Wilshire Pictures

introduce

Around the end of the summer, I wrote my first article on Seeking Alpha, about American Express (NYSE:AXP) (I suggest you take a look here).At the time, Amex stock was trading around $160, and I listed a number I believe there are reasons why this business has performed well over the long term. While it’s obviously too early to tell whether my long-term predictions will come true, I believe we can see progress being made toward achieving them.

Today, American Express stock is experiencing a very strong rebound from its October lows. I believe this aggressive rise is simply a correction between the stock price and the actual value of the business. I don’t think the stock is overvalued today, but it’s certainly not the bargain it was at $140.In this article I would like to review Business performance over the past few quarters and forecasts for next year. More importantly, I want to review whether the long-term outlook remains positive from my perspective.

investment thesis

If you recall, in my first article, I commented that my thesis – that American Express would outperform the market over the next decade – was based on three key points. First, their strategy for attracting Gen Z customers and how profitable that will be in the long run. On the other hand, their focus on top customers with higher purchasing power both protects them from the risk of delinquencies and defaults, and secures future cash flow by relying on savings, spending, and a more financially educated audience. Finally, the significant deleveraging the company has undergone over the past decade is expected to lead to greater generosity through share buybacks and dividend increases. So let’s take a look at how the company has fared on these three fronts over the past few months, and whether our paper points us in the right direction.

Generation Z customers

This is probably the most challenging point because it is a long-term strategy. However, if we note the CFO’s comments on the earnings call, it appears that they are still very committed to the strategy and are executing on it correctly. So as long as we continue to move in this direction, I believe that we as shareholders can be satisfied that this strategy is to protect the terminal value of the business over the long term, and over time we will see the results of it.

“With the growth of new accounts over the past few years, we now have more than 140 million cards running on our global network. Our commitment to continually innovating value propositions to meet customer needs is driving increased brand relevance across generations, including Millennials and Gen Z consumers. These customers account for more than 60% of the new consumer accounts we acquire globally in 2023, and 75% of new consumer Platinum and Gold accounts acquired in the U.S. come from this group. ” (…) “We continue to see growth across all age groups and generations, with Millennial and Gen Z customers once again driving our highest business growth in this segment. Their spend grew this quarter. 15%.” – Christophe Le Caillec (CFO, American Express).

top customers

As we’ve discussed, the second pillar supporting my long-term thesis about American Express is its focus on society’s wealthiest customers. This is crucial for the banking industry as it significantly reduces the risk of defaults and delinquencies. On this front, we see how the company’s delinquency metrics will remain at very healthy and manageable levels in 2023. Witnessing these numbers growing rapidly could be a sign that we are on the verge of a macroeconomic problem, or worse, that American Express is allowing low-quality customers into its ecosystem. From my perspective, the latter would be a red flag because it would completely undermine American Express’ differentiated value compared to other North American banking institutions. If you want to see for yourself the delinquency rates of major U.S. banks, I recommend checking out this Seeking Alpha News article.

Also related to this, a very interesting topic I came across last quarter was the CEO’s vision for possible alliances with other financial institutions, Probably an apple, which they have been linked to multiple times recently. In the following statement, the reporter asked the following questions:

There have been several articles mentioning you as a potential candidate to take over a credit card partnership from another large financial institution, the specific name of which I won’t disclose. But I thought maybe just talk about your interest in increasing co-branding partnerships? – Ryan Nash (journalist)

In response, the CEO responded as follows:

Well, I mean, you look at it, would you say, is your premium card base one of your biggest obstacles because sometimes partners want to reach everyone? That’s not us, right? When you think of American Express, you think of the premium space. We have been able to work with Delta, Hilton, Marriott, British Airways and many others. So there are others that we haven’t worked with or had exposure to because their card base is broad, their customer base is broad, and that’s what we’re thinking about. – Stephen Squery (CEO)

In these statements, it was made clear that the CEO’s vision for American Express was to make their products accessible to everyone. When you think of American Express, you think of the highest end of society, and that’s where they want to focus. Let’s put this into context: American Express’s CEO has publicly stated that the customers an alliance with Apple (or other financial institutions) would bring them aren’t premium enough for them. They presumably refuse to ally themselves with the largest companies in the world, or at least take on all customers.

To some, this may be seen as a mistake because the potential for growth is huge, but the goal is not just to grow for the sake of growth. The most important thing is to maintain the ultimate value of American Express, and the best way to do that is to continue to focus on the highest end of society. Accepting any customer would result in low-quality customers entering the ecosystem and increase delinquency rates, as well as weakening American Express’s brand image by diluting its exclusivity. I like to see a CEO have such a clear vision for the company and focus on retaining the company for as long as possible, even if it means sacrificing short-term growth.

