ratings business operates in a concentrated market. As far as we know, most corporate debt is rated by the three major credit rating agencies: Moody’s, S&P Global, and Fitch. Therefore, the company operates in a market with extremely high barriers to entry, as shown by the company’s 5-year average profit margin in the chart below.

Seeking Alpha

Moody’s Analytics operates in a more competitive market, which means margins are likely to be compressed. However, the segment provides diversified revenue, allowing Moody’s to smooth its income statement.

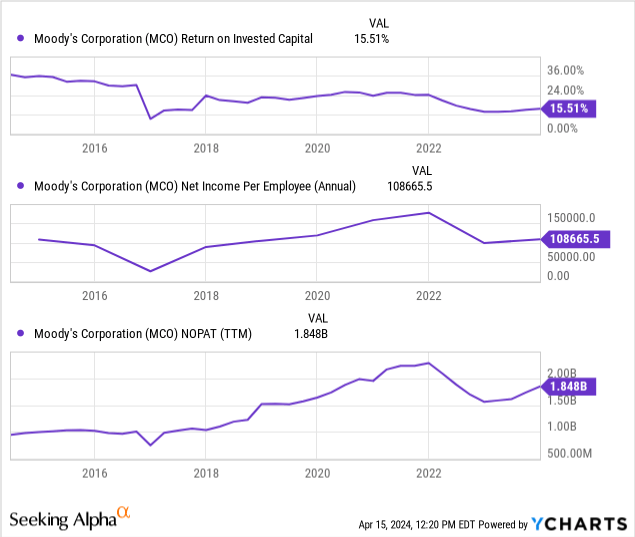

Some income statement-based metrics are briefly discussed below.

- return on investment: Moody’s high return on invested capital is encouraging, and the ROIC metric is often used to measure a company’s competitive advantage in the industry. This thought process links investment amounts to gain profitable market share.

- Nopat: Growing net profit after tax sometimes reflects continued value-added by management.

- Net income per employee: Finally, Moody’s has high net revenue per employee, reflecting the utility derived from its employees.

The variables above are vague, but we think they’re indicators worth noting.

Valuation and Dividends

A Price-to-earnings ratio expansion formula Used to value Moody’s shares because we believe the company’s maturity and modest depreciation and amortization enable a bottom-line valuation. Additionally, Seeking Alpha’s platform provides us with a comprehensive range of EPS forecasts from leading analysts – up to 19 forecasts per quantile for our given opportunity set.

We decided to focus on a December 2025 price target, as this timing is more or less consistent with our fundamental outlook.

Now, is Moody’s stock undervalued? Our interpretation of the P/E expansion formula suggests that Moody’s stock is undervalued. For context, the worst-case scenario results in a price target of $384 (the stock is trading around $378 as of this writing).

author’s works (Seeking Alpha)

Although the model we have chosen considers Moody’s stock to be undervalued, we encourage readers to consider other perspectives before making a final investment decision to ensure a holistic analysis. We decided to use a single metric for absolute valuation, but our view is not necessarily correct.

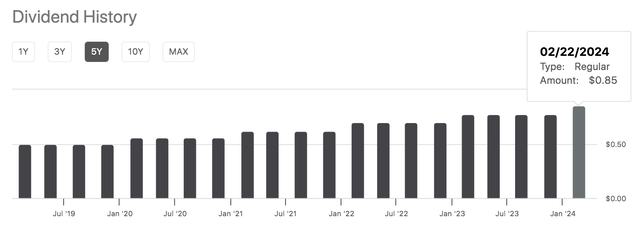

Additionally, we believe Moody’s forward dividend yield of 0.9% is not compelling and do not believe it provides a floor for Moody’s share price. Therefore, the true valuation of a stock must be carefully considered.

Seeking Alpha

risk

I have been praising Moody throughout this article. However, it is time to outline some of the risks to address the issue.

First, a fundamental risk worth considering is deleveraging in key areas, which could lead to reduced deal flow in Moody’s Management Information Systems segment. For example, we mentioned earlier that due to the natural inverse correlation (between interest rates and OAS), we expect option-adjusted spreads to increase when interest rates fall. As noted, S&P Global’s forecasts are inconsistent with our outlook, but we maintain the likelihood that credit spreads will rise, which could lead to lower high-yield bond issuance.

Explain credit and the credit interest rate cycle (Analyst prepared)

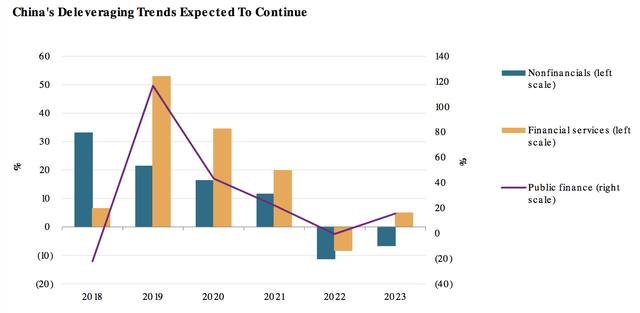

Another deleveraging issue to consider relates to China. Corporate deleveraging has been happening over the past few years and shows no signs of stopping.China is the world’s Second largest economy As such, it is Moody’s primary transaction processing provider. Continued deleveraging in China could have a significant impact on Moody’s top line.

China deleveraging (S&P Global)

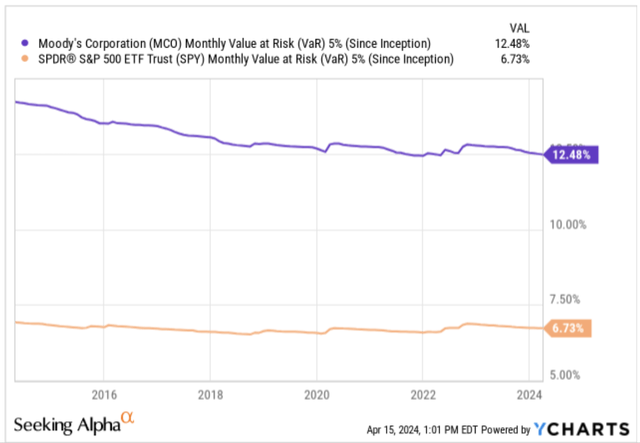

Finally, we urge readers to consider the tail risks of Moody’s stock. Moody’s bird’s eye view of the stock shows that the stock holds medium risk as its beta is moderate at 1.26. However, a closer look reveals that its monthly VaR of 5% is nearly twice that of the SPDR S&P 500 Trust ETF (SPY), indicating that there is considerable tail risk built into the asset.

YCharts, Seeking Alpha

The last sentence

Our analysis shows Moody’s fundamentals are solid. The company’s investor services are expected to benefit from the upcoming pivot in global interest rates, which could open investment grade and public debt opportunities for the company.

Additionally, Moody’s Analytics adds a long-term growth dimension to the Moody’s story, as its comprehensive offering aligns with the increasingly fragmented asset management space.

Finally, while other valuation methods must be considered, our P/E expansion formula suggests Moody’s is undervalued.

Consensus: Buy/Market Performance