Justin Sullivan

AAPL – Why We Like Around $170

The purpose of this article is to update our paper Apple Inc. (NASDAQ:AAPL) and upgraded it from Hold to Buy.We last covered the stock in December 2023 (see image below). In that article, we assessed the investment risk as its price hovered at all-time highs (around $193, as shown) and the P/E ratio rose to around 30x.this article Then two possible ideas were proposed at the time: 1) Wait for its price to return to around $170; 2) Hold AAPL shares indirectly through Berkshire Hathaway (BRK.B).

Seeking Alpha

Our previous article focused more on the second idea, detailing the key advantages of owning AAPL stock through BRK (such as “price to earnings on ownership” and long-term compounding in a very tax-efficient manner.

In this article we will look at the first Further thoughts as the share price has now corrected to levels closer to $170 (around $172 as of this writing). I will argue why this price level is an attractive entry point for us. The remainder of this article details key factors involving Apple’s wide moat, parts of its long-term growth, and return potential relative to the broader market.

Why is AAPL stock price retreating?

As mentioned, AAPL stock has undergone a significant correction over the past few months, falling more than 10%. There are certainly some good reasons for this revision. Next I will look at some possible reasons one by one and argue why these corrections are excessive, reflect short-term market thinking, and create a healthier entry point for long-term investors.

The first reason (and the most logical to me) is that, as mentioned in my previous article, AAPL is simply too overvalued at a price level approaching $200. With Apple’s stock price rising sharply in 2023, pushing valuations into bubble territory, a correction may be inevitable. By bringing P/E ratios to more normal levels, these adjustments are actually healthier for long-term investors (more on this in a later section).

The second possible reason is a potential slowdown in the Chinese market. Indeed, sales were down in China, a key market for many of Apple’s flagship products such as the iPhone. There may also be other fundamental headwinds, such as shifting consumer preferences, competition from companies like Huawei, and government restrictions on the use of Apple products. However, my point is that these factors may ultimately be short-term (for example, if you share Warren Buffett’s investment timeline). Furthermore, even if these headwinds become chronic, I think there are plenty of other positive catalysts that can compensate and continue to drive long-term growth, as shown below.

Service revenue growth

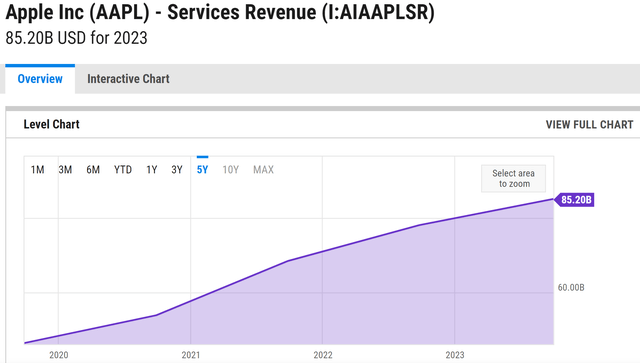

I think the main driver is long-term growth in services revenue. To be sure, I’m optimistic about the company’s overall product lineup, from the iPhone 15 series to the new MacBook Pro, as well as the Apple Watch Series 9 and Ultra 2. The products are extremely popular and continue to gain more fans (speaking of first-hand experience from teens and their friends’ parents). But more importantly to me in terms of business fundamentals, the popularity of its hardware is translating into strong growth in services (see chart below).

I expect services revenue to continue to grow and become a key return driver for several reasons. First, service revenue is more sticky than hardware sales and has higher profit margins. Second, AAPL’s service revenue growth is driven by its large installed base. Apple has more than 2 billion active device installations, including well over 1 billion paid subscriptions. Those levels are nearly double what they were three years ago. According to its last financial report, services accounted for 25% of revenue in recent quarters, up from 20% to 21% a year ago.

