deberarr/iStock via Getty Images

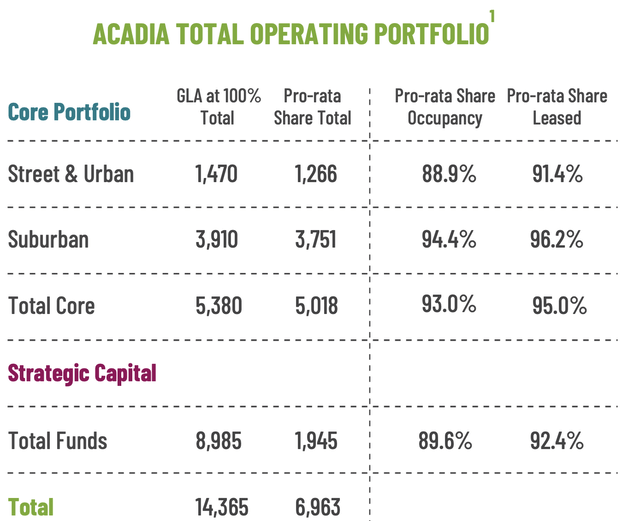

Arcadia Real Estate Trust, Inc. (NYSE:AKR)’s focus on street retail makes the stock one of the more unique retail REITs in the space. This internally managed REIT is pursuing growth through its core portfolio of 139 operating properties located in 5.4 countries. As of the end of the fourth quarter of 2023, total leasable area will be 1 million square feet. AKR’s pro rata share of 5 million square feet was also 93% occupied and 95% leased as of the end of the fourth quarter. The REIT also aims to generate additional growth through funds it co-invests with institutional investors. These dual investment platforms make up AKR’s investment strategy, and the fund owns and operates 50 properties representing approximately 9 million square feet. AKR’s prorated share is 2 million, which was 89.6% occupied and 92.4% leased as of the end of the fourth quarter.

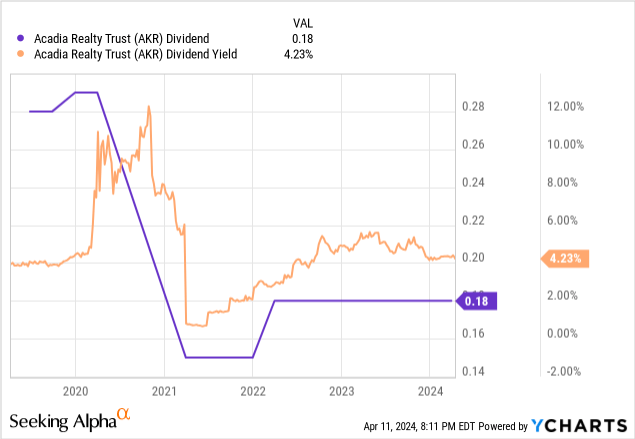

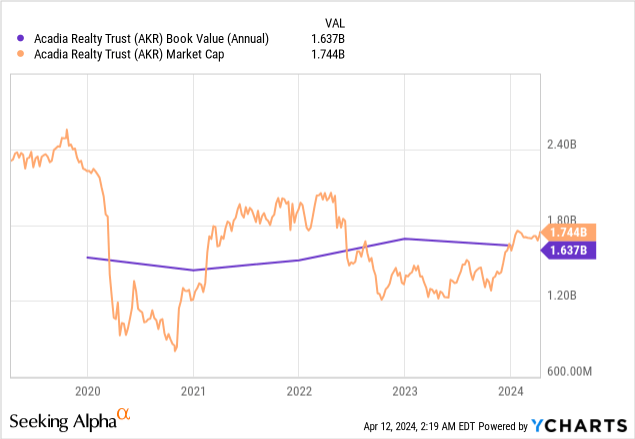

The real estate investment trust last announced a quarterly cash dividend of $0.18 per share, unchanged from the previous quarter, for an annualized dividend of $0.72 per share and a dividend yield of 4.2%. Crucially, quarterly distributions remain 38% below pre-pandemic levels in 2019. AKR’s FFO in the fourth quarter was $0.28 per share, an increase of $0.01 from the same period last year, and the dividend coverage ratio was 156%. Therefore, a core part of the REIT investment thesis is the growth prospects of dividends. When I last covered the stock, AKR’s 11% discount to GAAP book value on its quality assets had ended. That sets the stage for a January offering of 6 million shares of common stock that will ultimately raise $113 million in proceeds after underwriters exercise their 30-day option to purchase an additional 900,000 shares.

