photographer

Overview

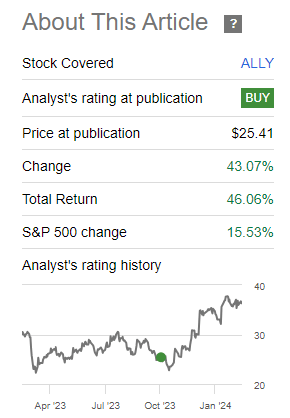

I have previously reviewed Ally Financial (NYSE: Allies) as a buy in October 2023. It appears my timing was ideal as the stock is now up over 46% since then.Price rises are bigger than expected and happen Much faster than expected. At the time of my initial analysis, the dividend yield was approximately 4.6%. After the price increase, the dividend yield is now just 3.3%, which isn’t very attractive but is in line with the industry median. So I think now is a good time to revisit and reassess the current outlook.

Seeking Alpha

As a quick overview, Ally is a digital financial services company that operates primarily in the United States and Canada. I emphasize “digital” because Ally is called a purely online service. They have no physical location and primarily operate online.them Mainly engaged in auto loans, insurance, mortgage loans and corporate businesses.

I think the biggest catalyst in 2024 will be interest rate changes, which I discuss further below, combined with fiscal tightening. Therefore, I maintain a Buy rating on Ally and expect further price gains this year.

interest rate sensitivity

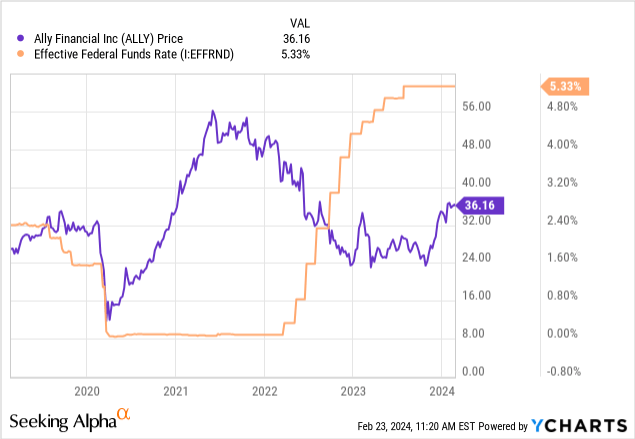

with the Fed expected If interest rates are cut sometime mid-year, ALLY’s price could rise significantly. Looking at the inverse relationship below, we can see that when interest rates were at all-time lows, the price of ALLY surged. Once interest rates started to rise, prices also fell, and now that interest rates are unchanged we see prices rising.

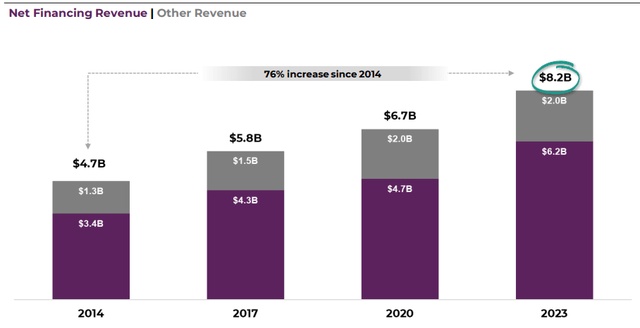

ALLY recently reported fourth-quarter earnings to wrap up its fiscal year. We can see that net financing income has increased significantly over the past decade, and I expect that to continue as long as we remain in a higher interest rate environment. Full-year revenue in 2023 will reach $8.2B, an increase of 22% compared with 2020, and an annual growth rate of approximately 7.4%.

ALLY Q4 Demo

Higher interest rates typically translate into increased loan interest income. Since Ally’s core business is lending, I believe they will be able to take advantage of this by charging a higher amount of interest income. From what I understand, this is a very cool cycle because this attracts more retail deposits and on the other hand ALLY is able to pay higher interest rates on deposits.

I’m referring to the annual interest rate they can offer on a savings account.It appears that Ally is currently offering The annualized rate of return is 4.35% on their savings account. These higher, more attractive APRs provide an incentive for people to deposit money. In turn, increased deposit levels allow ALLY to have more cash on hand that can be lent out at a profit. This cycle also benefits all departments in which ALLY operates.

As mentioned earlier, prices move in exactly the opposite direction of the federal funds rate. I predict that once interest rates finally come down, we may see price increases across the financial sector. Lower interest rates may stimulate borrowing activity in the consumer market. Consumers and businesses will be able to borrow debt more cheaply, so this is likely to drive demand across all segments in which ALLY operates. Increased demand may result in higher interest income from these loans.

