Koshiro Kiyota/iStock Editorial via Getty Images

Note: All amounts mentioned are in Canadian dollars. Stock prices referenced are from the Toronto Stock Exchange, not U.S. dollar OTC prices.

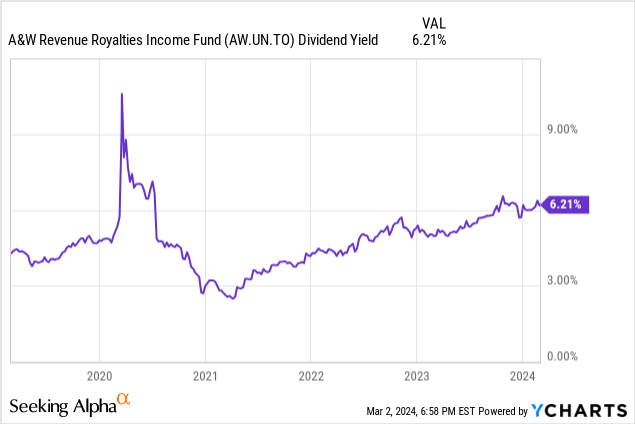

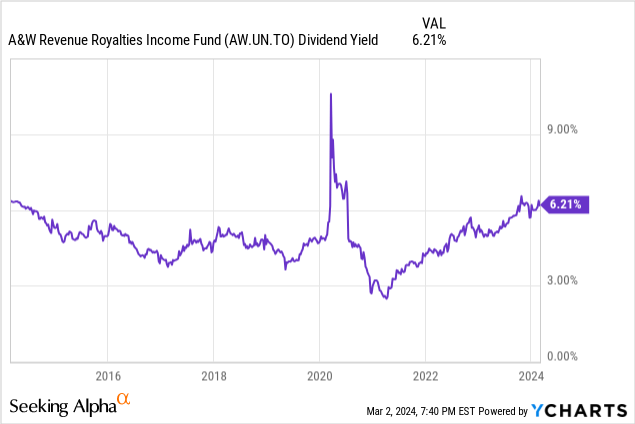

You can bid anything to any price. You can throw away rational multiples and move to “this time it’s different.”That’s almost it Always means that the return from that point onwards is worse than the return from the previous period. A&W Income Royalty Income Fund (OTC: AWRRF) (TSX:AW.UN:CA) is the same category that saw valuations take a leap in 2021 and jump to highly unreasonable levels. Of course, there will be “reopenings” in the future, but adjusting its trailing 12-month dividend yield to 3% is just plain foolish.

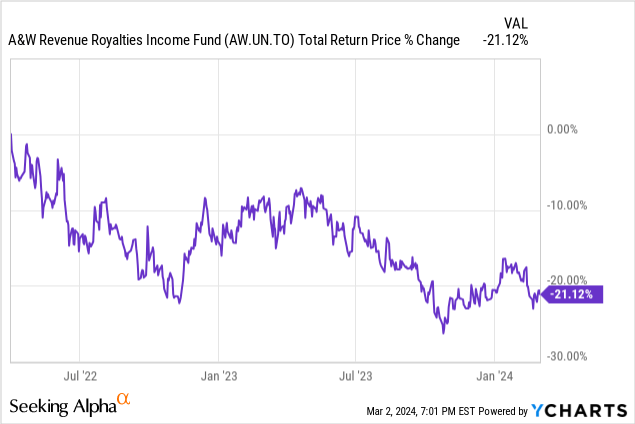

Simply put, though, A&W’s dividend yield has actually risen faster than the share price over the past 12 months, and the stock actually peaked near $42 in 2022. If you had bought then, you would have suffered a 21% loss despite the generous dividend.

We review the results for Q4 2023 and tell you why you might consider it an investment position now and what risks you should consider.

company

We have introduced this company more than once and will not repeat it here.