Y chart

Expected return of APPL

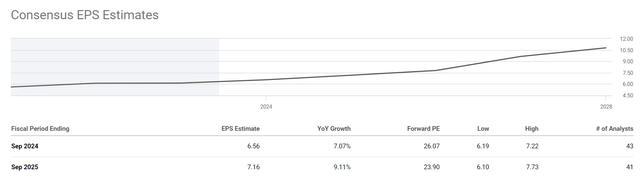

Now, let’s review our previous point about corrections. I mentioned before that by adjusting the P/E ratio to more normal levels (26x for FY1 and 24x for FY2, as shown in the chart below), it is actually healthier for long-term investors.

Seeking Alpha

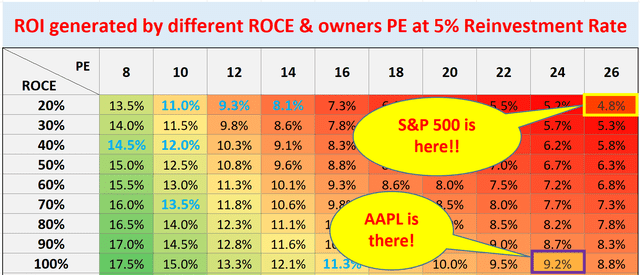

At these valuation levels, I expect Apple’s return potential to be much better than the market as a whole. My predictions only involve simple reasoning and napkin math, as described in a previous post. The point is:

AAPL’s ROCE (return on capital employed) is nearly 100%. With such ROCE, a 5% investment rate will drive 5% organic growth (100% ROCE * 5% reinvestment rate). Therefore, any P/E ratio close to or below 25x is attractive. A price-to-earnings ratio of about 25x provides a yield of about 4%. Given AAPL’s capital-light model, the true owner return rate must be higher than 4% (my analysis is about 6%). As a result, the long-term total return is close to 10%, which is much better than the overall market return (which is expected to be around 5%, as shown in the chart below).

Source: Author

Other risks and final thoughts

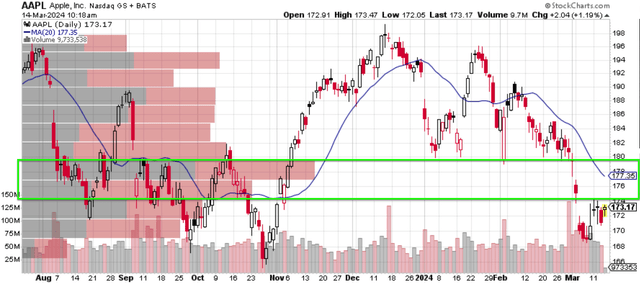

Before the close, there are some upside and downside risks worth mentioning. On the upward direction, the price is currently close to the support level, as shown in the chart below. As the chart shows, $175-$185 has been the most heavily traded range over the past few months (shown in the green box), providing support for further corrections below that level.

stock chart

In terms of downside risks, Apple faces all the risks common to other technology stocks, such as competition, technology obsolescence, global supply chain disruptions, etc. However, Apple’s business model poses some more unique risks. First, Apple relies heavily on a limited number of contract manufacturers, primarily in Asia. Disruptions at these plants could severely impact production and lead to shortages. Secondly, it can be said that Apple has been lagging behind in several technical areas. These areas include the use of artificial intelligence and VR (virtual reality). The success of its Vision Pro headphones is unclear, and so far, in my opinion, it lacks a blockbuster AI product.

All in all, as a value-oriented investment with a long-term focus, I think Apple’s strengths outweigh its weaknesses under current circumstances. There can (and there always will be) speed bumps and corrections along the way. However, I think its core moat remains intact in the long term. As has been argued in the past, a big part of its moat is its overarching brand, not just its technology. The rapid growth of its service areas will only further widen the moat. Finally, let me repeat my final conclusion. Over the long term, owning AAPL stock at nearly 25 times earnings is a no-brainer for me. When holding indirectly through BRK, an even higher P/E ratio would be justified (in this case, of course, it depends on the valuation of BRK stock as detailed in our previous analysis).