AdShooter/E+ via Getty Images

Robert Half’s Stock (NYSE: RHI) has underperformed over the past year, falling 6% despite a sharp rally in the broader market.Since investors were advised to sell RHI shares, the stock has fallen 13% while the market has fallen up 9%. Shares are also trading close to my $72 price target. Given such significant underperformance and the current share price, it’s worth taking another look at RHI to see if the shares are more attractive now. The business continues to face negative momentum and, therefore, I would not buy the stock.

Seeking Alpha

Look at it the most recent financial status Reported on January 30th, RHI earned $0.83, beating market expectations by 1 cent despite a 13% decline in revenue to $1.5 billion. As revenue fell, the company’s profit margins compressed, and profits fell by nearly 40%. Full-year profit increased to $3.88 from $6.03 in the previous year.in my It appears that the company also has an earnings “quality” issue, as its interest income and deferred compensation plan investment income of $112 million in 2023 added more than $0.80 to earnings per share.

Robert Half has an indisputably pristine balance sheet; the company has no debt and $732 million in cash on hand, about $7 per share. Thanks to the Fed’s policies, RHI is able to earn over 5% on cash, providing a good source of income. However, this revenue stream is unlikely to grow unless the Fed continues to raise interest rates, and will decline if the Fed eventually cuts rates. Since interest rates are widely believed to be above the long-term average, many interest-sensitive companies trade at lower P/E multiples because they assume they are “above” the long-term average.

For example, many insurance companies have P/E ratios below 12 times. It’s good that Robert Half has a good balance sheet, but interest income isn’t a revenue stream worthy of a 20x multiple in my opinion. Instead, I prefer to focus on RHI’s core business, value it, and simply add the equivalent of $7 per share to its cash position.

In addition to interest rate concessions, Robert Half faces continued headwinds in its core business of staff placement and temporary contract work. As mentioned, revenue was down 13% from last year. That’s on a pretty broad basis, with U.S. revenue down 16.7% year-over-year and overseas down 9.8%. Gross margin fell to 39.6% from 41.6% last year due to related operating leverage losses. Part of the decline is also due to contractors being slower to convert to full-time employees, as their clients have been hesitant to add headcount. In the face of these headwinds, Robert Half managed to reduce SG&A expenses by about 5.1% to $517 million, although the decrease was still smaller than the decline in revenue.

Contracted solutions revenue fell 17% this year to $887 million; finance and accounting account for nearly 75% of the unit. Permanent positions fell 22%, while Protiviti fell 7% to $463 million. Now, the fact that RHI’s business is weak may be surprising given that unemployment is near record lows, but the macro environment is actually not that favorable.

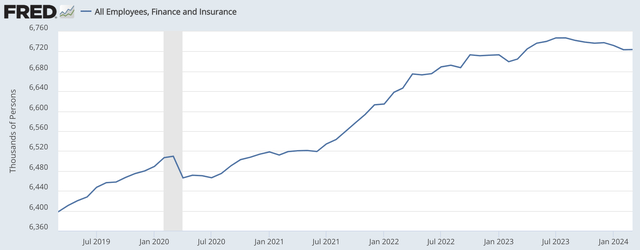

First, the RHI is not affected by changes in the labor market as a whole, or even in specific subsets of the labor market. As mentioned earlier, 75% of the company’s placements are finance and accounting related. It doesn’t matter what happens in manufacturing employment or construction employment, for example. Interestingly, while overall employment continues to rise, financial sector employment is actually 240,000 below last summer’s highs. Large banks have been cutting jobs to manage costs as they face an uncertain macroeconomic future. This is a continuing headwind for the company.

Federal Reserve Bank of St. Louis

Interestingly, management said the “tone” of customer conversations has been improving given “the adoption of more favorable interest rate policy” on the last earnings call. Therefore, recruitment activity is expected to increase this year. Unfortunately, I expect its next earnings report, likely in early May, to issue a more cautious outlook. Earlier this year, markets once expected six rate cuts; that has now been reduced to two. Quite simply, the interest rate environment has become more adverse again. The continued volatility in the outlook is why RHI’s clients have been unusually slow to convert contractors into employees, as they are hesitant to commit to increasing headcount.

