Ihor I Open/iStock via Getty Images

We started covering Accelleron Industries (OTCPK:ACLLY) even before it split from ABB (OTCPK:ABBNY) and when it started trading we said it was off to a good start and pointed us Particularly like the Services segment because of its recurring revenue elasticity.However, in our final article, we downgraded the company as we believe the valuation is already relatively high. Our downgrade is clearly premature as the stock has outperformed the S&P 500 (spy), up about 36% in about four months, despite no major news coming out of the company. Finally, the company released a major update on its 2023 results on March 27. We are revisiting our analysis in light of the recently released results and the now much higher valuation.

FY2023 Results

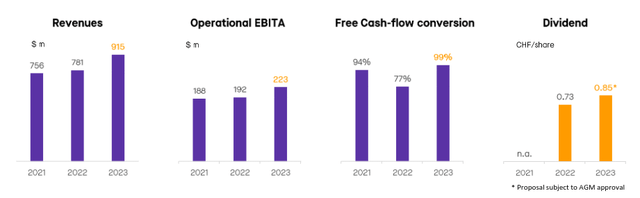

The results are reliable, but We don’t think they justify the share price gains over the past few months. Organic revenue grew by about 15.5%, mainly through price increases to compensate for part of the inflation in input costs. While it’s good to see that the company has the pricing power to protect its margins, we caution investors not to count on future revenue growth levels, as it will be more difficult to justify any significant future price increases to customers. We view sales growth as more sustained growth, and on that front, results were essentially flat.

The company did well, further improving its free cash flow conversion ratio to 99%, resulting in a dividend increase.

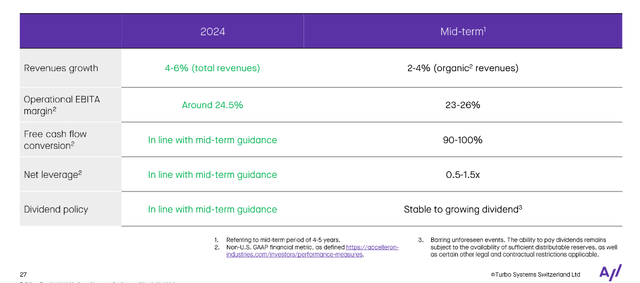

Accellron Industries Investor Presentation

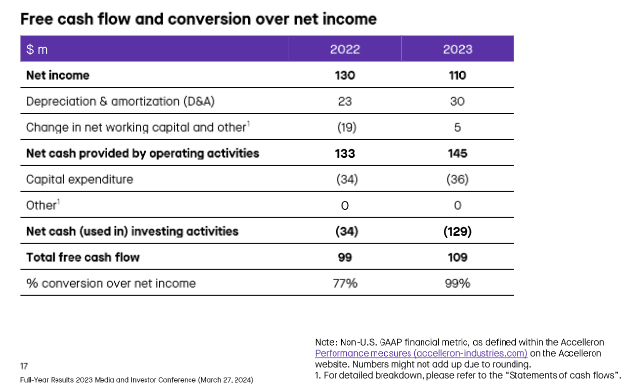

While operating EBITA increased accordingly, net profit was actually lower due to one-time costs, mainly related to the company’s spin-off and establishment as an independent entity. Free cash flow was also aided by changes in working capital and higher depreciation and amortization amounts.

Accellron Industries Investor Presentation

Notably, given the decrease in net profit, the dividend payout ratio increased to 93% of reported net profit after minority interests. We expect net profit to rebound in 2024 given improved operating EBITA and one-off costs should no longer impact profits. Nonetheless, we believe the dividend payout ratio will remain high and investors should not expect significant growth in dividends over the long term.

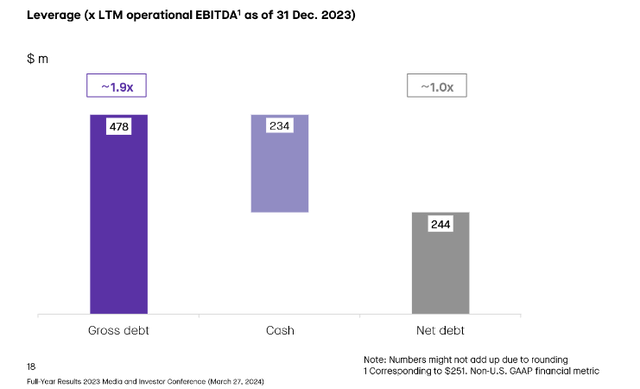

balance sheet

Accellron Industries remains committed to maintaining a strong balance sheet, and its leverage ratio has remained very good so far. Net debt and operating EBITDA increased due to the OMT acquisition, but leverage remained at a very healthy level of about 1x. The increased cash holdings also give the company the option to make some additional bolt-on acquisitions if the opportunity arises.

