Kiyota Koushiro

paper

I recommend a “sell” rating on Apple (NASDAQ:AAPL) primarily due to three factors: signs that their AI efforts may be lagging behind competitors, stagnant growth, and high valuation multiples compared to Google.

brief Narrate

In April 2010, Apple announced the acquisition of a new startup.Although the terms have not been made public, report At the time “from Apple’s perspective, the deal was probably small.” However, Apple had big intentions. They saw the acquisition’s potential to change the way users interact with their devices and continue to widen the technology gap between the iPhone and its other competitors.

What is the name of the company Apple acquired? Siri Inc. – Personal Assistant for iPhone.

Fast forward to October 2011, Apple executives Phil Schiller took the stage to deliver a keynote speech. Notably absent was Steve Jobs, who was in the final hours of his battle with pancreatic cancer. Although Jobs’s failing health cast a shadow over the company, the iPhone 4S had just been launched to the world. Keynote attendees were excited and eagerly awaited other announcements. Back then, Apple always kept attendees on the edge of their seats.

On stage, Schiller pondered the capabilities of technology. He pointed out:

For decades, technologists have been teasing us with this dream, that you would be able to talk to technology and it would do things for us. Haven’t we seen this over and over before? But it never comes to fruition.

This musing, which suggests pushing the boundaries of technology, piques the viewer’s interest.

Schiller then officially introduced Siri to the world. Interacting with technology via voice is no longer a dream, it is now a reality. Attendees were impressed by Siri’s ability to respond to text messages, find directions to specific locations, retrieve current weather forecasts, and recommend restaurants. Siri is no longer a third-party app; now it can be integrated directly into iOS. Apple executives touted it as “the coolest feature of the new iPhone” and praised it as a “smart assistant that helps you get things done.”

Apple’s dilemma

So what does the story of Siri have to do with Apple today? In a way, Siri was the first person in the world to experiment with artificial intelligence. After all, Siri’s main selling point is that you can now interact with your iPhone using conversational, natural language. Gone are the days when speech recognition grammar was (allegedly) imperfect and limited. Instead, users are able to interact with their devices in a free and instinctive way.

Now, does this sound familiar? Does this sound like many of the tech trends in the headlines today? Absolutely. This sounds a lot like the artificial intelligence applications dominating the news today.

It’s worth noting that Apple was well ahead of the rest of the world in these types of AI capabilities and use cases, but failed to capitalize on its early advantage. We’re talking about a company with thousands of software engineers, billions of dollars on its balance sheet, the brightest minds in Silicon Valley, and years of leadership. Still, they couldn’t take advantage.

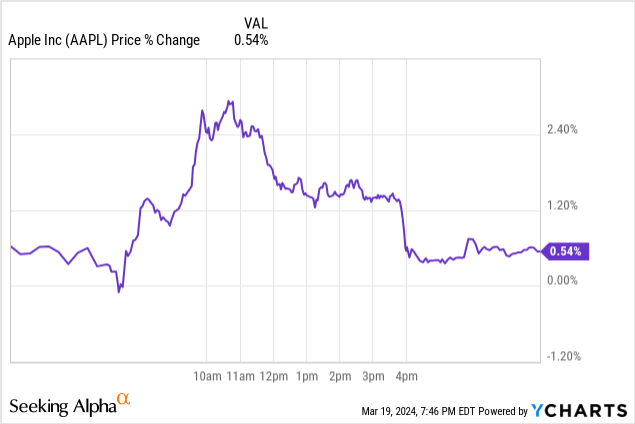

What prevented them from capitalizing on their early advantage was recent message Apple is in talks with Google (NASDAQ: GOOG ) to use its Gemini AI model in Apple devices and software. Apple recognizes the urgency and admits their artificial intelligence efforts haven’t kept up with the rapid pace of competitors. Surprisingly, Apple’s stock price rose by 2% after the news came out, and then fell back slightly.

Contrary to what the market thinks, I think this is negative news for Apple. Assuming this partnership becomes official, Apple could be sending a signal that their AI efforts aren’t on par with their competitors. That’s a troubling question, given how seriously the market attaches itself to Big Tech’s ability to compete in the artificial intelligence race.

The partnership with Google continues a worrying trend for Apple, particularly as its larger projects have the potential to enter new, larger markets.For example, it is report Just a few weeks ago, Apple canceled Project Titan, the team responsible for building the Apple Car.The program was launched in 2014 and has Troubled history. The team continued to change management and different leaders throughout its life, employing approximately 5,000 people at its peak. When it was terminated, the struggling program still had 1,400 employees working for it and had burned through a total of $10 billion. As popular and well-capitalized as Apple is, it simply can’t pull it off or even match it.

Essentially, Apple failed in cars from the start and ultimately failed. It now appears that Apple has lagged behind in the artificial intelligence arms race, choosing instead to license technology from competitors. They are starting out and failing to reach the largest markets. It’s a worrying trend for a company of its size, which needs huge revenue from any new product lines just to make progress.

Valuation

The market largely assesses Big Tech’s position in the AI arms race and assumes that all other business functions are more or less ancillary to their AI capabilities. Microsoft (NASDAQ: MSFT ) is a good example of this trend. On January 23, 2023, the day it invested $10 billion in OpenAI, Microsoft’s EV/EBITDA multiple was 18.3x. Today, Microsoft’s price-to-earnings ratio is 26.4 times. Of course, this multiple expansion is driven by overall market strength, but it goes without saying that Microsoft is also being rewarded for its leadership in the AI arms race.

