kini

I expressed my bullish view on ASML (NASDAQ: ASML) stocks highlighted their extreme ultraviolet (EUV) monopoly and strong growth in wafer demand in my July 2023 launch article. Since then, the stock price has soared 42%.With the rise of AI Demand, I believe that ASML will continue to maintain rapid growth in the near future, driven by the explosive demand for high-bandwidth memory (HBM) in artificial intelligence computing. I reiterate a Strong Buy with a one-year price target of €1,238 per share, or $1,340.

HBM growth drives EUV demand

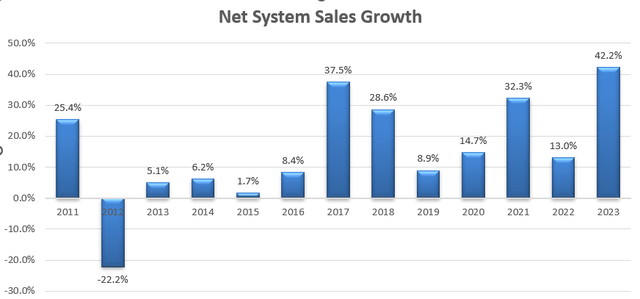

exist FY23Among them, ASML system net sales increased by 42.2%, of which logic increased by 60.2% annually and memory increased by 9.2% annually. At the end of the year, their backlog reached a record €39 billion.

ASML Annual Report

My biggest takeaway from their FY23 results is their huge growth potential HBM market driven by AI computing. High-bandwidth storage devices need to be used in conjunction with GPUs to process large amounts of data in generating artificial intelligence.

Let’s start with HBM’s three main suppliers:

In its recent earnings call, Samsung Electronics (OTCPK:SSNLF) stated that there is huge market demand for HBM and that most of its capital expenditures will be focused on expanding HBM production capacity.exist Fourth quarter fiscal year 2023Among them, Samsung Electronics’ HBM sales increased by more than 40% compared with the previous quarter. Additionally, they expect the next generation of HBM3 products to begin mass production later this year.

according to electronic data networkAmong them, SK Hynix’s sales of HBM3 chips in 2023 will increase more than five times compared with 2022, and they plan to continue to mass-produce HBM4. SK Hynix has ambitious plans to increase HBM capacity to meet the growing demand for GPUs.

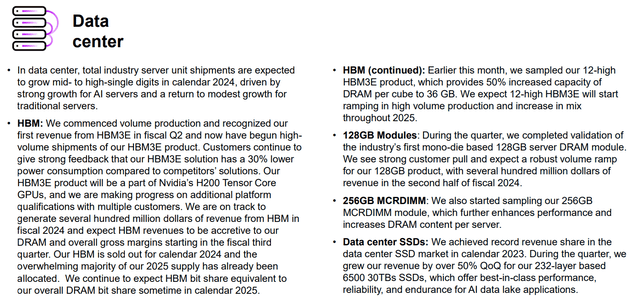

Micron (MU) released their Q2 FY24 Results on March 20 show that their HBM 2024 is sold out and the vast majority of supply for 2025 has been allocated, as shown in the slideshow below.

Micron Investor Introduction

Judging from the outlook provided by these three companies, industry demand for HBM appears to be quite high. These memory companies plan to increase manufacturing capabilities to meet growing demand and seize significant growth opportunities brought by artificial intelligence computing. For ASML, the benefits are clear: more HBM manufacturing means more EUV demand. During ASML’s earnings call, its management expressed optimism about EUV demand in the memory market. I expect that the expansion of HBM manufacturing may lead to significant growth for ASML in the near future.

China: Export restrictions

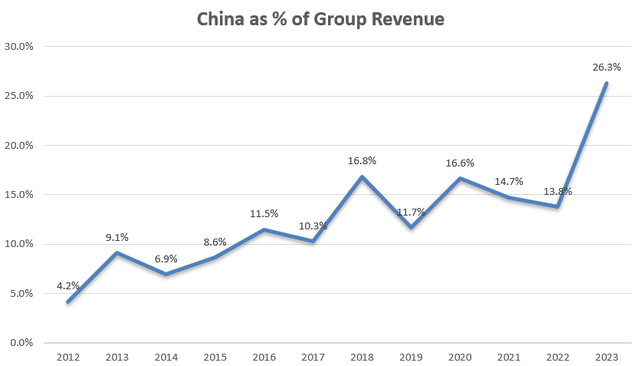

The U.S. government increasingly controls ASML exports to China. The Dutch and Japanese governments also imposed export restrictions on China under pressure from the United States. During the earnings call, ASML said the impact of Dutch and U.S. export control regulations would impact 10%-15% of its China system revenue. Given that China accounts for 26% of total revenue in FY23, according to my calculations, the impact on group revenue may be 2.6%-3.9%.

As shown in the figure below, Chinese companies had conducted multiple pre-purchases before the regulation came into effect. In FY23, ASML’s revenue in China increased by 148% year-on-year.

ASML Annual Report

ASML has not yet received export license approval for its NXE:2000 product and regulatory approval is on a case-by-case basis. Whether ASML will receive regulatory approval is uncertain.according to Tom’s HardcoreLatest export rules from the U.S., Netherlands and Japan restrict sales of tools and technology that can produce non-planar transistor logic wafers at 14nm/16nm and below nodes, 128-layer or above 3D NAND, and 18nm DRAM memory ICs at half pitch or less .

