Robert Way

In my last article about Alibaba (NYSE:Baby) I mentioned management’s intention to initiate a new buyback program to support the price per share.In the past few days, there is important news coming I think the potential for buybacks could permanently change how people view this company. In fact, the number of shares repurchased last quarter was the second-highest ever, giving both earnings per share and dividends a big boost. Investors can’t forever ignore a company that rewards shareholders in this way. In addition, China’s economy is gradually recovering, which may boost Alibaba’s domestic sales.

As for the ratings, like my previous article, I think Alibaba is one of the best opportunities right now, which is why I reiterate the rating for Alibaba Strong Buy.

unwritten rules

Buybacks are a common practice used by companies to generate investor interest. After all, if a company buys back its own stock, it means it thinks it’s a good investment and therefore thinks it’s undervalued.

An interesting study was conducted by S&P Global Show that U.S. companies that authorize and announce stock buyback programs historically exhibit statistically and economically significant performance following the announcement.

In other words, buybacks send a strong signal to the market, and investors typically respond positively. In fact, as shares outstanding decrease, both EPS and dividends per share increase, but earnings/dividends do not necessarily increase. Large American technology companies have used it extensively in recent years, and the effect on capital gains is obvious.

Goldman Sachs S&P 500 Index Buyback Forecast for 2024 and 2025

The companies that make up the S&P 500 index already rely on it, and by 2025 the total is expected to exceed $1 trillion. It seems that people are optimistic about the future prospects of the market.

However, there is one aspect that confuses me, and that is an unwritten rule. In fact, when a U.S. company engages in buybacks, the market reacts positively, such as when Meta announced it would buy back $50 billion worth of its own shares. By comparison, when a Chinese company announces a multibillion-dollar buyback, investors pay less attention. However, the impact on earnings per share and dividends per share follows exactly the same principles.

trading view

On February 7, Alibaba announced a capital increase of US$25 billion for buybacks, and the stock price per share rose 4.70% that day. Over the next few days, however, the price per share plummeted again, and as of today, the stock appears to be stuck in a long-running stalemate that began two years ago. Buybacks haven’t had the desired results, at least for now, but I remain optimistic and in this post I’ll explain why.

The inevitable impact of buybacks

There is still too much pessimism about Chinese stocks, which is why even a multibillion-dollar buyback program has generated little enthusiasm. However, in my opinion, it would be a mistake not to fully analyze its potential, as the impacts associated with it will be significant. Let me show you some numbers so you understand what I’m talking about.

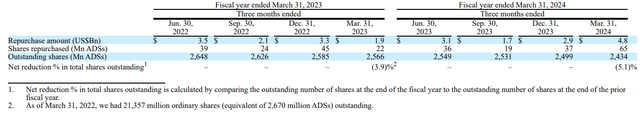

Alibaba FORM 6-K

- From June 30, 2022 to March 31, 2024, Alibaba spent US$23.3 billion to repurchase its own shares.

- For the fiscal year ending March 31, 2023, there was a net decrease of 3.90% in outstanding shares compared with the previous year. In the following fiscal year, this figure will be 5.10%.

- Last quarter alone, Alibaba spent $4.8 billion on repurchases and reduced the total number of outstanding shares by 2.60%. Such figures have not been seen in the past two years.

Based on this data, it’s clear management’s intention is to increasingly reduce shares outstanding. Surprisingly, however, the numbers devoted to this practice are growing.

The company has another $31.9 billion to spend on its own stock, but frankly I wouldn’t be surprised if it decided to commit more capital. There are two main reasons why I think so:

- Alibaba has never been so cheap, and buybacks have better results in this era. We’re talking about a leading company in multiple industries in China with domestic and international growth prospects, but NTM market cap/free cash flow is only 7.50x.

- Alibaba has net debt of -$58.59 billion and generated free cash flow of $22.02 billion in the last 12 months. It certainly isn’t short of cash.

Assuming that the price per share remains at $70 in the next two years and all $31.9 billion is used, the total number of outstanding shares will reach 1.978 million shares, a decrease of approximately 19% from the current level. This means that, with the same amount of profits generated and distributed, earnings per share and dividends would increase by approximately 23% over two years, taking into account only the impact of buybacks.

So Alibaba doesn’t even need to increase profits — it probably will — but the reduction in shares outstanding is enough to trigger a change in sentiment: The price per share of any company over the long term depends on earnings per share more than anything else. Investors may continue to avoid Alibaba, but sooner or later they will give in in the face of objective data.

In the above assumptions, I considered stagnant price per share, but if the stock price rose 20% to 30%, the argument wouldn’t change much: at these prices, buybacks are very efficient. As a shareholder, I hope they can increase it further.

Even in the face of data like this, many people will still have an extremely negative view of the company, and to some extent I don’t blame them. After all, it’s not easy to acquire a company whose political orientation is so different from ours that the government can decide its fate overnight. Anyway, I wonder what the government’s motivation might be for destroying one of its best companies, which by the way is rapidly expanding around the world. In my opinion, there is no reason to do this, which reassures me.

Finally, for those pessimists who don’t even believe in the veracity of financial statements, I invite you to prove their bad intentions. If you are better than your supervisor, now is the time to do it. As for me, I can assure you that I received the dividend in my account in January, and it was not monopoly money.

