User ba011d64_201

This monthly article series presents a dashboard containing aggregated indicators for the Information Technology industry.It also serves as a top-down analysis of sector ETFs such as Technology Select Sector SPDR Fund ETF (XLK) and First Trust NASDAQ-100-Tech Index Fund ETF (NASDAQ: QTEC), whose holdings are used to calculate these indicators.

shortcut

The next two paragraphs in italics describe the dashboard approach. They are necessary for new readers to understand these indicators. If you’re used to the series or short on time, you can skip them and look at the charts.

Basic indicators

I calculated the median of five basic ratios for each industry: Earnings Yield (“EY”), Sales Yield (“SY”), Free Cash Flow Yield (“FY”), Return on Equity (” ROE”), gross profit margin (“General Motors”). The reference range includes large companies in the US stock market. These five basic indicators are calculated based on the past 12 months.For them all, higher is better one. EY, SY, and FY are the inverse medians of P/E, P/S, and P/F. They are more suitable for statistical study than P/E ratios, which are unavailable or unavailable when “something” is close to zero or negative (for example, a company with negative earnings). I also looked at two momentum indicators for each group: median monthly return (RetM) and median annual return (RetY).

I prefer the median to the mean because the median divides a group into a good half and a bad half. The capitalization-weighted average is affected by extreme values and the largest companies. My indicators are designed for stock picking, not index investing.

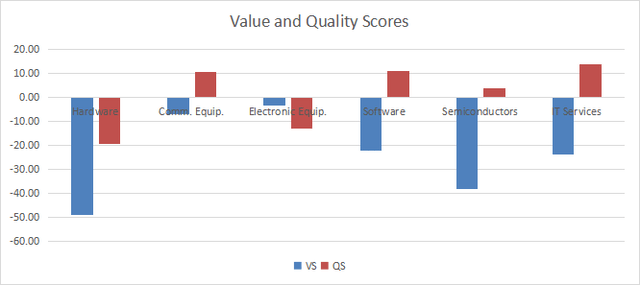

Value and Quality Score

I calculate historical benchmarks for all metrics. They are recorded as EYh, SYh, FYh, ROEh, and GMh respectively, and are calculated as the average value during the 11-year review period. For example, the EYh value for Hardware in the table below is the 11-year average of the median earnings yield of hardware companies.

The Value Score (“VS”) is defined as the average percentage difference between three valuation ratios (EY, SY, FY) and its benchmark (EYh, SYh, FYh). Likewise, the Quality Score (“QS”) is the average difference between two quality ratios (ROE, GM) and its baseline (ROEh, GMh).

Scores are in percentage points. VS can be interpreted as the percentage of underestimation or overestimation relative to the baseline (positive values are good, negative values are bad). This interpretation must be viewed with caution: the baseline is an arbitrary reference, not a hypothetical fair value. This formula assumes that all three valuation metrics are equally important.

Current data

The table below shows the metrics and scores as of writing. Columns represent all the data named and defined above.

|

VS |

quality standards |

Ernst & Young |

SY |

Storm |

roe |

General Motors |

Well |

gentlemen |

Storm |

Rohe |

hh |

Leiter M |

Retina Y |

|

|

hardware |

-48.99 |

-19.19 |

0.0031 |

0.4807 |

0.0345 |

4.82 |

34.32 |

0.0341 |

0.9578 |

0.0368 |

6.23 |

40.75 |

-1.97% |

33.32% |

|

communication. equipment. |

-6.99 |

10.76 |

0.0289 |

0.2898 |

0.0293 |

20.56 |

60.87 |

0.0311 |

0.2659 |

0.0380 |

16.49 |

62.83 |

-4.44% |

-10.42% |

|

Electronic equipment |

-3.11 |

-12.71 |

0.0407 |

0.6087 |

0.0410 |

15.38 |

20.72 |

0.0398 |

0.7508 |

0.0382 |

13.36 |

34.85 |

-2.18% |

9.42% |

|

software |

-21.97 |

11.32 |

0.0219 |

0.1071 |

0.0255 |

23.06 |

81.95 |

0.0248 |

0.1563 |

0.0330 |

18.16 |

85.62 |

-4.16% |

13.11% |

|

semiconductor |

-38.22 |

4.01 |

0.0280 |

0.1431 |

0.0186 |

28:00 |

59.45 |

0.0439 |

0.2243 |

0.0322 |

24.82 |

62.47 |

-3.19% |

6.59% |

|

Information technology services |

-23.77 |

14.16 |

0.0350 |

0.1714 |

0.0231 |

33.08 |

58.68 |

0.0365 |

0.3004 |

0.0305 |

27.10 |

55.23 |

-4.51% |

2.41% |

Value and Quality Chart

The chart below plots value and quality scores by industry (higher is better).

The value and quality of technology (Chart: Author; Data: Portfolio123)

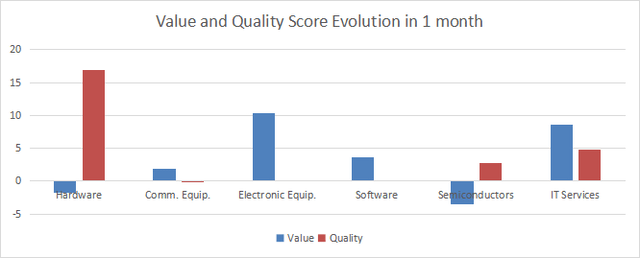

Evolution since last month

The value scores of electronic equipment and IT services have improved, while the quality of hardware has also improved significantly.

