Wire

age ( OTCPK:AGESF ) currently offers a forward dividend yield above 8% and trades at a discount to its peers, making it attractive to income investors.

As I analyzed in my previous article, ageas is an interesting revenue play in the European insurance industry due to a good combination of high dividend yield and better growth prospects than most of its peers.

While the company hasn’t reported earnings since my last article on ageas, it gave a strategy update a few months ago, so in this article I take a look at its business strategy and outlook for the next few years. Is it still an interesting income option for long-term investors?

Policy update

The European insurance market is quite mature and the growth prospects are not particularly impressive, but ageas is a company with considerable exposure This gives the company better long-term growth prospects than most of its peers.

in its latest investor dayageas confirmed most of the growth targets set out in its Impact24 strategy, helped by good performance in its three most important markets, namely Belgium, the UK and China.

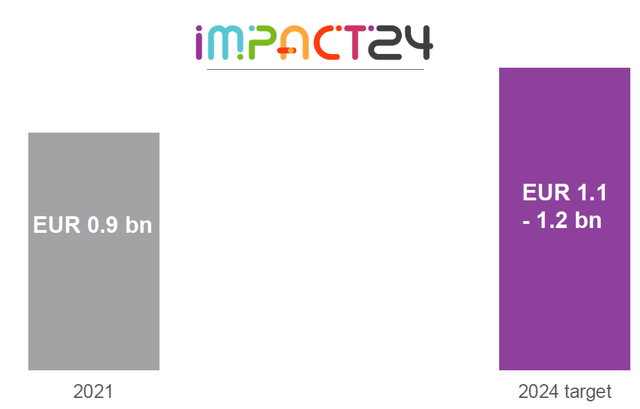

From a financial perspective, the company is targeting earnings growth of about 6-8% annually over the 2021-24 period, which is on track to be achieved. In fact, its 2023 net operating results are expected to be at the upper end of the range of €1.1-1.2 billion, meaning ageas may hit its target a year earlier than expected.

operating profit (Aijers)

While that’s not an impressive growth rate, investors should consider that insurance is a relatively low-growth industry that has been negatively impacted by the pandemic in recent years. As such, this track record can be considered quite positive, indicating that Ageas has a sound business fundamentals that bodes well for its future growth.

Ageas has better growth prospects in Asia, with China being the most important market, but the company is also taking steps to improve its operations at home and in the UK.

In Belgium, ageas owns 75% of AG Insurance, with the remainder held by BNP Paribas (OTC: BNPQY). The company is the market leader in the life and non-life insurance market, which is relatively concentrated compared to other countries. In fact, the top five insurance companies in Belgium account for more than 60% of the total market share, giving them some pricing power over their smaller rivals.

AG Insurance’s premium growth has been slightly higher than the overall market over the past few years as the company has been pushing investment-linked sales in the life insurance space, which is key to offsetting weakness in guaranteed products. In the non-life insurance sector, improvements in company efficiency have resulted in lower combined ratios over the past few years, becoming the main driver of profit growth in this sector.

The business unit has returned 100% of its profits to Ageas’ holding level, becoming the group’s main source of cash. This is not expected to change much in the future as the market matures and AG Insurance is well capitalized, so it can All its profits are distributed to shareholders.

Considering that Belgium is a mature market with relatively bleak growth prospects, ageas’s strategy is to improve efficiency, that is, through digitalization, aiming to improve the cost ratio in the medium and long term. This means earnings growth should remain in the low single digits for the foreseeable future, but the sector should remain an important source of dividend remittances over the long term.

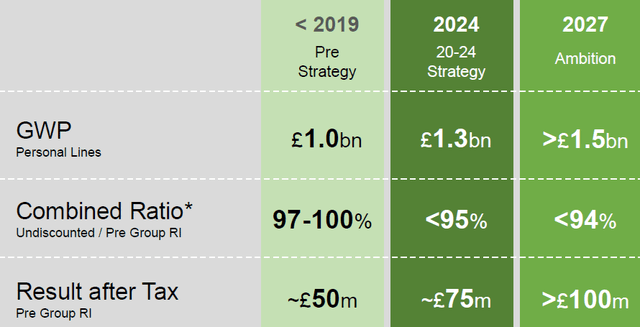

In the UK, Fulgis’s strategy focuses on business restructuring because the market competition is quite fierce, growth prospects are low, and the company’s efficiency was not very high in the past few years. In addition, its own organizational structure is somewhat complex, operating under 12 brands and offering more than 400 products, which results in poor operating indicators. In fact, its combined ratio averaged above 100% between 2014-19, meaning it was unprofitable on an underwriting basis.