Deleveraging

Finally, in my previous article we discussed the massive deleveraging the company has undergone over the past decade, which will result in a significant increase in dividends and a more aggressive share repurchase program due to its improving financial position . In that sense, it seems to be coming true. First, in their latest earnings report, they announced they would increase their dividend by 17% in 2024, from $0.60 to $0.70 quarterly. Even with this increase, the payout ratio will remain around 20%, which is well within a very sustainable range and can continue to grow in the future.

On the other hand, shares outstanding decreased by 2.15% in 2023, and a few quarters ago they approved a $15 billion buyback program. At current prices, 10% of outstanding shares will be phased out when the plan is completed. Given the company’s healthy balance sheet and strong cash generation, I wouldn’t be surprised to see share reductions accelerate to 3% per year, as we will now see.

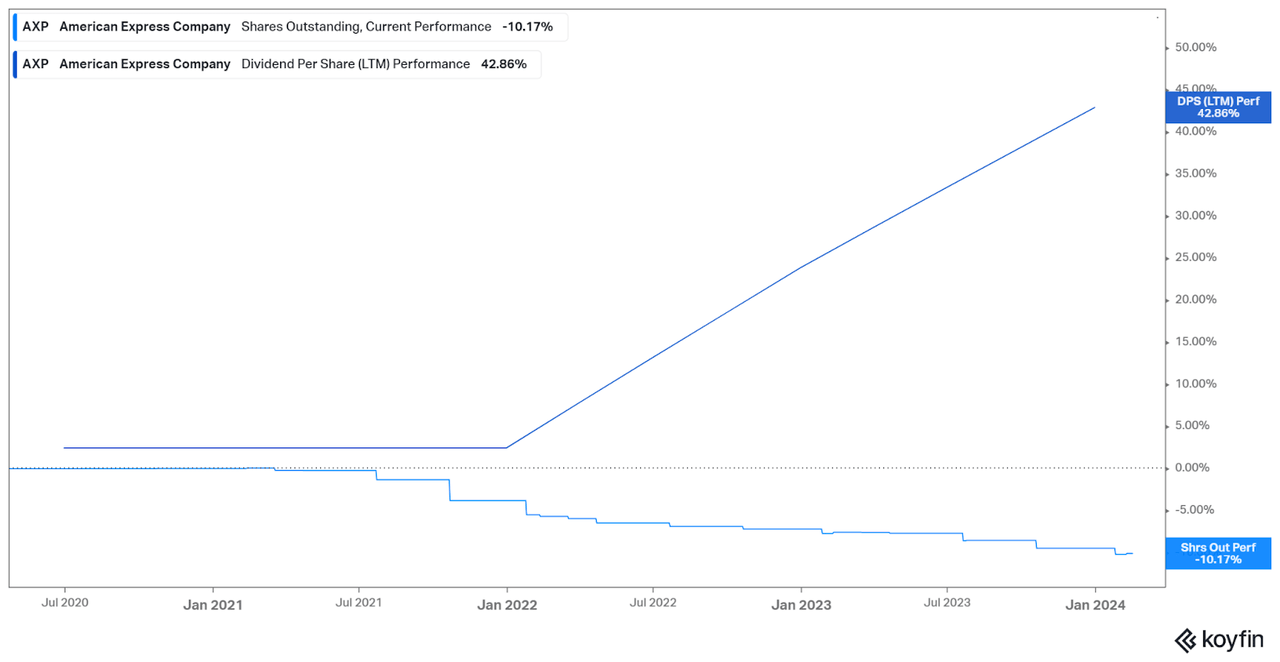

We can see from the chart below that capital returns to shareholders have been very impressive since the start of the pandemic, with dividends per share increasing by 43% (taking into account no increase in 2021) and reducing shares outstanding by more than 10%.

