Piccio

United Energy Corporation (NASDAQ: LNT) is a regulated utility company that provides electricity to approximately 1 million customers in the Midwest and natural gas to approximately 425,000 customers.

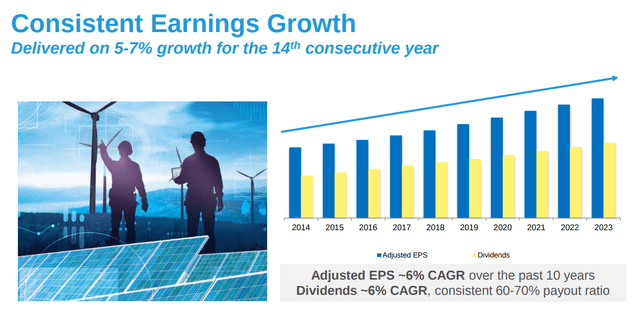

The company has a history of solid profitable growth, 14 consecutive years Achieve at least 5% adjusted earnings per share growth.

United Energy Investor Introduction

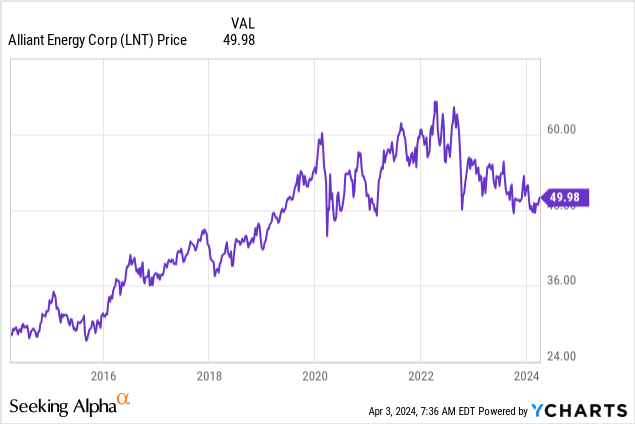

Although Alliant Energy’s adjusted earnings per share growth has been relatively stable, the stock price is below its pre-pandemic price in early 2020 and below its 2022 highs.

In terms of potential reasons for the stock’s decline, Alliant Energy shares fell early in the pandemic given the broader market decline. In my view, Alliant Energy shares are set to decline in 2022 due to headwinds from rising interest rates.

U.S. Treasury yields rise as rate hikes begin in early 2022 U.S. Treasury yields move higher All else being equal, dividend stock yields become less attractive.

On February 15, 2024, Alliant Energy announced its 2023 results, reflecting continued steady growth. For the future, management expects further growth.

2023

for 2023On a temperature-adjusted basis, Alliant Energy’s adjusted earnings per share increased 5.5% annually to $2.88, marking the company’s 14th consecutive year of 5-7% growth.

According to management, temperature changes can cause Loss per share $0.06 Earnings per share are $0.07 in 2023 and $0.07 per share in 2022.

On the tail end, Alliant Energy’s earnings per share increased due to higher AFUDC due to revenue needs and capital investments.

On the downside, net interest expense resulted in Earnings per share decreased by $0.19 Capital spending plans have led to an increase in long-term debt through 2023, and rising interest rates have also led to higher spending.

My conclusion is that United Energy is enjoying another year of solid growth despite rising interest rate headwinds.

2024

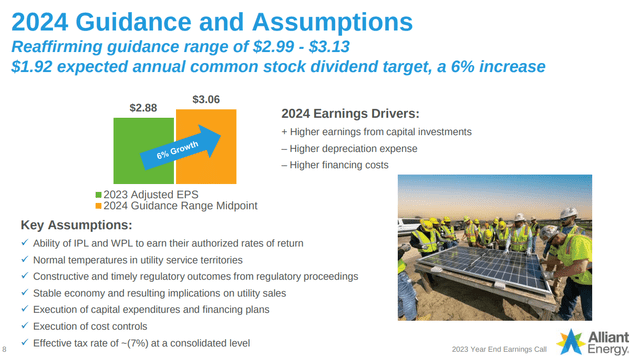

for 2024Alliant Energy is expected to further stabilize growth.

For this year, management reiterated its previous adjusted earnings per share guidance range of $2.99 to $3.13 per share, as higher earnings from capital investments are expected to aid growth. At the midpoint of the guidance range, that would increase about 6% to $3.06 per share.

As a result, management projects a 2024 annual dividend target of $1.92, a 6% increase from the 2023 annual dividend.

United Energy Investor Introduction

For the future, management believes the company’s long-term earnings per share growth potential is 5%-7%.

In terms of management, Lisa Barton succeeds John Larsen as CEO On January 1, 2024, Larsen became the company’s executive chairman.

My conclusion is that management believes 2024 will continue to be another year of relatively stable growth for the company, given the higher expected returns on capital investment. Over the long term, management believes United Energy has further potential for profitable growth.

risk

Falling electricity prices could become a headwind if rising electricity use doesn’t offset falling prices.