Dividends paid out in 2024 will total $2.5 billion, nine times less than free cash flow over the last 12 months. The dividend has plenty of room to grow, and along with buybacks will be two key drivers of dividend per share growth. The current dividend yield is only 1.40%, but I wouldn’t be surprised if the dividend per share grows 20% per year over the next 5 years. At that time, if you buy Alibaba at the current price, the cost dividend rate will be 3.60%. Basically, it becomes your dividend company.

China’s Economic Recovery and IPO Failure

China has never fallen into recession because gross domestic product has continued to grow rapidly, albeit at a slower pace than in the past. Regardless, there’s no denying that the entire country has been facing an economic slowdown since the collapse of China’s biggest builders – Evergrande first – and the collapse of the real estate bubble.

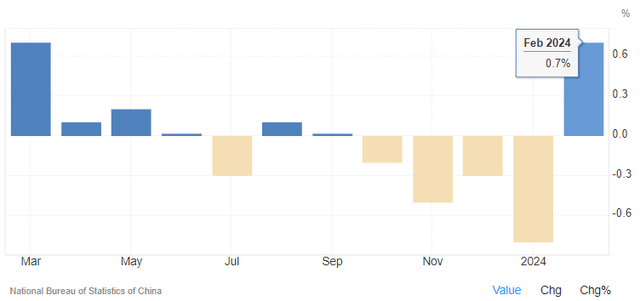

This is evidenced by the fact that consumption is down and China is facing deflation rather than inflation. We are in a completely different macroeconomic situation than the Western world, where interest rates are high and the labor market remains strong.In the case of China, interest rates have experienced a decline to stimulate economic activity, and first fiscal stimulus Already assigned recently. After all, the country expects GDP to grow by 5% this year and will make every effort to achieve this goal.

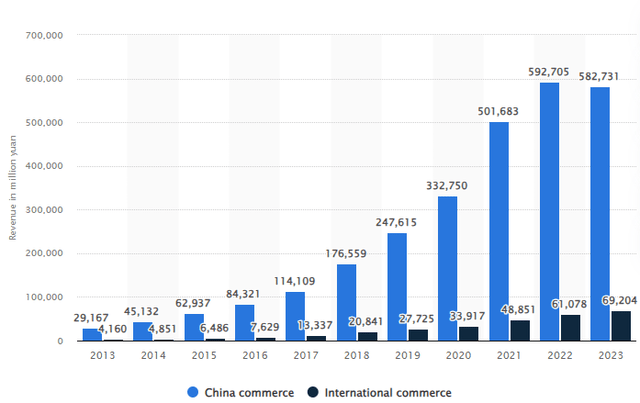

To sum up, the reasons for Alibaba’s slow domestic revenue growth are obvious. The entire country is facing a complicated period since 2022, but today the government is working hard to turn the situation around.

politician

This situation also occurs in The Company’s financial results; In fact, international sales grew strongly while domestic sales stagnated.

Because there are certain differences, China is facing 2008, and from this point of view, the situation is more likely to improve than worsen. Alibaba’s price today factors in the worst-case scenario; in fact, it doesn’t collapse until late 2022 and then stabilizes at current levels. Additionally, I’m surprised by the stock’s low volatility, currently trading around $70-80 per share since early 2024. After years of declines, my impression is that it’s now hard to get below that level.

China’s economic recovery won’t be easy, but the government has the tools to succeed. We all know that economic cycles are not linear trends, and the best time to invest is during an economic downturn. Fiscal stimulus coupled with a gradual recovery in the housing market will revive the country’s economic growth.

Trade and Economic Network

The first signs of recovery seem to have appeared, in fact, after 4 months of negative consumer price index Became a regular again. This is an early sign that consumption is recovering, but the results may be affected by the Lunar New Year on February 10. During festivals, people tend to spend more money.

Finally, I want to touch briefly on the IPO situation because it caused panic among investors.

Alibaba plans to list its cloud business and logistics company Cainiao separately. However, in both cases, management decided to put the IPO on hold, and the market reacted poorly to the news. Personally, I think this reaction is unreasonable, as it makes no sense to list these two business units during such a difficult period for the Chinese stock market: the goal of the IPO is to obtain capital, not to sell the company.

A cloud that is not growing will certainly not be taken seriously; Cainiao is growing, but its valuation is still below fair value. Management rightly chose to delay the IPO until a better time came along. In addition, since Alibaba owns 64% of Cainiao, it plans to invest US$3.75 billion to acquire 100% of the company’s shares.This is the right choice again: rather than selling Rookie, it is better to acquire full ownership Given the depressed prices. In short, there’s nothing to complain about with such impeccable management, but the market thinks differently.

in conclusion

Alibaba is a company with unquestionable profit potential; however, a strong distrust of the Chinese stock market has put any positives on the back burner. The buyback program could be decisive to significantly increase earnings per share and dividends per share, which could ultimately change the perception of the company. In addition, China’s economic growth may be boosted by fiscal stimulus, as it was in the West a few years ago.

As of today, the company is so depressed that any valuation model is redundant in my opinion. Suffice to say, assuming free cash flow remains constant over the next 12 months, Alibaba can hypothetically purchase all of its outstanding shares in a little over 5 years. Comparing that to a company that everyone wants to have in their portfolio, Nvidia is trading as if it were $59.44 per share.