KanawhaTH

investment thesis

After strong performance in fiscal 2023 and 2024, global markets, led by the United States, have delivered solid gains to investors since the market bottomed in late 2022. Most developed countries have paused interest rate hikes as the Reserve Bank paused them. of sovereign countries assess their country’s growth prospects based on their respective inflation forecasts.Recently, the Federal Reserve released their forecasts last week They still expect three rate cuts this year, with the European Central Bank expressing a similar view earlier this month.

Such rate cut forecasts are positive for the outlook for global equity markets as lower interest rates once again stimulate economic growth. U.S. stocks are starting to look expensive by some valuation metrics, and investors seeking diversification can allocate capital to many areas of global markets.For investors who want broad-based returns iShares MSCI ACWI Fund reaches global markets (NASDAQ:ACWI) is one such ETF that offers investors the opportunity to invest their money in a broad range of global stocks.

The balanced approach offered by ACWI looks attractive to me, but the deep diversification of stocks combined with the fund’s relative underperformance makes the prospects of the ACWI ETF look unattractive to me. For the reasons outlined in the post below, I’m rating it a “Hold” for now.

About ACWI ETF

The iShares MSCI ACWI ETF is managed by iShares, the ETF arm of BlackRock. The fund provides investors with a streamlined portfolio construction process by providing exposure to a broad range of equity markets in developed and emerging market economies around the world, while minimizing any need for rebalancing in the process.this Fund prospectus shows The ACWI ETF is supposed to be used for “international diversification and seeking long-term growth in a portfolio,” so it may only appeal to investors who want access to global markets but have a long-term horizon.

The ACWI ETF achieves its investment objective by tracking U.S. dollar-denominated investment results. MSCI ACWI Index. The index consists of large and mid-cap developed and emerging market stocks spread across more than two dozen emerging market economies and a similar number of developed market economies. The index tracks over 2,000 constituent stocks, so I would expect the ACWI ETF to have a similar degree of deep diversification.

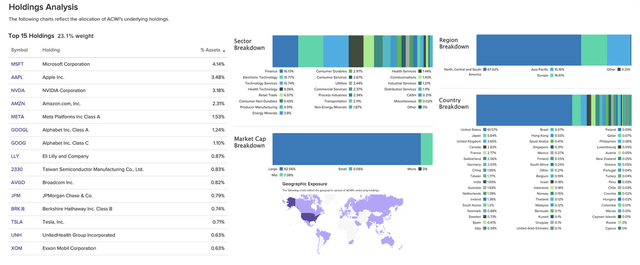

The chart below shows the top 15 holdings compared to ACWI’s fund composition by category.

Chart showing MSCI ACWI ETF holdings (etfdb)

Peer comparison

Here’s how the ACWI ETF compares to some of its peers. The following list is sorted by funds from largest to smallest assets under management.

MSCI ACWI ETF compares to its peers. Note that the ACWI ETF pays dividends semiannually. (exist)

Both the ACWI fund and its largest peer by assets under management, the Vanguard Total World Stock Index Fund ETF (VT), are relatively new compared to the SPDR Global Dow ETF (DGT), which has been around since the early 2000s. Now, comparing ACWI to VT, I find that investors spend 25 cents more for every $100 of capital invested to remain invested in ACWI. On top of that, the 0.32% trailing dividend yield differential doesn’t make ACWI attractive. However, ACWI slightly outperformed VT in every time period except the 10-year period, where it outperformed VT by 4.2%. Also note that ACWI pays dividends semi-annually.

Additionally, the DGT fund also appears to be more attractive, even though its fees are 0.5%, which is 0.18% higher than ACWI. I believe this relative attractiveness is important to investors, as DGT’s trailing dividend yield is 0.64% higher than ACWI’s.

Relatively speaking, the long-term appeal seems uninteresting

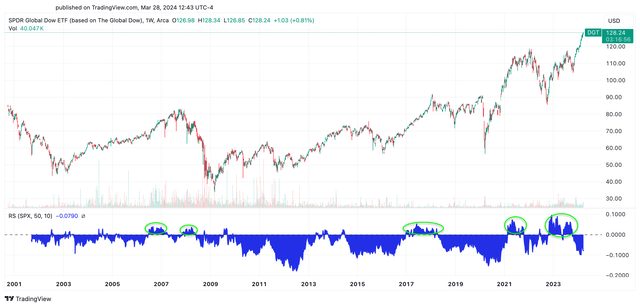

As I noted earlier in the ACWI case, most global broad market ETFs have a long-term outlook for their ETFs. To compare the relative performance of the Global Broad Market ETFs to the S&P 500, I compared the past performance of DGT to the S&P 500. Since DGT is an older fund, it makes sense to consider this first.

DGT underperforms S&P 500 (Trading View)

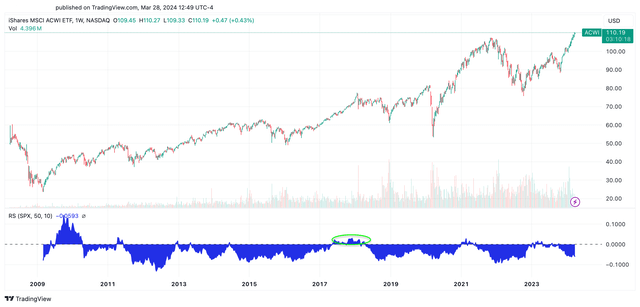

From the chart above, I’ve circled the areas where DGT has performed relatively well relative to the S&P 500. This suggests that there are very few examples of large market index ETFs like DGT outperforming the S&P 500 when compared to the S&P 500. These underperformances look even more pronounced when ACWI’s relative performance is compared to the S&P 500, as shown below.

ACWI performed worse than the S&P 500 compared to DGT in earlier chart (Trading View)

In my opinion, the Global Broad Market ETF is not that attractive compared to DGT’s relative history. However, if investors prefer international diversified funds like DGT and VT, then they will be a better choice compared to ACWI.

Additionally, ACWI funds trade at higher valuations compared to some peers. To arrive at a relative valuation, I looked at the forward valuation of the underlying index. The forward valuation of the MSCI ACWI index tracked by the ACWI fund is 17.4 times the forward price-earnings ratio, which is significantly higher than DGT FundThe forward valuation is 12.9. Given this outlook, I remain neutral on ACWI funds.

Risks and other factors to consider

One of the biggest factors to consider in 2024 is the upcoming election cycle this year in many countries around the world. The election could affect the outcome of global stock markets in two ways, which could create volatility and in turn affect the prospects for those stocks.

Additionally, the interest rate environment has so far provided stable conditions for business operations, but if reserve banks, including the Federal Reserve, are forced to raise interest rates, this could create headwinds for global markets, including ACWI stock.

focus

After conducting a thorough review of ACWI, I believe that ACWI’s value proposition is currently insufficiently attractive to investors given the relative performance of its peers. Long-term investors may stay invested, but similar funds such as DGT and VT funds offer better risk/reward. For the reasons noted in this article, I believe the current Hold rating on the ACWI Fund is appropriate.