Increase savings and financial efficiency

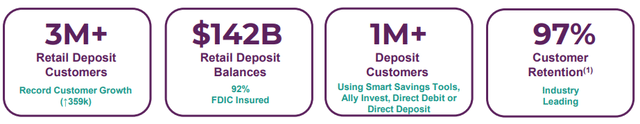

Retail deposits increased to $14B this quarter. This is an increase of $4.6B from the same period last year, which equates to approximately 48% annual growth. Of the total deposits, 92% are FDIC insured, which gives me confidence in future stability. While that’s impressive in itself, I also feel it’s important to mention that their customer retention rate this quarter was 97%. As an Ally customer, I completely understand why this happens. Their customer service has always been very helpful, fast and responsive.

Ally Q4 Demo

Not surprisingly, younger Gen Z and Millennials continue to account for the largest share of new customer deposits. Data tells us that the younger generation prefers mobile banking and online banking.For example, Millennials and Generation Z 5 times more likely More mobile banking users than their parents.

As of the end of the fourth quarter, 10% of customers were using multiple Ally tools or services simultaneously. The Ally app makes it super easy to check your savings or checking account, as well as open a CD or brokerage account. Their app serves as the hub for all of these components, so as Ally is able to acquire more customers, I believe the number of people using multiple services will increase.

ally report EPS (earnings per share) was $0.16. Total net income came to $2.1B and they tightened the portfolio by reducing RWA (Risk Weighted Assets) by $4B. I say “tightening” their portfolio because that was accomplished by cutting back on retail auto and other unsecured sectors to improve the portfolio. These improvements mean they reduce the amount of capital they need to hold as a buffer and free up cash for more lending. Simply put, more cash available for lending means higher profitability.

They continue to make capital improvements and implement cost savings to increase efficiency.Although unfortunately Ellie was fired More than 5% As early as October 2023, they had saved $80 million in employee costs. Management also reported that it secured $100 million in capital through tax strategies last quarter.

Automobile market segment strength

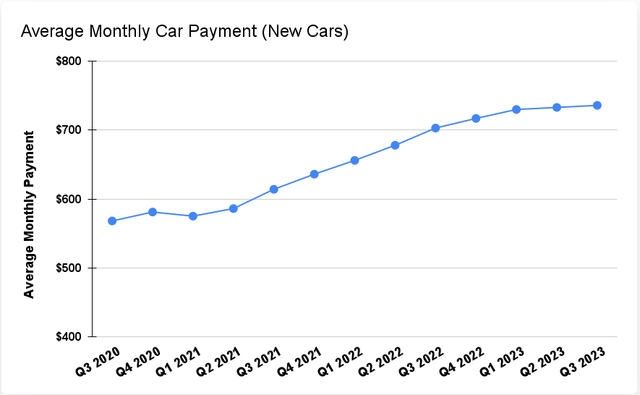

Another thing I want to highlight is that total loan originations within the automotive space were $9.6B. That’s important because that’s a 10.81% increase from the year before, which is in line with the direction of the average monthly car payment. The average car payment is now over $700/month, and it’s clear that Ally is sharing its fair share of this growth.

car edge

Ally’s retail auto origination yield is 10.7%, with approximately 40% coming from those with the highest credit quality ratings. In 2023, consumer auto-related applications totaled $13.8 million, of which only 30% were approved. Ally makes profits while maintaining risk-adjusted standards for approved auto loans. The 13.8 million applications were the highest number of applications received since 2019. The CEO said during the earnings call:

Going forward, we see our retail auto yields continuing to expand as we originate new loans at higher yields than our current portfolio. Disciplined growth and higher-yield corporate financing and credit card lending, coupled with continued declines in low-yield mortgages and securities, are also drivers of profitable asset yields. Our ROA momentum is unique in the industry and, coupled with our strong deposit franchise, supports our confidence in an attractive net interest margin trajectory. – Jeff Brown, CEO

Dividends and Valuation

As of the latest announced quarterly dividend of $0.30 per share, the current dividend yield is 3.3%. The dividend hasn’t been raised since 2022, so I expect a dividend increase by the end of this year. ALLY can definitely support a raise thanks to its free cash flow growth and conservative payout ratio. The current dividend payout ratio is 39%, which is healthy. ALLY also has operating cash totaling $4.7B, which is more than enough to weather any future headwinds or economic uncertainty.

