Bjoern Wylezich/iStock Editorial via Getty Images

introduce

One industry that I lack exposure to is the basic materials industry. While I knew enough about the energy sector, the basic materials remained elusive.Since companies in this industry often Commodity prices change, and most are not suitable for dividend growth investors looking for reliable growth in sales and earnings per share. In this article, I will analyze Air Products and Chemicals (NYSE:APD), the industry’s leading Dividend Aristocrat.

I analyzed the company last year and found that its valuation was stagnant, as its shares traded at a price-to-earnings ratio of over 24 times. A year later, I revisited the company and looked for the market leader.This article will explain my buy thesis for the company based on its better valuation and excellent growth opportunities The major economic trend is the energy transition.

Seeking Alpha’s company profile reads:

Air Chemical Products provides atmospheric gases, process and specialty gases, equipment and related services in the Americas, Asia, Europe, the Middle East, India and internationally. The company produces atmospheric gases including oxygen, nitrogen and argon. Provides process gases such as hydrogen, helium, carbon dioxide, carbon monoxide, syngas and specialty gases to customers in a variety of industries, including refining, chemicals, manufacturing, electronics, energy production, medical, food and metals. It also designs and manufactures air separation, hydrocarbon recovery and purification, natural gas liquefaction, liquid helium and liquid hydrogen transportation and storage equipment.

Good fundamentals and reasonable valuation

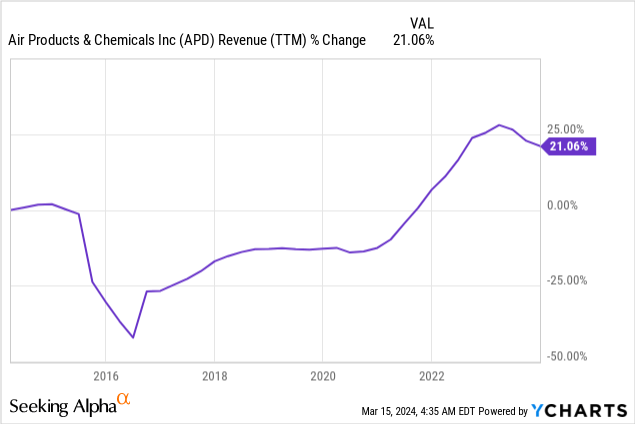

Air Products’ revenue has grown just 21% over the past decade. Over the past few years, the company has been adjusting its product portfolio to better meet customer needs. The company grew primarily organically and through a number of acquisitions to expand its global presence, primarily in Latin America.focus on Due to the high demand for gases, the company is also selling other divisions such as electronic materials. So while sales are growing slowly, the result is a more focused company and higher profit margins. Going forward, as seen by Seeking Alpha, analysts unanimously expect Air Chemical Products’ sales to grow at around 6% per year over the medium term.

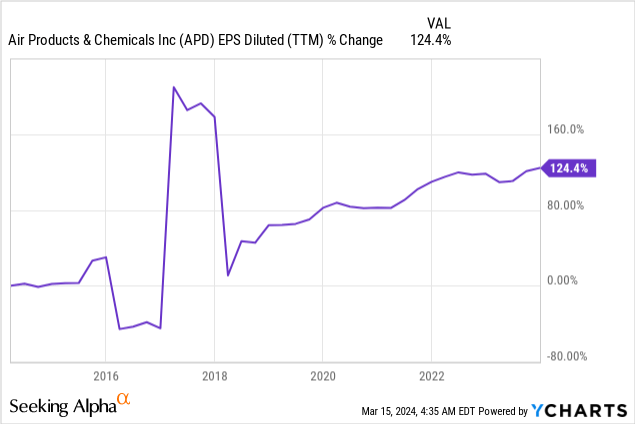

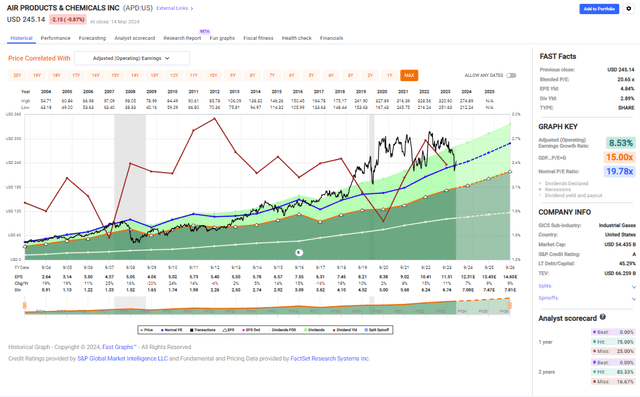

Air Products’ EPS (earnings per share) has grown at a faster rate this decade. With EPS up 124%, investors can see the success of the company’s restructuring.It does this by focusing strategically on It does this even though the share count is higher than it was a decade ago. This strategic shift allows the company to focus on its core business with higher profit margins. Over the medium term, as shown by Seeking Alpha, analyst consensus expects Air Chemical Products to maintain earnings per share growth of around 9% per year over the next few years.

