User ba011d64_201

Author: Peter C. Earle

In March 2024, Ireland’s daily price index experienced its third largest increase in more than a year, rising by 0.82%.The rise took our proprietary inflation index to a new record high of 289.2, surpassing The previous high was reached in September 2023 at 288.60.

AIER daily price index and US consumer price index (NSA, 1987 = 100)

(Image source: Bloomberg Finance)

The largest price increases among the daily price index constituents in March 2024 were automotive fuel, catering and Internet service/electronic information providers. The largest declines were in household supplies, residential phone service and household food. Among the 24 index constituent stocks, 16 constituent stocks increased in price and 8 constituent stocks fell in price.

The U.S. Bureau of Labor Statistics (BLS) released March 2024 Consumer Price Index (CPI) data on April 10, 2024. Key release indicators (core and headline) were 0.1% higher than forecast both quarter-on-quarter and year-over-year. Both headline and core monthly CPI data rose 0.4%, compared with expectations of 0.3%.

Among the major categories, the food index edged up 0.1% in March 2024, with household foods remaining unchanged, but three-sixths of major grocery store food category indexes fell, while prices rose in the remaining three. Other domestic foods declined 0.5%, primarily due to a sharp 5.0% drop in butter prices, while cereals and bakery products posted their largest ever single-month seasonally adjusted declines. Driven by a 4.6% rise in egg prices, meat, poultry, fish and eggs rose 0.9%, non-alcoholic beverages rose 0.3% and fruits and vegetables rose 0.1%. After rising 0.1% in February, the eating out index rose 0.3% in March, with limited service meals rising 0.3% and full service meals rising 0.2%.

In March 2024, the energy index rose 1.1% as gasoline prices increased 1.7% (up 6.4% before seasonal adjustment), electricity prices increased 0.9%, and natural gas prices remained unchanged. However, the fuel oil index fell 1.3% in March.

From a month-on-month perspective, among the core insurance types, motor vehicle insurance grew by 2.6%, continuing the upward momentum since February. Clothing prices also rose 0.7%, as did personal care, education, home furnishings and operating prices. However, the health care index edged up 0.5%, used cars and trucks fell 1.1%, and various other categories including leisure, new cars and air tickets also declined.

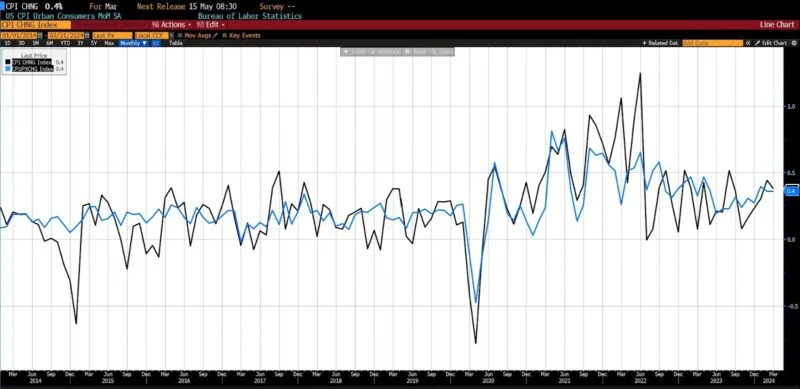

U.S. CPI overall data and core month-on-month data in March 2024 (2014 to present)

(Image source: Bloomberg Finance)

From March 2023 to March 2024, the overall CPI rose by 3.5%, higher than the expected 3.4%. The core CPI increased by 3.8% annually, which was also higher than the 3.7% predicted by the survey.

Among food categories over the past 12 months, the Household Foods Index rose 1.2%, the Household Other Foods Index rose 1.4%, and the Fruits and Vegetables Index rose 2.0%. Non-alcoholic beverages also increased 2.4%, meat, poultry, fish and eggs increased 1.3%, and cereals and bakery products increased 10%. However, the Dairy and Related Products Index fell 1.9% for the year. In terms of energy, the index rose 2.1% over the same period, driven by a 1.3% increase in gasoline prices and a significant 5.0% increase in electricity prices. In contrast, the natural gas and fuel oil indices fell 3.2% and 3.7% respectively last year.

Last year, the index for all items except food and energy rose by 3.8%, with housing costs rising by 5.7%, making a significant contribution to overall growth. Other significant increases include motor vehicle insurance (22.2%), health care (2.2%), entertainment (1.8%) and personal care (4.2%).

U.S. CPI overall and core annual ratio in March 2024 (2014 to present)

(Image source: Bloomberg Finance)

U.S. consumer inflation continues to trend upward, as reflected in recent government data, dampening expectations for an early rate cut from the Federal Reserve, especially in a politically fraught election year. Inflationary pressures are evident across a variety of basic goods and services, with staggering inflation rates in sectors such as car insurance (22.2%), transportation (10.7%) and hospital services (7.5%). Over the past four months, core and headline consumer price index (CPI) data have continued to exceed expectations, a situation further exacerbated by a surge in oil prices to near $90 a barrel, exacerbating concerns about affordability and living standards. Cost concerns. In addition, the U.S. inflation rate has exceeded 3% for three consecutive years, which is the longest period of sustained high inflation since the late 1980s and early 1990s.

AIER’s daily price index, which focuses on a small subset of very common products and services consumed by Americans, suggests that mainstream government statistical agencies are underestimating upward price pressures. In March 2024, our inflation measure increased by more than twice the increase in BLS core CPI.

The swap contracts predicted to be decided by the Federal Reserve will be adjusted to a higher interest rate level, indicating that the possibility of an interest rate cut is reduced, and the expectation of the first interest rate cut has been postponed from June to July. Options traders have also changed their bets and now speculate there will be just one rate cut this year. The market reaction highlighted a shift in expectations, with the likelihood of a rate cut in June falling sharply and now favoring a rate adjustment before September. CME Group’s FedWatch tool shows a sharp decline in the likelihood of a rate cut, with fewer than two expected by the end of the year.

It is becoming increasingly clear that opting to halt rate increases at a policy rate range of 5.25 to 5.50 is premature at best and may ultimately prove insufficient. If inflation data for another two to three months continues on its current trajectory, the possibility of a 0.25x interest rate hike is likely to become a reality, albeit a remote one.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.