Revenue, NOI and Book Value

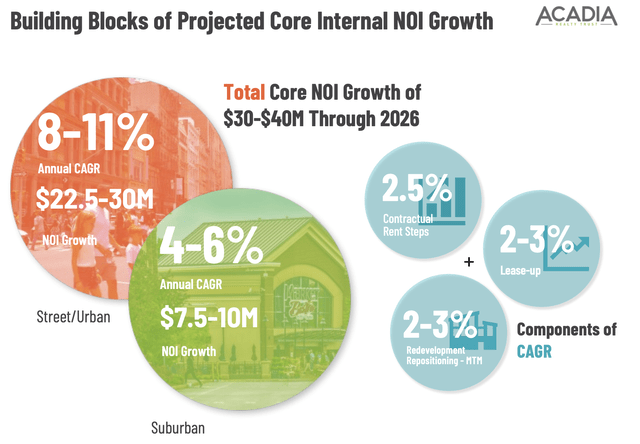

AKR currently trades at a modest 6% premium to its book value at the end of the fourth quarter. The real estate investment trust’s fourth-quarter revenue was $85.51 million, an increase of 6.1% over the same period last year and exceeding market expectations of $8.15 million. Same-property net operating income grew 4.2% in the fourth quarter and 5.8% for full-year 2023, with the REIT’s street retail portfolio achieving 10% same-property NOI on the back of new core cash rent spreads of 44% in 2023 growing up. The full-year growth was 25%, and the fourth quarter growth was 25%. The growth was driven by the recapture and re-leasing of a space in Soho, In New York, visitor numbers are growing as the city continues to rebound from the pandemic.

Arcadia Real Estate Trust March 2024 Investor Update

The retail properties that AKR focuses on are mainly located in high-density areas such as Soho in New York and Melrose Place in Los Angeles, which have formed a unique driving force for NOI’s growth.This REIT projects annual growth for many years to come More than 10% Rental spreads range from 10% to 50%. AKR expects total core NOI to increase by $30 million to $40 million by 2026.

Arcadia Real Estate Trust March 2024 Investor Update

Dividend Growth Prospects and the Fed

AKR currently pays out approximately 64% of its FFO as dividends.This is because REITs are facing With significant core debt maturing in 2026, FFO at the midpoint of fiscal 2024 is expected to be $1.28, up approximately 5% from the same period last year, and same-property NOI is expected to increase by 5% to 6%. The main driver of this. However, I think short-term returns going forward are likely to be relatively flat as the pending Fed rate cut is delayed until later in 2024. The start of summer rate cuts will provide a catalyst for common stocks, but inflation remains stickier than consensus, limiting the need for the Fed to ease monetary policy.

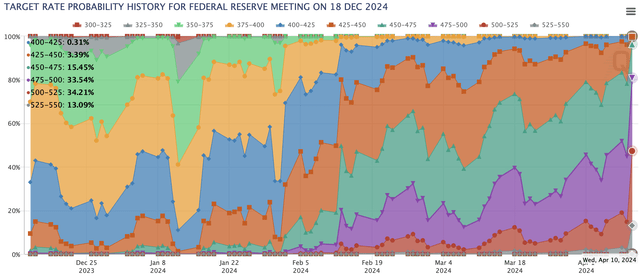

CME Group Fed Watch Tool

The likelihood of this most significant catalyst has diminished significantly in recent weeks, with markets now expecting the Fed to essentially keep interest rates at 22-year highs until the December FOMC meeting.According to data from CME Group’s FedWatch tool, the likelihood that interest rates will remain at their original levels in 2024 has increased from about 0.1% to 13.09% The base case now is for a single rate cut of 25 basis points, down from at least three cuts of 75 basis points in early 2023. Fundamentally, AKR is a high-quality REIT that currently trades above book value and has a lower dividend yield than larger REITs. Retail REITs such as Agree Realty (ADC) and Kimco (KIM) have unique portfolios and are expected to achieve double-digit NOI growth in the coming years. While AKR is a lower buy than the other two investment grade REITs in relative terms, the street retail focus will drive double-digit NOI growth and could continue a dividend recovery that has stalled since early 2022. AKR is currently rated a Hold.