Max Zolotukhin/iStock via Getty Images

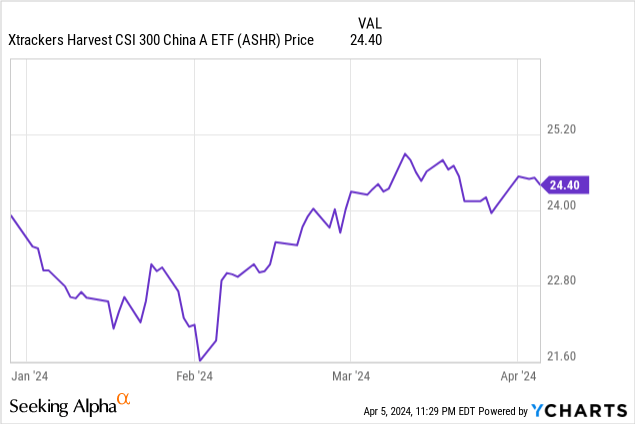

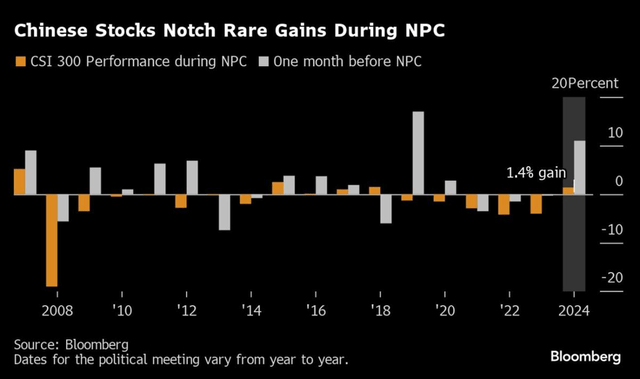

Caution on Chinese stocks ahead of Lunar New Year (see ASHR: It’s too early to be a contrarian investor in mainland China), more optimistic news flows out of China, especially news related to capital market stability and policy stimulus Significantly changes risk/reward. The market seems to agree, with A-shares – those listed on mainland China – rising so far this year after a post-New Year rally.

Burundi

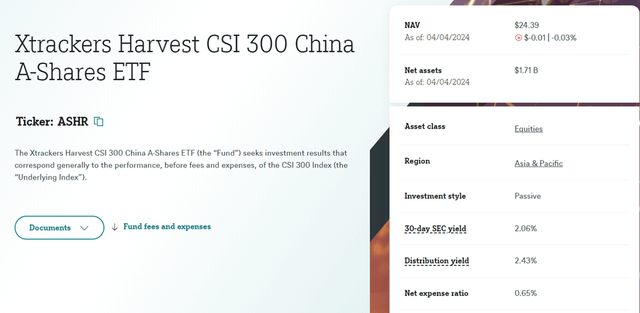

Recently, the People’s Bank of China, the central bank of China, has also begun to accelerate the pace of monetary easing. Not only Record mortgage rate cut It can also be done by injecting new liquidity Buy central government bonds ——Plan in time and in advance to issue 1 trillion yuan of ultra-long-term special bonds. While the new policy is not quite a QE-style balance sheet expansion, it should still keep risk-free rates supported and guard against any adverse supply and demand dynamics. Sovereign bond market. More broadly, it also shows the positive intentions of Chinese regulators on achieving economic growth (5% GDP target in 2024) and inflation targets (3% in 2024), which bodes well for stocks. There is also historical discounted valuation to consider, which ensures a margin of safety against possible negative revisions in the future. All in all, exposure to China’s large-cap stocks via Xtrackers’ Harvest CSI 300 China A ETF (NYSE: ASHR) might not be a bad idea.

