Fachroni

Introduction and thesis

Artems filter technology (NYSE:ATMU) is a leader in the filtration industry, specializing in the design, manufacturing and distribution of innovative filtration solutions.The company has become a key player in providing sustainable and high-performance filtration Systems across departments.

Atmus is a spin-off of Cummins (CMI), which continues to hold a majority stake in the company but is seeking to sell its entire holding.

The spin-off of Atmus reflects its current market position. The business is a leader in an industry that will be severely disrupted by the electrification trend and will need innovation to create new and improved value propositions.

Atmus currently faces significant execution risk in reviving its long-term growth trajectory, especially given the certainty of its core technology transformation.We haven’t seen enough progress yet Ensure income replacement and long-term healthy growth.

The business is reasonably well positioned to respond with strong cash flow and limited debt, however, any upside beyond that is not priced in. We suspect this will take at least 5 years, but there is limited certainty. Since Atmus trades at a slight discount to its peers, we believe the stock is likely within its fair value range.

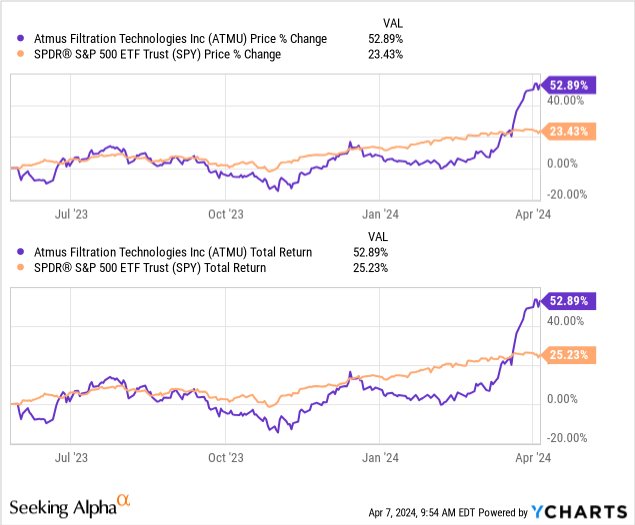

share price

Atmus’ share price performance has been strong since the company went public, with recent gains putting the stock ahead of the market.

financial analysis

Capital IQ

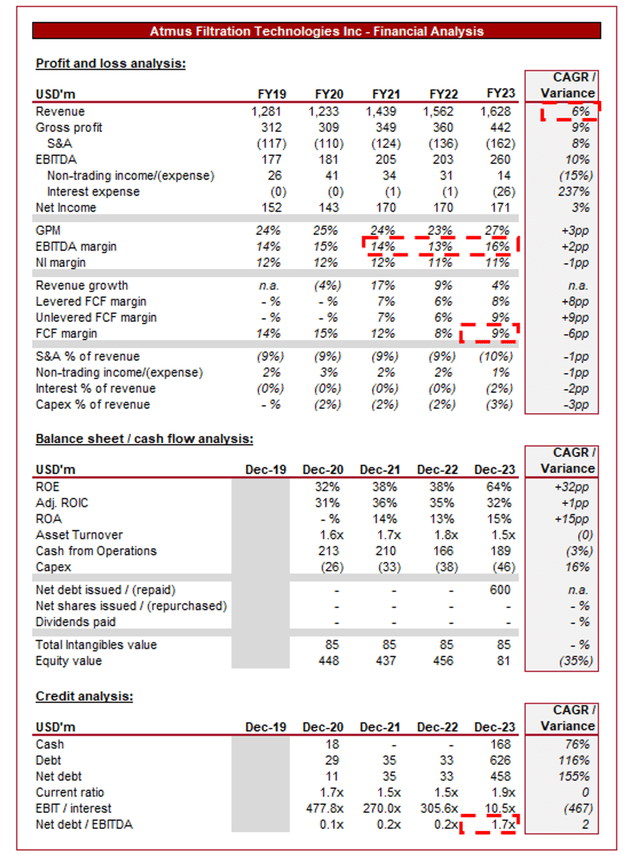

The above describes the financial performance of Atmus.

business model

Atmus is a leading supplier to the commercial filtration market, specializing in comprehensive solutions for (on/off) highway vehicles. Its product portfolio extends beyond traditional fuel and air filters to include crankcase ventilation systems, coolants and other specialty chemicals.

Designed to minimize emissions and ensure optimal vehicle protection, Atmus products enable efficient use, extended service intervals and reduced customer costs.

The company has gradually expanded its target market as management seeks to diversify the company and increase its growth potential. This is becoming increasingly important due to the electrification trend, which poses a fundamental risk to the Atmus industry. In theory, a complete transition to clean energy would eliminate the need to minimize emissions, thereby eliminating Atmus’ business. In fact, this is not the case, but the fundamental risks remain and will intensify in the coming decades.

Management is actively seeking to address this issue through the following four points, with the broader goal of maximizing current performance and funding the expansion and innovation of its business.