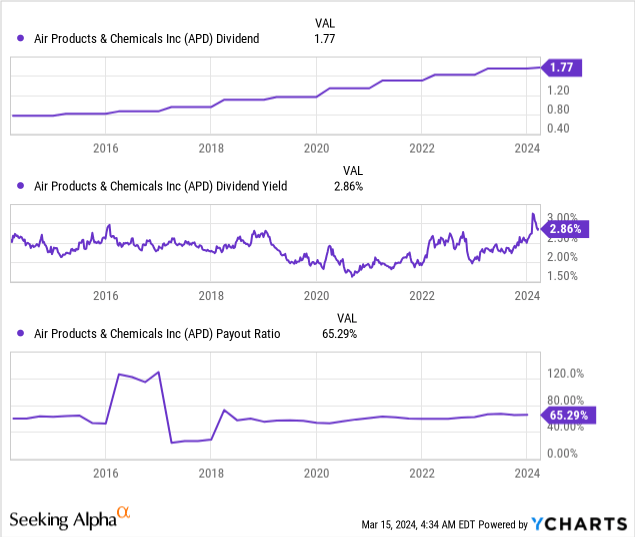

The company is leveraging earnings per share growth to reward shareholders with growing dividends. Air Products is a Dividend Aristocrat, having increased its dividend payments every year for 41 years. The latest increase was 1% in January, which was below the usual 9% average dividend growth over the past decade. The company’s payout ratio is 65%. Therefore, investors should expect mid-single-digit growth as the company lowers its payout ratio while investing heavily in new plants and projects.

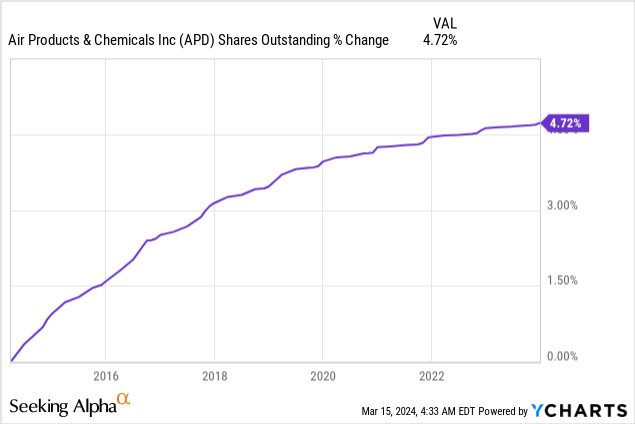

In addition to dividends, I often check whether a company is returning capital to shareholders through buybacks. Buybacks are an effective way to return capital by supporting earnings per share growth. When a company reduces the number of shares outstanding, earnings per share will grow. In this case, the company does not buy back shares, and the share count has increased by 4% over the past decade. This is not dilutive, primarily because earnings per share increased despite the increase in share count. I would expect the company to consider repurchasing shares when valuations are attractive.

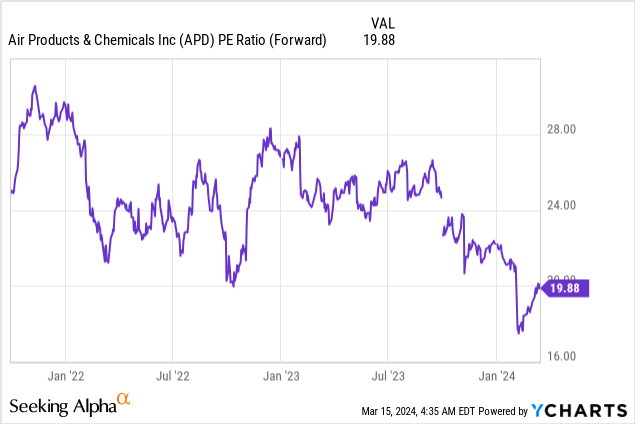

The company’s price-to-earnings ratio is 20 when using 2024 EPS forecasts. That’s not a low valuation, especially in the current interest rate environment. However, this is nearly the lowest valuation we’ve seen in the last twelve months. It’s also 20% lower than the valuation I saw when I analyzed the company last year. I think that as a blue-chip industry leader, the company deserves a generous valuation. Although the price is not cheap, it is not bad.

A chart from Fast Graphs also shows that the company is currently fairly valued. The company’s average price-to-earnings ratio over the past two decades has been 20, and it is currently 20. The company’s growth rate during the same period was 8.5%, which is consistent with the current forecast of 9%. medium-term growth rate. Therefore, investors have a decent and fair chance of entry into a company that has been trading at expensive levels for over five years in a row.

quick chart

Hydrogen represents a huge opportunity for the company and removes possible risks.

