Hiroshi Watanabe/DigitalVision via Getty Images

About five years ago, NPA I raised $230 million to form a special purpose acquisition company (SPAC). In April 2021, the company completed a $1.4 billion merger with AST I Science to form the company, AST Space Mobility Company (NASDAQ: ASTS).

As of this writing, ASTS stock is trading at $2.81 and is currently in a serious downtrend. The company will release fourth-quarter earnings results after the bell on Monday, April 1. How will AST SpaceMobile’s report attract buyers?

Here are five points for the reader to consider.

1/ AST SpaceMobile loses money in third quarter of 2023

In the third quarter, AST lost 23 cents per share. The company didn’t post any revenue in the period, compared with $4.168 million in revenue the year before.Operating expenses included $19 million in depreciation and amortization and engineering expenses The most notable is the service cost of $19.52 million. This is up from $1.17 million and $14.49 million respectively last year.

During the conference call, Chairman and CEO Abel Avellan highlighted its space-based 5G capabilities and 40 megabits per second data rates. Participants involved in testing 2G, 4G and 5G include its partners Vodafone (VOD), Rakuten and Nokia (NOK).

As a side note, readers should heed the warning that VOD stock is at high risk of a dividend cut. Nokia filed a patent infringement claim against Reddit (RDDT) after failing to monetize its intellectual property quickly enough. Reddit recently completed its IPO and it was a huge success. On Tuesday, March 26, RDDT stock was trading as high as $74.90.

The CEO said about 85% of planned capital expenditures are for five satellites scheduled to be launched in the first quarter of 2024.

The company ended the quarter on September 30, 2023 with just $135.7 million in cash. Unusually, the stock initially maintained its value on Jan. 2, when the company said it would seek to close and fund a strategic investment.

2/ ASTS stock issuance

ASTS shares fell after pricing as they were unable to absorb the size of the $100 million equity offering. The company announced an offering of 32.26 million shares at $3.10 per share. The scale of the product and its low price are disconcerting. AST is likely anticipating weak demand for the stock. Fundamentally, the funds raised will guarantee its solvency for several quarters. For example, the company lost $50.75 million last quarter. Comprehensive loss attributable to common stockholders was $21 million.

The company said on the conference call that it expects adjusted operating expenses to decline by $25 million to $30 million per quarter. Historically, the company has spent $37 million to $40 million per quarter.

Once AST completes its rollout, operating costs will steadily decline over the next one to three quarters.

3/ Opportunities

AST is confident in its partners launching their services. Vodafone (VOD), for example, is considering offering services to complement its market-leading terrestrial network. The CEO said its partners will use:

“The first and only stage-based cellular broadband network delivering voice calling, text messaging, video calling, internet browsing, email, music streaming and social media wherever Vodafone customers are.”

AT&T (T) highlighted support for Direct 5G voice calls during its earnings call.

AST SpaceMobile mobile network operator The list includes Vodafone, Rakuten, AT&T, Bell Canada (BCE), Indosat, Liberty Latin America, LTC, MAXs, Micon, MTN, Muni, NISA, Optus, Orange, Salam, Safran, Smart, Smile Suntel FTC, Telecom Argentina, Telefonica , Telkomsel, Team Tetra, Uganda Telecom and Jazz.

AST SpaceMobile’s 5G cellular broadband design has unique qualities. In addition to over 3,100 patents and patent pending claims, it also boasts the best manufacturing processes. The upcoming first-quarter report reviews the progress of manufacturing activities at the company’s Midland, Texas, facility. The company needs to forecast lower operating expenses because it leverages a high level of vertical integration throughout its manufacturing process.

4/ Quantitative warning on ASTS stock

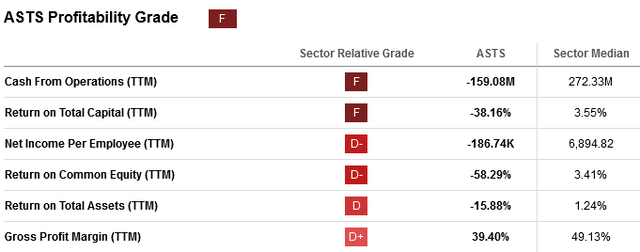

Seeking Alpha Quant has a warning on ASTS stock.

Seeking Alpha

The system showed poorer profitability, with negative earnings per share revisions. The company’s profitability metrics are poor compared to peers in the communications services industry:

Seeking Alpha

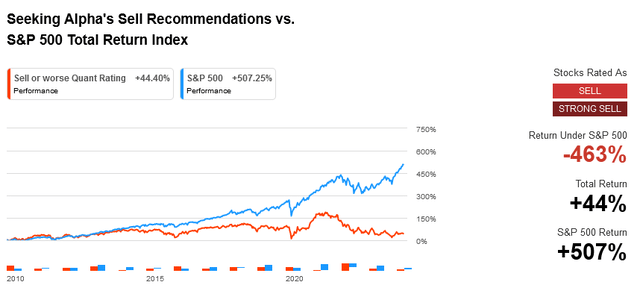

The stock has a Quantitative rating of “Sell”. At that time, the stock was down 463% compared with the S&P 500 Index (SP500).

Seeking Alpha

5/ Related investments

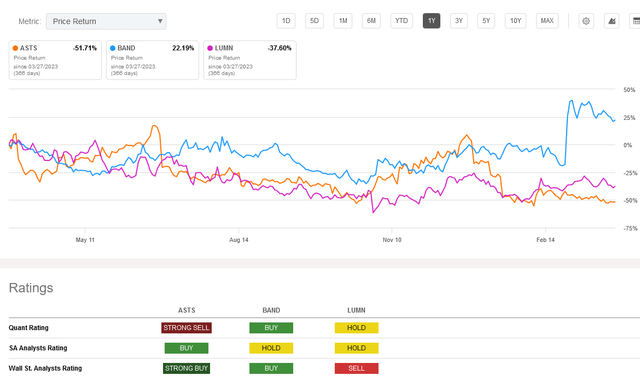

Investors might consider Bandwidth (BAND) or Lumen Technologies (LUMN) instead of ASTS stock.

Seeking Alpha

In the fourth quarter of 2023, Bandwidth’s non-GAAP earnings per share were 38 cents. It expects first-quarter revenue to reach $166 million, up slightly from $165.39 million in the fourth quarter. Most importantly, the company can achieve lower costs through its cloud communications business. Profitability should expand in the coming quarters, helped by innovative investments.

Lumen had a strong fourth quarter and needs to explain its operating cash flow dynamics more publicly. Until then, LUMN stock will trade between $1.25 and $1.75 for the foreseeable future.

What you gain

AT&T’s lackluster performance and BCE stock’s downward trend raise some questions about AST SpaceMobile, Inc.’s quarterly results when it releases next week. Market expectations for the telecom business are neutral to negative, which may curtail capital expenditures this year. Shareholders will react to management’s progress in closing deals with its biggest potential customers.