Petris

array technology (NASDAQ: ARRY) is one of the leading investments in solar tracking technology. However, I think the short- to medium-term risks are worth weighing against the longer-term prospects offered by the growth of the solar market.The company lacks sustained net profits and a balance sheet that could be improved. Based on the current risks associated with earnings estimate revisions, I believe the stock is fairly valued, with no margin of safety in the price.

Company Profile

Array is a global provider of solar tracking solutions and services for large power plants. It designs, manufactures and supplies systems that increase the efficiency of these solar projects. Its tracking system significantly improves fixed tilt installations by adjusting the angle of the solar panels to track the path of the sun during the day, maximizing energy capture.

company initial public offering Array was launched in October 2020 and was founded in 1989. Array generates 78.5% of its operating revenue from the United States, 8.8% from Brazil, 7.9% from Spain, and 4.8% from the rest of the world. Array acquires STI Norland The company will spend approximately $652 million in a combination of cash and stock by 2022, making it one of the largest solar tracking companies in the world. Now, 77.4% of its operating income comes from the Array Legacy business and 22.6% from the STI Norland business.

Long-term market outlook and financial analysis

Mordor Intelligence estimates solar tracker market size It will reach US$36.62 billion in 2024 and is expected to reach US$100.51 billion in 2029, with a compound annual growth rate of 22.38% during the period. This is part of a broader trend in the energy sector, where solar energy is becoming an increasingly important contributor to global electricity generation. World Economic Forum sees solar growing faster than any other energy technology in history.

Solar renewable energy has three main competitors:

- wind force

- hydroelectric power

- Geothermal

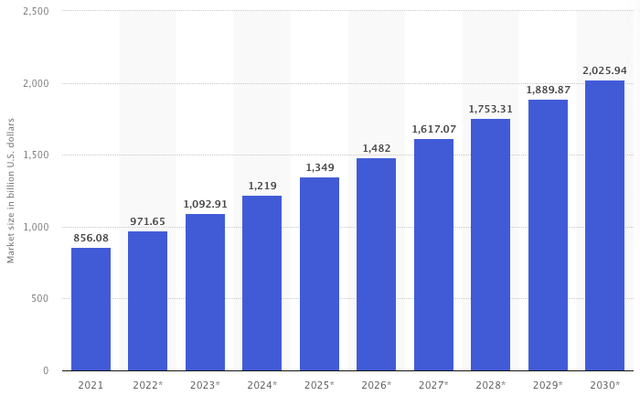

These renewable energy suppliers are the most important contributors to the size of the renewable energy market, which Next Move Strategy Consulting predicts will reach $2,025.94 billion by 2030.

Global renewable energy market size from 2021 to 2030 (politician)

I’ve identified four major competitors to Array, only one of which is publicly traded regardless of market capitalization:

- next tracker (NXT): The leader in solar tracking, known for smart, integrated solar tracking solutions for large power plants. This is both a direct threat to Array and an important investment opportunity.

- Optoelectronic hardware solutions: The business includes the design, manufacture and supply of advanced solar trackers for installation systems.

- Soltec Power Holdings: Provides solar tracking solutions to improve the efficiency and performance of solar installations.

- Arctech Solar Holdings: Provides solar tracking and shelving solutions and is known for innovation.

We could also include Shoals (SHLS) and Sunrun (RUN) based on similar market caps.

- shoal: Specializing in the design and manufacture of balanced system solutions that are critical to the operation and installation of solar energy systems.

- Shangrun: Known primarily for residential solar, storage and energy services.