Against this backdrop, ageas has streamlined its operations in the country, focusing mainly on larger and more efficient individual businesses, while exiting market segments where the cost base was too high and it did not have any competitive advantage compared to its peers. Ageas currently operates in the car and home insurance segments under just two brands and has reduced its workforce by more than 700 in the country to reduce costs.

It also invests in technology and data analytics to improve its operations and provide better customer service, making it more efficient and competitive than its peers. As a result of these measures, it has reduced operating expenses by approximately £55 million per year, which has contributed positively to earnings growth in recent years and was an important factor in the improvement in its combined ratio.

Ageas expects to improve its combined ratio to below 95% in 2024 (from 97-100% before 2019) and below 94% in 2027. The company also expects some growth in revenue over the next few years, which is also expected to support future earnings growth, with the aim of achieving post-tax profits of over £100m by 2027, up from around £100m before the turnaround plan was implemented a few years ago. £50 million.

british target (Aijers)

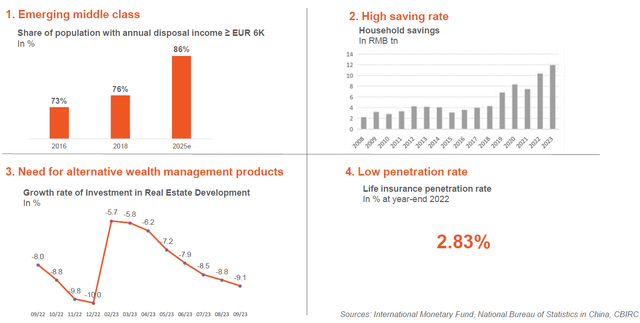

In Asia, the company operates in several countries, including India or Malaysia, but its main growth engine is China, a situation that is not expected to change much in the near future. Ageas holds a 24.9% stake in China Taiping, China’s sixth-largest life insurance company, which has about 15 million customers and operates through agency and bancassurance agreements.

Although its business was impacted by COVID-19-related restrictions in 2022, its commercial performance improved significantly in the first half of 2023, with double-digit growth in both capital inflows and new business value.

Additionally, the company has very high renewal rates, meaning its business is highly repetitive and should continue to grow at a strong rate in the near future, supported by distribution agreements in the banking space, while in agency On the merchant side, its strategy has shifted toward profitability and reduced the number of agents working with the company.

Going forward, its growth prospects are good due to the positive industry backdrop as the country’s middle class continues to grow and insurance penetration continues to remain at a relatively low level, which bodes well for the medium to long-term growth of the industry.

China grows (Aijers)

Regarding profits in 2023, ageas expects to announce financial results at the end of February, and is expected to show positive operating momentum based on good performance in the first half of 2023.

Its operating profit should be around 1.23 billion euros, slightly above the company’s own guidance, and dividends should grow to 3.20 euros per share relative to 2023 earnings, according to analyst estimates. Ageas said it expects to grow its annual dividend by 6-8%, so given that a dividend of €3.20 per share implies annual growth of 6.7%, it could exceed current expectations.

Even assuming ageas’ annual dividend meets expectations, its forward dividend yield is about 8.2% at the current share price, which is quite attractive to income investors.

in conclusion

While the European insurance market has matured, FTLife holds an interesting position with its leadership position in Belgium, which provides predictable recurring cash flow over the long term, plus some growth prospects in the UK As a turnaround story, and a good growth industry driver in China.

Despite this positive backdrop, one of the most attractive features of its investment case remains its high dividend yield, which is sustainable over the long term and very attractive to income-oriented investors. interesting. Ageas currently yields over 8%, giving it an above-average yield and a lower valuation than its peers, making it an excellent choice for European insurance income.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.