GrandviewGraphics/iStock via Getty Images

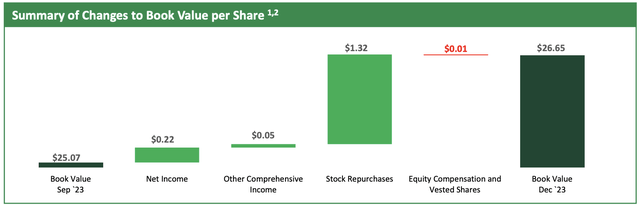

ACRES Commercial Real Estate (NYSE:ACR) Even after rising 50% in one year, the significant discount to book value remains large.Commercial Mortgage REIT’s last reported GAAP book value per share was $26.65 As of the end of the fourth quarter of fiscal 2023, the quarterly increase was $1.58 per share, mainly due to MREIT’s stock repurchase program. The weighted average annual shares outstanding at the end of the fourth quarter decreased by 2.78% to 8,566,058. ACR shares currently trade at $14.09, trading at a significant discount of 47% to book value.After expanding the repurchase authorization, approximately $9.8 million remains in the program US$10 million November.

ACRES Commercial Real Estate Fourth Quarter Fiscal Year 2023 Report

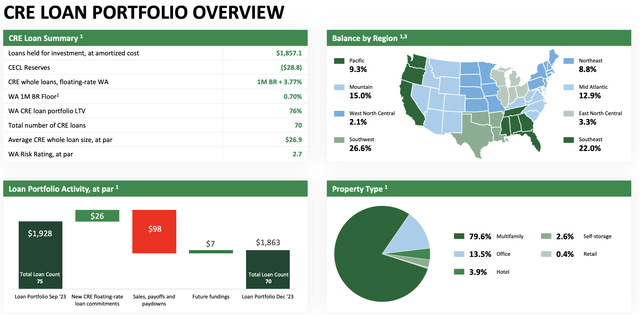

ACR’s loan portfolio at the end of the fourth quarter was $1.86 billion Net of a provision for credit losses of $28.8 million. The mREIT is dominated by multifamily loans, which account for 79.6% of its CRE loan portfolio, with office loans accounting for the second largest portion at 13.5%. The U.S. is also geographically diverse, with 70 loans at the end of the fourth quarter with interest rates 3.77% above the one-month benchmark rate. The investment strategy here is that, with strong underwriting quality, a buyback program, and continued growth in book value per share, ACR will be able to end its discount to book value. Keeping credit losses and bad loan provisions low will constitute a key tenet of the bull market.

ACRES Commercial Real Estate Fourth Quarter Fiscal Year 2023 Report

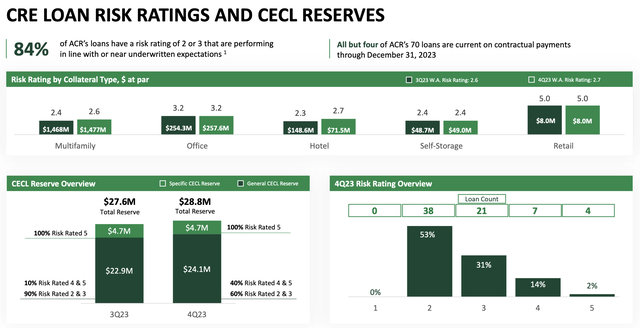

Underwriting quality, risk and liquidity

Due to uncertainty about the direction of US CRE, the market has discounted ACR by 50%. This part of the economy has become a demon for the stock market and spells the end of the entire U.S. financial system. However, ACR’s inherent focus on multifamily loans means its portfolio is better protected from the uncertainty caused by rising vacancies in work-from-home offices. As of the end of the fourth quarter, approximately 84% of ACR’s loans had a risk rating of 2 or 3, with four loans not meeting contractual obligations.This is from 92% of loans The risk rating at the end of the third quarter was 2 or 3.

ACRES Commercial Real Estate Fourth Quarter Fiscal Year 2023 Report

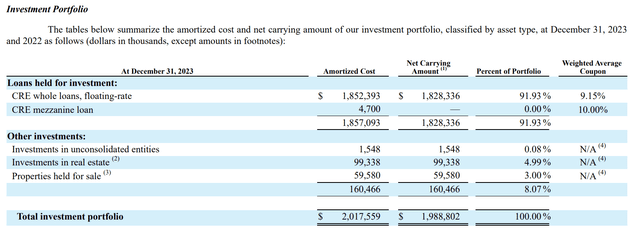

ACR’s CECL provisions were $28.8 million, an increase of $1.2 million from the third quarter as the risk rating of its multifamily loans deteriorated slightly, to 2.6 from 2.4 at the end of the third quarter. However, CECL reserves represent only 1.55% of ACR’s loan portfolio, highlighting the benefits of mRETI’s focus on multifamily properties and healthy underwriting standards. As of the end of the fourth quarter, ACR’s total investment portfolio was $2.02 billion, up slightly from the previous quarter, with net mREIT investments in real estate and properties for sale at $158.9 million. Available liquidity at the end of the fourth quarter was $108 million, which consisted of $83 million in cash and $25 million in unlevered assets and expected available financing.

ACRES Commercial Real Estate Fiscal Year 2023 Form 10-K

Preferred Stocks and the Fed

| Preferred series | Liquidation Price Discount ($25) | annual distribution | Cost yield% | float date |

| 8.625% Fixed to Floating Series C Cumulative Preferred Stock (NYSE:ACR.PR.C) | -3% ($24.20) | $2.16 | 8.91% | July 30, 2024 |

|

7.875% Series D Cumulative Redeemable Preferred Stock (NYSE:ACR.PR.D) |

-14.2% ($21.45) | $1.96875 | 9.18% | not applicable |

ACR owns two excellent preferred stocks (ACR.PR.C) and (ACR.PR.D) that provide a healthy investment profile. The Series D trades at a double-digit 14.2% discount to liquidation value of $25 per share, currently pays an annual coupon of $1.96875, and works out to a yield on cost of 9.18%. However, I strongly prefer the C series. The liquidation discount is lower at 3%, but floating rates will be implemented from the end of July. The rate is equal to the three-month SOFR plus a spread of 5.927% per annum, subject to a floor of 8.625%.The three-month SOFR is currently 5.34775% Since the preferred stock was originally priced using LIBOR, an additional 0.26161% adjustment is required. Therefore, assuming the Fed does not cut interest rates by then, the total coupon will be 11.5%.

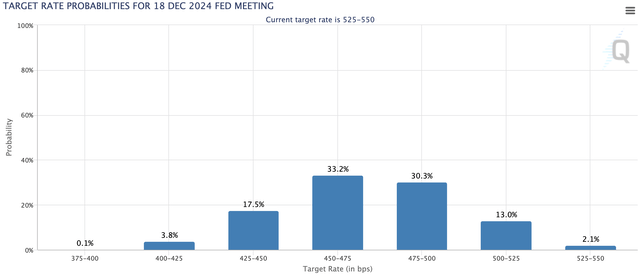

CME Group Fed Watch Tool

The Fed is expected to cut interest rates by at least 75 basis points by 2024, with the CME FedWatch tool pricing the base rate at 4.50% to 4.75% at the end of the year. Therefore, the Series C floating coupon should still be in the double digits by the end of the year, with the potential discount ending due to the positive duration effects of the Fed’s rate cuts. I rate both the common and preferred shares a Buy, and I’ll take a position on the Series C round sometime in April. The nearly 50% discount on common stock was too steep for ACR’s multifamily portfolio, and the market sold the stock at such a low price that it can only be seen as an overreaction to CRE’s anxiety.