ipoba

investment thesis

AppLovin (NASDAQ:APP) is a mobile advertising company.

AppLovin serves mobile application developers and advertisers. In short, it helps app developers make money from their apps by showing ads to users.Essentially, AppLovin acts as a middleman A relationship between app developers who want to monetize their apps and advertisers who want to promote their products to mobile users.

The business is growing at a CAGR of about 28% and is priced at about 16 times forward free cash flow. Strong growth to $1.5 billion is not easy to achieve. But AppLovin expects to achieve this goal by 2024.

Price target: $90 in 2025.

quick review

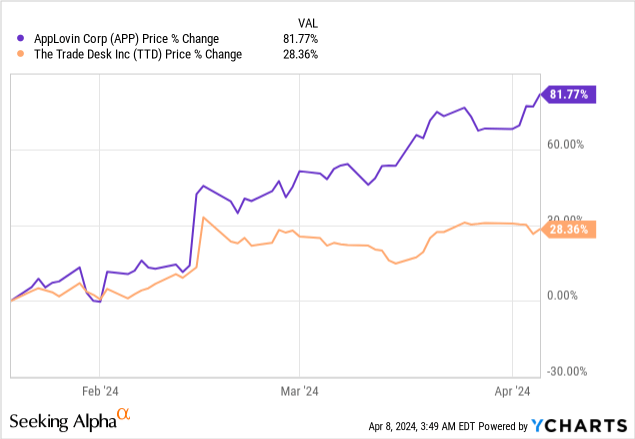

On January 20, 2024, I wrote an analysis article titled “The Trade Desk Vs. AppLovin: Why One Is a Better Stock.” I think:

In 2024 APP will Is a better investment than TTD

Here’s how both stocks have performed since then.

Important background

A stock that has risen a lot in a short period of time can look scary. Easy to sell off, right?

No, that’s not right. Every stock is vulnerable to a sell-off. always. It makes no difference whether it’s up, down, or moving sideways before selling off. You should never invest with any other assumptions.

What matters is what the stock’s prospects are for next year. That’s what’s driving stock prices higher. Everything else is just noise.

Second, as far as investing is concerned, there is no point in waiting for a sell-off that may or may not happen. Either the intrinsic value of the business is growing or it is not. Maybe it’s going to have a bad quarter or something. There is nothing we can do about it.

But there’s no point investing in a stock just because it’s gone up and worrying that it might sell off.

Investors will pay a higher premium (or share price) for stronger free cash flow, which will increase over time. It would be a step further if they were more confident that those free cash flows are stable, consistent, predictable and capable of growing even more.

Why choose AppLovin? Why now?

AppLovin plays a vital role in the mobile advertising industry, helping companies connect with users in a more targeted and efficient way.

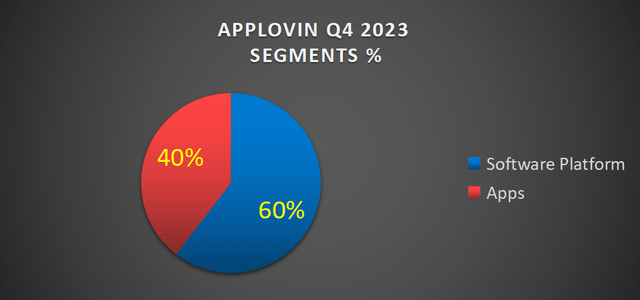

AppLovin is a mobile marketing platform specializing in the optimization and monetization of mobile apps. It provides solutions for app developers, the crown jewel of the business, called the software division, which currently accounts for 60% of AppLovin’s business.

The author’s works on the APP

Then, it has another section called the application section. This segment is a highly commoditized business. It helps clients acquire users through targeted marketing strategies (but still generate stable cash flow).

AppLovin is best known for its advertising technology AXON 2. The company has proven its ability to drive substantial growth and deliver superior performance solutions to its customers.

AppLovin is focused on extending performance marketing technology to television through CTV programs and Array, two long-term growth opportunities, and is poised to enter new markets and close the gap in the industry for superior advertising solutions.

AXON 2 has been successfully integrated into a variety of business verticals, both gaming and non-gaming, demonstrating the versatility and adaptability of the company’s technology capabilities.

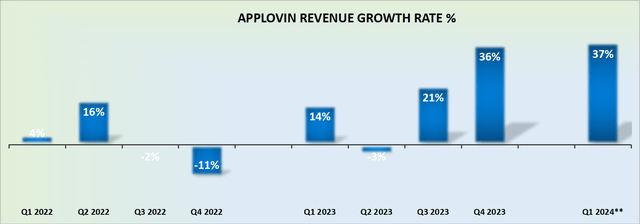

The compound annual growth rate may reach 28% in 2024

APP revenue growth rate

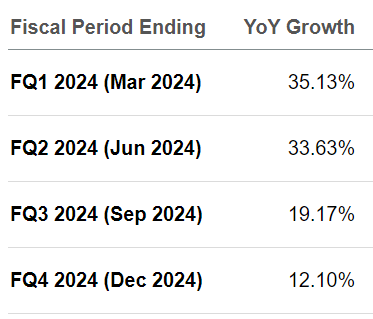

Growth rates will be very strong in the first quarter of 2024. Given that the first quarter’s hurdles weren’t particularly low, that means the second quarter will likely see at least 45% year-over-year growth. Likewise, I wouldn’t be surprised if Q3’s CAGR reaches around 20%. Of course, the fourth quarter of 2024 will be extremely challenging.

As a point of reference, consider AppLovin’s expected analysis of its revenue growth rate.

AT Premium

You can see that analysts’ expectations were in line with my expectations. It’s always nice to see this kind of consideration.

Next, we’ll discuss the stock’s valuation.

APP stock valuation — 16x free cash flow

I believe approximately 70% of AppLovin’s EBITDA can be converted into free cash flow. Therefore, free cash flow of $350 million appears to be achievable in the first quarter of 2024.

This would represent a year-on-year increase of 24% compared to the same period last year, which, needless to say, is a strong improvement. But more importantly, given that first-quarter growth was about 37% year-over-year, I believe free cash flow growth of 24% year-over-year means the business will likely have more operating leverage to draw on in the coming years.

Regardless, I still believe there will be $1.5 billion in free cash flow in 2024.

risk factors

AppLovin relies heavily on mobile advertising for its revenue. Any changes in the industry (for example, considering changes in cookies or similar advertising tracking metrics) could have a negative impact on the company’s growth prospects.

In addition, competition in the mobile advertising field is fierce. AppLovin faces competition from established companies, such as Alphabet Inc. (GOOG) (GOOGL), as well as emerging companies that offer similar services, such as Unity Software Inc. (U).

In addition, ad tech company valuations change based on macroeconomic factors. If there is no soft landing in the U.S. recession, APP’s valuation will be compressed. This will cause its shares to sell off.

bottom line

In my opinion, AppLovin Corporation stock is cheap and ready to move higher. The company’s recent outperformance has been driven by its software platform. AppLovin is strategically focused on cutting-edge initiatives, such as its artificial intelligence advertising engine AXON 2, which is an engine for continued growth.

Furthermore, the stock’s valuation of 16x free cash flow is very cheap, given its strong free cash flow profile and the potential to further increase operating leverage. With the first quarter of 2024 showing substantial growth and expected free cash flow of $1.5 billion in 2024, I believe AppLovin Corporation stock is undervalued.