Cranach/iStock via Getty Images

Fallen Angels have significantly outperformed broader bond and high-yield bond benchmarks for decades, as has the VanEck Fallen Angel High Yield Bond ETF (NASDAQ:ANGL). I last covered ANGL in mid-2023.In that article I argued iShares Fallen Angels U.S. Dollar Bond ETF (NASDAQ:Fallon) is a slightly superior investment because FALN has lower fees and a higher yield. Since then, ANGL’s fees have dropped to 0.25% and its yield has risen to 5.4%, both figures comparable to FALN. Therefore, I now believe these two funds have similar fundamentals and value propositions. Both are worth buying due to their proven strategies and strong track records.

Fallen Angels Overview and Analysis

ANGL invests in fallen angels, a very specific type of bond. To understand ANGL, we must understand these securities and how they relate to the broader corporate bond market.

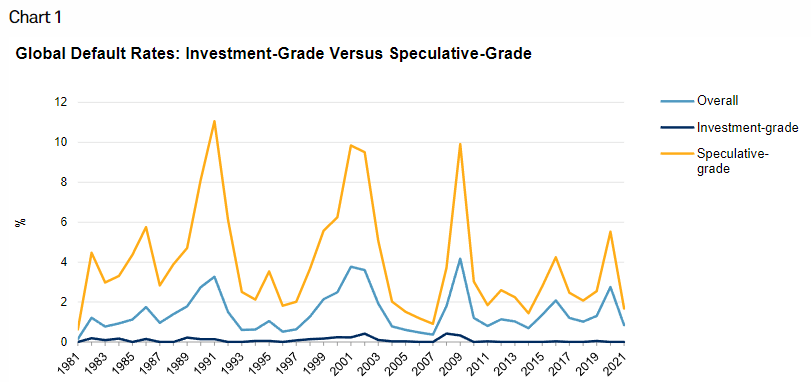

Corporate bonds can be divided into two parts. Investment grade bonds are bonds issued by companies with strong balance sheets and low default rates. Non-investment grade bonds, bonds issued by companies with weaker balance sheets and higher default rates, especially during economic downturns and recessions.

Standard & Poor’s

Some institutional investors and index funds are unable to invest in non-investment grade bonds due to higher default rates, so they focus on investment grade bonds. For example, Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ: BND) is the largest bond ETF on the market and invests exclusively in investment-grade bonds.

The corollary to the above is that some institutional investors are forced to sell bonds that have been downgraded from investment grade to non-investment grade, known as “fallen angels.” For example, if a bond held by BND is downgraded to BB, the fund will be forced to sell the bond. A forced sell-off would cause bond prices to fall and yields to rise. Importantly, the magnitude of these changes will almost certainly be very high, with a lot of institutional investors and a lot of forced selling, and therefore inconsistent with fundamentals.

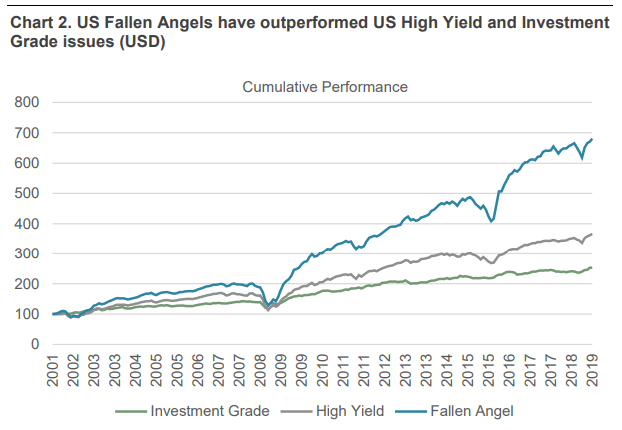

Investors can take advantage of the above advantages in the following ways Buy Fallen angel. Doing so means buying deeply discounted bonds with yields above average for risk levels. Doing so should also lead to above-average returns as conditions stabilize and prices recover. Fallen angel bonds have consistently outperformed most other high-yield bonds for decades, and by a wide margin.

Russell Investment Services

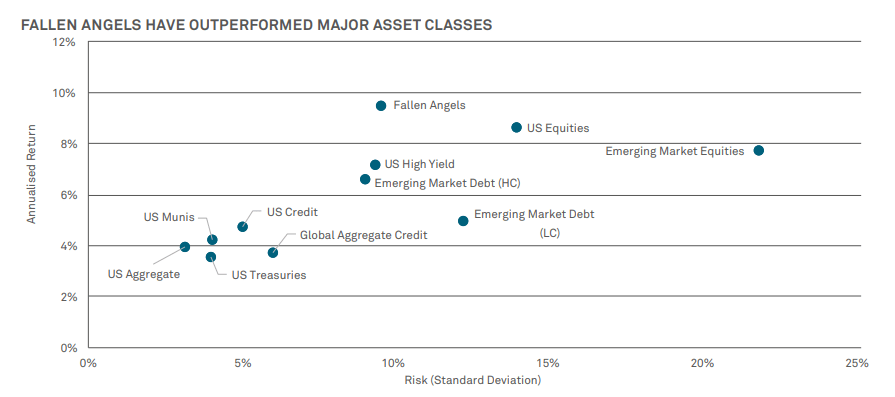

Risk-adjusted returns have also been quite strong, but have declined recently.