coyfin

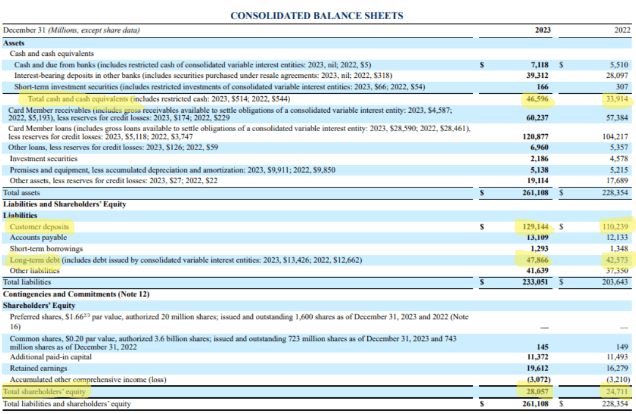

Obviously, if we dig into why they’ve been able to return all this capital, we see great management by senior executives coupled with great business performance. Later, we’ll analyze the income statement, but for now, I want to focus on the balance sheet, which clearly shows how the deleveraging I’m talking about is real, and how American Express is in a much better financial position now than it was a decade ago. many.

American Express’s balance sheet isn’t easy to explain, as they explain in their 10K that they have different types of debt and even different ratings, but I’ll briefly go over the most interesting points. First, we saw how cash and equivalents have soared over 25% this year, driven primarily by increases in cash as well as deposits from other banking institutions. As interest rates rise, the increase in deposits is positive as they generate more interest on cash than in previous years. American Express itself has also seen significant growth in customer deposits. I have also mentioned this in previous articles. This is what we discussed at the time:

“Therefore, their first priority is to establish themselves as a trustworthy company with a positive image in North America. After the banking panic at SVB, many people sought safe havens to protect their funds.” – My last article about American Express

As we can see, deposits increased by 15%, which, as we commented, highlights the trust generated by American Express. Then long-term debt also increases, but at a significantly slower rate than cash, so American Express effectively remains a net cash position. A decade ago, when net debt reached nearly $40 billion, this seemed impossible. I reiterate that the company is in a much better financial position than it was a decade ago, and I think that’s key, in addition to the organic growth of the business itself, which will be the leverage they use to outperform the market over the next decade.

AXP 10K 2023

Valuation and conclusion

After conducting a fundamental review of the company, it is now time to re-evaluate its valuation to see if we may be facing a good buying opportunity despite the sharp rise we have experienced in recent weeks.

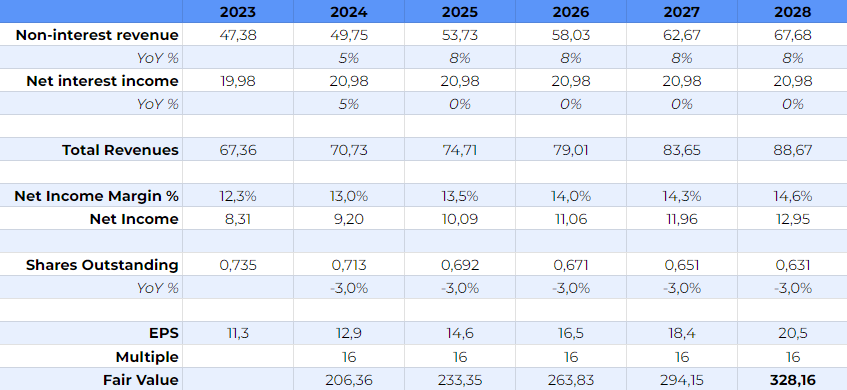

For my valuation, I assume both interest and non-interest income will increase 5% next year, with non-interest income growing 8% per year from then on, while interest income remains stagnant. I prefer to assume the latter won’t grow, as it will be difficult for American Express to continue to grow those revenues significantly given the high likelihood of a rate cut by the Federal Reserve. So I’d rather be fairly conservative and assume they’ll stagnate, although they probably won’t.

I will also assume that margins expand slightly and that shares outstanding decrease by 3% per year as discussed in this article. Finally, I assigned a multiple of 16x, consistent with its historical average. While this multiple could expand to around 18x due to the significant reduction in terminal risk through deleveraging this decade, I prefer to stay conservative and keep it at 16x.

Putting this all together, we arrive at a 2028 price target of $328, which implies a CAGR of 8.25% from current prices. If we add dividends (which yield about 1.5%), we might see a total return of about 10%.

Author’s calculations

In my opinion, 10% annual compounded total return is not enough to buy this stock. In my opinion, I would prefer a potential return of 15% on this type of stock, so I am downgrading the company from “Buy” to “catchThe company was clearly undervalued when we wrote our last article, and to me, it’s a bargain. For now, however, it’s still a reasonable investment, but I’d prefer a higher expected return before buying. Always say, if you already hold it in your portfolio, that doesn’t necessarily mean you should sell it. I don’t think it’s a good idea to sell such a great company just because it’s probably slightly overpriced.