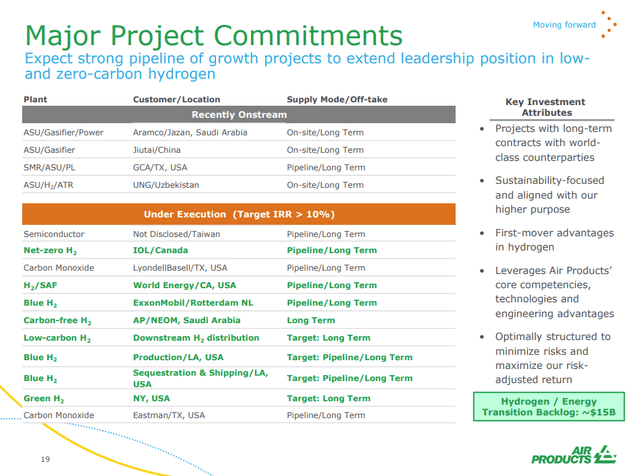

The company’s most significant growth opportunity outside of its core business is the expansion of hydrogen and carbon capture. Green hydrogen is the cleanest form of hydrogen and is made from water.Blue hydrogen is made from natural gas and therefore requires carbon capture to avoid greenhouse gas emissions Gas, mainly CO2. The company is active in these areas and in sustainable aviation fuels. The company operates for companies including ExxonMobil’s hydrogen projects as the world transitions to a greener period in energy. The current hydrogen and energy transition backlog is $15B.

“Air Products is pursuing a first-mover growth strategy with our core industrial gases business as the first pillar and our blue and green hydrogen projects as the second pillar.”

(Seifi Ghasemi, Chairman, President and Chief Executive Officer, 2024 First Quarter Conference Call)

Air Products

A second growth opportunity for the company is Western countries’ desire to keep supply chains within their borders. So they are not only investing in new renewable fuels such as hydrogen but also building new plants in Europe and North America. Therefore, we expect European adjusted EBITDA to grow 28%. Air Products and chemicals companies will benefit as developed markets invest heavily in energy industries within their borders. The chart above also highlights the number of new projects in the United States, Canada and Europe.

“We had a very strong performance in Europe with margins up 1,000 basis points as people did a good job of holding on to prices as energy prices fell.”

(Seifi Ghasemi, Chairman, President and Chief Executive Officer, 2024 First Quarter Conference Call)

The final opportunity for growth is the company’s disciplined capital allocation policy.The company focuses on the core gas and hydrogen, so no items are required. It focuses on ROI (return on investment), which is how it increased EPS by more than 120% while sales grew only 21%. This strategy allows the company to launch multiple new projects simultaneously while also returning capital in the form of dividends. The company has successfully more than doubled its capital expenditures to generate future cash flow while maintaining earnings per share and dividend growth.

“Creating shareholder value: Cash is king, the value of each share of stocks grows in the long term, and capital allocation is the most important job of the CEO.”

(Investor Presentation, First Quarter 2024 Conference Call)

“We expect to return approximately $1.6 billion to shareholders by 2024 while continuing to execute on hard return industrial gas and clean hydrogen projects.”

(Seifi Ghasemi, Chairman, President and Chief Executive Officer, 2024 First Quarter Conference Call)

While there are some emerging growth opportunities in developed markets, primarily based on hydrogen and the energy transition, there are also risks to the air products and chemicals company investment thesis. The company faces some serious headwinds in China and across Asia. This is the result of China’s slowing economic growth. China is a leader in the energy transition and has invested heavily in hydrogen. If its growth slows, it could hinder the company’s growth rate.

“The factors affecting our guidance are: first, the sales headwinds caused by China’s weak economic growth are greater than expected.”

(Seifi Ghasemi, Chairman, President and Chief Executive Officer, 2024 First Quarter Conference Call)

Additionally, the company discovered some weaknesses at its core Gas core business. The weakness was mainly felt in the helium segment, where the company’s sales fell due to lower demand in the global electronics market. This weakness caused the company to initiate weaker-than-expected guidance. If this continues, growth rates may slow, making it more difficult to justify current valuations.

“Demand for helium in electronics is declining, especially globally.”

(Seifi Ghasemi, Chairman, President and Chief Executive Officer, 2024 First Quarter Conference Call)

in conclusion

All in all, Air Products is one of the few Dividend Aristocrats in the primary materials industry. This is a highly volatile industry. Therefore, establishing a long-term track record of dividend growth is complicated. The company’s sales and earnings per share growth provide strong fundamentals that have driven dividend growth for more than 40 years. These sound fundamentals present the company with some very promising growth opportunities. It seeks to grow by capitalizing on the energy transition megatrends we are seeing around the world.

Growth measures are primarily targeted at developed markets, primarily around hydrogen (green and blue). The paper has risks, mainly China’s weaknesses that affect the entire Asian region. However, I believe the company is fairly valued, and while the margin of safety isn’t comprehensive, it’s enough to take a position. Therefore, I think Air Products is a buy. If the share price falls, more cautious investors may consider buying the stock gradually over the coming months.