A&W Demo

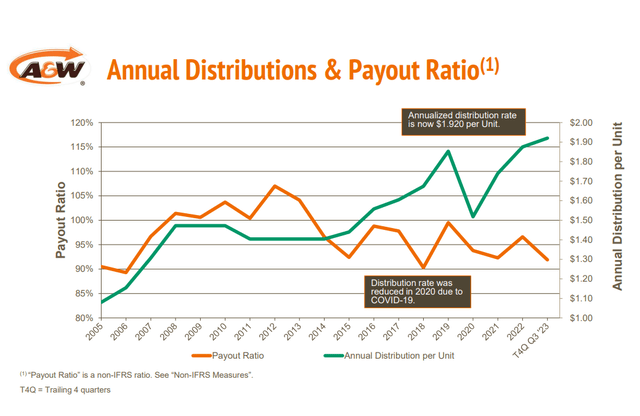

Those interested can refer to an earlier article detailing this setting and why it is useful. We’d like to add here that the company typically retains very little cash since it doesn’t need cash to fund its expansion. It also prefers to pay out most of its earnings as dividends, and it targets effectively 100% payout. So investors shouldn’t complain about the extremely high payout ratio. This is a feature, not a bug.

A&W Demo

Q4 2023

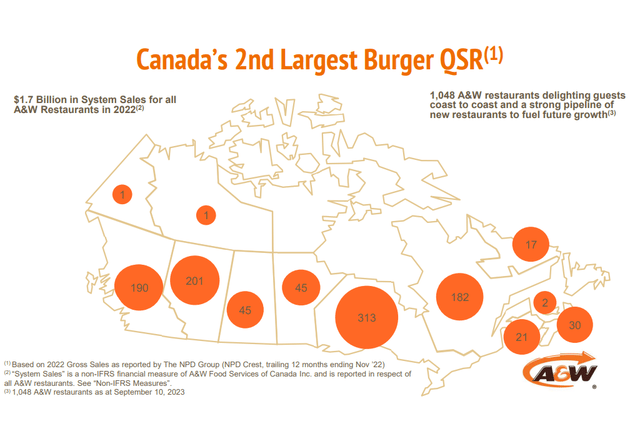

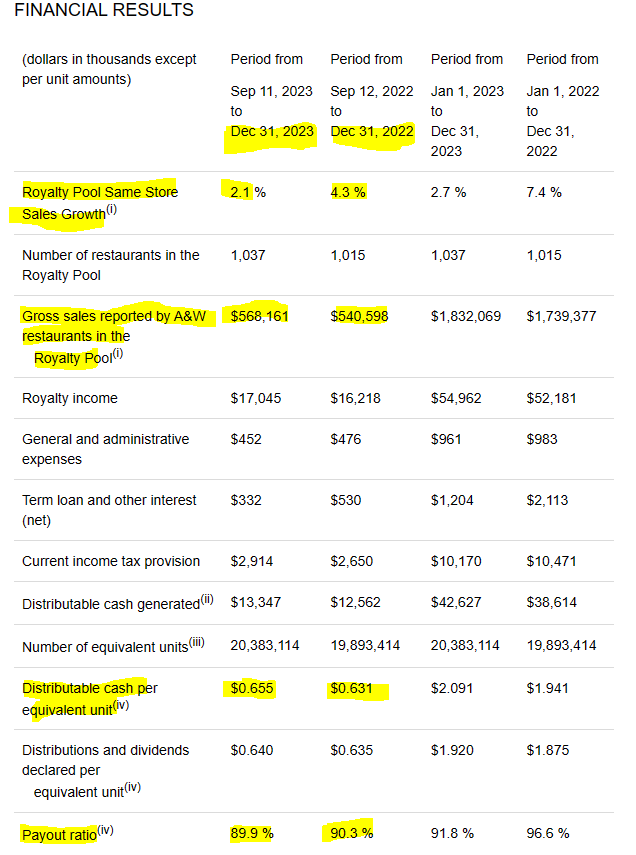

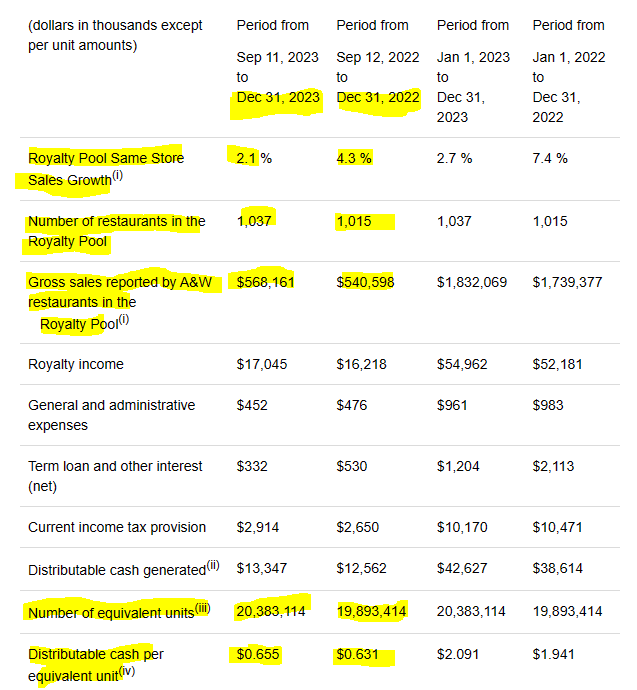

The fourth quarter of 2023 capped off a great year for A&W. Same-store growth was mediocre at 2.1%, but overall sales grew by more than 5% compared with the fourth quarter of 2022.

A&W Fourth Quarter 2023 Results

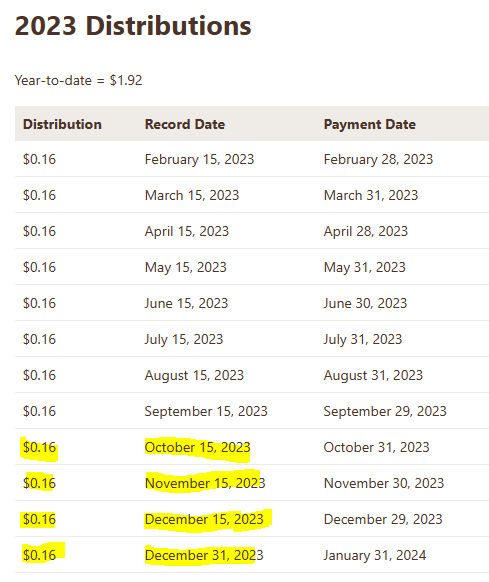