Export restrictions are expected to create some growth challenges for ASML; however, based on my calculations, the overall revenue growth impact is in the low to mid-single digit range.

Recent Results and FY2024 Outlook

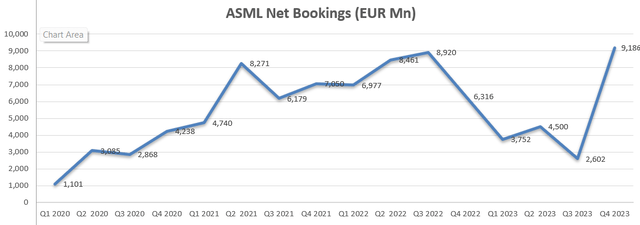

exist Fourth quarter fiscal year 2023As shown in the chart below, ASML net bookings reached a record high of €9.18 billion. Revenue increased by 12.6% year-on-year. The company expects fiscal 2024 net sales to be similar to fiscal 2023. It is worth mentioning that ASML achieved total net sales growth of 30.2% in FY23, while the bleak growth outlook in FY24 reflects strong comparability and the impact of China’s export restrictions. In fiscal 2023, they generated free cash flow of 3.28 billion euros, paid dividends of 2.34 billion euros, and repurchased 1 billion euros of their own shares.

ASML quarterly results

Over the past six years, ASML has achieved an average net income growth of 20.9%. Therefore, the growth rate in fiscal 2023 is quite abnormal and well above the historical average. I attribute the growing demand for artificial intelligence in China and the large number of pre-orders to the high growth in fiscal 2023. Investors should note that ASML’s growth is closely tied to fab manufacturing expansion cycles; therefore, ASML’s growth rate can be quite volatile. For example, their Logic revenue grew 60% in fiscal 2023, and they expect manufacturing expansion to slow in fiscal 2024.

So, I think their fiscal 2024 guidance is reasonable. As discussed earlier, I expect the growing demand for HBM to become a structural growth driver for ASML in the short term.

Valuation

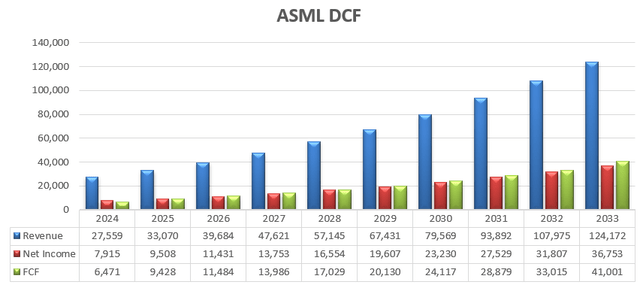

As discussed, I expect fiscal 2024 revenue growth to be flat, reflecting growth headwinds from China and some normalization of wafer fabrication capacity expansion. For normal growth, I expect ASML to achieve ~20% revenue growth, a level consistent with its historical average. I believe that the growing demand for HBM will provide long-term growth momentum for ASML.

ASML achieved operating margins of 32.8% in fiscal 2023, and I expect their future margin expansion to be driven by gross margin improvement as well as operating leverage from R&D expenses.

New product innovation is critical for ASML because the average selling prices and gross margins of these products are much higher. For example, on March 12, ASML declare The first TWINSCAN NXE:3800E is now installed in a wafer factory. The NXE:3800E is designed to manufacture wafers using 2nm and 3nm level technologies. I expect their continued R&D innovation will drive their gross margin expansion going forward. In the model, I assume gross margin growth of 10 basis points and R&D operating leverage growth of 10 basis points.

ASML DCF – Author’s calculation

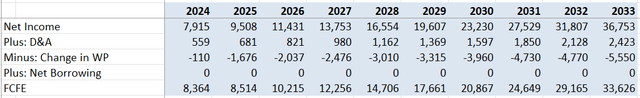

I calculate their free cash flow to equity by adjusting net income for depreciation/amortization, changes in working capital, and net borrowings.

ASML DCF – Author’s calculation

The cost of equity is estimated to be 13.5%, assuming the following:

-Risk-free interest rate: 2.99%. 10-year euro area central government bond face value yield curve

-Market risk premium: 7%

-Beta: 1.51. SA’s 24-month data

Discounting all FCFE at 13.5%, my one-year price target is €1,238 per share, or $1,340, according to my estimates.

Other matters

I think ASML’s biggest risk is exports to China, as discussed previously. Current export restriction rules in the Netherlands, the United States and Japan may have some meaningful impact on the progress of Chinese chip development. However, I believe that the Chinese government will invest a lot of money to develop its own EUV. I admit that there is a considerable gap between ASML’s leading EUV and China’s local manufacturers; however, don’t forget that ASML is just a company, and China is an entire country. Investors should not underestimate the speed of China’s progress in this area.

In addition, ASML repurchased 8.85 billion euros of its own shares in fiscal 2021, followed by $4.64 billion in stock repurchases in fiscal 2022. However, they only repurchased €1 billion of their own shares in fiscal 2023, which could suggest management may think their share price is overvalued or less attractive compared to previous years.

in conclusion

I think the growing demand for AI computing requires more memory in GPUs, which will spur memory/logic capacity expansion in the near future. In my opinion, ASML will benefit from industry-wide capacity expansion. Despite the uncertainty surrounding their exports to China, I remain optimistic about their long-term growth potential. I reiterate a Strong Buy with a one-year price target of €1,238 per share, or $1,340.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.