Financial advisors remain largely optimistic about the near-term direction of the economy and financial markets.

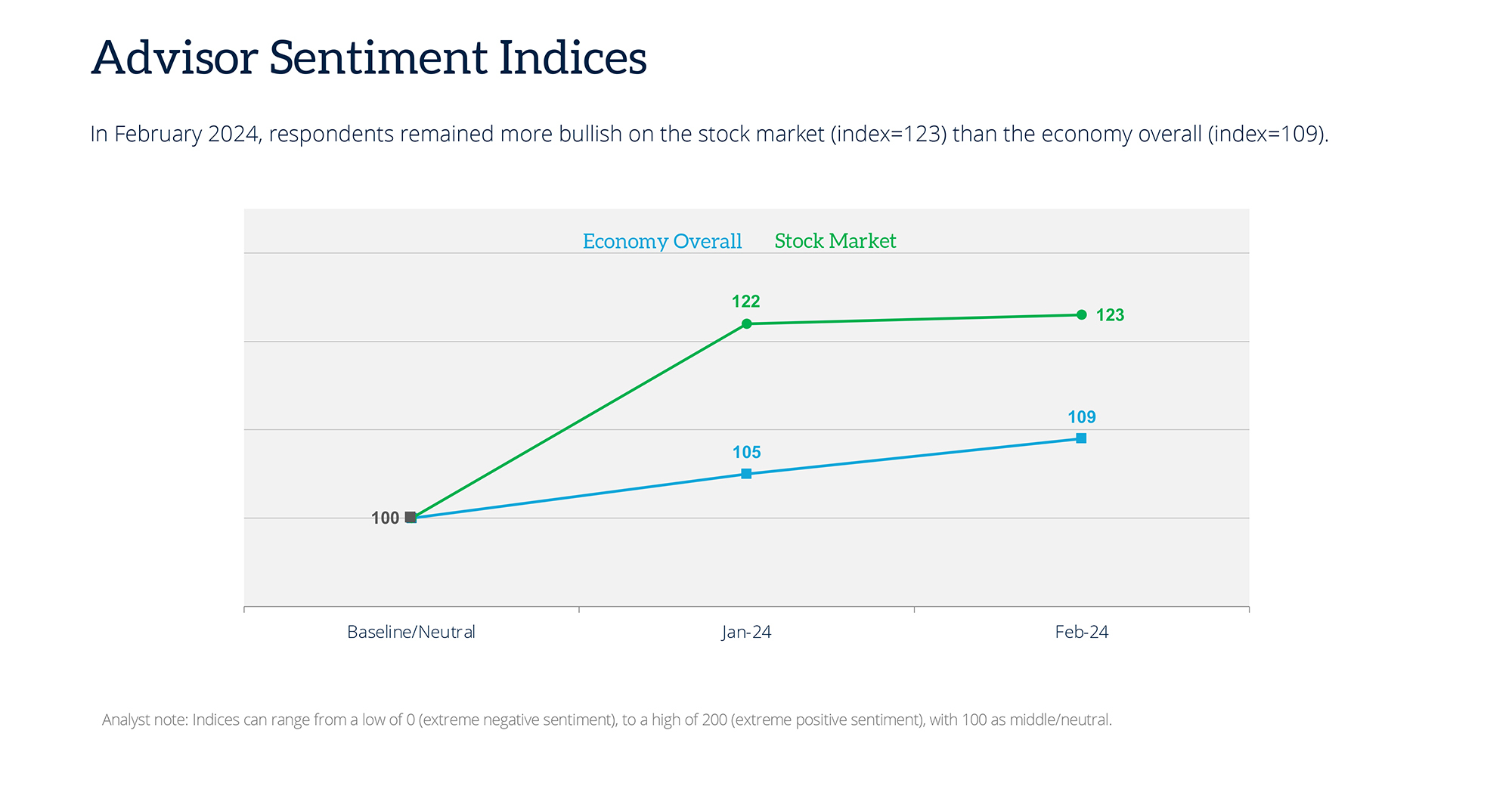

Statistically, sentiment rose slightly on both fronts in February wealth management network The Advisor Sentiment Index, a monthly measure of advisors’ views on the health of the economy and stock market.

Optimism about market conditions rose one percentage point in January, from 122 to 123. (A reading of 100 reflects a neutral view.) Sentiment on that front rose four points, from 105 to 109, although advisers took a more cautious view on the economy.

Click to enlarge

The Advisor Sentiment Index is a monthly survey of more than 120 retail-oriented financial advisors that assesses their current views on economic and stock market conditions, and where they think both are headed over the next six months and beyond. Year.