The total number of restaurants in the royalty pool increased and distributable cash per unit increased by 3.8%. While total distributions in the fourth quarter of 2023 increased slightly relative to the fourth quarter of 2022, the payout ratio declined slightly. Those confused about the amount must note that an additional allocation was made in the fourth quarter and will be skipped once in the first quarter.

A&W Demo

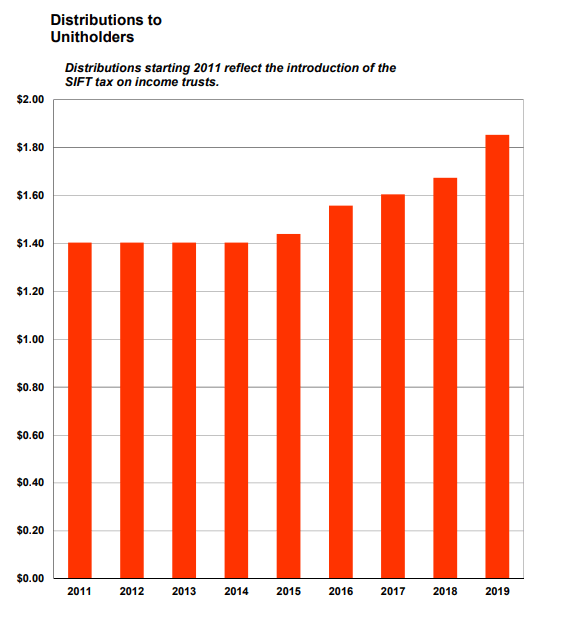

Annual allocations are now firmly above pre-pandemic levels and appear to be well-reached.

2019 A&W Briefing

Appearance

A&W is a franchise play that benefits primarily from sales growth (same-restaurant sales) and inflationary changes in revenue from those restaurants. They don’t really benefit, at least to the same extent, from opening new franchises. The reason is that they have to issue new units for these restaurants.

