Diloch Cressatabon

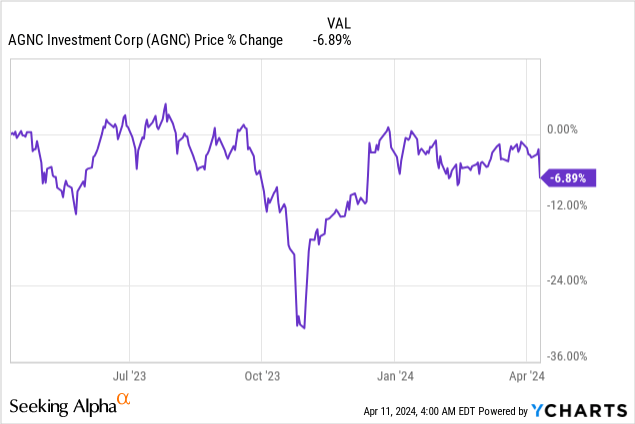

AGNC Investment Corporation (NASDAQ: AGNC) and other mortgage REITs with heavy investments in rate-sensitive mortgage-backed securities are expected to be beneficiaries of the Fed’s rate pivot in fiscal 2024.With inflation coming in March Wednesday’s weather was hotter than expected and the market is adjusting to expectations for a cut in the federal funds rate, which I suspect will pose considerable headwinds to AGNC’s valuation. The prospect of book value growth and rising long-term financing costs could also hurt AGNC in the short term. Due to the latest developments in inflation, I believe the risk profile of highly leveraged mortgage REITs has worsened, and I downgrade AGNC stock to Hold.

Previous rating

I featured AGNC and Annaly Capital Management, Inc. (NLY) late last year – Top Mortgage REITs for 2024 — because the potential for lower financing costs will boost mortgage REITs’ net interest income. The March inflation report showed inflation growth accelerating month over month, which unfortunately changes the outlook for AGNC and the broader mortgage REIT industry. My new rating is Hold.

Accelerating inflation is changing AGNC’s risk matrix

consumer price up 3.5% In March, according to the latest inflation data, this means that inflation accelerated from the previous month: in February, consumer prices rose by 3.2%, which itself represents an acceleration from the 3.1% inflation rate in January. Accelerating inflation is a problem for mortgage REITs such as AGNC, which own large portfolios of interest-sensitive mortgage-backed securities.

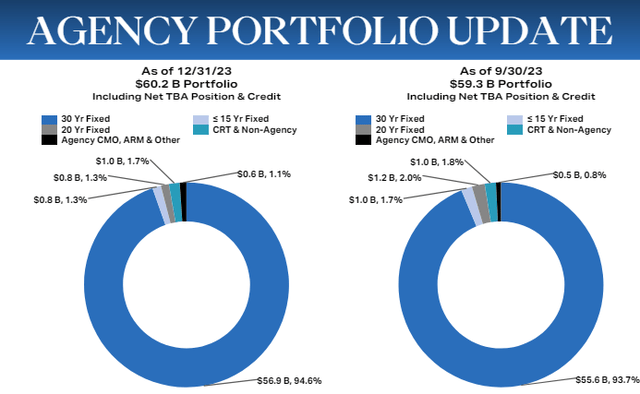

AGNC had $60.2B in agency mortgage-backed securities at the end of fiscal 2023, growing $0.9 per quarter. Mortgage REITs purchase these mortgage securities with debt, making AGNC and other leveraged mortgage REITs vulnerable in a high-rate world.

AGNC

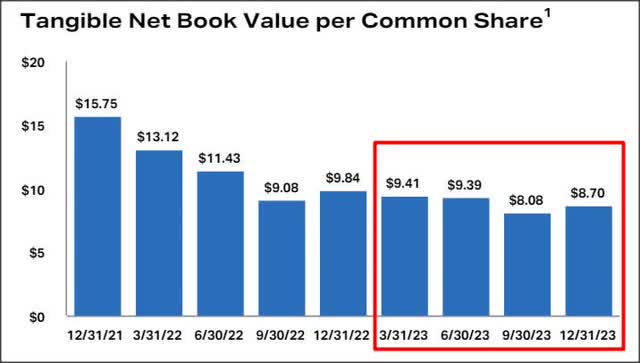

The Federal Reserve’s aggressive tightening policies have done considerable damage to AGNC over the past two years, as higher interest rates have weighed on the valuation of the company’s portfolio of mortgage-backed securities. AGNC’s net tangible book value fell sharply two years ago after the Federal Reserve began raising the federal funds rate to control soaring inflation.