Score changes (Graph: Author; Data: Portfolio123)

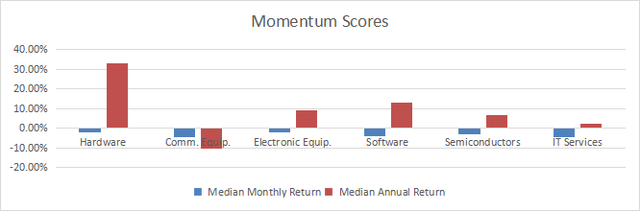

momentum

The next chart plots momentum scores against median returns.

Technology Momentum (Chart: Author; Data: Portfolio123)

explain

According to my monthly S&P 500 dashboard, the entire information technology industry is 32% overvalued compared to the 11-year average. Nonetheless, communications equipment and electronic equipment are close to their valuation benchmarks. Software and IT services are moderately overvalued. Prices in the hardware and semiconductor industries are too high. Hardware has the worst value and quality scores. Quality may partially offset the overvaluation of communications equipment and, to a lesser extent, software and IT services.

QTEC News

First Trust NASDAQ-100-Technology Sector Index Fund ETF (QTEC) began investment business on April 19, 2006, tracking the Nasdaq-100 Technology Sector™ Index. It holds 41 stocks and has an expense ratio of 0.57%, compared with XLK’s expense ratio of 0.09%.

as described first trustbasic index “Composed of companies in the Nasdaq 100 Index Classified as Technology according to Industry Classification Benchmark”. Constituents are equally weighted, and the index is reconstituted annually and rebalanced quarterly.

Constituent stocks have the same weighting after each rebalance, but the weightings may change based on price action. The table below shows the top 10 holdings along with their current weightings and fundamental ratios. Together they account for 27% of the asset’s value. The risk associated with the top holdings is much lower than that of capital-weighted ETFs like XLK, with Apple (AAPL) and Microsoft Corp. (MSFT) combining to account for 43.6% of the asset value. The definition of the technology industry is different from that of GICS: it includes Internet companies such as Meta Platforms that provide communication services for GICS.

|

stock ticker |

Name |

weight% |

EPS Growth%TTM |

Price to Earning Ratio TTM |

P/E ratio moving forward |

yield% |

|

exist |

Micron Technology Corporation |

3.28% |

-347.51 |

not applicable |

165.07 |

0.38 |

|

AVGO |

Broadcom Corporation |

2.71% |

-8.30 |

49.82 |

28.54 |

1.56 |

|

team |

Atlas Corporation |

2.65% |

-7.26 |

not applicable |

80.51 |

0 |

|

sprint |

Mendash Corporation |

2.64% |

60.72 |

not applicable |

547.75 |

0 |

|

dog |

Data Dog Company |

2.64% |

180.56 |

983.11 |

88.34 |

0 |

|

Mehta |

Yuan Platform Company |

2.64% |

73.52 |

34.36 |

25.47 |

0.39 |

|

LRCX |

Lam Research Corporation |

2.62% |

-30.47 |

37:00 |

32.88 |

0.84 |

|

Morley |

Marvell Technologies |

2.62% |

-461.38 |

not applicable |

49.43 |

0.34 |

|

huge |

Applied Materials |

2.61% |

13.94 |

24.45 |

25.18 |

0.77 |

|

domain resolution system |

Cadence Design Systems |

2.56% |

23.66 |

80.11 |

51.54 |

0 |

Data calculated using Portfolio123

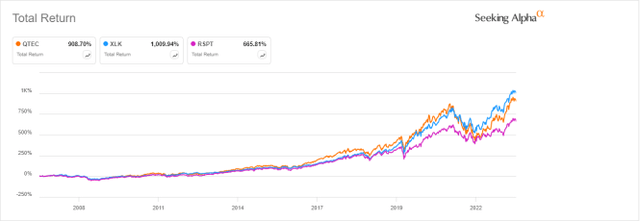

Since January 1, 2007, QTEC has underperformed XLK but outperformed the Invesco S&P 500® Equal Weight Technology ETF (RSPT).

QTEC with XLK, RSPT since January 1, 2007 (seeking Alpha)

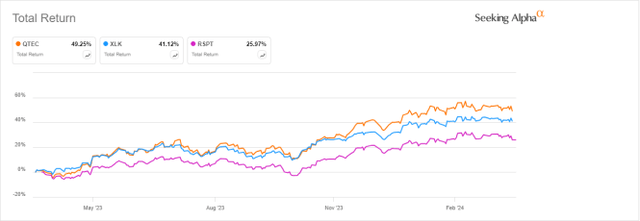

However, QTEC has outperformed both benchmarks over the past 12 months:

QTEC and XLK, RSPT, 12-month return (Seeking Alpha)

To sum up, QTEC is a highly diversified technology ETF. The idea looks great for investors willing to avoid concentration in large-cap stocks such as popular tech ETFs like XLK. However, the strategy has failed to deliver outsized returns since 2007.

Dashboard list

I use the first table to calculate value and quality scores. It can also be used in the stock picking process to check where a company stands among its peers. For example, an Ernst & Young column tells us that IT services companies with yields above 0.035 (or P/E below 28.57) are leading the industry by this metric. Subscribers are sent a monthly dashboard list of the most profitable companies that are simultaneously in the better half of their peers across three valuation metrics. The stocks below are part of a list sent to subscribers a few weeks ago based on currently available information.

|

external |

Extreme Networks |

|

JBL |

Jabil Corporation |

|

car |

Automotive Network Inc. |

|

Telephone |

TE Connectivity Ltd. |

|

NXP |

NXP Semiconductors |

|

root |

Generation Digital Company |

|

information Center |

Interactive Digital Company |

It is a rotational model with a statistical bias of long-term excess returns rather than an analysis of each stock.