germi_p/iStock Editorial via Getty Images

introduce

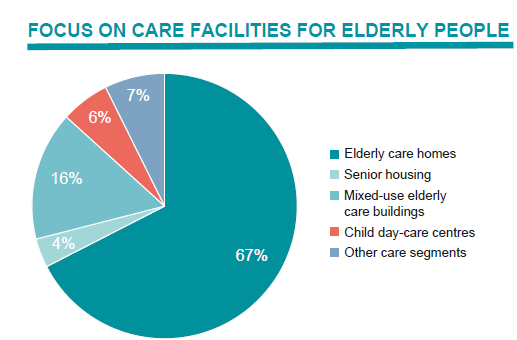

Aedifica ( OTCPK:AEDFF ) is a Belgian REIT focused on healthcare real estate, with a particular focus on nursing homes and other facilities targeting an aging population.

Aedifica Investor Relations

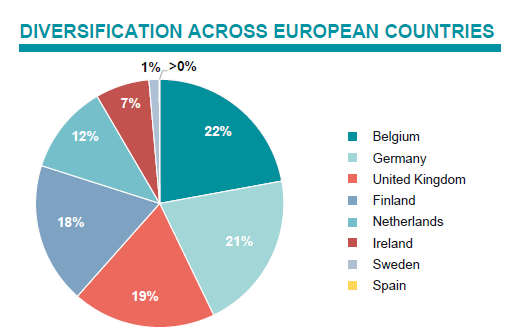

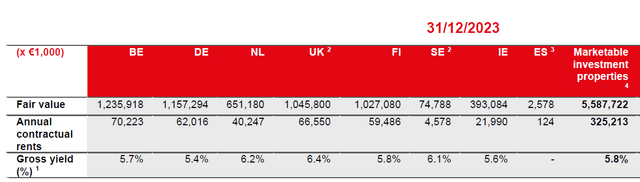

REITs are Active in multiple countries, as the chart below shows, there aren’t any major differences between Aedifica’s four largest markets, as Germany, Belgium, the UK and Finland all make up around 20% of the portfolio.

Aedifica Investor Relations

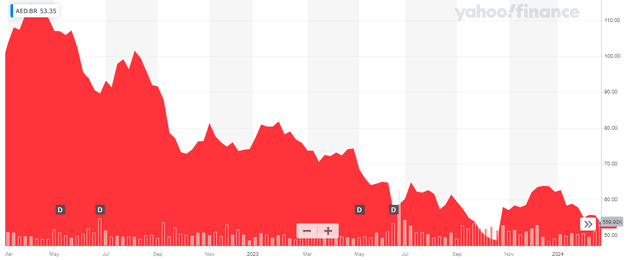

Aedifica’s primary listing place is Euronext Brussels, where the company’s stock symbol is AED.this Average daily trading volume in Brussels is 64,000 shares, One of the advantages of the master list is the options available.There are currently 47.55M shares outstanding, with a market capitalization of just over €2.5B (based on The share price is currently just above 53 euros.

Yahoo Finance

2023 results show dividends paid in full

One of my favorite things about Aedifica is its CPI-linked indexation. This allows the REIT to gradually increase rental income, and means Aedifica is generally not affected by inflation, except for the “timing” issue: it usually only raises rent once a year. The second reason I was attracted to Aedifica is that its leases are triple net leases, which significantly reduces the capital expenditures required to keep the property operational.

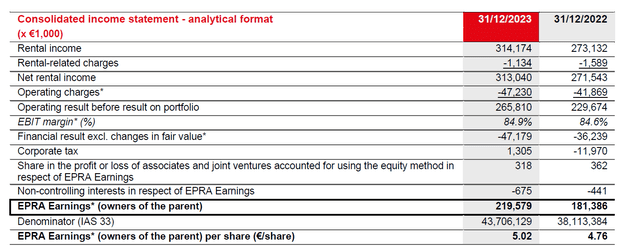

As shown below, Aedifica Generated total rental income of €314 million Net rental income was €313 million. EPRA’s earnings were close to 220 million euros, and based on the weighted average number of shares for the year, EPRA’s earnings per share were 5.02 euros.

Aedifica Investor Relations

Strong earnings (although EPS will decline in 2024) while maintaining a safe balance sheet: gearing to just under 40% at the end of 2023.This will help REITs complete their investment plans

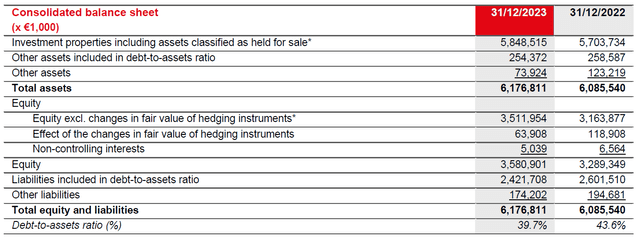

Aedifica Investor Relations

Looking at the fair value of the real estate asset base, Aedifica’s assets are valued at €5.59B, using a rental yield of 5.8%.

Aedifica Investor Relations

Aedifica’s rental revenue guidance for the year is €330 million, which would reduce fair value by just over €500 million even if you apply a 6.5% cap rate, which would result in an updated NAV per share of around €62-63.

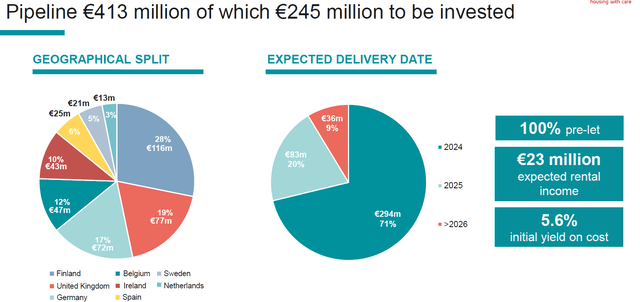

Aedifica also continues to advance its product line €294 million in development assets It is expected to be completed in 2024. The entire portfolio will add €23 million to rental income, resulting in a cost yield of 5.6%. I don’t think Aedifica wants to see higher returns before committing to new projects.