Seeking Alpha

Assuming the same premise that artificial intelligence is the future and determines much of the basis for big tech company valuations, there’s no reason for Apple’s valuation to be higher than Google’s. After all, Apple has essentially given in to Google in the artificial intelligence arms race.

According to the paper, valuation metrics for Apple and Google are beginning to converge. A year ago, Apple’s EV/EBITDA multiple was 19.1x, while Google’s was 13.8x. Today, the gap between multiples has narrowed. Apple currently trades at 20.1x EV/EBITDA, while Google trades at 17.6x.

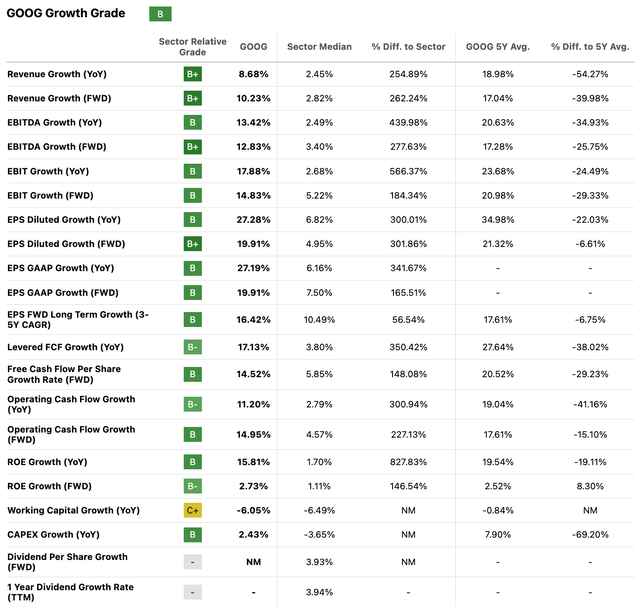

In addition, Google not only has the upper hand in artificial intelligence, but it is also growing faster. Google’s expected revenue growth rate and expected EBITDA growth rate are 10.2% and 12.8% respectively.

Seeking Alpha

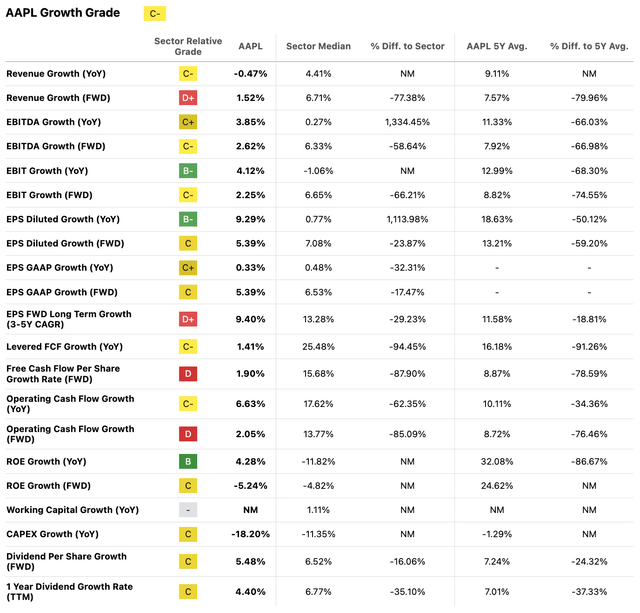

This greatly exceeded Apple’s expected growth indicators of 1.5% and 2.6%.

Seeking Alpha

Putting these factors together, it seems unreasonable for Apple to command a higher valuation multiple than Google.

I believe that over time we will continue to see Apple and Google’s P/E ratios converge and eventually diverge, with Apple trading at a lower P/E than Google. As time goes on, Apple’s absence from the AI race will only become more apparent. They will no longer be at the forefront of technology. Instead, Apple will be at the mercy of its competitors in accessing its technology.

risk

As Apple moves forward in the field of artificial intelligence, their biggest catalyst for the future will be the Apple Vision Pro, which in their own way Character, is “the most ambitious product Apple has ever created.” The Vision Pro is Apple’s ticket back into the market. Of course, at the current price of over $3,499, it’s still a long way from becoming mainstream. But if their recent launch proves anything, it’s that their most loyal customers are at least open to new technology.

In many ways, the Vision Pro has the potential to be as transformative and game-changing as the iPhone. It challenges the status quo of computing over the past 15-20 years. However, if the Vision Pro doesn’t reach the mass market in the next few years, Apple may miss out again, as it’s only a matter of time before competitors jump on the same train.

Another risk for bearish investors is that Apple’s stock price could continue to trade higher than its peers due to its positioning as a popular luxury brand. These brand dynamics may be the reason for the difference in valuation multiples between Apple and other big tech companies. After all, there are few brands in the world that command as much support and loyalty as Apple. This strong support could help boost Apple’s valuation even during a period of stagnant growth and uncertainty for the company.

in conclusion

What Apple has accomplished so far is staggering and mind-boggling.They’ve been Wall Street darlings for years and Main Street. Wall Street because they provide incredible returns for investors, and Main Street because they are supported by millions of consumers. However, Apple’s throne is starting to show signs of weakness.

Rumors about their possible partnership with Google to use Gemini AI suggest that Apple’s artificial intelligence efforts may be lagging behind those of the competition. Ahead of any unexpected breakthroughs, Apple seems to have raised a white flag – signaling that they will no longer be at the forefront of technology, but at the mercy of other big tech companies.

This storyline unfolds at a time when the company’s growth has stalled, casting a shadow over their future. Add to that the fact that Apple is currently valued at a higher multiple than Google – from whom they will license their AI services – and it’s hard to justify their current price. Therefore, I recommend a “Sell” rating.