David Becker

Invest in Alibaba (NYSE:BabyFor many investors, myself included, this is an absolute disaster. The narrative about Chinese companies has been one of victory, not fundamentals.Maybe that’s the problem because I continue to ignore external negative factors Focus on the numbers.When Alibaba reported its Third quarter numbers In early February, they achieved a double harvest of revenue and profits, while increasing their repurchase authorization by an additional $25 billion. No matter what Alibaba does, the market response is not good. Alibaba still looks like a value trap, not a value game. I have made several purchases below the $100 level and continue to dollar cost average into my positions, but I am still at a loss. It’s all about the numbers, and if you believe the numbers, Alibaba might just be a coiled spring waiting to burst.I While it’s wrong to go all the way down, I still believe there are huge opportunities for investors with a higher risk tolerance and a willingness to speculate. While Alibaba’s stock looks like it’s about to hit bottom, it’s likely to continue falling.

After watching their results and earnings calls and looking at current and future valuations, I realize that Alibaba stock is still interesting, and I’m not prepared to consider this investment a loss. Chinese President Xi Jinping Met with a group of U.S. business executives, including Cristiano Amon of Qualcomm (QCOM) and Stephen Schwarzman of Blackstone Group (BX). Despite geopolitical tensions, China appears to be trying to increase overseas investment, which could ultimately be the catalyst that long-term Alibaba holders need to reinvest. Although Alibaba stock has underperformed, I plan to increase my holdings because I believe the opportunities outweigh the risks.

Seeking Alpha

Following my previous article on Alibaba

Alibaba’s share price has declined slightly since the last article on January 5, 2024 (which can be read here). Since January 5, 2024, the S&P 500 Index has risen 12.02%. Alibaba continued to wait and see during the rise, and its stock price fell -2.22%. In my previous article, I discussed why investing is still possible even if the stock price is lower than when Alibaba went public. Now that we have more data, and more information on how to use Alibaba Cash, I wanted to follow up with a new article. I’ll discuss why I think these numbers are real, Alibaba’s fundamentals, and why the stock can act as a coiled spring.

Seeking Alpha

Risks to My Investment Thesis on Alibaba

While I remain bullish on Alibaba, its stock price has been in steady decline for years. The first risk to my investment thesis is that if the stock continues to trade sideways or continues to move lower, more of its value will be eroded. The next risk is worsening geopolitical tensions, with Chinese investments in the U.S. market remaining scrutinized and undervalued. No matter how low the odds, there is a risk that the numbers are inflated. On top of that, there are several factors working against Alibaba, making it a bad investment if relations between the two countries improve and the investment community is willing to put new money into Chinese stocks. There’s also a risk that Alibaba’s shares will eventually be delisted in the U.S., which would pose a different set of problems. I do recommend contacting your brokerage firm and asking them directly what will happen if your stock is delisted. I’ve asked this question and I’m very pleased with the answers I received, but I would recommend that current and potential investors ask. Ultimately, Alibaba’s stock price may remain in its current depressed state, and the opportunity cost may be high.

When I look at Alibaba as a company, I still believe I’m getting a great deal and the stock could see significant upside given a better geopolitical landscape

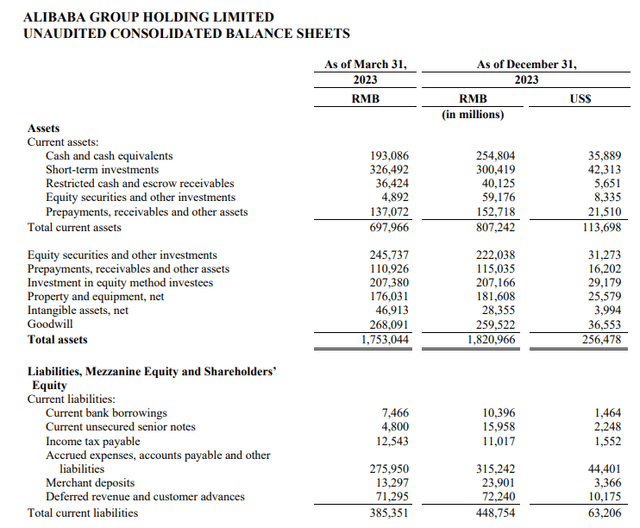

My concern for Alibaba is the same as for other companies.I’m dissecting finance Alibaba has a solid foundation, starting with its balance sheet. When you buy Alibaba stock, you are investing in a company with $86.54 billion in existing liquidity. Alibaba has $35.89 billion in cash and cash equivalents, and another $42.31 billion for short-term investments. Alibaba has another $8.34 billion in equity securities and other investments that can be liquidated immediately. Looking at long-term assets on the balance sheet, Alibaba still has $31.27 billion invested in stocks and other investments, and another $29.18 billion invested in equity method investment objects. Overall, Alibaba’s total liquidity, ranging from existing investments to long-term investments, is $146.99 billion. Alibaba’s total liquidity is equivalent to 81.91% of its market capitalization of $179.46 billion. Alibaba has $19.66 billion in long-term debt on its balance sheet, and when accruals, capital leases and other liabilities are taken into account, total debt is $95.6 billion. Alibaba can eliminate all debt and retain more than $127 billion in remaining liquidity; or it can eliminate all debt and retain more than $45 billion in liquidity on its balance sheet. This is one of the best balance sheets I’ve ever read, and it’s not every day you can buy stock in a company that has 80%+ of its market cap on its balance sheet for cash.