The royalty pool is adjusted annually to reflect sales from new A&W restaurants added to the royalty pool (minus sales from any A&W restaurants that have permanently closed). The Food Services segment pays additional royalties related to net new restaurant sales based on the formula set forth in the Amended and Restated License and Royalty Agreement. The formula provides for payments to food services based on 92.5% of new restaurant net sales and 92.5% of the unit’s current earnings, adjusted for income taxes due on the trademark. The consideration is payable to Food Services Company in the form of additional limited partnership units (“LP Units”).

source: annual report

They do share some of that, and certainly those sales grow over time, but the equity issuance does offset that growth angle to some extent. You can see it in this quarter’s results, with cash per unit growing 3.8%, which is between same-store growth (2.1%) and total growth (5.1%).

A&W Fourth Quarter 2023 Results

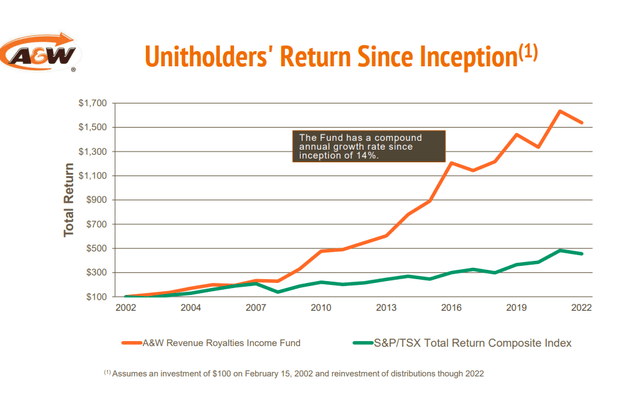

It’s a pretty good model, though, and if you add in the 6.2% yield and get the long-term distribution growth of 3.8%, you’ll get a total return of 10% with fairly little capital risk. They actually do better than that in the long run, although we won’t hold our breath for anything on this court today.

A&W Demo

We can see that there’s a lack of risk even on the debt side, as A&W has only accessed $15.7 million of a $40 million credit facility.

As of December 31, 2023, Food Services has drawn $15,726,000 from the credit facility (January 1, 2023 – $8,149,000), of which $3,366,000 was repaid on January 28, 2024, and $198,000 has been issued Letter of Guarantee (January 1, 2023 – USD 8,149,000). $198,000), leaving $24,076,000 in available facilities (January 1, 2023 – $31,653,000)