Atmus

We do see reasonable scope for success in this regard, although how “success” is achieved is difficult to assess. As a leader in the segment, the company has a strong brand and deep expertise positioning it in delivery points 1-3.

Atmus has partnered with many leading OEMs to expand its penetration by leveraging its trust and ability to deliver at scale. It’s much easier for Atmus to cross-sell to OEMs than smaller competitors that lack the relationships and global footprint. This allows Atmus to enter related industries or expand production.

Additionally, the company has strong exposure to the aftermarket segment, and free cash flow generation is necessary to reinvest in its supply chain to improve efficiency.

Our concern is that we believe points 1-3 are not enough to drive growth in the long term and that the company needs fundamental innovation beyond related products. This needs to be in a future-proof vertical, but leveraging its existing capabilities. Management believes industry is the most realistic path, and we agree. This will likely require M&A and reinvestment in free cash flow, which Atmus is well positioned to do.

finance

Atmus’ results have slowed significantly recently, with revenue growth of +9.4%, +5.2%, and (1.2)% over the past four quarters. Still, as we mentioned before, its profit margins have remained stable.

We attribute the decline in growth primarily to the macroeconomic issues discussed, with capital spending softening as demand is expected to decline. Consumers and businesses are increasingly worried about the near-term outlook and are turning defensive. We believe its margins reflect the company’s fundamental strength, which means competition remains deadlocked.

Additionally, management highlighted that the company benefited from subdued supply chain inflationary pressures and continued increases in pricing, with sales being offsetting factors. These small positives suggest Atmus could achieve a soft landing in 2024.

Current economic conditions are a near-term headwind for Atmus. As interest rates and inflation rise and consumers face a cost-of-living crisis, businesses are trying to protect profits while maintaining stable capital positions.

Before discussing how this will impact the company’s future, it’s worth discussing how this has impacted its growth in recent years. Inflation allowed Atmus to increase prices, although this was offset by rising costs, resulting in a net neutral margin. Additionally, various automotive industries have experienced supply chain issues due to semiconductor shortages and slow growth in production facilities post-pandemic, resulting in higher prices. This resulted in higher than expected growth rates.

Looking ahead, as economic conditions worsen, we expect demand to be soft in the coming quarters, affecting capital requirements. The U.S. recession probability indicator has exceeded 50%, while unemployment rates in the West have begun to rise slowly. With retail sales largely flat month-on-month, we believe the economy is fragile.

Still, interest rates are expected to fall in 2024, at least in the U.S., which could act as an offsetting factor and contribute to a soft landing. We expect FY2024 growth to be (2)%-2% due to unclear pricing and likely lower demand.

Capital IQ

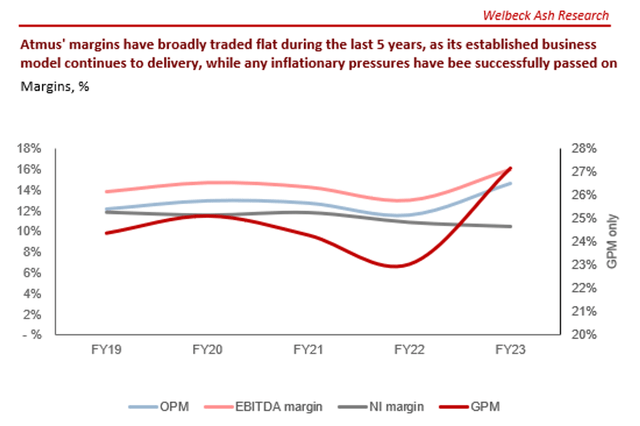

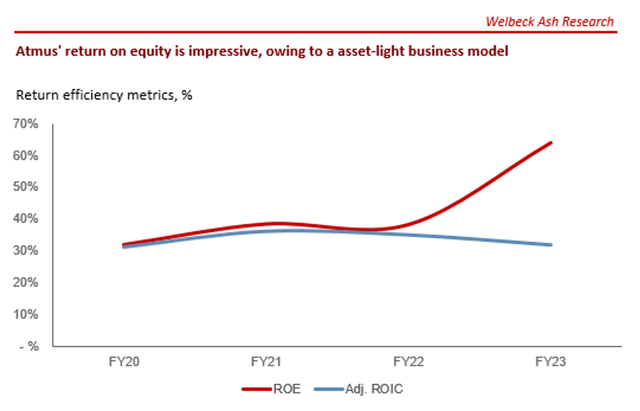

Atmus’ flat margins reflect its leading industry position, allowing the company to maintain its unit economics despite changing market conditions. Conversely, without breakthrough innovation, it means there is limited room for improvement.

We do believe Atmus can drive improvements by achieving its strategic goals of diversifying into industrial segments, thereby increasing scale, and increasing aftermarket activities, thereby driving sales growth.