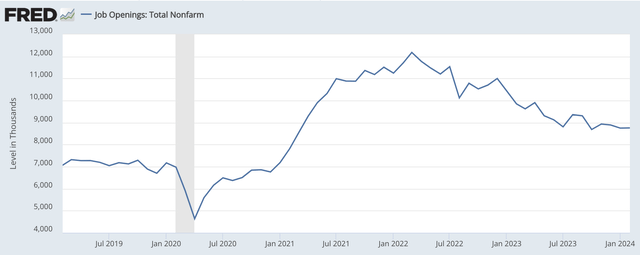

In fact, I see no evidence in the macro data that this improvement in tone will lead to an improvement in economic activity. Ultimately, Robert Half benefited from the turmoil in the job market. As a placement service, it requires hiring by an employer. If the unemployment rate is 3% but no employers are hiring or firing workers and simply retaining employees, this will reduce the need for recruitment activity compared to a 5% unemployment environment with significant job losses through resignations, layoffs, and hirings. . We seem to be in the first situation. As the chart below shows, job openings have fallen significantly over the past two years, and there is no evidence yet of a rebound. All else being equal, a reduction in vacancies may result in a reduction in recruitment.

Federal Reserve Bank of St. Louis

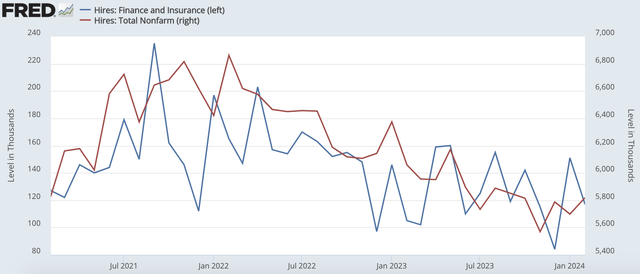

In fact, this is what is happening. Given the small sample size, finance and insurance hiring is even more volatile than total hiring. By any measure, recruiting activity is well below its 2021-2022 peak, which could leave RH in a rather subdued revenue environment.

Federal Reserve Bank of St. Louis

Employment activity rarely accelerates as the economic cycle ages; typically, economic growth continues to slow as fewer unemployed workers and employers increase staffing. Now, if we don’t have a recession (which is my base case), I expect hiring activity to continue to rebound around current levels, and financials may decline a bit, but at a slower pace than last year, in part because it’s easier Compare.

In the medium term, I think investors should also consider a risk: artificial intelligence. Many predict that as artificial intelligence becomes more widespread, economic productivity should increase. Higher productivity, of course, means fewer people can do the same job. If this does occur, employment and hiring activity may slow further, especially since many finance and accounting activities are very process-focused, which may make AI adoption easier.

Personally, I think predicting the timing of major changes such as artificial intelligence is extremely difficult. Additionally, the pace of adoption of the technology is uncertain, it could create jobs elsewhere, and RHI could try to change its recruiting and contracting efforts to meet this demand. To be clear, I don’t expect AI to cause mass unemployment. What I’m more concerned about is when recruiting activity eventually rebounds; it’s likely to be slower than in the past given continued productivity gains.

Frankly, in an optimistic scenario, assuming recruiting activity is near the bottom, we could see results remaining around current levels, but in a recession, we could see further pressure. Since the Fed will keep interest rates higher for an extended period of time, it’s hard for me to see a reason to accelerate interest rate increases. Now, with its strong cash position, it can continue to buy back shares, Robert Half raised its dividend by 10% after its quarterly report, and the stock currently yields 2.8%.

However, given that the macro picture is less favorable, I think second-quarter earnings are likely to come in the coming weeks, with downside risks to sentiment. Excluding interest income, RH’s profitability would likely be $2.90-$3.20 assuming flat revenue and margins close to Q4 levels. Given its pristine balance sheet and strong free cash flow position, I value it at about 20x or about $60, plus $7 in cash, giving a fair value of about $67, down from my previous estimate of $72 , because I thought RHI could earn $3.60 when the Fed seemed ready to ease policy more dramatically. If there are more than 5% negative effects, I will continue to avoid RHI.