we are

investment action

I recommend a Hold rating on BigCommerce (Nasdaq: BIGC) Last time I wrote this, I was very worried about weak future growth and uncertainty about sales strategy changes.based on Based on my current outlook and analysis, I still recommend a Hold rating despite the attractive potential upside. While I do feel more optimistic about medium-term growth potential, growth headwinds were evident in the 4Q23 results, and I don’t see valuation multiples rising until BIGC shows overall growth acceleration.

review

As I feared, BIGC’s growth has slowed. In its Q4 2023 report, BIGC reported total annual recurring revenue (ARR) of $336.5 million, a 100 basis point annualized decline to 8% (YoY growth of 9% in Q3’23), compared to Q3 2022’s annualized growth rate of 9%. A decrease of 800 basis points compared to the fourth quarter. Corporate account ARR has seen the same slowdown, to $245.1 million, up 9% year-on-year, compared with 11% in Q3’23 and 29% in Q4’22. Growth is clearly not showing any signs of recovery, as BIGC guided for midpoint FY2024 total revenue of $331.1 million, implying 7% year-over-year growth (note that this is still 200 basis points higher than my original FY2024 forecast ).

The pace of this guide reinforces my point that underlying demand remains poor. Looking back to the third quarter of 2023 (November), management guided for fiscal 2024 to achieve high-single-digit (hsd) to low-double-digit (ldd) growth, which would imply growth of about 10%. The value has not yet been revised down by 300 basis points. This is concerning because the sticky inflationary environment appears to be having a significant impact on BIGC, and if the Fed does not cut interest rates in 2H24 (a rate cut is increasingly unlikely), BIGC may see growth deteriorate further, causing BIGC to potentially There is a decline. several quarters.

While management noted that consumer spending proved more resilient than they expected, especially during the holiday season in Q4, I don’t think the market will buy into this optimism. The reality is that sales cycle times remain long for enterprise deals and customers remain focused on reducing contract volumes. Comments on corporate deals also indicate that getting a new corporate logo will be difficult.

However, I do see some very positive takeaways, which makes me optimistic about BIGC’s medium-term growth prospects once it overcomes the current tough macro conditions. One of my main concerns about BIGC is the change in sales strategy and the company’s continued search for a new go-to-market (GTM) leader following the departure of the previous president. Encouragingly, transaction volumes are not slowing down.

In fact, BIGC saw improvements in retention, competitive win rates, and cross-sell, so it appears the new GTM strategy is working better than I expected. BIGC should see higher upsell success rates as the GenAI tool rolls out – I particularly noticed that BIGC offers a strong value proposition in its AI offerings.

Take BIGC’s GenAI tool as an example. They enable customers to get answers directly in their store dashboard. During the holidays, one in four support chats was resolved by customers without even picking up the phone. As another example, BIGC’s product BigAI uses Google’s Vertex AI to improve storefronts and operations, increasing revenue by more than 100% and click-through rates by more than 20% among customers who use related products.

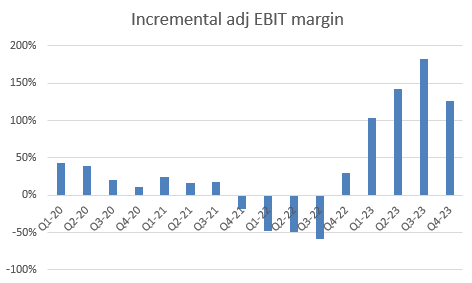

One area where management deserves credit is improving the profitability of the business, which I think has been largely ignored by the market. In the fourth quarter of 2023, gross profit margin increased by 260 basis points to 78.8%, and adjusted gross profit margin increased by 260 basis points to 78.8%. EBIT was $5.4 million, with a profit margin of 6.4%. Adjusted EBIT margin of 6.4% accelerated 790 basis points sequentially and was BIGC’s highest margin ever. To some extent, this does support management’s comments that they see the appeal of upselling (it’s cheaper to sell to existing customers than to buy a new logo). While it’s not the neatest way to determine profit expansion potential, a year-over-year incremental adjusted EBIT analysis shows that BIGC has indeed turned a corner in driving profit growth.

author’s works

Valuation

author’s works

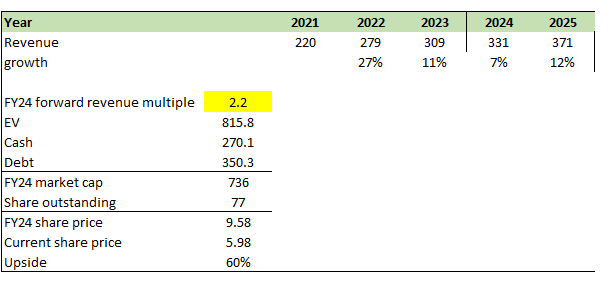

I have updated my model FY2024/25 growth rates to 7% and 12% to reflect management’s FY24 growth guidance, which is 200 basis points higher than my previous assumption of 5% growth. My view on the growth trajectory is the same, which is that growth will slow further in FY24 due to macro conditions. However, I also have more confidence in a recovery in fiscal 2025, as changes in sales strategy appear to be working (addressing one of my previous concerns). I expect that when BIGC releases more product modules, the upsell momentum will increase further. I also believe that the market will upgrade valuations only if BIGC shows signs of accelerating growth. If BIGC grows in line with my expectations in fiscal 2025, valuation could surge to 2.2x forward revenue (which is where it was trading 3 months ago). While the potential upside is attractive, I think it’s best to wait until BIGC reports an acceleration in revenue growth.

final thoughts

My recommendation is a hold rating. While management remains optimistic about consumer spending and notes the success of a new sales strategy that has improved retention and upsells, the macro environment appears to be a greater headwind. I believe the lack of revenue growth acceleration will continue to keep valuation multiples within range. Although there are some positive signs in the medium term, especially with the launch of GenAI tools, I would recommend delaying investment until BIGC shows clear growth improvements.