Reed Vancelick

One of the best feelings in the world is seeing an opportunity you are very optimistic about materially increase in value in a relatively short period of time.Last year, due to the sharp decline in financial stocks, In the wake of the banking crisis, I found myself drawn to banks of all types and sizes. In many of these cases, I am bullish, with a Buy rating on most companies. But a few end up earning a Strong Buy rating from me.One of the companies is union bank (NYSE:ASB), a regional bank with roots dating back to 1861.

Because the bank is so cheap and it performed so well during and after the banking collapse, I ended up giving it my most bullish rating.Although I’ve never gone that far As for buying shares in this business, this rating indicates that I believe the stock will significantly outperform the market for the foreseeable future.

The company’s shares have surged 27.7% since the company was rated as such in mid-October last year. That’s nearly double the S&P 500’s (SP500) gain of 16.8% during the same time frame.

Unfortunately, nothing is ever a perfect investment opportunity. At some point, a stock deserves a downgrade. Unfortunately for ASB, that moment is now. While the agency still offers some attractive prospects for value-oriented investors, I think it makes sense to downgrade the company to Buy for now.

It’s time to be less optimistic

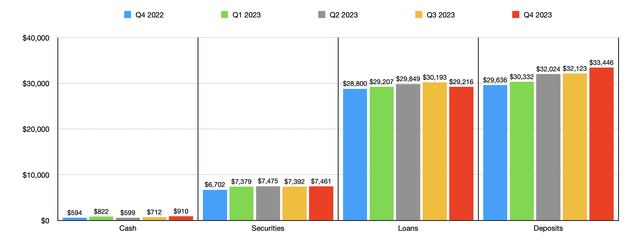

When I wrote about Associated Banc-Corp last October, we only had data covering the second quarter of fiscal 2023.Today, that data has expanded to the rest of the year. The first thing we should discuss are the agency’s key balance sheet items. My biggest concern is deposits. As of 2023, the figure is $33.47 billion. This means the company will end fiscal 2022 with revenue of $29.64 billion, continuing its growth. Each quarter between these two time windows, the institution’s deposits increased in value.

What is also exciting is that although we have seen an increase in uninsured deposit exposure over the past few quarters, it remains at a reasonable level of 22.7%. That’s significantly lower than the 30% cap I’d like to see.

Author – SEC EDGAR Data

In addition to deposits, we should also pay attention to other things. For example, loan value also increased from $28.8 billion at the end of 2022 to $29.22 billion at the end of 2023. But it’s worth noting that lending actually peaked in the third quarter, totaling $30.19 billion. As far as I know, many investors who focus on the banking industry are worried about the risks of office properties. The good news for investors is that as of the end of last year, only 3.6% of the loans owned by Union Bank Corporation were specifically for office assets.

Author – SEC EDGAR Data

The value of securities remains within a fairly narrow range most of the time. The value of the securities has not changed much after increasing from $6.7 billion at the end of 2022 to $7.38 billion in the first quarter of last year. By the end of 2023, this number has increased to $7.46 billion. At the same time, the value of cash has become ubiquitous. The lowest is US$593.7 million and the highest is US$909.5 million by the end of 2023.

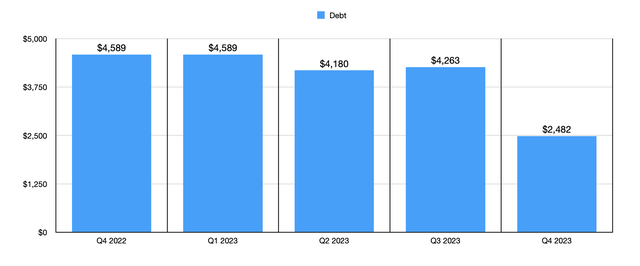

What’s really positive is that even as the cash value rises, the value of the debt on the company’s books has fallen. The company had $4.59 billion in debt at the end of 2022. By the end of last year, that number had dropped to $2.48 billion.

Author – SEC EDGAR Data

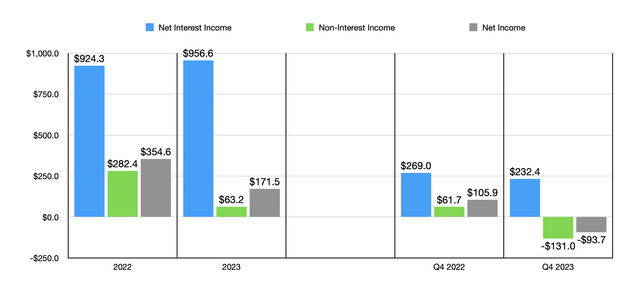

That’s not to say everything is going well for the agency. There have been some bumps in the road when it comes to revenue and profits. Take the final season of 2023 as an example. Net interest income totaled $232.4 million in the quarter. That was down from the $269 million reported a year ago. But the bigger problem is that non-interest income fell to negative $131 million from $61.7 million. This resulted in net income falling from $105.9 million to negative $93.7 million. The good news is that this change was driven in large part by a $136.2 million loss from the sale of part of its mortgage portfolio. Management is doing this as part of a strategic move to better position its business moving forward. The company also booked a $59 million loss related to investment securities. As you can see in the chart above, this really hurts the overall performance in 2023. The good news is that the one-time nature of these projects makes it easy to figure out what the future holds for the business. On an adjusted basis, I calculate full-year 2023 net income to be $344.7 million.