When asked about their current views, 40% of advisors had a positive view on the economy, while another 40% had a “neutral” view. Only 20% have a negative view of the current economy.

However, the economy is not the stock market, and optimism about current market conditions is much higher. About 69% of advisors believe market conditions are positive. The survey showed that only 5% of consultants had a negative view.

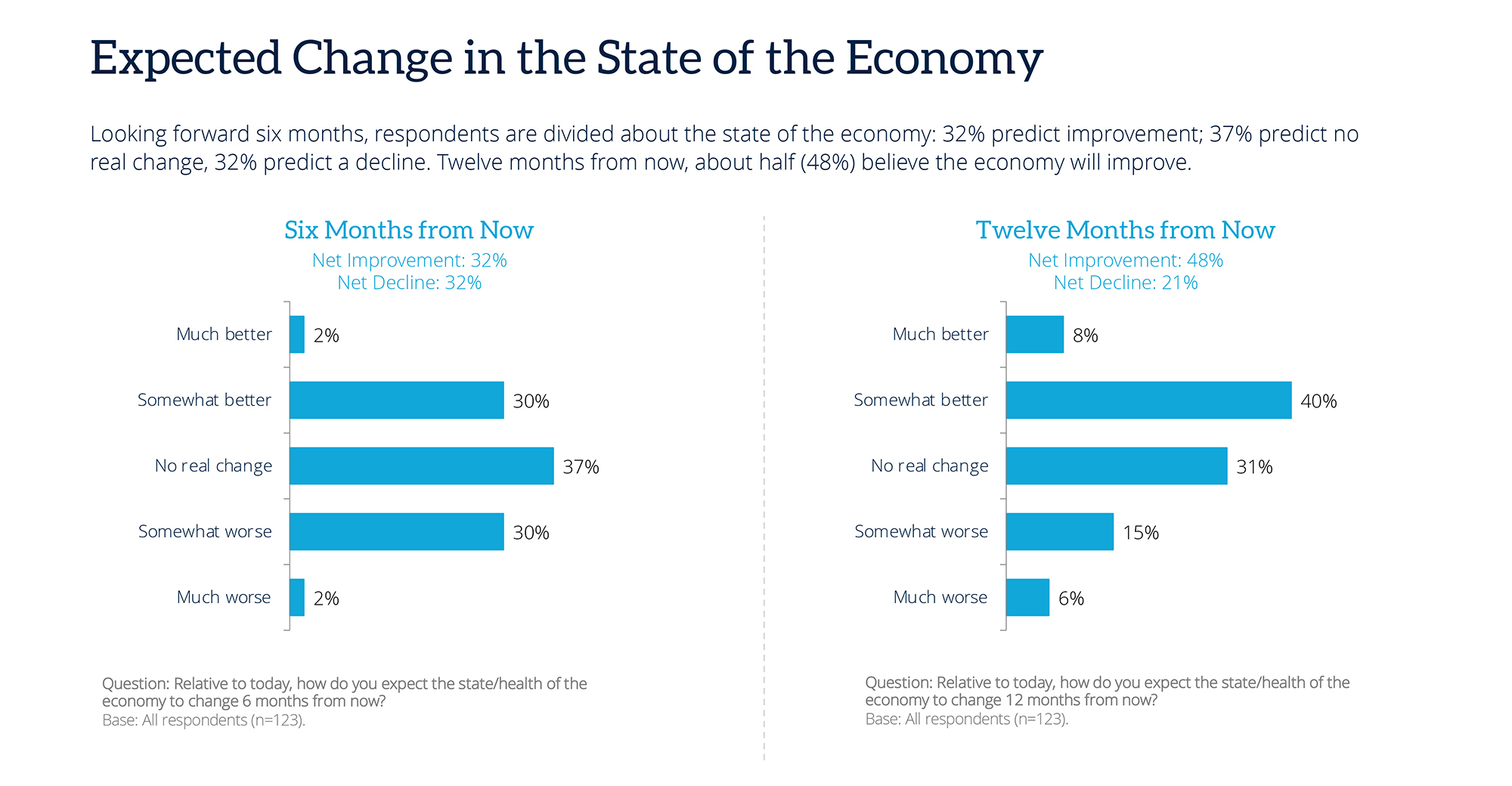

Looking ahead, more consultants expect things to get bleaker over the next six months ahead of what is sure to be a divisive national election. About 32% predicted a decline. Looking ahead to February 2025, they become more optimistic, with almost half expecting conditions to improve.

