Andrew Burton

Despite posting good profit numbers last month, Alibaba (NYSE:Baby) stock has failed to gain momentum and has underperformed the broader market in recent quarters. As international capital continues to withdraw from China in large numbers, the influence of geopolitics continues to increase. As risks continue to rise, it’s a safe bet that Alibaba stock will likely remain “dead money” for the foreseeable future due to the lack of a major catalyst that could improve the situation. Therefore, I believe it is better to look for opportunities at home rather than try your luck investing in Alibaba, which has yet to recover from the Beijing-led crackdown that began more than three years ago.

There are more challenges ahead

Since the last article on Alibaba was published in November, the company’s shares have fallen more than 5%, significantly underperforming the broader market.although The company revealed a decent earnings report Third-quarter data last month showed that revenue for the period rose 5% annually to $36.67 billion, but that was not enough to allow Alibaba’s stock to appreciate all the way and create additional shareholder value.

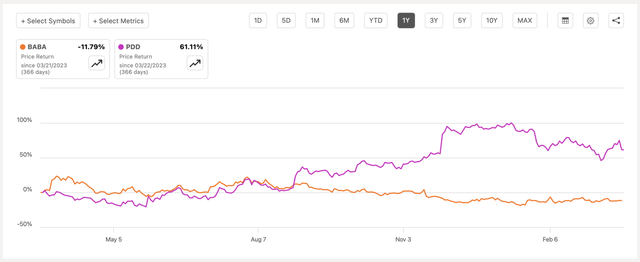

This is partly because Alibaba’s core e-commerce business has been unable to regain growth momentum amid China’s economic difficulties.In the third quarter, Alibaba’s Taobao and Tmall Group businesses produced Revenue was US$18.18 billion, an increase of only 2% year-on-year. By comparison, Alibaba rival Pinduoduo (PDD) recently announced revenue of $12.52 billion in the December quarter, up 123% year over year.This impressive growth rate is partly due to aggressive marketing The company’s Temu business implemented strategies to drive sales and attract new customers quickly. Pinduoduo’s stock price has surpassed Alibaba’s in the last year, and if the business continues to grow at a similarly aggressive pace, it’s only a matter of time before it starts generating more revenue than Alibaba’s core business itself.

Comparison chart (Seeking Alpha)

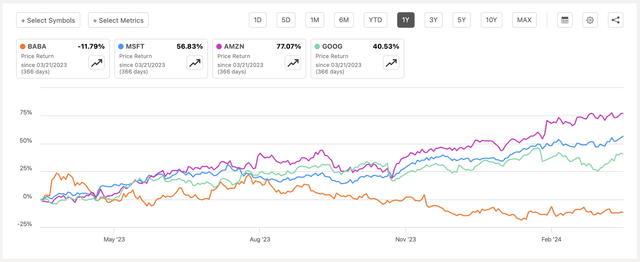

At the same time, Alibaba’s cloud business continues to struggle due to intensifying competition and geopolitical challenges. In the December quarter, Alibaba’s cloud business revenue was US$3.95 billion, an increase of only 3% year-on-year.In contrast, cloud business Microsoft (Microsoft Financial Times), Amazon (Amazon), and Google (GOOG)(GOOGL)’s revenue was US$25.9 billion, US$24.2 billion, and US$9.19 billion, respectively, which represents year-over-year growth of 20%, 13%, and 25.5% respectively.

At its current growth rate, Alibaba is unlikely to pose a threat to Western dominance of the cloud industry in the short term, and increased domestic competition will only make it harder for the company to significantly improve its cloud business. That’s why Western tech companies are also likely to continue to outperform Alibaba and become more attractive investments for the foreseeable future.

Comparison chart (Seeking Alpha)

this The only major benefit for Alibaba at this stage is that after last year’s disappointing results, the company is likely to significantly increase its revenue and profit growth rates in the next few years. However, that may not be enough to help the stock appreciate significantly anytime soon.

The Communist Party of China will continue to exist

I started covering Alibaba on Seeking Alpha back in 2021, and my first article about the company was titled Alibaba: Whether you like it or not, the Chinese Communist Party will continue to exist. In that article, I said that while the Beijing-led crackdown on the private sector appeared to be coming to an end, there was no guarantee that Alibaba wouldn’t feel more pressure from the central government. Since then, Beijing has significantly tightened its control over Chinese society, Alibaba’s share price has halved, and the Chinese government now officially holds a stake in some of the company’s businesses.Although all this is the result structural changes These changes in China under Xi Jinping are likely to continue to have a direct negative impact on Alibaba’s business performance and its stock price in the long term.

Currently, China is the only major economy in the world grappling with this problem deflation There are indications that due to unwilling Beijing approves new stimulus measures. This could have an immediate impact on Alibaba’s struggling e-commerce business.

More importantly, international capital is now leaving China, and it also left China last year suffer There were net outflows of capital for the first time in years. Without an influx of international capital, it will be difficult for Alibaba’s stock price to appreciate in the short term, especially as China itself continues to face new challenges. systemic risk.