Author – SEC EDGAR Data

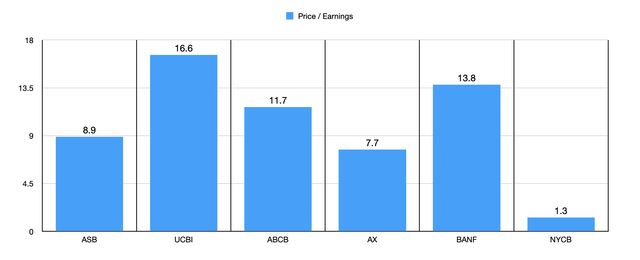

Using these numbers, I was able to calculate that the institution’s adjusted P/E ratio is 8.9. While this is definitely not the cheapest price I’ve seen in banking, it’s in the range of what I prefer. In the image above, you can see how the agency compares to five similar companies in this regard. When it comes to the P/E ratio approach, only two of the five businesses I compared it to ended up being cheaper.

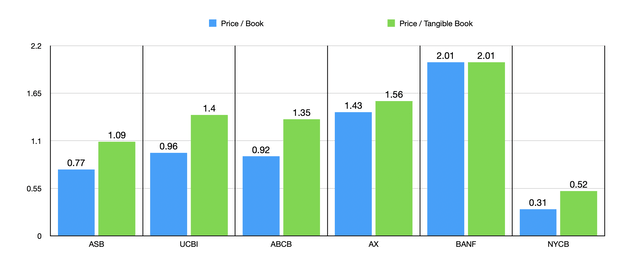

But there are other ways to value a company. For example, in the image below, you can view the picture by price of booking multiple and price of tangible booking multiple. Only one of the five companies is cheaper than Associated Banc-Corp on a book price basis, and the same statement applies to the tangible book price method.

Author – SEC EDGAR Data

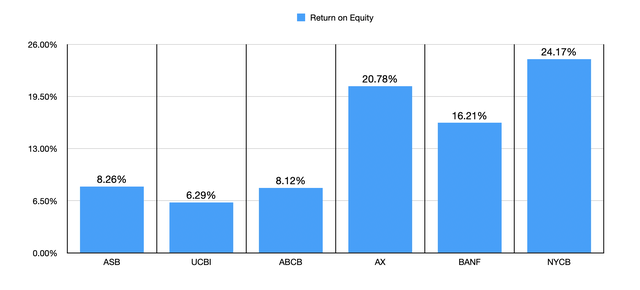

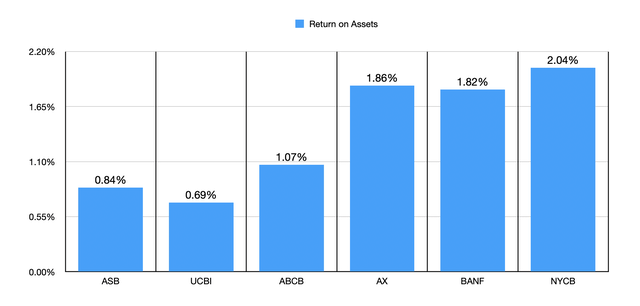

While Union Bank may not be the cheapest, it definitely skews toward the cheaper end of the spectrum. However, some institutions are worth trading at low prices, while others are not. To get a feel for what’s going on here, I decided to compare Associated Banc-Corp to the same 5 companies using the institution’s ROE. Associated Banc-Corp’s reading is 8.26%, which is good, but not great. Three of the five companies ended up being better than that. In the next chart below, I do the same thing using ROA. In this case, four of the five companies ended up higher than Associated Banc-Corp.

Author – SEC EDGAR Data Author – SEC EDGAR Data

take away

As things stand, I still believe Associated Banc-Corp stock offers some attractive opportunities for investors. However, it’s clear that easy money has been made. That doesn’t mean there isn’t room for additional upside. But it’s more likely that it will be more difficult to significantly outperform the market in the future.

I do think there’s still enough upside to warrant a “Buy” rating for the bank. But I will continue to watch the agency to see if further downgrades are ultimately necessary.