James Bray

Unless otherwise stated, all values are in CAD. Ownership of the stock is generally limited to Canadians.If you’re wondering “What is Aboot?” you can Read more here.

In our last coverage of Alaris Equity Partners income trust (TSX:AD.UN:CA), which we believe is grossly mispriced, and the high yield combined with price appreciation should easily net you 10%+ annual returns. Specifically, we say:

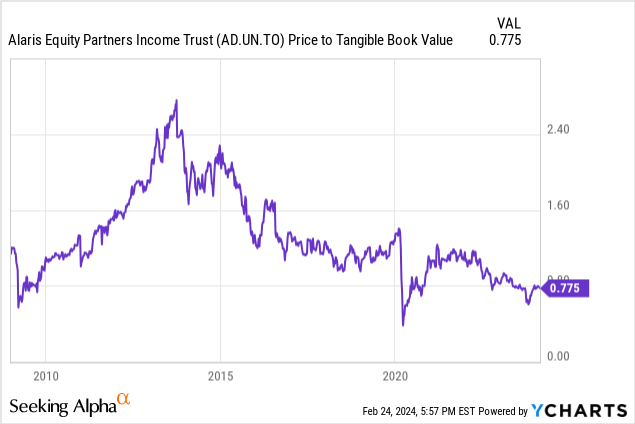

At some point in the next cycle, you’ll likely get a multiple of at least 1.0x tangible book value. We continue to rate it a Buy and consider it one of the lower-risk yield investments. The debt side is more attractive as total debt to EBITDA has remained below 2.5x. Alaris has two tranches of bonds trading on the Toronto Stock Exchange, one of which matures in May 2027 The yield to maturity exceeds 9%. We own primarily these shares (93% of our dollars) and also own a smaller share of common stock (7% of our dollars).

source

Despite not having bubble-like characteristics, the stock has performed well and kept pace with the broader index.

Seeking Alpha

We review what we have done since then and look ahead to our upcoming annual results on March 14, 2024.

Our bond positions

As mentioned above, the majority of our U.S. dollar investments are in exchange-traded bonds due 2027, the Alaris Equity Partners Income Trust 6.25% Senior Unsecured Notes (AD.DB.A:CA).This symbol is currently missing from Seeking Alpha, but you can find it It’s TMX. One of the reasons we’re slamming this is that it’s trading at over $90 in late 2023, making it extremely cheap relative to the risk. By making a safe bet, you can earn a yield to maturity of over 9%.

TMX

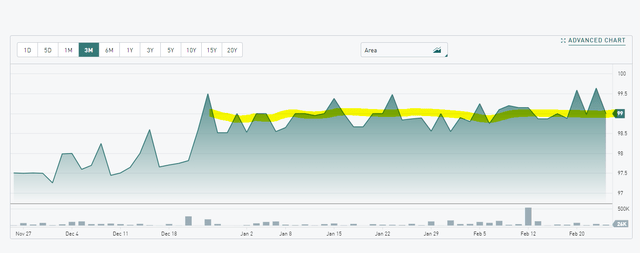

As you can see on the far side of the chart above, the bond is close to par value and we’re happy to lock in a gain of nearly $99.00. At this price, the yield to maturity is nearly 6.6%, and while the bond is still safe, we don’t think it’s a great buy. risk adjustment In the long term. There are a lot of places that can be done better than 6.6% while being even less risky. This is an example with a 7.5% yield, which we still think is less risky than that. We will provide you with another one in this article.

Equity

We still own the common shares (a small position) and believe they represent at least a tangible book value opportunity.

Note how expensive transactions were in 2013-2014. Of course, we don’t think that’s reached yet, but at 0.775x tangible book value, there’s still some value. The upcoming results should further solidify this. The U.S. economy performed well in the fourth quarter of 2023, with real GDP growth and inflation maintaining a healthy mix. Alaris is a top-tier royalty game, and the companies that provide the funding reallocate to Alaris based on changes in their own revenue. These revenue changes are nearly consistent with nominal GDP, and most of Alaris’ investments are in the United States. As a result, we expect the company to deliver strong results in 2023 and a healthy reset in partner allocations in 2024.

another bond

Since we sold 93% of the position (i.e. bonds) and are still bullish on the company, why don’t we just buy the stock? The reason is that we are actually third in the capital structure of the same company. While we’re selling the long-term bond at close to $99.00, the company’s second exchange-traded bond is trading slightly below that price. Alaris Equity Partners Income Trust 5.50% Convertible Unsecured Subordinated Notes (AD.DB:CA) were trading at $98.8. While 20 cents is not a complete reason to convert the bonds, the bonds will mature on June 30, 2024. A yield of 5.5% is decent, but when combined with capital appreciation, these yields will exceed 9% closer to maturity. Over the past two months, patient buyers have had numerous opportunities to purchase this product for less than $99.00, which we’ve highlighted here at MP Services.

TMX

The bonds total just $100 million, while the company’s tangible equity is valued at nearly $1 billion. Alaris last had debt at 1.9 times EBITDA, and its diversified portfolio is firing on all cylinders. On a risk-adjusted basis, a safe setup of 9% is very impressive, and we have a lot of cash parked there.

judgment

We prefer to control for position size in a single company, and to do this we count all investments within that company, whether they are stocks, preferred stocks, or bonds. Since we are heavily invested in short-term bonds, we have chosen not to add more equity. The company is performing well and is certainly cheaper relative to the valuations we’ve seen for BDC. Unlike a BDC, it is not affected by interest rate cuts because it earns distributions independent of interest rate cuts. Most of its partners also have very low leverage. Some actually have no other form of liability beyond the royalties they share with Alaris. Most BDCs provide loans to companies with debt exceeding 5 times EBITDA. This is still a good prospect for investors, and we will likely buy more common stock as the AD.DB bonds mature.

Please note that this is not financial advice. It looks like it, sounds like it, but surprisingly, it’s not. Investors should conduct their own due diligence and consult with professionals who understand their objectives and limitations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.