Yardni

ASHR Overview – Mainland China Investment’s Preferred ETF

The Xtrackers Harvest CSI 300 China A-Share ETF, currently managed by DWS, continues to track China’s flagship CSI 300 Index, a market capitalization-weighted basket of the largest and most liquid mainland-listed companies. Net assets have remained relatively unchanged since last quarter at about $1.7 billion, and the fund’s net expense ratio is 0.65%. While ASHR itself isn’t the largest and most liquid China fund (i.e., iShares’ MSCI China ETF (MCHI)), ASHR stands out in the A-share ETF space. For context, the closest U.S.-listed A-share ETF peers, iShares’ MSCI China A ETF (CNYA) and the Kingsoft MSCI China A 50 Connect Index ETF (KBA), both manage smaller asset bases. ASHR is slightly higher than CNYA and KBA in terms of fees, although the fund’s liquidity advantages (and tighter bid-ask spreads) make ASHR very competitive in terms of overall costs.

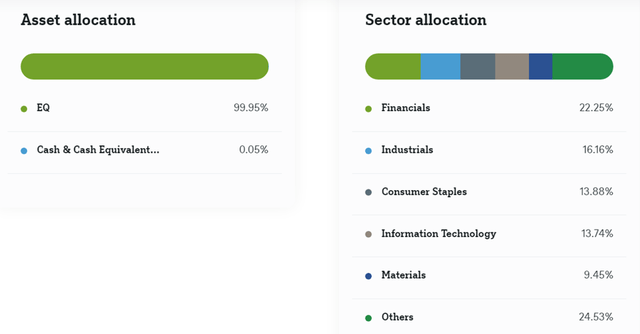

Decentralized WS

According to the fund’s Latest industry segmentationThe top two risk exposures: Financials (unchanged at 22.3%) and Industrials (slightly higher at 16.2%), remained consistent. The key change this quarter is that ASHR increased its allocation to consumer staples to 13.9%, while its allocation to information technology declined (to 13.7%). Together with the materials industry (higher at 9.5%), the contribution of the top five ASHRs is still relatively high at about 75%, so the industry concentration risk is still worthy of attention. The other two major China A-share ETFs offer similar compositions, but with higher (KBA) and lower (CNYA) allocations based on the size of their respective portfolios.

Decentralized WS

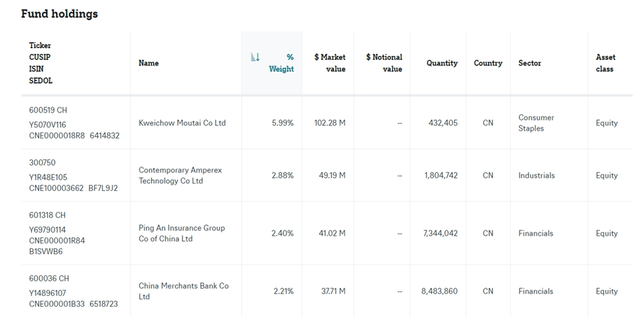

At the individual stock level, the fund’s 287-stock portfolio is similarly consistent at the top, with major spirits franchise Kweichow Moutai remaining the largest holding at 6.0%. There has also been some reshuffling among the other top five companies, with Chinese banking and insurance franchises such as Ping An Insurance Group (OTCPK: PNGAY) and China Merchants Bank (OTCPK: CIHKY) ceding some share to No. 2 holding company Battery Manufacturer CATL. All in all, ASHR portfolio composition is consistent with leading A-share ETF alternative CNYA, and should remain that way given its similar asset allocation standards. KBA, on the other hand, is more concentrated and more volatile; for example, its current single stock position is now tilted toward materials companies such as CATL, Zijin Mining, and Wanhua Chemical, all of which benefit from more favorable cycles sexual fluctuations. Therefore, investors looking for a more balanced, non-cyclical approach to A-share investing should continue to like ASHR.

Decentralized WS

ASHR performance – signs of recovery after several years of decline

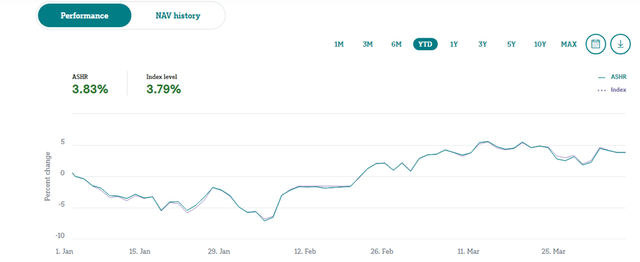

After years of decline, ASHR finally turned a corner in 2024, growing 3.8% so far this year. However, the fund’s net asset value has still declined by -16.7% and -13.3% on an annualized basis over the past one and three years due to the impact of the COVID-19 pandemic, respectively. While the fund’s overall compound interest rate since its inception in 2013 has remained positive at +3.1% per year, it’s worth noting that most of the positive returns were generated in ASHR’s inception.

