Robert Way/iStock Editorial via Getty Images

Investment thesis: I believe Adidas is likely overvalued at the moment given the pressure on net sales and the high EV/EBITDA ratio.

In my last post in November, I did adidas AG’s argument (OTCQX:ADDYY) needs to see substantial earnings growth to justify further gains in the future.

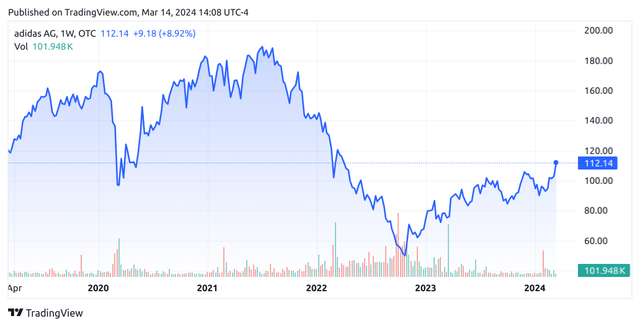

The stock has since risen to $112.14 as of this writing:

trading view

The purpose of this article is to assess whether adidas AG has the ability to continue growing given its recent performance.

Performance

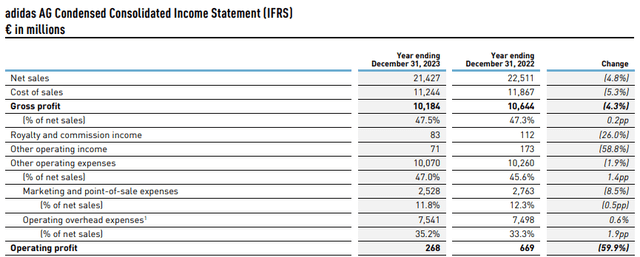

When looking at recent earnings result Judging from the data released by Adidas on March 13, 2024, net sales fell by 4.8% compared with the previous year, and gross profit fell by 4.3%.

adidas AG Press Release: Fourth Quarter 2023

Earnings per share fell sharply to -€0.67 from €1.25 per share in 2022, but this was mainly due to a net loss of €58 million in 2023 – which reflected a very high tax rate. For context, net profit in 2022 was €254 million.

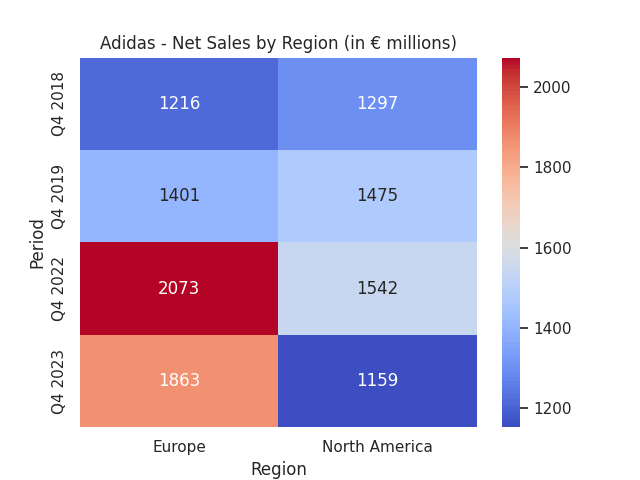

Additionally, when looking at fourth quarter net sales by region (excluding 2020 and 2021 due to the impact of the COVID-19 pandemic), we found that sales in both Europe and North America were up year-over-year. The declines increased by 10% and 24% respectively.

Data comes from adidas AG press releases for the fourth quarter of 2019 and the fourth quarter of 2023. The author used Python’s seaborn library to generate the heat map.

The reason for the sharp decline in sales in North America has a lot to do with the impact of weak Yeezy sales. In my previous article, I warned that although Adidas has successfully sold off most of its Yeezy inventory, the company may still consider writing off 300 million euros of remaining inventory.

Although Adidas has managed to sell a lot of this inventory, operating profit reflected what the company said was “double-digit” million euros in Yeezy-related inventory write-offs. Looking forward, Adidas expects to sell remaining inventory “at cost” and expects sales to reach 250 million euros in 2024, well below the 750 million euros recorded in 2023.

From a balance sheet perspective, while the quick ratio is up slightly from last year, it is still below 1 as total current assets declined, while inventories remain above 2021 levels. The decline we saw last year:

| December 2021 | December 2022 | December 2023 | |

| total current assets | 13944 | 11732 | 9809 |

| in stock | 4009 | 5973 | 4525 |

| Total current liabilities | 8965 | 9257 | 8043 |

| quick ratio | 1.11 | 0.62 | 0.66 |

Source: Information from adidas AG Q4 2021, Q4 2022 and Q4 2023 press releases. With the exception of the quick ratio, figures are in millions of euros. Quick ratio is calculated by the author.

In addition, judging from the ratio of long-term debt to total assets, although long-term borrowings have declined compared with last year, total assets have declined during the same period, so there is not much change. The ratio of long-term liabilities to total assets.

| December 2021 | December 2022 | December 2023 | |

| Long term loan | 2466 | 2946 | 2430 |

| Total assets | 22137 | 20296 | 18020 |

| Long-term debt to total assets ratio | 11.14% | 14.52% | 13.49% |

Source: Information from adidas AG Q4 2021, Q4 2022 and Q4 2023 press releases. Figures are presented in millions of euros, except for the ratio of long-term debt to total assets. The ratio of long-term liabilities to total assets is calculated by the authors.