Aedifica Investor Relations

Important note: REITs only need to invest €245 million in 2024-2026 to complete these assets. Since the REIT will retain approximately €50 million of earnings per year (the difference between EPRA earnings and dividends payable to shareholders), it should have no problem obtaining funds to complete its development pipeline.

Aedifica to increase dividend despite weaker 2024 results

I have the utmost respect for management teams that allow dividends to fluctuate based on earnings. After all, that’s exactly what dividends should be: distributing (a portion of) a company’s earnings to shareholders.

For 2023, no questions asked: the REIT reports earnings per share of €5.02 and will pay a dividend of €3.80, giving a dividend yield of about 76%. It doesn’t matter. For 2024, however, the REIT has guided for a dividend of €3.90 per share (+2.5%), although earnings will fall 6% to €4.70 per share. Based on 2024 guidance, the payout ratio will increase to 83%. The lower profit results were primarily due to an increase in share count. During 2023, the number of shares increased from 39.9 million to 47.5 million, but the weighted average number of shares was 43.7 million, which is the figure used to calculate EPRA earnings of €502 per share.

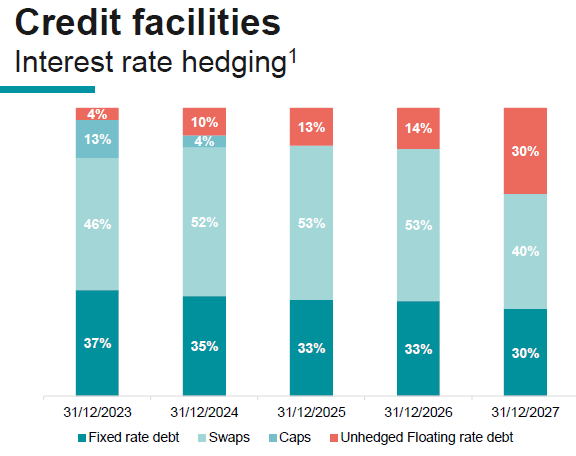

While this does mean the dividend is still well covered by earnings, 2024 may not be the last year Aedifica has to deal with earnings pressure. Aedifica’s average cost of debt at the end of 2023 was 1.9%. Fortunately, REITs have hedged the vast majority of their interest rate risk, as you can see below, as well as a significant portion of their fixed-rate debt.

Aedifica Investor Relations

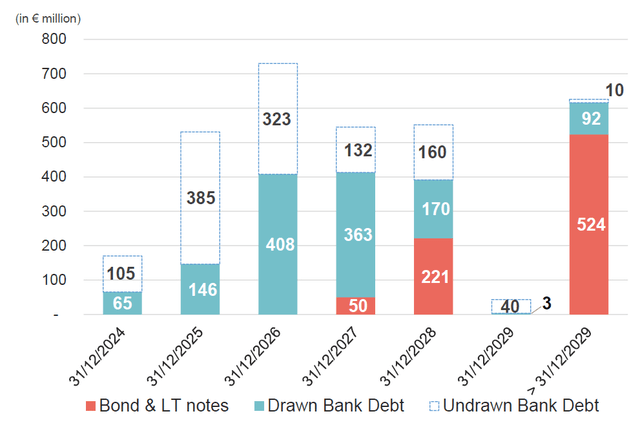

However, interest rate hedging apparently only takes into account hedging before maturity. As the chart below shows, Aedifica may face some headwinds heading into 2026. The €211m of debt maturing in 2024 and 2025 can be easily refinanced, while the expected increase in debt costs is likely to be fully compensated by higher rental income.

Aedifica Investor Relations

The real test will come in 2026 and 2027, when debt totaling 820 million euros will have to be refinanced. Fortunately, two things work in Aedifica’s favor. The first factor is the expected decline in interest rates over the next few years. I think it’s possible that Aedifica’s cost of debt will be lower than it is today in 2026. Secondly, there are still two years until 2026, which gives Aedifica enough time to “right-size the portfolio” and drive a few rent increases by then, and complete its portfolio, which will add over $2,000 to rental income million euros (part of the full operating expenses of euros 23 million is included in the 2024 guidance).

In theory, and this is just a theory, assuming all other costs and expenses remain constant, an average 2% annual increase in net rental income would cover a 4.5% refinance. A rate that I think is definitely achievable if the ECB does start lowering its benchmark interest rate later this year.

investment thesis

I have a sizable long position in Aedifica and I’ve been waiting for the annual results before deciding if I should add to that position (the position is slightly underwater at the moment). I’m not quite sure how REITs will weather the turbulent waters, but Transparent’s 2023 update allays my concerns. While earnings will decline in 2024, this is primarily due to the full impact of the 2023 financing, and we will likely see earnings increase again in 2025 as the REIT should be able to continue growing rental income while the impact of debt refinancing remains relatively limited.

An added benefit is that Aedifica’s dividends will only be subject to 15% rather than 30% withholding tax (although this benefit may disappear in a few years as the UK portfolio will no longer count as European residential healthcare real estate. Aedifica may The decision will be made to reduce the size of its UK portfolio while investing in other European assets to meet the requirement of 80% of assets in European residential real estate, all dependent on the importance of reduced dividend tax to the REIT.

Aedifica trades at a 25% discount to its net asset value (based on a 5.8% cap rate) and a 15% discount based on a 6.5% cap rate. In addition, the dividend yield of 7.3% is also very attractive.

I have a long position and will continue to add to that position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.