Decentralized WS

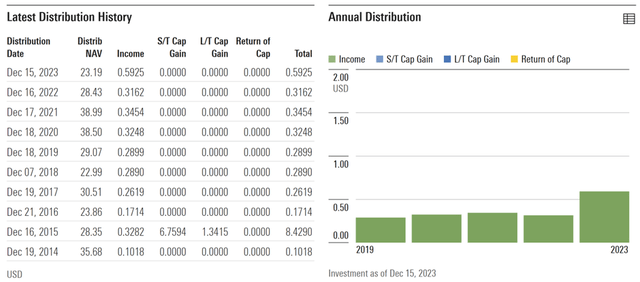

What the fund does well, though, is maintain small tracking error (after fees) relative to its benchmark CSI 300 Index. It’s also worth noting that ASHR has outperformed comparable A-share companies CNYA and KBA this year; while the fund has lagged other options in the short term, its relative performance over the past decade has remained very solid. Finally, ASHR’s distribution (up to $0.59/share in 2023) equates to a 30-day yield of 2.1% (versus 2.4% in the trailing 12 months) – which is at the high end of the category.

Morningstar Corporation

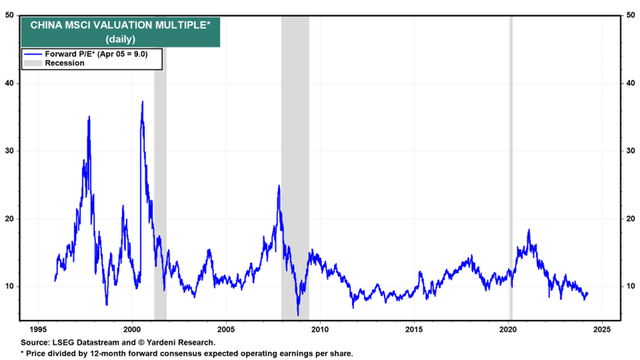

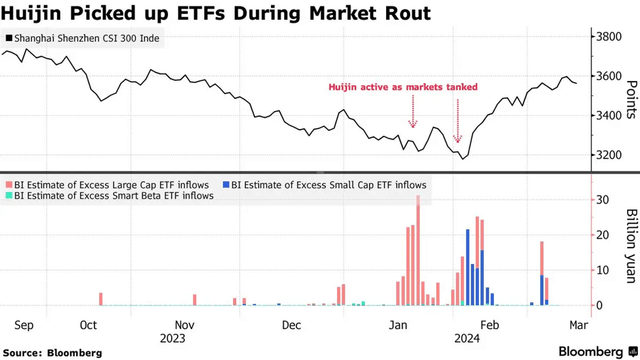

Last but not least is the valuation factor, with Chinese stocks (using MSCI China as a proxy) currently priced at a historical discount of around 9x relative to expected earnings. By comparison, consensus forecasts for earnings growth in 2024/2025 are +14%/+13%. So even if we see a possible downward revision to these earnings numbers, the downward revision to P/E ensures investors have plenty of cushion.A series of fiscal and monetary policy support measures have increased the margin of safety, many of which are increasing in scale; stock purchases by state funds are of particular concern because they Pay attention to CSI 300 large-cap stocks ASHR (CSI 300 Tracker) should be kept well supported.

Burundi

China may finally be “investable” again

It’s been a long time coming, but China’s data is finally starting to improve; while macroeconomic improvements may not be there yet, a positive rate of change bodes well for stocks. In my opinion, between mainland China (A-shares) and overseas listings (H-shares and US-listed depositary receipts), the nature of the policy stimulus deployed determines the risk/reward in favor of the former, especially for China’s large-cap For enterprises. Caps have always been a direct beneficiary of government efforts to stabilize markets. Given the difference between policy support, relatively high earnings growth prospects, and historically low valuations, ASHR is attractive here as an investment in China’s recovery.