My opinion and outlook

Regarding my thoughts on the above results and the implications for the stock’s future growth trajectory, it’s clear that net sales came under significant pressure in the most recent earnings quarter.

Additionally, adidas AG currently expects remaining Yeezy inventory to be sold at cost throughout 2024, meaning we may see further headwinds to growth in the short to medium term.

In particular, I believe that adidas AG is likely overvalued at the moment, despite the growth we’ve seen in Adidas stock recently.

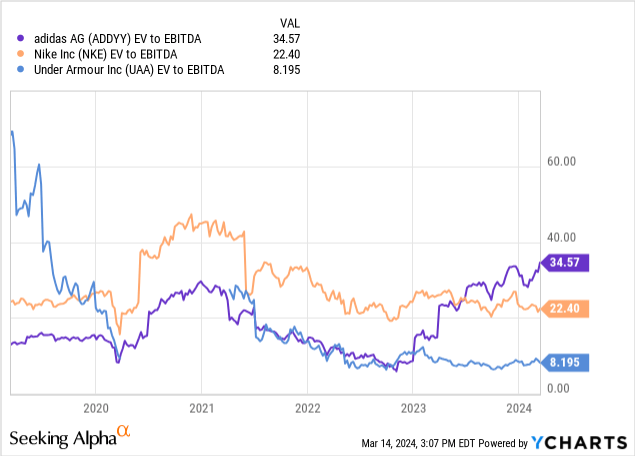

Here are the ranges for EV/EBITDA ratios and EBITDA per share since September 2020:

| date | Enterprise value/interest, tax, depreciation and advance profit | EBITDA per share |

| 14/09/20 | 25.84 | 6.37 |

| 14/03/21 | 28.65 | 6.21 |

| 14/09/21 | 15.95 | 10.55 |

| 14/03/22 | 11.3 | 9.534 |

| September 14, 22 | 8.311 | 8.317 |

| 14/03/23 | 15.42 | 5.566 |

| September 14, 23 | 26.9 | 3.654 |

| 14/03/24 | 34.57 | 3.315 |

| median | 20.895 | 6.29 |

Source: P/E and EPS data from ycharts.com. Median EV/EBITDA and median EBITDA per share are calculated by the authors.

As you can see from the chart above, the current ratio is 34.57x, which is higher than the median of 20.895x for the given period. In this regard, I believe that if the stock tends to return to the median EV/EBITDA ratio of 20.895x and EBITDA per share remains at the current level of $3.315, then $69.26 will represent fair value for the stock this time around (20.895* 3.315).

Additionally, we can see that since the start of 2023, adidas AG has gone from having the lowest EV to EBITDA ratio to having the highest ratio compared to Nike (NKE) and Under Armor (UAA):

Y chart

As mentioned, we have seen significant price increases since November.One of the reasons for the price increase is largely due to assembly The stock rebounded in January due to a “reassuring” pre-closing earnings call ahead of this month’s full-year results. Specifically, the call resulted in a 4.8% rise in the stock price, and while the specific details of the earnings call before the close were unclear, the stock’s rise showed that investors were clearly anticipating encouraging news on net sales growth as well as earnings for the quarter.

However, this is not the case and we see the company facing pressure on both metrics.

From this perspective, I think the market may be overvaluing the stock right now, and without a significant rebound in earnings growth, Adidas may not be able to sustain its current price of $112.

risk

In terms of the potential risks Adidas currently faces, we see that the Yeezy brand is clearly an important part of the company’s sales strategy – especially in North America. There is a long-term risk that once the brand sells off its remaining inventory, the company may face greater challenges keeping its brand relevant in the North American market.

In this regard, the company is more focused on its reputation for producing quality footwear, with brands such as Samba and Gazelle selling reasonably well to date.In addition, Tigst Assefa set a marathon world record in the Berlin Marathon last year wearing Adizero Adios Pro Evo 1 super shoe Helping significantly increase brand awareness of this and other products in Adidas’s footwear lineup, this year will be an important indicator of whether the company can finally improve sales of its broader footwear products after relying heavily on the Yeezy brand.

Specifically, the U.S. market will be very important in this regard, as Adidas has the ability to position its footwear brand as a more premium product than Nike, even though the latter’s brand presence is much stronger in the U.S. This year will be a major turning point in whether we see a significant increase in demand for the Adidas footwear brand across the market – with the Adizero Adios Pro Evo 1 super shoe significantly increasing the company’s brand awareness. As summer approaches, the company’s footwear sales are likely to grow significantly due to seasonal demand.

However, if we end up seeing sales of these brands remain lower than the historical sales of the Yeezy brand, that could give investors pause.

in conclusion

All in all, adidas AG’s net sales came under pressure in the latest quarter. While the company has the potential to rebound and improve its reputation among the broader footwear brand, I believe the stock remains overvalued at the moment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.