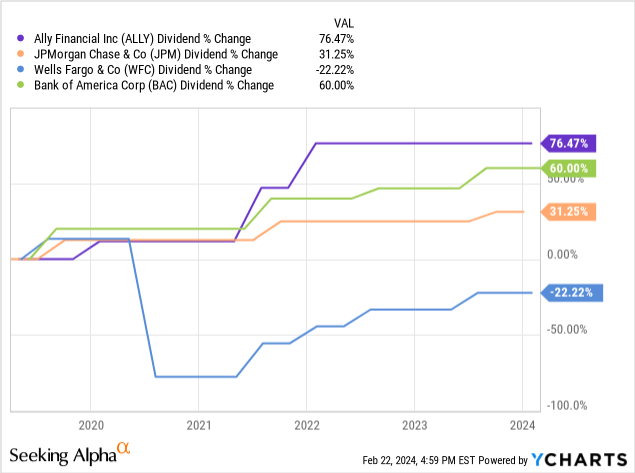

Even though the dividend didn’t increase, dividend growth remained strong. Since 2019, dividends have grown more than 75%. We’re seeing this growth outpace major banks like JPMorgan Chase (JPM), Bank of America (BAC), and Wells Fargo (WFC).

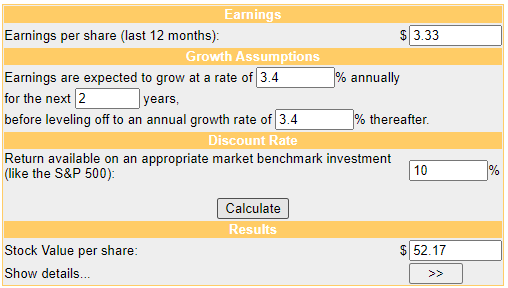

ALLY’s current average price target on Wall Street is $40.28 per share. This is an 11% increase from current price levels. With interest rates coming down, I think this price target is certainly achievable. ALLY expects earnings per share of 3.33 in 2024, which I think is achievable given their current revenue growth. Their expected revenue growth rate is expected to be 3.4%, which is lower than the 5-year average revenue growth rate of 6.24%, but is a conservative estimate in DCF (discounted cash flow) calculations.

I feel comfortable using averages because these revenue averages are also very consistent with management’s expectations. In the last financial report, the net interest margin was expected to grow by 3.25-3.3%, and other income grew by 5-10%. On average, management expects growth prospects next year to be 4%.

money chimpanzee

Using DCF calculations, we can determine that a reasonable price by the end of fiscal year 2024 is $52.17/share. This means that, factoring in the current dividend, we expect double-digit returns next year if growth proceeds as planned and meets expectations. This potential upside equates to approximately 43% upside.

risk profile

Ally Q4 Demo

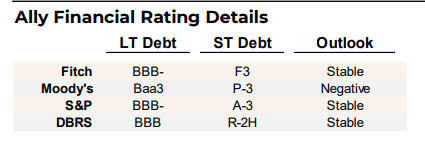

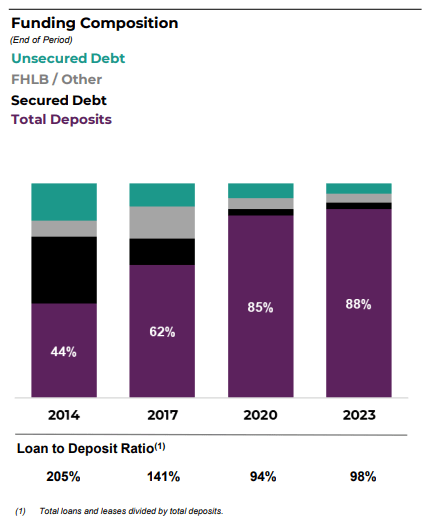

The outlook on Ally’s debt profile remains essentially stable, with Moody’s the only ratings agency to give it a negative outlook. However, it seems to me that Ally’s financial situation has improved. For example, their loan-to-deposit ratio has declined since 2017 and currently stands at 98%. The loan-to-deposit ratio tells us that ALLY is using virtually all customer deposits to fund its loan portfolio. While it is efficient from a lending perspective, it also creates a layer of risk in situations where liquidity is required. Reference, Average Between April 2022 and April 2023, Bank of America’s loan-to-deposit ratio was 70%.

ALLY Q4 Demo

While a higher loan-to-deposit ratio may lead to higher profitability, it also increases risk. In this case, banks will become more dependent on external funding. So while ALLY’s loan-to-deposit ratio is well above the average of other U.S. banks, its position has improved significantly over the past decade.

take away

I believe ALLY is still a buy despite the price increase. I think the company’s prospects look good, and the catalyst of a rate cut could generate higher upside. Each of their business areas continues to grow, especially in automotive. With the current dividend yield above 3% and the conservative payout ratio, I suspect a dividend increase may be on the way. Additionally, the price remains undervalued from a DCF perspective, with significant double-digit upside potential if growth expectations are met.

Even though Ally doesn’t have any brick-and-mortar locations, its strong customer retention rates show us that a brick-and-mortar presence isn’t necessary to be successful. Management also controls financial inefficiencies by actively reducing the loan-to-deposit ratio. Therefore, I maintain my Buy rating on Ally.