shisheng ling/E+ via Getty Images

Elevator promotion

I evaluate Man Truck Alliance Co., Ltd. (NYSE: YMM) stock as a holding. Previously, I wrote in June about Yun MM’s near-term financial prospects and its long-term financial goals. First article on February 20, 2023.

My attention turns to the latest quarterly results in the All Truck Alliance’s current update. Due to higher-than-expected sales and marketing costs, operations management’s actual operating income in the fourth quarter of 2023 failed to meet market expectations. Despite good first-quarter 2024 revenue guidance, the company’s sales and marketing expenses will likely remain high going forward. My Hold rating on All Truck Alliance remains unchanged given its revenue growth guidance and cost outlook.

YunMM’s fourth-quarter operating profit fell below consensus expectations

Before the market opens on March 7, 2024, Manche Alliance disclosed its financial results Q4 2023 Earnings Press Release.

According to the financial report, the company’s normal operating profit will decrease by -13% quarterly, from 458.5 million yuan in the third quarter of 2023 to 398.8 million yuan in the fourth quarter of 2023. More importantly, Manche Alliance’s latest fourth-quarter normal operating income was -13% lower than the market consensus forecast of RMB 458.3 million (Source: S&P Capital IQ).

In addition, in the last quarter of last year, YunMM’s revenue increased by 25% year-on-year and 6% from the previous quarter, reaching RMB 2.408 billion. In its financial report, the All Truck Alliance cited “rapidly growing user base and order volume” as the key reason for its revenue growth. The company’s revenue grew +5% in the fourth quarter of 2023 compared to the seller’s consensus sales forecast of RMB 2,303.0 million S&P Capital IQ data. This shows that the All Truck Alliance’s operating income failure in the fourth quarter of 2023 was not due to lower-than-expected revenue growth.

It was higher-than-expected spending that caused Full Truck Alliance’s actual fourth-quarter operating profit to fall short of consensus forecasts. Specifically, in the last quarter of last year, YunMM’s sales and marketing costs increased by 50% year-on-year and 45% from the previous quarter, reaching RMB 421.0 million. Due to a significant increase in sales and marketing expenses, the company’s fourth-quarter 2023 normalized operating margin was 16.6%, -3.3 percentage points lower than the analyst consensus forecast of 19.9% (Source: S&P Capital IQ).

The All Truck Alliance explained during the company’s fourth-quarter 2023 earnings call that higher “marketing investments to acquire new users” and “branding to increase our brand awareness” resulted in significantly higher sales and marketing costs. increase.

Unfavorable cost outlook overshadows good first-quarter revenue guidance

According to the midpoint of guidance shown in its financial report, YunMM expects revenue to reach 2.135 billion yuan in the first quarter of 2024. The company’s revenue guidance means Full Truck Alliance’s sales are expected to grow 25% year over year in the first quarter of 2024, which is the same year-over-year revenue growth rate in the fourth quarter of 2023.

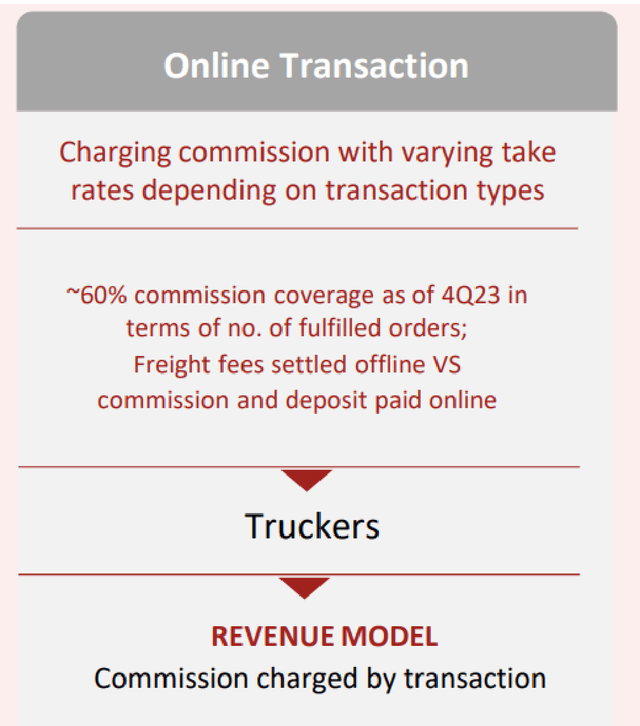

Trading commissions were YMM’s fastest-growing revenue source in the fourth quarter of 2023, and are likely to be the company’s primary revenue driver this year.

In the fourth quarter of last year, the company’s trading commissions increased by +44% compared with the same period last year. In comparison, the freight brokerage service and freight listing service revenue of the Manchu Truck Alliance in the latest quarter increased by +19% and +10% respectively compared with the same period last year. Looking ahead, Truck Alliance said in its fourth-quarter earnings briefing that its “commission revenue growth” in 2024 could “potentially exceed what we experienced over the past year (2023)” given its “current commission rates are very conservative.” Achieved growth rate”. “

Manche Alliance’s transaction commission income model

YMM’s investor presentation slides

On the other hand, rising operating costs may continue to impact All Truck Alliance’s profitability going forward.

At the fourth-quarter results conference, YMM outlined its expectations, which is to “increase our user acquisition efforts (in 2024) compared with last year.” The company also said on its latest quarterly earnings call that “over the long term, we expect sales and marketing expenses to continue to increase as we expand new business.”

Considering the company’s lower-than-expected operating income in the fourth quarter of 2023 and its forward-looking management commentary, there are reasons to worry that Yunyuan’s actual operating margins in the short and long term may not be as good as investors’ expectations.

Actual share buybacks fall short of expectations

The Truck Alliance disclosed in its fourth quarter 2023 financial report that it spent approximately US$200 million on stock repurchases from early March 2023 to early March 2024. In other words, YMM’s historical one-year buyback yield is about 3%, which I think is decent but unattractive.

Notably, the company has completed only 40% of the one-year, $500 million stock buyback program launched in mid-March last year.

Given that the company had $3.9 billion in cash and investments on its balance sheet as of the end of 2023 (about 60% of market capitalization), it’s realistic to think that Full Track Alliance has the financial capacity to be more aggressive with stock buybacks.

What’s more, Truck Alliance’s conservative stance on buybacks could send a message that the stock is currently valued at 12.9x (Source: S&P Capital IQ) agrees that the forward twelve-month normalized price-to-earnings ratio is reasonable.

concluding thoughts

The outlook for All Truck Alliance is mixed, warranting a Hold rating.

On the one hand, the company’s revenue growth guidance for the first quarter of 2024 is good. YunMM expects revenue to increase by 25% in the first quarter of this year.

On the other hand, Yun MM expects to invest more in sales and marketing in the future. This indicates that the actual operating income and operating profit margin of the Manchu Truck Alliance in the first quarter of 2024 and the full year of 2024 may not be in line with analysts’ expectations, and there are significant risks.