Alibaba

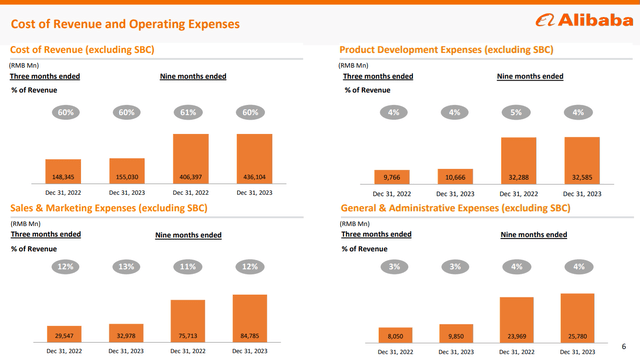

Alibaba has a strong foundation, and when you buy a lot of cash, you also get an operating group of companies that can generate tens of billions in profits. In the trailing 12 months (TTM), Alibaba generated revenue of $130.67 billion. Alibaba’s gross profit was US$49.53 billion, with a gross profit margin of 37.91%. Alibaba’s EBITDA was $25.6 billion and free cash flow (FCF) was $21.51 billion. In terms of absolute profits, Alibaba’s net profit during the TTM period was US$14.13 billion. In addition to taking nearly as much market capitalization in cash from its balance sheet, Alibaba generated more than $130 billion in revenue and $14 billion in net profit. This is a company operating in the largest country in the world, and as the population continues to grow, their revenue and profits should increase.

Alibaba

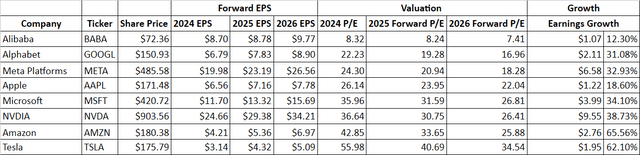

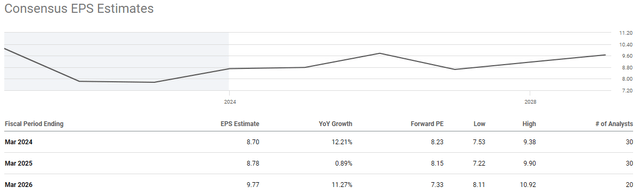

When I looked at analyst forecasts for Alibaba, earnings per share were expected to be $8.70 in 2024 and $9.77 in 2026. Alibaba trades at 8.32 times 2024 earnings and 7.41 times 2026 earnings. None of Magnificent 7 is trading anywhere near these levels, with the main difference between the companies being where they operate. The lowest valuation among the Magnificent 7 is Alphabet (GOOGL), with a 2024 price-to-earnings ratio of 22.23 times and a 2026 price-to-earnings ratio of 16.96 times. Alibaba effectively trades like a tobacco company, although it operates in multiple market segments, including digital media and entertainment, wholesale commerce, retail commerce, international commerce, cloud infrastructure and logistics networks. If you believe the numbers, Alibaba looks like an absolute steal from a valuation perspective.

Steven Fiorillo, “Searching Alpha” Seeking Alpha

Alibaba’s capital allocation plan looks promising

One of the biggest questions is whether Alibaba’s data can be trusted. There has been speculation about this, but one of the signs that you can trust these numbers is the capital allocation plan they provided me. Alibaba will begin implementing its dividend plan in December 2023. Alibaba pays a dividend of US$1 per year, with a yield of 1.4%. By distributing part of the income to shareholders through dividends, it helps to strengthen the authenticity of its profitability. If Alibaba increases its dividend and becomes a dividend growth company in 2024, we could see more credibility to its name and a new group of investors taking an interest in the company.

Alibaba also has a strong repurchase plan. They repurchased 36.6 million ADS shares in the third quarter, with a total value of US$2.9 billion.During this period 2023 calendar yearAmong them, Alibaba repurchased 112.2 million ADS shares with a total value of US$9.5 billion. Alibaba reduced its share count by -3.3% in 2023. Alibaba’s share repurchase program has $10.3 billion in approved liquidity remaining, and its board of directors has approved another $25 billion in repurchases by the end of March 2027. In the next three years, it will authorize repurchases of US$35.4 billion, equivalent to 19.67% of its market value.

While I can’t guarantee that these numbers are real, the evidence suggests that Alibaba is generating enough capital to return billions of dollars to shareholders through its dividend program while also repurchasing tens of billions of dollars’ worth of stock. I think the capital allocation plan adds a level of legitimacy to Alibaba and will help make investments more attractive as float continues to shrink while Alibaba continues to generate billions in quarterly profitability.

Seeking Alpha

in conclusion

Investing in China has been a losing proposition for some time, but geopolitical tensions may be on the mend. If your risk threshold is not high, then Alibaba may not be a good investment because there are many unknown factors, especially when it comes to the policies of the Chinese Communist Party. When I look at the current valuation, capital allocation plan, and earnings from the business, I find Alibaba to be a company I’m willing to invest in, despite the risks. Over the next few years, if conditions change and capital flows into Chinese investments, Alibaba could appreciate significantly. I think Xi Jinping’s recent actions are a clear sign of things to come. Maybe I’m naive, but I feel like China wants to improve its standing on the global stage, and to do that, they know their policies and stances need to change. Alibaba is a risky investment but has significant upside potential, and if the stock price doubled, it would still trade at less than 15 times 2026 earnings. It may take a few years, but I think Alibaba has the potential to get back to at least $150, maybe even $200.