David Ramos/Getty Images News

Aena SME, SA ( OTCPK:ANYYY ) is the world’s largest airport operator by passenger volume, with the majority of its traffic in Spain. The Spanish government owns 51% of the company and retains majority voting control.

I introduced Aena last time in the article “Aena: Demand continues to grow as passenger traffic resumes and continues to grow.”

In this article, I am optimistic about Aena as I think the airport operator will benefit from the onset of rate normalization and there will be opportunities to develop vertical airports in the future. I also note that passenger traffic through Aina Spanish Airport has steadily improved in 2023 through the third quarter of 2023, and write that the stock has room to rise if traffic continues to strengthen.

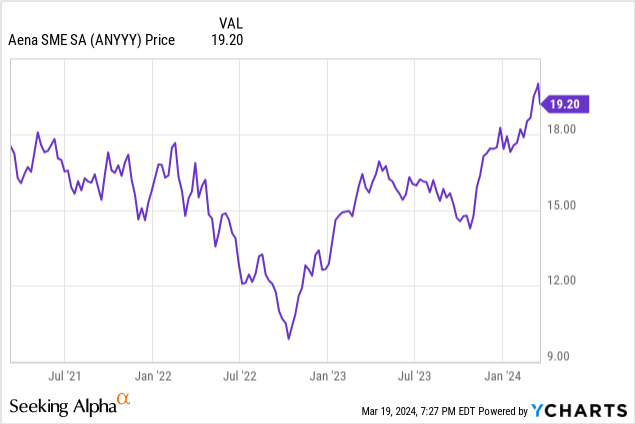

Aena shares fell sharply from 2020 to mid-2022 amid 8 headwinds Affected by the epidemic, it has suffered losses in several consecutive quarters since the first quarter of 2020.

Early in the pandemic, Aena Spanish airport passenger traffic fell in 2020 to 27.6% of pre-pandemic levels in 2019. In 2021, Aena’s passenger traffic through its Spanish airports was only 43.6% of 2019 levels.

However, Aena’s passenger traffic has strengthened in recent years, with traffic at the company’s Spanish airports rebounding to 102.9% of 2019 levels in 2023. With stronger traffic and a more optimistic future, Aena stock should perform relatively well in 2023 and early 2024.

Since my last article, Aena reported full-year 2023 results on February 28, and the company also released an updated 2022-2026 strategic plan on March 7, 2024, reflecting passenger growth in 2026 Volume growth continues to be strong and optimistic.

All year 2023

for 2023Aena’s passenger traffic continued to rebound and its financial performance strengthened as a result.

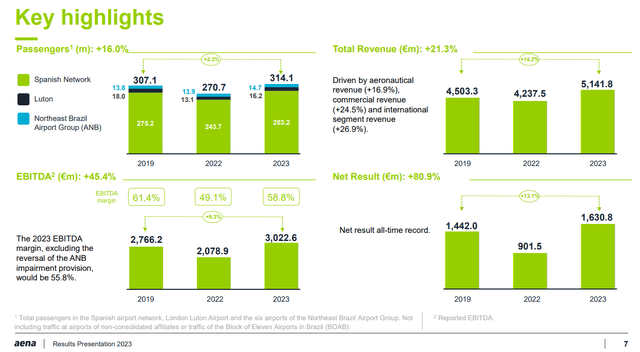

This year, the Aena Group’s passenger traffic, which includes Spanish airports, London Luton Airport and northeastern Brazil airports, increased by 16% year-on-year to 314.1 million passengers, accounting for approximately 102.3% of pre-epidemic passenger traffic in 2019.

In Spain, Aena’s passenger traffic increased by 16.2% year-on-year to 283.2 million passengers, accounting for approximately 102.9% of passenger traffic in 2019.

In terms of financial performance, Aena’s revenue increased by 21.3% year-on-year to 5.1418 billion euros. Annual EBITDA increased by 45.4% year-on-year to 3.0226 billion euros, an increase of 9.3% compared with 2019.

Excluding the reversal of impairments from Northeastern Brazil Airports Group, Aena’s EBITDA margin was 55.8%.

Net profit was 1.6308 billion euros, including non-recurring financial items.

Aena Investor Introduction

With EBITDA growing significantly, Aena’s net financial debt to EBITDA ratio was 2.06 at the end of 2023, compared with 3 at the end of 2022.

As a result of its 80% dividend policy, Aena will propose to the Ordinary General Meeting a gross dividend of €7.66 per share from profits for 2023, up from €4.75 per share in the previous year.

It’s important to realize that Aena SME, SA ADR is 1/10th of Aena’s common shares, so the proposed annual dividend plan for Aena SME, SA ADR is actually about $0.83 at current exchange rates.

My conclusion is that Aena’s passenger numbers and financial position are quite strong in 2023.

2024

2024 has been another strong year so far in terms of passenger traffic growth in Aena’s primary market.

In February, one day longer than last February, the airport in Aena, Spain received 19,226,616 passengersThe annual increase was 15.7%, and 95,490 tons of cargo were transported, an annual increase of 18.6%.

