Spain/E+ via Getty Images

In the many different stock markets I observe around the world, it’s usually only a small number of stocks at the top that drive all the returns.Although I had long expected that this rule of thumb would apply First, for smaller stock markets with only a handful of stocks and often single-digit large-cap stocks, in recent years this idea has also begun to apply to the two largest stock markets in the world: when considered as a single market, the U.S. and even Europe. In the United States, the current term for these market-leading stocks is “Gorgeous 7” or “Mag 7” for short, I saw this week This article comes from European index provider STOXX Compare a basket European stocks are calling the M7 “GRANOLAS”. The STOXX article pointed out that “GRANOLAS” stocks only account for 21% of the STOXX Europe 600 Index (stoke), but contributed to STOXX’s 60% increase in the past year.

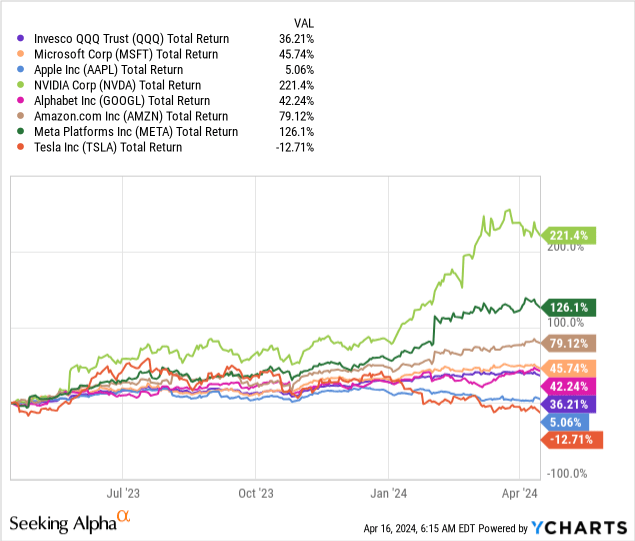

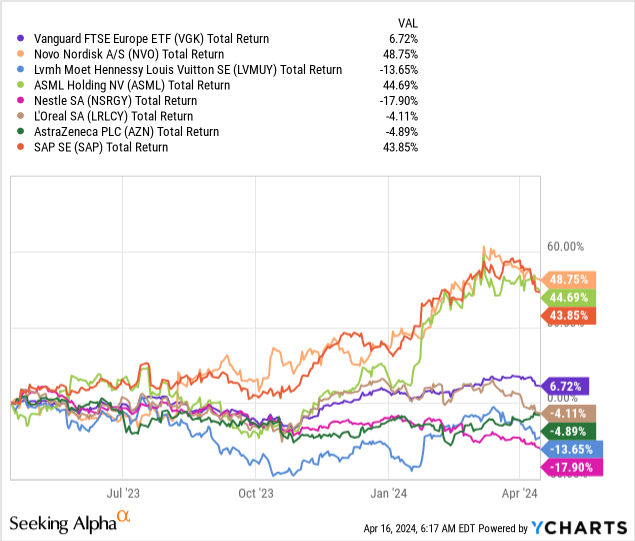

In this article I would like to make a head-to-head comparison between the US Magnificent 7 and the European GRANOLAS, which I then plan to apply in deciding a trading strategy between the US benchmark and the European benchmark. For the U.S. benchmark, I use the Invesco QQQ Trust ETF (QQQ) as it is one of the most liquid ETFs in the world, currently ranked number one is Mag 7, which has a combined weight of 41% of QQQ. For Europe, I would use the Vanguard FTSE Europe ETF (NYSE:VGK), as it is the largest U.S.-listed ETF focused on European stocks and may be more accessible to many readers than the Euro-denominated STOXX. The GRANOLAS basket currently accounts for only 18.8% of VGK, but as the second chart below shows, it may also be responsible for most of VGK’s recent returns, just like it is for STOXX. Before I get into GRANOLAS, I want to run these two quick charts showing the recent returns of Mag 7 and GRANOLAS compared to QQQ and VGK respectively.