Accellron Industries Investor Presentation

research and development

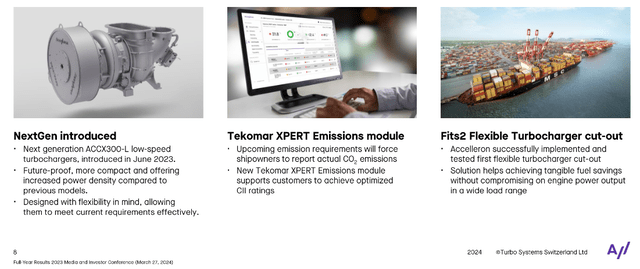

We like that the company continues to invest in R&D, especially to prepare solutions for the upcoming emissions needs that its customers will face. It also further improves the performance of the turbochargers, which are already among the best performing.

This is important because it’s a signal that the company still sees some growth opportunities, even if the future could be very challenging for them if the world goes fully electric. At the same time, the company is seeing increased demand for data centers (backup generators) and a boost from new more sustainable fuels in the shipping industry.

Accellron Industries Investor Presentation

Appearance

In the medium term, there are a number of tailwinds that could provide growth opportunities for the company, including strong growth in data centers, many of which use turbochargers as emergency backup generators. The company also benefits from sectors that are difficult to decarbonize, such as shipping, where tighter regulations are prompting shipowners to order dual-fuel ships.

These dual-fuel engines have had a positive impact on Accelleron because they require more and more advanced fuel injectors, and the requirements for increased efficiency and fuel flexibility make adding a turbocharger more attractive, in some cases Even necessary. Despite these tailwinds, the medium-term organic growth target of only 2% to 4% is not particularly attractive. In the longer term, we believe the company may even experience negative growth if industries such as shipping start to electrify.

Accellron Industries Investor Presentation

Valuation

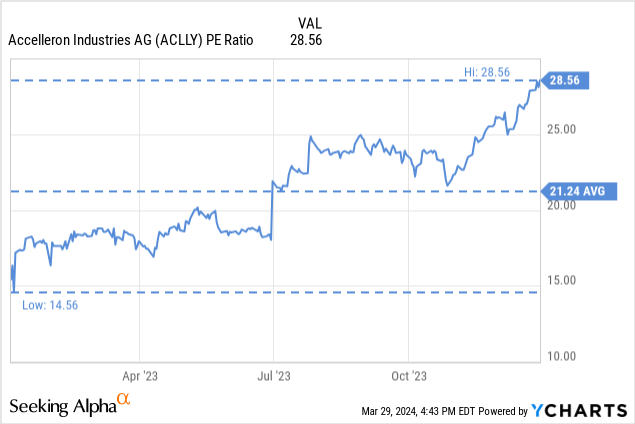

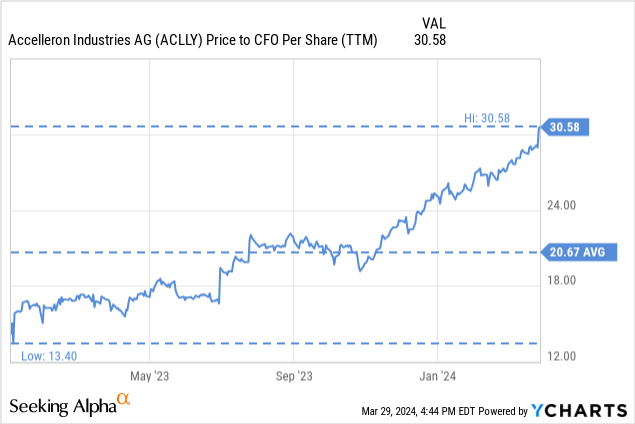

Much of the price increase is clearly the result of multiple expansion, and it’s difficult to understand why investors are willing to pay the multiples of technology companies for industrial companies with relatively poor growth prospects.

We find the price increases in the last 3-4 months particularly difficult to explain, as the company has made no significant progress during this period.

Given the poor medium-term growth prospects of 2% to 4% organic growth and the price to operating cash flow above 30x, we further downgrade the stock to “Strong Sell”.

Since the company pays out most of its earnings in the form of dividends, and the current forward dividend yield is around 2.5%, we don’t see much to get excited about. The dividend yield is low, and given the high payout ratio and low organic growth, prospects for significant dividend growth in the future are not promising.

risk

We believe Accellron Industries investors face two major risks. One is that industrial companies with mediocre growth prospects are overvalued. The second one is probably ten or twenty years down the road, but we do believe that even an industry like shipping will eventually be electrified. Battery costs continue to fall significantly and efficiency continues to improve. Therefore, it is only a matter of time before electric ships become a reality. It’s mainly a question of when, not if, which is why we think investors should pay a lower P/E for the business.

in conclusion

After reviewing Accelleron Industries’ full-year 2023 results, we downgraded our rating to “Strong Sales.” The financial performance wasn’t particularly bad, and we didn’t find any particularly disturbing results. It’s just a matter of valuation multiple expansion, and business performance clearly doesn’t warrant such growth. The company has paid out most of its profits in the form of dividends, and the dividend rate is relatively low, leaving little room for dividend growth in the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.