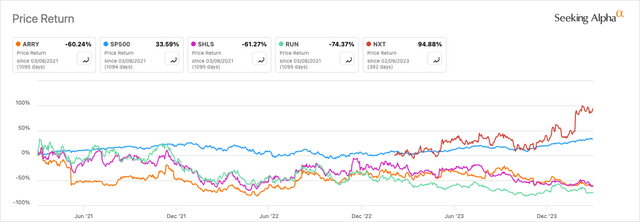

It’s worth noting that Array has significantly underperformed over the past three years compared to the S&P 500, which is a major trend in the solar market at this time:

Author, using Seeking Alpha

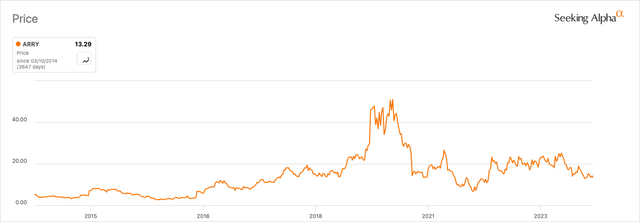

As I mentioned before, Array had its IPO in 2020 and its price had risen significantly prior to that and is now back to what I consider to be a more modest valuation, in part due to a general slowdown in solar demand in the U.S., Array’s current core market . However, I also attribute this to what I believe were too high expectations and excessive market sentiment that led to an overvalued IPO.

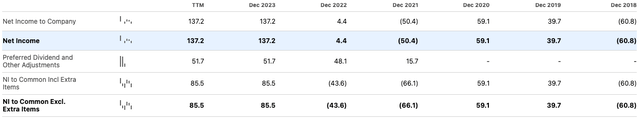

Part of the instability that comes with investing in Array is that despite being founded in 1989, the company has consistently posted net losses since 2018 and 2021:

Seeking Alpha

Its 2021/2022 losses affected by anti-dumping/countervailing duty investigation challenges, which affects Array’s ability to accurately forecast 2022 estimates. Projects generating approximately $250 million in revenue were delayed, affecting the company’s financial position. Additionally, CEO Kevin Hostetler noted:

Many things outside of our control, such as the AD/CVD investigation, the conflict in Ukraine, and continued commodity and logistics volatility, will cause difficulties throughout the remainder of the year (2022).

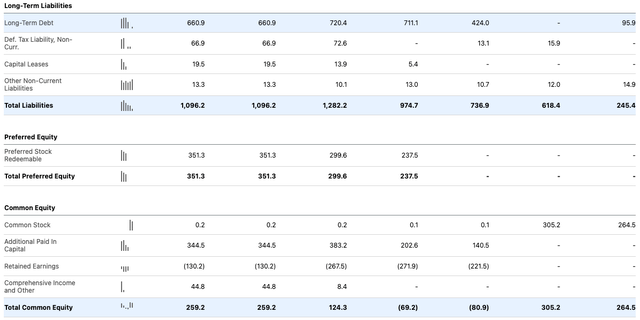

The balance sheet is likely to be stronger, as its equity-to-assets ratio is 0.36 and its liabilities-to-equity ratio is 1.2. Compare this to the three publicly traded peers I use for competitive analysis:

- shoal: The equity ratio is 0.62 and the debt-to-equity ratio is 0.36.

- Shangrun: The equity ratio is 0.26 and the debt-to-equity ratio is 2.12.

- next tracker: Equity ratio is -1.49 and debt-to-equity ratio is -0.05.

It’s clear that Shoals is at the top of the list when looking at the balance sheet, while both Sunrun and Array have significant debt to repay, which could inhibit future growth. Nextracker falls slightly outside the competitive analysis framework as it IPOs in 2023 and was founded in 2013, so it is the latest of four peers with an unusually weak balance sheet.

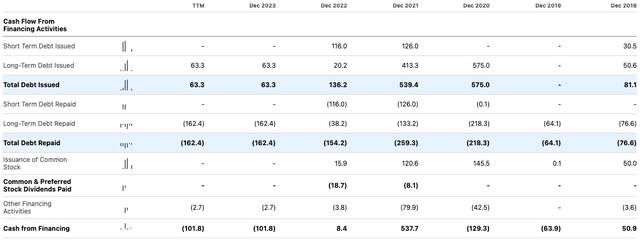

It’s worth noting that Array does not repurchase common stock, and its cash flow statement shows high levels of debt issued since 2018, with the most significant contributions being $575 million issued in 2020 and $539.4 million issued in 2021. However, it is paying down this debt with significant amounts of money each year, which is prudent given the current need for a better balance sheet overall.