Nonetheless, we are hesitant to have an impact over the next 3 years as financial contributions may not be enough to drive the process forward. That said, both factors are critical to the company’s long-term success, so margin improvement is a secondary benefit. It’s worth highlighting that EBITDA-M (roughly translated into free cash flow return) of about 16% is impressive.

Capital IQ

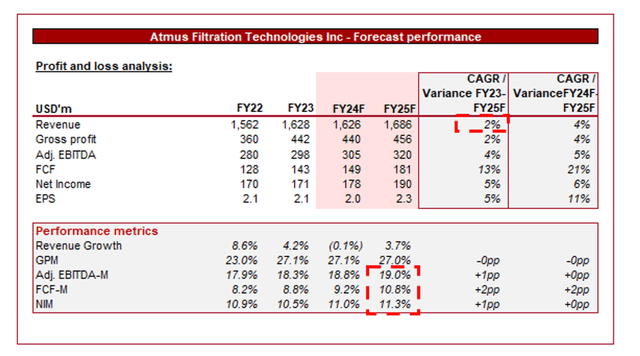

The above is Wall Street’s consensus for the next few years.

Analysts predict poor growth in the coming years, with a compound annual growth rate of 2% in fiscal 2025. At the same time, profit margins are expected to remain broadly flat.

We agree with these predictions. Despite reinvestment and clear strategic direction, management is unlikely to transform itself before fiscal 2025. Even so, the company may face offsetting downward pressure as the automotive sector increasingly shifts toward clean energy.

Balance Sheet and Cash Flow

Thanks to its stable free cash flow generation, Atmus has a bulletproof balance sheet that allows for limited use of debt. The company currently has an ND/EBITDA ratio of 1.7x and an interest coverage ratio of 11x.

We’d like to see management use this free cash flow to innovate and grow its business model, whether through M&A or organically, thereby increasing its growth potential.

Capital IQ

Industry analysis

Seeking Alpha

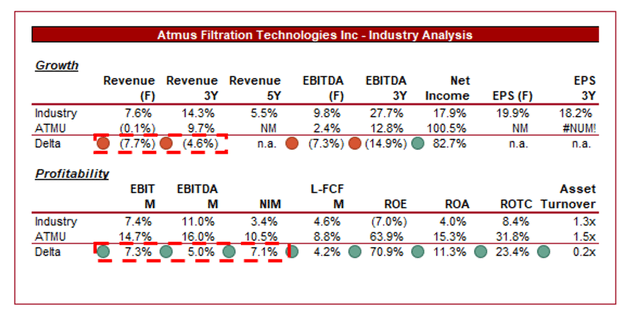

Presented above is how Atmus’ growth and profitability compare to its industry average, as defined by Seeking Alpha (27 companies).

Atmus’s financial performance is respectable, but its business weaknesses are also evident. The company enjoys high profit margins due to its market leadership and product maturity.

However, the opposite of this is growth, which is much lower than that of its peers. The company is seeing weak demand as its industry moves away from filtration needs. Furthermore, this is somewhat inherent in its position in the market. The company is a leader, but the highly mature industry it targets limits its scope for attractive growth.

Valuation

Capital IQ

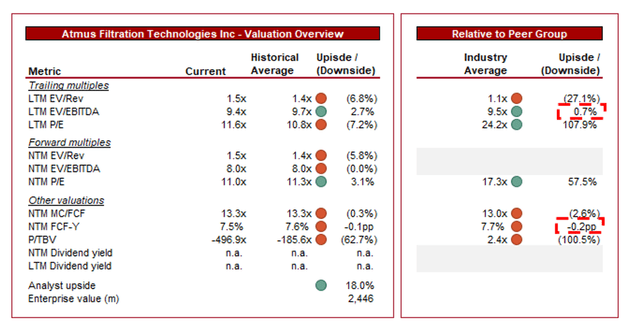

Atmus currently trades at 9x LTM EBITDA and 8x NTM EBITDA.

This valuation represents a discount to peers on an LTM EBITDA basis (approximately 1%) and NTM MC/FCF basis (approximately 58%). We think this is justified because while its free cash flow and margins are strong, we think the threat to its business model is enough to offset the expected premium that comes from it. Lower-than-average growth isn’t necessarily a concern due to margins, but when the benefits of inflation are factored in, the delta is actually much larger.

Until Atmus can illustrate a long-term growth trajectory above its inflation target, we believe a discount to its peers is warranted. This means the stock is within its fair value range.

Key risks of our paper

The risks of our current paper are:

- Successfully transform the industry.

- Innovation in filtration technology.

- As the industry transitions to clean energy, regulatory challenges impact operations.

- Price competition intensifies, affecting market share.

final thoughts

Atmus is a quality business due to its market leadership, deep expertise and industry relationships. The problem the company faces is fundamental changes in industry technology that may cause Atmus to decline in importance over the next few decades.

Management is actively seeking to transform the company, but it will take time and investment. At this stage, especially after the sharp rise in the stock price, we see no room for upside.