Most importantly, given the current situation, Beijing is likely to continue to exert additional pressure on the private sector and concentrate power in the state. Geopolitical tensions rise This threatens to undermine the current rules-based international order. Therefore, even at current prices, it’s difficult to justify a long position in Alibaba, as the risks appear to continue to outweigh the growth opportunities.

valuation debate

In most of my previous articles on Alibaba, I’ve been saying that the company is fundamentally undervalued, but the valuation argument doesn’t matter at this stage. That’s because current market sentiment continues to be heavily skewed toward Chinese companies since the start of a Beijing-led crackdown on the private sector in late 2020. Even though Alibaba’s stock has been largely undervalued for some time, that hasn’t stopped it from continuing to lose value further and trade in distress.

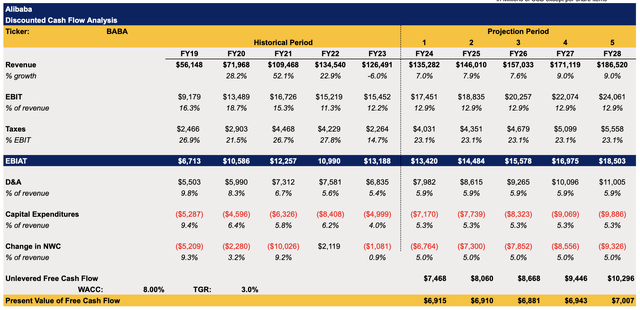

My DCF model below clearly shows that Alibaba stock is worth holding from a purely fundamental perspective. The assumptions in the model are mostly consistent with or close to historical levels of street estimates. The terminal growth rate in the model is 3%, while the WACC is 8%.

Alibaba’s DCF model (Historical Source: Seeking Alpha, Hypothesis: Author)

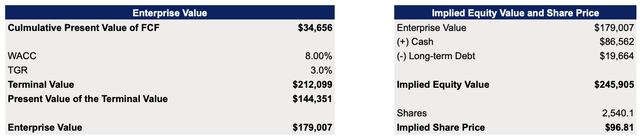

The model shows that Alibaba’s enterprise value is US$179 billion, and its fair value is US$96.81 per share, an increase of approximately 34% from the current market price.

Alibaba’s DCF model (Historical Source: Seeking Alpha, Hypothesis: Author)

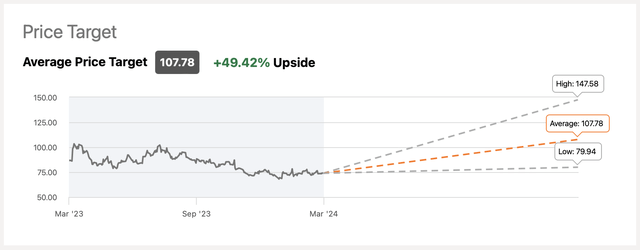

This target price is also slightly lower than consensus On the street, but also well above the minimum target.

Consensus Price Target (Seeking Alpha)

Still, it’s difficult to give Alibaba a Buy rating at this stage due to a lack of momentum and current market sentiment still being primarily negative for Chinese companies.

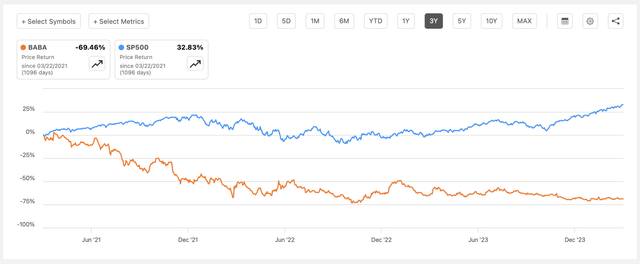

That’s why when it comes to value or growth investing, I still believe there are better opportunities domestically, with undervalued companies more likely to create shareholder value than their Chinese peers. The comparison chart below clearly supports this view, as the Typical ETF (SPY), which holds shares of S&P 500 companies and trades at higher multiples, has consistently outperformed Alibaba in recent years.

Comparison chart (Seeking Alpha)

What’s more, investing in China has been a poor choice for investors in recent decades. Although China’s GDP has been growing at an alarming rate since joining the World Trade Organization in 2001, the S&P 500 has still significantly outperformed China’s main index (SSE50) and the Hong Kong Index (HIS) since the early 2000s. Given the heightened geopolitical tensions, it is certain that this will continue to be the case for the foreseeable future.

Comparison chart (Seeking Alpha)

bottom line

Considering that Alibaba has been underperforming despite posting solid earnings numbers and trading at a discount from its fundamentals, it’s reasonable to assume that its stock will remain “dead money” for the foreseeable future. That’s why I’m sticking with a Hold rating, as the stock will likely continue to trade around current prices with limited upside and downside, as has been the case in recent years.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.