The first chart shows QQQ’s total returns over the past year versus the total returns for the seven stocks in the Mag 7, showing that five of the seven stocks have gained more than QQQ over the past year, and most have done so by quite a lot. . Coupled with QQQ’s 41% concentration in Mag 7, this is one of the reasons why I believe these stocks have been too narrow, too fast, and too strong, which in my opinion means a reversal is more likely. .

The second chart compares VGK’s total returns over the past year to the seven largest names in the GRANOLAS basket, since including all 11 names would make the chart harder to read.Here we see a different pattern than in the United States, where four out of seven names lag VGK has made up the difference over the past year with only the top three performing more significantly. What this tells me is that while Novo Nordisk, ASML, and SAP appear to be Europe’s closest equivalents to NVIDIA in the U.S. market, VGK’s returns are not too clearly dominated by those names.

What is granola?

STOXX’s article lists the names and euro market capitalizations of the 11 stocks that Goldman Sachs put into the GRANOLAS basket, but here I want to correctly introduce these 11 stocks and their US ticker symbols so that it is easier for US readers to reference. The first thing you’ll notice is that there are actually three N’s and two S’s, making this acronym even more confusing than it seems at first glance:

- GSK Plc (GSK) – 0.69% VGK, Pharmaceuticals

- rightoche Holding AG (OTCQX:RHHBY), holds 1.41% of VGK, pharmaceuticals

- ASML Holding NV (ASML), accounting for 3.05% of VGK, semiconductor equipment

- nitrogenestle SA (OTCPK:NSRGY), 2.27% of VGK, packaged foods

- nitrogenovartis AG (NVS), holds 1.60% of VGK, pharmaceuticals

- nitrogenovo Nordisk A/S (NVO), holds 3.17% of VGK, pharmaceuticals

- L’oxygenreal SA (OTCPK:LRLCY), 0.64% of VGK, personal care products

- LVMH (OTCPK:LVMUY), 1.78% of VGK, luxury goods

- AstraZeneca Plc (AZN), holding VGK 1.59%, pharmaceuticals

- SAP SE (SAP), VGK, Software and 1.71%

- Sanofi SA (SNY), VGK 0.85%, Pharmaceutical

Just as the Mag 7 seems to be dominated by the companies that most of us interact with through screens, what jumps out at me when it comes to granola is that 8 out of 11 of these companies offer what we put in or on our bodies : Six of them are Nestlé in the form of pharmaceuticals, Nestlé in the form of food and beverages, and L’Oréal in the form of cosmetics. The closest comparison between GRANOLAS and Mag 7 is probably comparing ASML to NVIDIA and SAP to Microsoft, but that’s the closest the two look. This could be a reason to own both, as U.S. tech and European pharma might complement each other well in a portfolio, or it could also be seen as Europe potentially outperforming if the U.S. AI bubble bursts and the economy recovers . For what it’s worth, I own far more of these granola names and have written more about them in my investment group than I have about Mag 7, and I’ve written the last two The first published article about them was about Nestlé and Novo Nordisk.

For now, I’ll keep the high-level introduction to GRANOLAS and do a head-to-head comparison of VGK and QQQ through each quantitative rating category of GRANOLAS versus Mag 7.

Dividend Rating: Mag 7 vs. GRANOLAS

As an investor who still prefers dividends, GRANOLAS clearly has a significant advantage over Mag 7 in this category. Dividends. 9 of the 11 granolas also have a Dividend Growth Score of “B+” or better, which is just as important because dividend yield plus dividend growth is a simple basis for estimating future returns.