Russell Investment Services

With the above in mind, let’s take a closer look at ANGL.

ANGL – Overview and Analysis

Strategy and Holdings

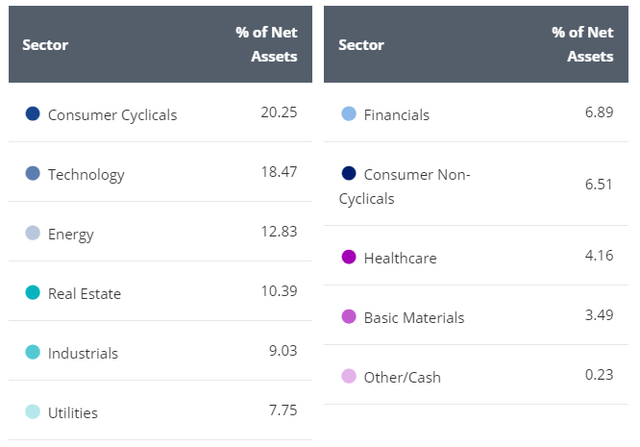

ANGL is an index ETF that invests in fallen angels and tracks the ICE U.S. Fallen Angels High Yield 10% Constrained Index. This is a surprisingly diversified fund, investing in 145 securities from most relevant industry sectors.

English

Concentration is above average, with the fund’s top ten issuers accounting for more than 40% of its portfolio. Issuers are capped at 10.0%, but only three issuers have allocations above 5.0%.

ANGL appears to be quite diverse. Fallen Angel ETF. Because the fund focuses on the specific area of high-yield corporate bonds, diversification is well below average. Investors might consider pairing this fund with other funds that focus on different assets, although I’m very bullish on ANGL regardless.

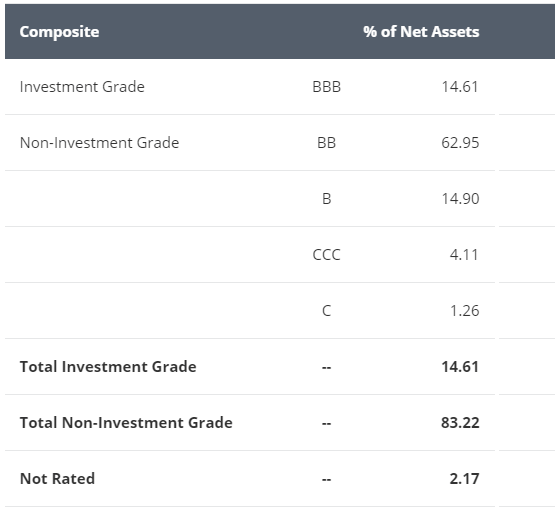

ANGL focuses on non-investment grade bonds, but holds a surprising 14.6% share of investment grade securities. These are almost certainly recently upgraded bonds that should be sold in the coming weeks/months.

English

ANGL’s investment-grade bonds are almost certain to deliver substantial gains in the near term. This is because upgraded bonds tend to increase in price as higher credit quality leads to increased investor demand. ANGL should sell these bonds as soon as possible, effectively locking in gains.This is somewhat common for funds, as fallen angels are only slightly riskier than investment grade bonds (remember, they yes Initially investment grade).

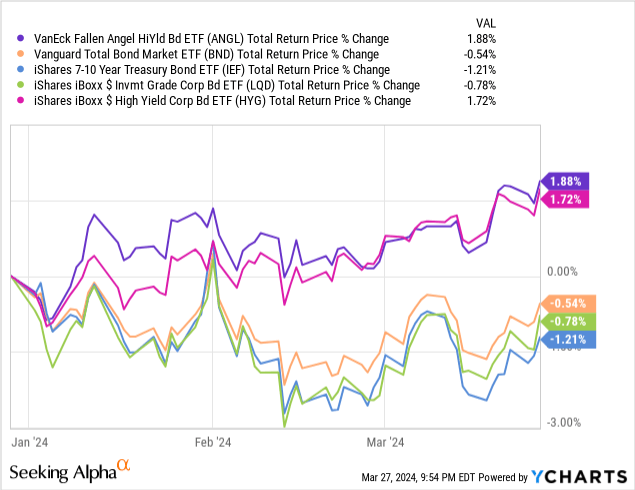

For what it’s worth, ANGL has outperformed estimates so far this year and has largely been in line with expectations. Still, the returns are very similar to those of the high-yield corporate bond benchmark, although it does depend on the specific time period in question.