As electricity costs fall, natural gas demand is likely to fall.

Electricity consumption may not be as strong as expected in the short term given changing temperatures or changes in the economy.

Alliant Energy’s regulatory rate base may not grow as expected.

Regulators may not allow Alliant Energy to earn as much as the market expects based on its regulated rates.

My point of view

The long-term thesis for Alliant Energy is fairly simple, as the stock is fairly attractively valued, with a forward 2024 price-to-earnings ratio of 16.28, and management believes its long-term EPS growth potential is 5%-7%. With this growth, the stock price has the potential to rise over the long term, given the EPS growth.

Additionally, lower interest rates may result in lower financing expenses, helping to increase earnings per share. Lower interest rates may also make Alliant Energy’s stock more attractive to some dividend investors, which could help its valuation.

In my opinion, interest rates will start to fall this year and normalize within a year or two because inflation is not as high as it was in 2022 or early 2023.

When consolidating debt, Alliant Energy remains quite attractive as the company has an investment-grade credit rating, earnings growth potential, and a forward EV/EBITDA ratio of 12.06 compared to its 5-year average of 13.88.

However, over the medium to long term, I think there is more uncertainty about United Energy’s long-term EPS growth rate given two trends.

One trend I think is just beginning is that electricity consumption is increasing as electric vehicles, data centers, and other relatively new sources of demand increase.

Another trend that is starting to have a bigger impact is the falling cost of solar power.

according to a Office of Energy Efficiency and Renewable Energy 2021 ReportIn 2020, solar photovoltaics accounted for approximately 3% of the U.S. electricity supply, and it is expected to increase significantly as a proportion of the total electricity supply in the coming decades as utilities decarbonize.In some cases, solar energy will account for approx. By 2035, 40% of U.S. electricity supply will By 2050 it will reach 45%.

At the same time, the cost of solar power is expected to fall significantly from the beginning of this century.For example, the U.S. government’s goal is to reduce the levelized cost of energy for utility photovoltaics to 2 cents/degree by 2030, from 4.6 cents/degree in 2020.

Because solar is intermittent, utilities are currently limited in how much solar power they can generate because it cannot meet baseload demand, which varies by location but is likely about 50% of peak demand.

However, as battery technology continues to become more economically competitive, a combination of solar and batteries may be able to offset some of the often more expensive baseload needs in the future.

Over the longer term, the trend toward more economically competitive solar and batteries could mean a lower-than-expected regulatory rate base for the energy generation portion of Alliant Energy’s business. Additionally, if solar becomes economically competitive, some large industrial customers may generate their own electricity, reducing demand.

Because of these two trends, I think there are two scenarios in the medium to long term.

One scenario is that electricity consumption grows so much that Alliant Energy must upgrade its grid and therefore spend more on top of its regulated rates. In this case, additional spending on the grid and additional investments in energy production to meet the growth in electricity demand are more than enough to offset any declines due to lower generation costs.

In another scenario, the cost of electricity production fell significantly, and the increase in electricity consumption was not able to offset the decline in production costs, resulting in a lower-than-expected regulatory electricity price base. If that happens, I think regulators and the decisions they make in terms of allowable returns on top of regulatory rates will become increasingly important.

Personally, I think the bullish former scenario is more likely to happen, but given that the latter bearish scenario is also possible, I would hold Alliant Energy in a diversified portfolio that includes the Big Seven, And I wouldn’t rate it an Overweight.

Given near-term EPS growth potential, I still rate Alliant Energy a Buy for a diversified portfolio.

EPS estimates

In terms of earnings per share expectations, analysts on average expect Alliant Energy to earn $3.07 per share in 2024, $3.27 per share in 2025, and $3.48 per share in 2026, according to Seeking Alpha. This puts the company’s forward price-to-earnings ratio at 16.28 in 2024, 15.30 in 2025, and 14.38 in 2026.

Seeking Alpha

In terms of EPS forecasts through 2026, I think Alliant Energy can hit average analysts’ EPS estimates because the company’s history of adjusted EPS growth is within the range of analysts’ forecasts.

Factoring in results through 2023, Alliant Energy’s adjusted earnings per share compound annual growth rate over the past 10 years is about 6%.

However, I think management’s long-term EPS growth forecast of 5-7% in 2026 may be less certain, given the impact of solar and potential growth in electricity consumption. As I mentioned before, there are upside scenarios and downside scenarios, although I personally am cautiously optimistic and think the upside scenario is more likely.

In terms of fair valuation, I think Alliant Energy could trade at a forward price-to-earnings ratio of 18x 2024 EPS estimates as interest rates likely start to normalize, which gives me a price target of $55.26 in about a year.

For a long paper, I would focus on Alliant Energy’s earnings reports, interest rates, electricity consumption trends, and electricity prices. If electricity usage rises significantly without electricity prices falling that much at all, I think that will help the stock. I think the earnings report could be the catalyst.