AGNC’s net tangible book value fell 38% in fiscal 2022 and then fell another 12% in fiscal 2023. AGNC’s book value stabilized in the second half of last year, largely on expectations that the Federal Reserve would end its tightening policy, easing pressure on mortgages. Financing costs for real estate investment trusts increased significantly last year. However, rising inflation in March changed that trajectory.

AGNC

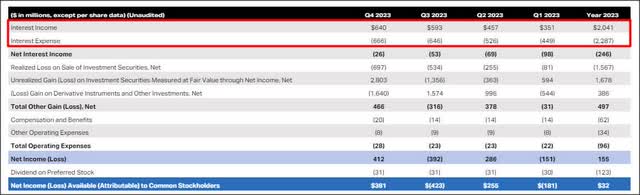

A direct consequence of the latest inflation report is that AGNC’s interest expenses will remain high in the short term. In the fourth quarter, the mortgage REIT’s interest expense was $666 million, an increase of 107% year over year. The REIT’s interest income increased 84% year-on-year to $640 million, leading to increasing pressure on AGNC Investment’s net profit and book value. I believe this pressure is likely to persist now, limiting the upside rerating potential for REITs.

AGNC

AGNC Investment Valuation

Accelerating inflation is a considerable headwind for AGNC’s near-term profit potential, as it could delay a federal funds rate cut that would have helped the mortgage REIT’s net interest income.

With inflation higher than expected, the Fed will almost certainly delay the end of its tightening policy, possibly until 2025. As a result, I believe AGNC’s book value growth prospects have weakened significantly this week.

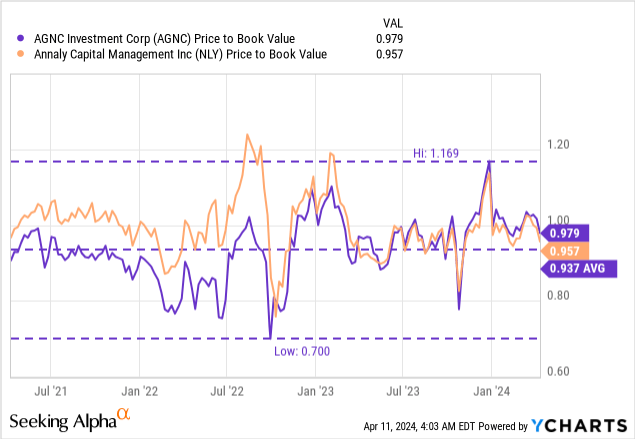

AGNC stock currently trades at a price-to-book ratio of 0.98x, although it recently traded at a 17% premium to book value. Mortgage REITs are typically valued based on their book value because they own large portfolios of mortgage-backed securities, mortgage servicing rights and commercial real estate securities that are required to be marked to market under accounting regulations.

For context, Annaly Capital trades at a P/E ratio of 0.96, and the same argument I made here for AGNC applies to the largest mortgage REIT. I already rated Annaly Capital in February: Don’t Chase a 14% Yield (rating downgrade).

As inflation picks up again, I expect AGNC’s book value to come under increasing pressure given the delayed interest rate trajectory, and to see AGNC return to a larger discount to book value (~10%) in the near term, I Wouldn’t be surprised. Therefore, I believe there is considerable valuation risk to AGNC, especially if there are no serious doubts about the Fed’s plans to lower the federal funds rate. However, if there is a large enough discount to book value, say 20%, I would consider purchasing the stock (~$7.63) in an opportunistic, short-term focus manner.

AGNC Risks

AGNC’s stock price began to re-rate in December, mainly because the Federal Reserve guided that the federal funds rate could be cut up to three times in fiscal 2024. With a rate cut now becoming less likely, I think the risk profile has worsened significantly, and the 16% yield is riskier for dividend investors. If the market goes against expectations and inflation slows significantly in the coming months, the Fed may continue to implement three federal funds rate cuts in fiscal 2024. This would also change my view on AGNC’s book value outlook and possible outcomes. A positive change in rating.

Conclusion

The inflation update is very bad news for AGNC and the entire mortgage REIT industry. Longer-term higher inflation means the Fed will not push for a federal funds rate cut in fiscal 2024, which in turn means mortgage REITs with portfolios made up of rate-sensitive mortgage-backed securities are increasingly facing A lot of pressure. Additionally, higher long-term interest rates mean there won’t be any relief for mortgage REITs’ financing costs, which will not only hinder profitability but also impact AGNC’s valuation factors. With the adverse inflation update having a profound impact on AGNC, I think a rating change to Hold is justified!