Data comes from YCharts

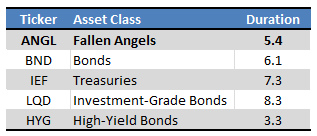

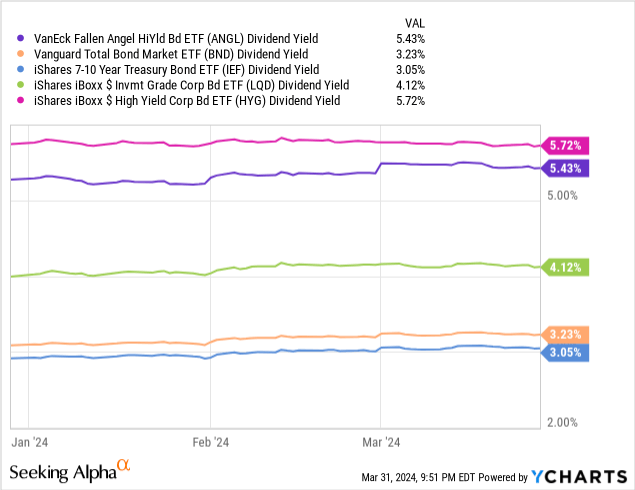

Finally, ANGL has a duration of 5.4 years, which is slightly below the bond average but slightly above the high-yield bond average. The fund’s credit quality/holdings data are broadly consistent.

Fund Filing – Form by Author

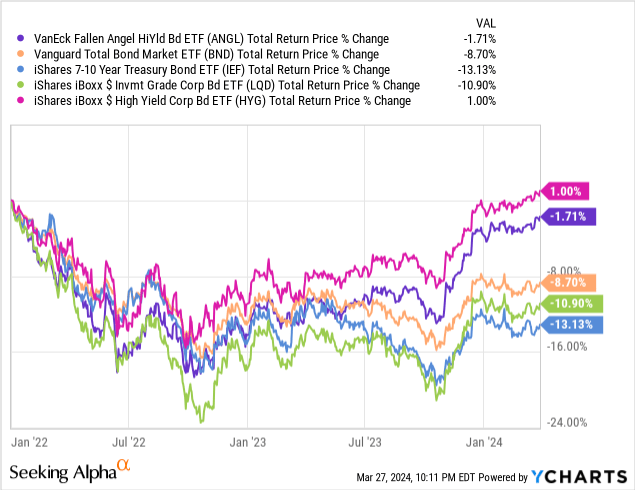

For the reasons stated above, ANGL should perform better than most bonds when interest rates rise and perform worse when interest rates fall. For high-yield corporate bonds in particular, the opposite is true. For example, take a quick look at the fund’s performance since early 2022, when the Fed began raising interest rates.

Data comes from YCharts

Other factors can also affect fund performance, which leads me to my next point.

track record

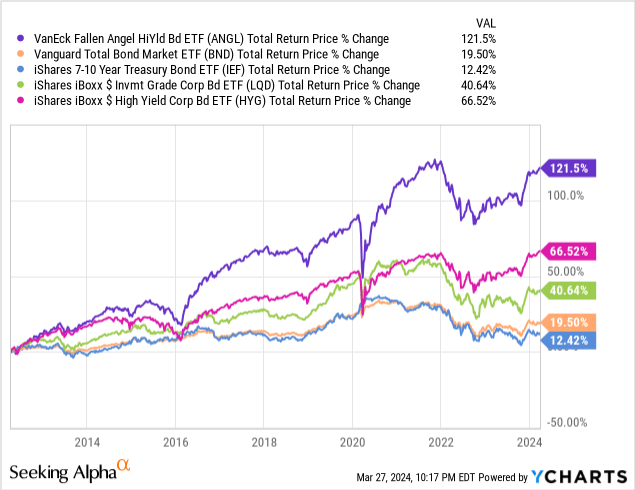

ANGL has a strong track record, with the fund outperforming most bonds and bond sub-asset classes since its inception and posting healthy margins.

Data comes from YCharts

Looking at specific time periods, the fund appears to have outperformed reasonably Consistent, although much weaker since the Fed started raising rates.

Seeking Alpha – Author Form

ANGL’s outperformance is entirely due to the outperformance of Fallen Angel itself, as well as the aforementioned forced selling issues. Simply put, Fallen Angels outperform the Fallen Angel ETF. Since the fund’s performance and returns are driven by structural market issues, the outperformance will continue, at least in my opinion.

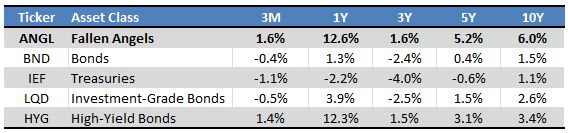

Dividend analysis

ANGL currently yields 5.4%, which is above the bond average but below the high-yield bond average.

ANGL’s dividend yield does not take into account potential capital gains due at par on the fund’s holdings. Taking these factors into account, the potential return/yield to maturity rises to 6.8%, which is slightly higher than the above figure.

English

At the same time, the above numbers do not take into account the potential gains from purchasing Fallen Angels at fire sale prices, nor the potential gains from those prices recovering quickly.

Overall, ANGL’s dividend yield is somewhere between good and good, but definitely no The key advantages or characteristics of the fund. Its investment strategy and performance are. Many high-yield ETFs have higher yields than ANGL, but very few have comparable/higher returns.

in conclusion

ANGL’s proven strategy, strong performance, and healthy dividend yield of 5.4% make this fund a buy.