Quantitative Rating: Mag 7 vs. GRANOLAS

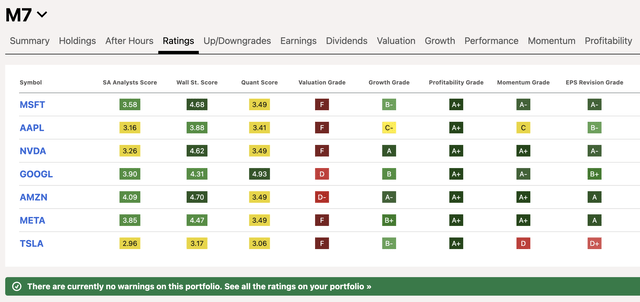

Here, I find it important to look at the different categories on the ratings tab together, as the different ratings may be related in some way, telling us why one stock is cheaper than another. When we looked at the Mag 7, we found that five of the seven stocks had valuation grades of “F”, with the other two having “D” and “D-” ratings. These expensive valuations remain the reason I rarely hold these stocks for the long term. However, those who remain bullish on U.S. large-cap growth stocks will point out how many “A’s” and “A+” these stocks receive in every other category, especially profitability, but also in growth, earnings revisions and momentum. While I also prefer stocks with green in these columns, I focus on stocks outside of U.S. large-cap stocks, largely because I don’t like such a deep red in the valuation column either. I must also admit that I am also concerned that these seven stocks currently have “no warning” – high valuations without warning is usually a very alarming warning to me.

Quantitative ratings for seven major stocks as of April 16, 2024 (Seeking Alpha)

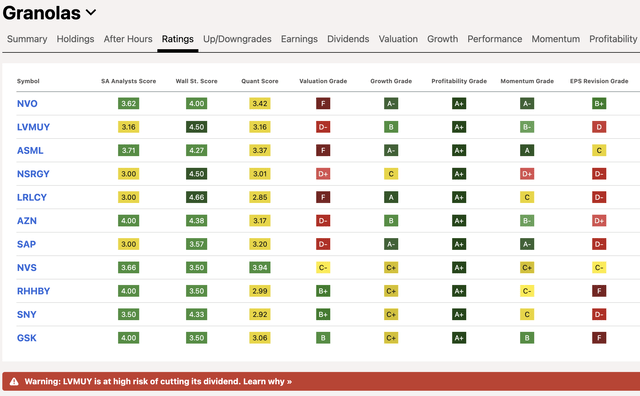

When we run the same ratings screen for GRANOLAS stocks, we see that the largest 7 of the 11 stocks also receive Ds and Fs in valuation, but these stocks also tend to receive As and Bs in the Growth and Momentum columns. All 11 companies receive an “A+” for profitability, but in other columns there appears to be a strong negative correlation between more reasonable valuations and attractive growth or revised ratings. Here I find it necessary to look a little deeper and see which of these quantification scales I might disagree with based on my understanding of each business, to me using a consumer name like NSRGY or LRLCY is better than It’s easier to do this with a non-consumer-oriented name, such as ASML or SAP. As I mentioned in my October article on Nestlé, while I agree that Nestlé’s future growth prospects may not be as high as many technology or healthcare companies, I think its global diversification and wide moat are well worth its current valuation. value (dividend yield exceeds 3%).A 3% dividend yield looks particularly good considering the dividend yields of Swiss companies The Swiss National Bank is First felled in the west interest rates, bringing the benchmark interest rate back to 1.5%. The warning on LVMUY is also one I’m glad to see because LVMH’s dividend growth It does seem to be faster than I thought was sustainable, and it’s reassuring that Seeking Alpha It is also marked by the rating method.

Quantitative Ratings for European GRANOLAS Stocks as of April 16, 2024 (Seeking Alpha)

VGK vs QQQ: What am I doing

My current conclusion from comparing VGK and QQQ is not what I expected when I first started writing this article: the Mag 7, and indeed the QQQ as a proxy, looks uniform enough in terms of being expensive and powerful that I Might as well spend as much time studying the differences between Microsoft and Meta as QQQ, at least for now. On the other hand, when we look at Europe, VGK’s GRANOLAS dominance is less than half of QQQ’s Mag 7 dominance, and there seems to be greater dispersion even within these top 11s. Here, I do find it worth picking the differences between Nestlé and L’Oréal, which have similar scores, rather than expecting VGK to provide me with equally good exposure to European equities. Currently, I do both of these things primarily by buying puts and put spreads on QQQ, as I expect QQQ’s rally may reverse, while maintaining long positions on most (but not all) of them Many have covered calls.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.