D3signAllTheThings

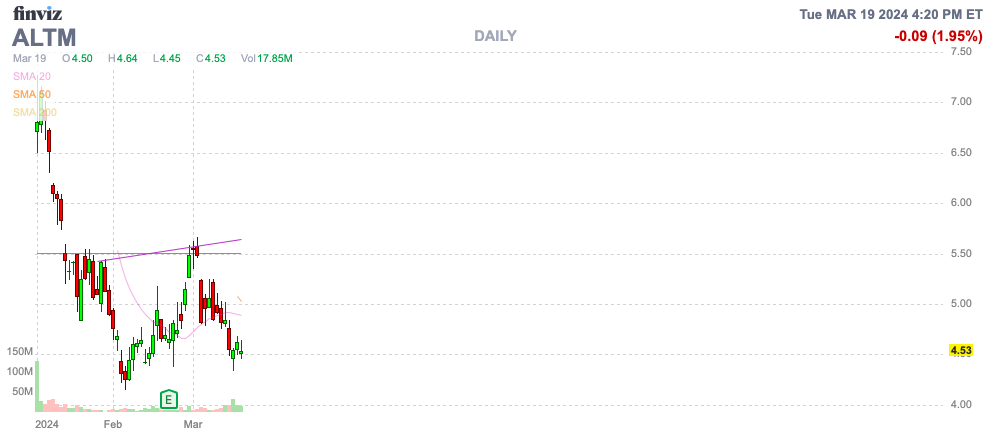

Lithium stocks are rebounding from the bottom, with the recent merger of Livent Corporation and Allkem Limited Achadim Lithium Corporation (NYSE:ALTM) can provide an opportunity to acquire forgotten stocks Shuffle. The stock quickly plummeted after the merger closed in early 2024 investment thesis Still extremely bullish on lithium stocks with initial coverage of Livent.

Source: Finviz

Merge completed

Arcadium Lithium completed its merger on January 4 and reported 2023 results that included only Livent’s data. In many similar cases, the market gets confused by the numbers listed in the financials and incorrectly assigns valuations based on acquired growth metrics rather than organic growth.

The merger involves shareholders of both companies acquiring the following shares of Arcadium Lithium:

- Allkem shareholders receive: (A) an Arcadium Lithium ASX listed CDI; or (Second) one share of Arcadium Lithium’s NYSE-listed stock, subject to their place of residence and the election, if any, they make with respect to each share of Allkem common stock they hold, except for shareholders in certain non-qualifying jurisdictions , these shareholders will replace such CDIs upon closing.

- Livent shareholders will receive 2.406 shares of Arcadium Lithium’s NYSE-listed common stock for each Livent share held.

The combined company expects 2023 revenue of approximately $1.9 billion, but the combined company’s sales in 4Q23 were only $324 million, with an annual run rate of approximately $1.3 billion.

The merger is expected to achieve synergies of $60-80 million in cost savings this year and ultimately $125 million in synergies. Arcadium will essentially reduce the overlap between the two legacy companies in order to achieve these cost cuts, which appear to be necessary based solely on the revenue hit from falling lithium prices.

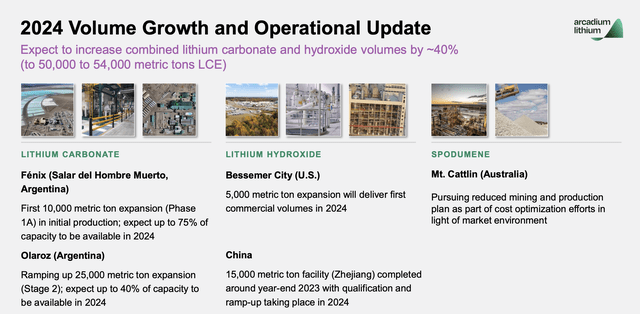

Arcadium is an interesting story, as the combined company is expected to increase lithium production by 40% annually through 2024. With growth at the Fenix and Olaroz mines in Argentina, combined lithium production is expected to reach 50,000 to 54,000 metric tons LCE.