Passenger traffic and cargo traffic at the airports in Spain’s Aina network both hit record highs in February, maintaining the upward trend seen last month and throughout most of 2023.

Aena expects to end 2024 with revenue of approximately Spain’s Aina Airport carries 294 million passengers, compared with 283 million in 2023. The company further added, “The outlook for summer 2024 looks good, with a schedule increase of approximately 7% compared to 2023.”

In January 2024, the Spanish government also allowed Aena to increase the fees it charges airlines using the company’s Spanish airports 4.09%.

My conclusion is that passenger traffic in Aena’s primary market will be moving in the right direction in 2024 and it could be a strong year in terms of traffic growth.

Updated Strategic Plan 2022-2026

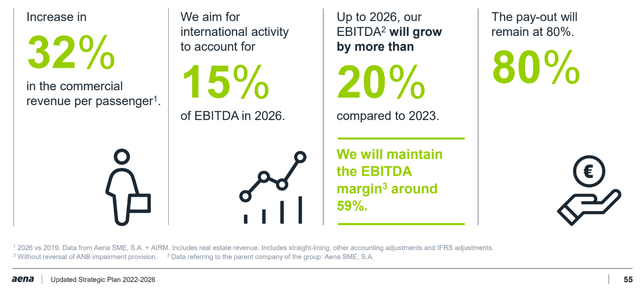

for Updated Strategic Plan 2022-2026, Aena expects passenger traffic to continue to grow. Management specifically anticipates that the number of passengers in Spain will reach approximately 294 million in 2024, approximately 300 million in 2025, and approximately 310 million in 2026.

If Aena’s airports outside Spain are included, Aena expects global passenger throughput to exceed 1 million per day by 2026. In addition to Spain, the company also has a considerable market share in Brazil, as Aena currently handles approximately 20% of the country’s passenger traffic.

In terms of financial performance, Aena expects EBITDA margins in 2026 to be approximately 59%, and international business to account for approximately 15% of EBITDA in 2026.

Aena also expects EBITDA to increase by more than 20% in 2026 compared with 2023 without revoking ANB’s impairment provisions.

Management also confirmed an 80% dividend policy.

Aena Investor Introduction

Aena said that going forward, it will propose at least double the investment committed during the previous regulatory period, with strong traffic as the main reason.

To put this figure into perspective, Aena plans to invest a total of €3 billion during the current regulatory period 2022-2026.

My conclusion is that given Aena’s guidance for Spanish passenger numbers in 2026, continued growth is expected in its key market. Additionally, management seems to believe that there will be more investment opportunities given the stronger transportation potential. The company is also more diversified internationally, which could be an opportunity for further growth.

risk

If economic conditions soften or flight demand is not strong for a number of reasons, passenger traffic may not be as strong as anticipated.

If passenger traffic isn’t strong, Aena’s profitability and stock could face headwinds. For example, the company has suffered eight consecutive quarters of losses due to reduced passenger traffic due to the epidemic.

Given that the Spanish government owns 51% of Aena, the airport operator may at times operate in the interests of Spain rather than shareholders.

Aina may not be able to successfully adjust to the VTOL.

Valuation

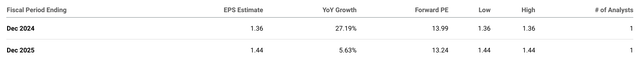

In terms of Aena SME’s profit forecasts, the SA ADR is 1/10 of Aena’s common shares and analysts expect earnings to grow.

In terms of expectations, analysts on average expect Aena SME, SA ADR to post earnings of $1.36 per share in 2024 and $1.44 in 2025. As of March 19, the company was trading at $13.99 for 2024 and $13.24 for 2025, which I think is an attractive valuation.

Seeking Alpha

In terms of expectations, I think if Aena can meet its passenger traffic growth guidance, it can hit the average analyst earnings estimate, which I think the company can achieve assuming air travel isn’t disrupted by any major negative events. Target.

Therefore, I continue to rate Aena a Buy and view it as Equal Weight in a diversified portfolio that includes the Big Seven.

I think Aena could trade on a 2024 P/E of 16 or higher next year if passenger traffic continues to strengthen and rates begin to normalize. This gives me over 14.3% upside as of March 19 levels.

However, I wouldn’t hold too much Aena because, as the pandemic has shown, air travel can change dramatically in a short period of time.

In terms of passenger traffic, the strengthening of the Eurozone economy may be some of the drivers.According to IMF data for January 2024, they expect euro area real GDP to grow 0.9% In 2024 it will be 1.7%, in 2025 it will be 1.7%, and in 2023 it will be 0.5%.

Another potential driver could be starting to lower interest rates, which I think could happen this year. In terms of interest rates, I think it will normalize in a year or two.

In terms of the things I focus on, I would first look at passenger transport trends mainly in Spain but also internationally and make sure they are moving in the right direction in the long term.

I would also look at interest rates. I think Aena will get further momentum if interest rates start to fall, as that could help make its annual dividend more attractive.

I’ll be keeping an eye on management’s handling of VTOLs as this may be a growth market in the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.