Seeking Alpha

On the balance sheet, we can see that a large portion of the current total liabilities of $1,096.2 million is made up of said long-term debt, $660.9 million to be specific. Moreover, we can also see the negative impact of retained earnings, which was greatly enhanced by the additional paid-in capital of $344.5 million. The balance sheet also showed further evidence of earnings instability, showing negative equity in 2020 and 2021:

Seeking Alpha

I think there are significant risks to Array’s balance sheet, and I believe there are better solar investments on the market, particularly in China, including LONGi, which has an equity-to-assets ratio of 0.44 and significantly stronger growth prospects.

Valuation

Based on long-term profit forecasts, I believe Array is currently quite undervalued. The semiconductor industry’s median TTM P/E GAAP ratio is about 24.5, and Array’s sales ratio is about 25. Array’s forward P/E GAAP ratio is about 23. Array looks promising compared to its peers:

- shoal: The TTM P/E GAAP ratio is about 56 and the forward P/E GAAP ratio is about 30.

- Shangrun: Operating at a loss and therefore not applicable.

- next tracker: The TTM P/E GAAP ratio is about 35.5, and the forward P/E GAAP ratio is about 22.4.

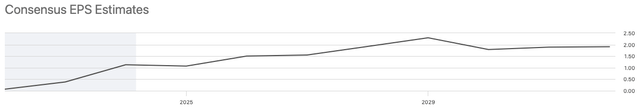

Array’s profit forecast for fiscal year 2024 shows a modest contraction in normalized real earnings per share of -5.18%, followed by an annual increase of 40.49% in fiscal 2025. Annual growth will slow to a more modest 3% in fiscal 2026.

Seeking Alpha

So I believe there will obviously be some volatility over the next few years, but based on Array’s price history, now doesn’t appear to be a bad time to buy.

Seeking Alpha

Given consensus expectations for higher growth in fiscal 2025, I would typically suggest the stock is undervalued at this point based on the following calculations:

- The non-GAAP price-to-earnings ratio is 11.5.

- Normalized real earnings per share will grow by a total of 45.67% in the next two years.

- My forward non-GAAP P/E fair value estimate is 16.75.

- The actual forward non-GAAP price-to-earnings ratio is 12.3.

- The indicated margin of safety is 26.6%.

However, as we will see, the revision risks outlined next reveal why my estimates are offset by near-term downside expectations.

Momentum and revision risk

Array prices have depreciated by 35.12% in the past year and 46.61% in the past six months. This outlines the significant short- to medium-term risks of investing in Array at the moment, and I believe investors should be brave enough to withstand the potential downside risks of buying now.

There’s further evidence that long-term returns are lower than current expectations as EPS revisions are mainly trending downwards. December 2025 is significant for investors buying at current valuations, with six-month profit estimate revisions trending at -18.16%. This shows that long-term investors received lower returns than expected. I think this risk significantly outweighs some of the market forecasts I outlined above, but I also think sentiment may change once the global economy returns to growth and renewable energy becomes a major spender in government and business budgets.

in conclusion

There are short- to medium-term downside risks to this investment, but I think the long-term prospects for the stock are bright. However, I see no evidence that this is one of the solar investments that will significantly outperform the S&P 500 over the long term, and I think its balance sheet is one of the core areas of improvement that needs to be addressed due to its volatile net income. Additionally, I believe that as the solar market surges and artificial intelligence is introduced more powerfully into solar technology, Array may face competition that could reduce its market share. My analyst rating on the stock is Hold.