Source: Arcadium Lithium Q4’23 Demo

Like the rest of the lithium market, Arcadium predicts capital spending will slow in 2024 and beyond as long as lithium prices remain low.inside 4Q23 financial report releasedCEO Paul Graves highlighted the potential for this market situation to drive up lithium prices in the future, similar to 2022:

“It’s clear that few lithium expansion projects make economic sense at current market prices, and the longer prices stay around these levels, the greater the impact on future supply shortages. As we argued in 2022 “This will increase the likelihood of rapid future lithium price increases, although the complexity of the global battery supply chain makes the timing and extent of such increases difficult to predict.”

Arcadium will slow expansion capex to $450 to $625 million in 2024, with an additional $100 million in maintenance capex. Additionally, the lithium company has encountered problems with its construction projects in Argentina that could slow down 52,000 tonnes/year of LCE by 2027, although the company said existing projects for which environmental licenses have been issued will not be affected.

Lithium may eventually face a situation where production cannot keep up with demand for electric vehicles and green energy because current prices do not support future mine development.

Huge upside potential

Arcadium Lithium has consolidated sales of $1.9 billion in 2023, and the stock is valued at about $5 billion. The new company has about 1.15 billion shares outstanding and its share price is only $4.50.

Investors really shouldn’t focus too much on 2023 results, as what’s really key is what Arcadium Lithium might produce in 2024 and beyond. The combination of the two companies and forecasts of production growth through 2024 have focused investment decisions on future targets, although this is normal for any stock.

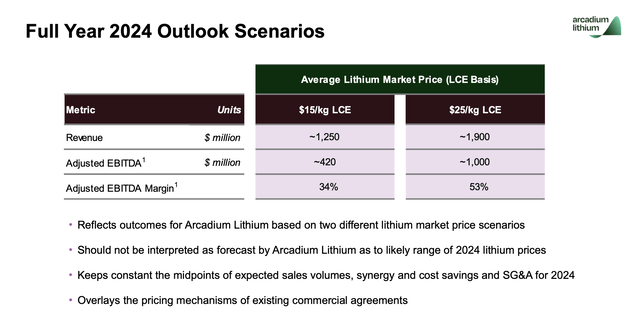

Based on lithium prices of approximately $15 per kilogram LCE, the company expects revenue of approximately $1.25 billion. Keep in mind that based on 2023 prices and higher production levels in 2024, Arcadium Lithium will generate sales of approximately $2.8 billion.

Source: Arcadium Lithium Q4’23 Demo

Considering the eventual huge EV demand to convert all vehicles to electric in 2030 and beyond, as well as lithium mining issues, an LCE price of $25/kg is more likely. Arcadium Lithium expects sales of approximately $1.9 billion and adjusted EBITDA of $1.0 billion under this pricing plan.

Keep in mind that the company expects capital expenditures to total more than $600 million this year and will post adjusted EBITDA of just $420 million, which doesn’t provide the cash flow to continue spending even at reduced levels in 2024. If lithium prices don’t rebound, Arcadium Lithium may cut more capital spending in 2025.

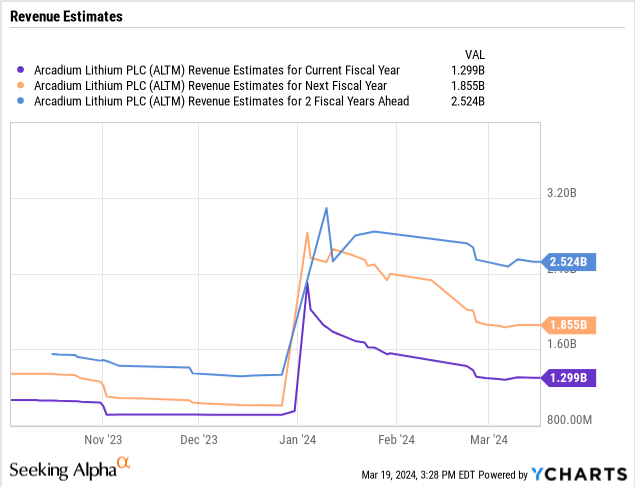

Consensus revenue forecasts expect revenue to eventually jump to $2.5 billion by 2026.If revenue just exceeds $2 billion and adjusted EBITDA exceeds $1 billion, the stock will be cheap under any circumstances

take away

The key takeaway for investors is that investors should assume Arcadium Lithium will eventually rise significantly, given projected production growth and the likelihood of another spike in lithium prices. Investors should take advantage of the current share price weakness to buy Arcadium Lithium.