Source: Annual Report

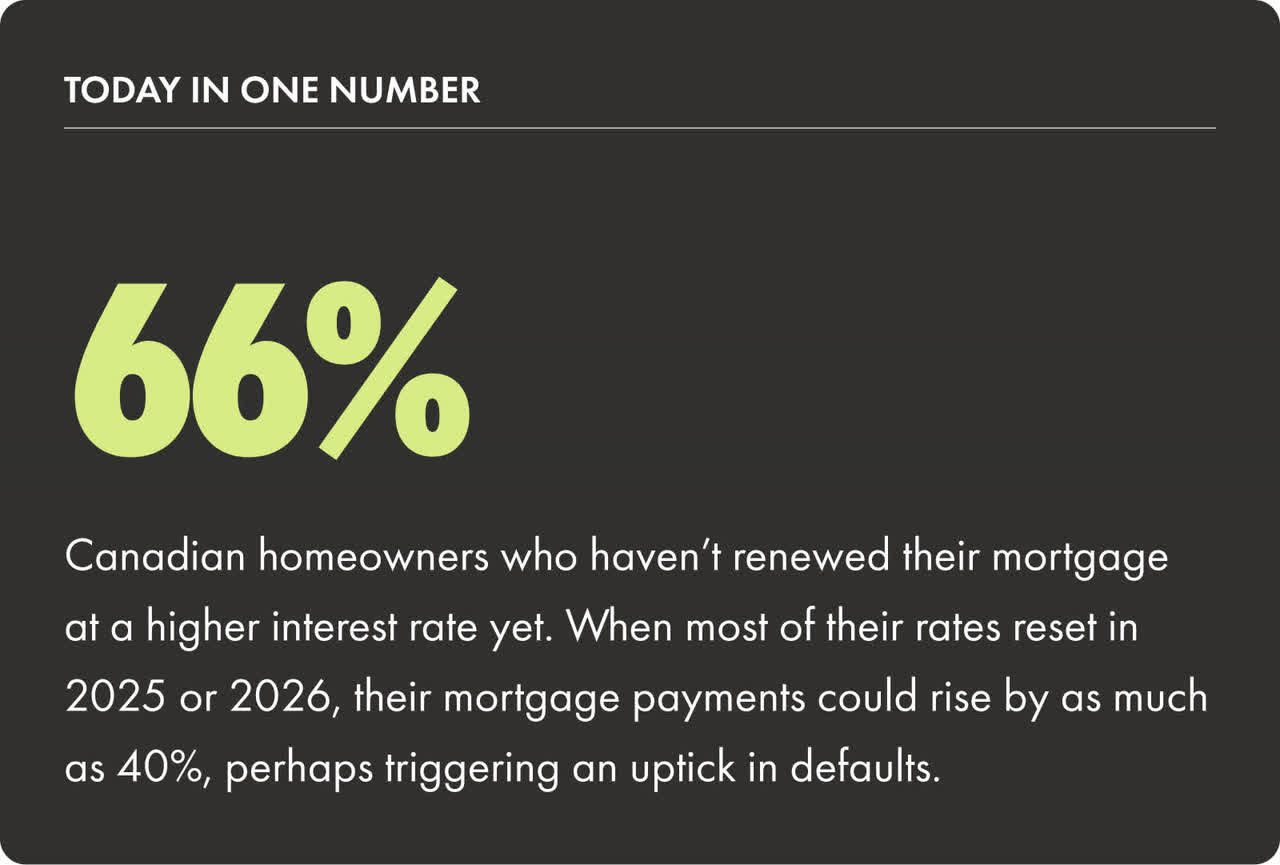

Annual pre-tax royalty income is approximately $55 million, resulting in a negligible EBITDA figure. The risk here arises from the company’s broader macro issues. Fast food has always been expensive, and somehow the pandemic has really turned fast food into a “luxury product.” We have watched menu items go from $5 to $7 in 4 years. A 40% price increase is indeed unacceptable. Unless they restore pricing rationality as soon as possible, they will rebound. Canadians are also deeply in debt and pinning their hopes on interest rate cuts. We say that because as a country we think it makes more sense to reset your mortgage every 5 years rather than lock it in for 30 years.

Wealth SimpleX

You also saw last quarter that the CEO refused to acknowledge what everyone with basic math skills knows: customers are hurting. So your setup risk is higher, but on the plus side we ended up keeping the A&W trade at a reasonable level. If you ignore the COVID-19 price collapse of 2020 (which saw dividend yields rise vertically over the past 12 months), this would be the highest yield you’ve gotten in the past decade.

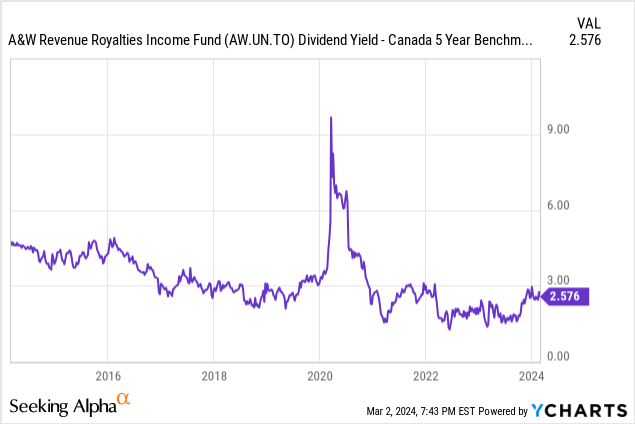

Of course, the objection is that interest rates are also higher. If you plot the dividend yield as a spread to the Canadian 5-year bond yield, it doesn’t look cheap today.

So which argument should we rely on?

judgment

Our rationale for assigning less weight to GOC-5 yield spreads is that we believe the high interest rate environment will only persist as long as inflation remains stubborn. While prices won’t rise quickly from 2020-2023, we believe A&W’s annual price changes can approach the rate of inflation. The company has built-in offsets and the highest absolute dividend yield over the past decade is more than enough to get started. We’d also like to point out here that if it paid out all dividends earned, the dividend yield would be 6.77%. All things considered, we think now is a good time to start chipping away at this issue as enough damage has been done by the valuation compression. We’ll do that with the starting spot sometime next week.

Please note that this is not financial advice. It looks like it, sounds like it, but surprisingly, it’s not. Investors should conduct their own due diligence and consult with professionals who understand their objectives and limitations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.