Yuichiro Chino/Moment via Getty Images

Those who can’t change their minds can’t change anything”. ——Bernard Shaw

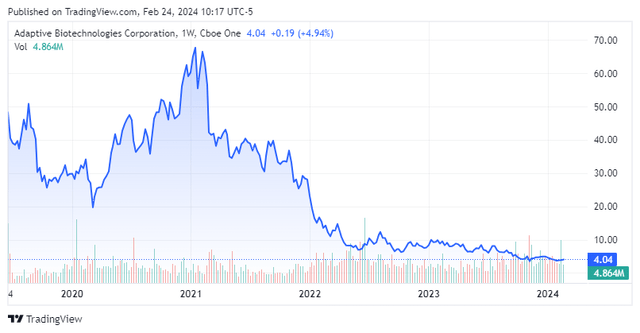

Today, we Adaptive Biotechnology, Inc. (NASDAQ: ADPT) The diagnostics company was in the spotlight as it recently reported fourth-quarter results FY2023. The stock has lost more than 50% of its value in the past 12 months.in our last article In July, we declined to make any investment recommendations on these stocks, but did note that they appeared to be getting closer”buying area‘. Can share prices recover in 2024? Analysis below.

Seeking Alpha

Company Profile:

The Seattle-based commercial-stage diagnostics company develops an immunomedicine platform for diagnosing and treating a variety of diseases. The company has multiple products on the market, including core immunosequencing product immunoSEQ and clinical diagnostic product clonoSEQ Products are used to detect and monitor minimal residual disease in patients with multiple myeloma, B-cell acute lymphoblastic leukemia and chronic lymphocytic leukemia.

Adaptive’s platform leverages proprietary chemistry, computational biology and machine learning to identify and translate these adaptive immune system properties at scale, precision and speed, enabling the development of disease monitoring and clinical diagnostic tests, as well as the development of immunotherapies. The stock currently trades at less than $4 per share, giving it a market capitalization of approximately $585 million.

ClonoSEQ is a key asset of Adaptive’s minimal residual disease, or MRD, business unit. The test is known for its accuracy and clinical utility. Adaptive has benefited from the Covid pandemic, with its T-Detect™ COVID test for confirming recent or previous COVID-19 infection receiving FDA approval for Emergency Use Authorization back in early 2021. With the Covid pandemic, these revenues have essentially disappeared. They are part of the field of immunomedicine.

Fourth quarter results:

The company released its fourth-quarter earnings digit February 14th. Adaptive Biotechnologies’ GAAP loss was 48 cents per share, 15 cents below forecasts. Net loss for the quarter was $69.5 million, up from $40.8 million in the fourth quarter of 2022. Adjusted EBITDA for the quarter was negative $24.7 million, compared to negative $19.6 million in the same period last year.

February company introduction meeting

Revenue fell about 17% year over year to $45.8 million, more than $2 million below consensus estimates. MRD revenue accounted for total sales of US$30.8 million, an increase of 9% over the same period last year. In fiscal year 2023, MRD’s sales reached US$102.7 million, an increase of 18% over fiscal year 2022. ClonoSEQ test volume grew 53% during the year and 49% year-on-year in the fourth quarter.

February company introduction meeting

Management set preliminary fiscal 2024 sales guidance for the MRD business at $130 million to $140 million. Leadership provided no guidance to its immunology medicine unit. They also expect full-year operating expenses, including cost of revenue, to be in the range of $360 million to $370 million in fiscal 2024.

February company introduction meeting

Analyst Comments and Balance Sheet:

Since the release of fourth-quarter results, five analyst firms, including Piper Sandler and JP Morgan, have renewed their buy/outperform ratings on the stock. The target price range is $5 to $10 per share. Goldman Sachs ($5 price target) and Morgan Stanley both maintained hold ratings on the stock.

Currently, about eight percent of the outstanding shares are held short. In 2023, multiple insiders sold a total of nearly $3m worth of stock. However, the stock has not seen any insider activity so far in 2024. As of fiscal 2023, Adaptive Biotechnologies had just over $345 million in cash and marketable securities on its balance sheet. Leadership expects cash burn to be approximately $35 million per quarter in fiscal 2024.

judgment:

Adaptive Biotechnologies reported a GAAP loss per share of $1.56 for fiscal 2023 on revenue of just over $170 million.Current analyst firm consensus The company will cut its losses to $1.31 per share in fiscal 2024 as sales edged up to $175 million. They expect a loss of $1.06 per share in fiscal 2025, with revenue jumping 25%.

February company introduction meeting

Management still has some aggressive goals to drive the company toward profitability in the coming years. Management also hired Goldman Sachs to study some strategic alternatives. The company also received FDA IND approval for its first potential cell therapy product during the quarter.

February company introduction meeting

However, until management can bring adaptive technology closer to profitability; it’s hard to find a reason to invest in the stock right now.

The most important factor for survival is not intelligence or strength, but adaptability”. – Charles Darwin