Click to enlarge

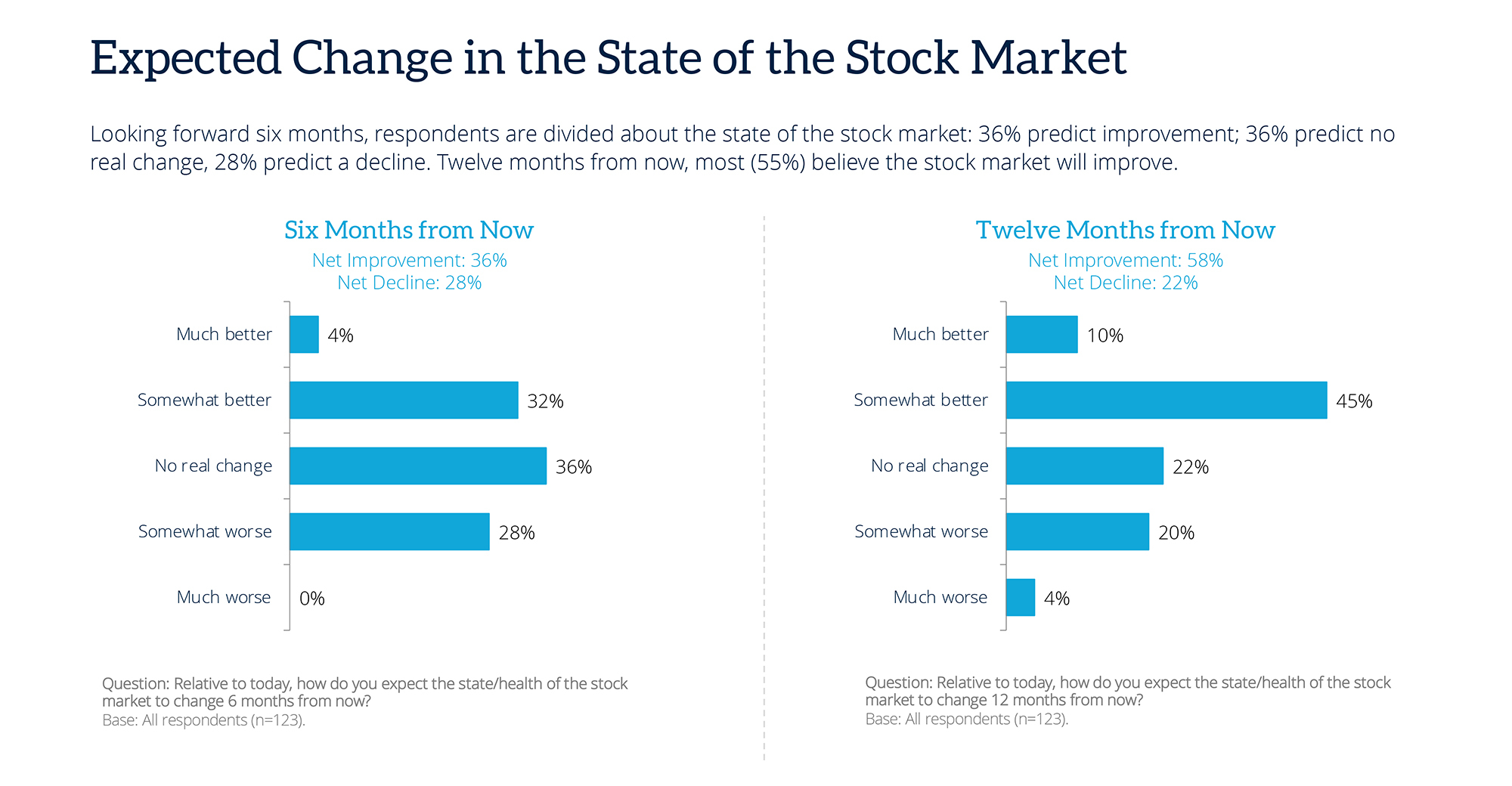

Most advisers share the same view on the stock market, with more than a quarter expecting a net decline within six months. However, when asked about their views on markets in February 2025, almost 6 in 10 advisors expected conditions to improve as the election fades into the past.

Click to enlarge

Methodology, data collection and analysis by WealthManagement.com and Informa Engage. Data were collected from February 22 to 28, 2024. Methods conform to accepted marketing research methods, practices and procedures. Beginning in January 2024, WealthManagement.com will begin rolling out short monthly surveys to active users. Data will be collected during the last 10 days of each month, targeting a minimum of 100 financial advisor respondents per month. Respondents were asked about their views on the economy and stock market now, six months and one year from now. Responses are weighted and used to create an index relative to a neutral value of 100. Over time, ASI will provide directional sentiment for retail-facing financial advisors.