berlinguette/iStock via Getty Images

Recently, I’ve seen a lot of articles touting B2Gold Corp. pop up in my feed (NYSE:BTG)’s attractive dividend yield and why investors should buy the stock.Has been a professional resource investor for more than ten years Since I know B2Gold very well, I decided to seriously research B2Gold to see if it was really a “discount” deal.

In my opinion, BTG’s recent stock troubles are related to concerns that the company has run out of steam on its Back River project in Nunavut.

I personally believe B2Gold’s revised cost estimates are realistic, and recent gold forward sales suggest these cost overruns are fully funded. Therefore, my rating for BTG is a Speculative buying.

Company Profile

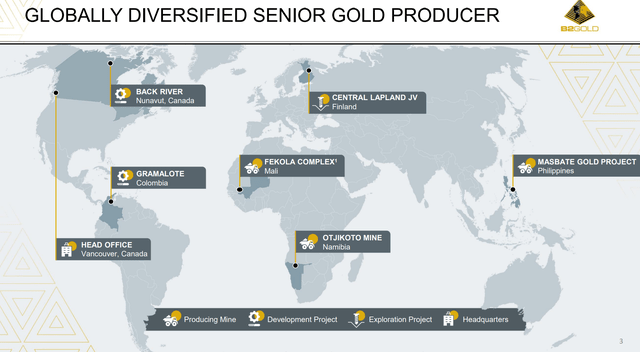

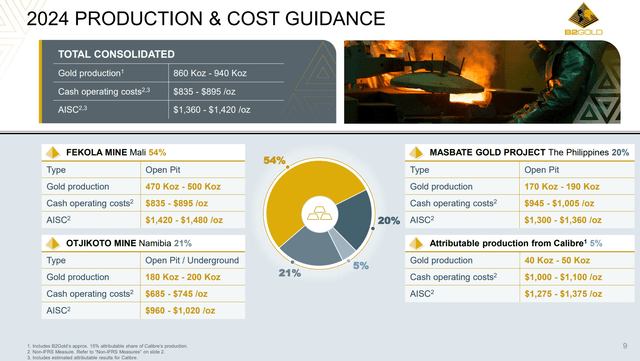

B2Gold Corp. is a senior gold producer with approximately 1 million ounces of gold.Gold production primarily from three producing mines (Fekola, Masbate and Otjikoto) Its ownership interest in Caliber Gold (CXB:CA) (figure 1).

Figure 1 – B2Gold Asset Overview (BTG investor introduction)

A brief history of B2Gold

B2Gold is a rare success story in the mining industry, where the management team built a premium gold producer from the ground up through organic growth and acquisitions.

B2Gold was founded in 2007 by chief executive Clive Johnson and other former Bema Gold executives, which it sold to Kinross Gold (KGC) in 2007. Starting with Bema’s remaining exploration assets in Colombia and Russia, B2Gold IPOed on the Toronto Venture Exchange and raised $100 million CAD, a sizeable sum for a junior gold explorer/developer funds.

B2Gold rose to producer status (and the TSX) through the 2009 acquisition of Central Sun Mining, a troubled producer with 2 mines in Nicaragua (El Limon and La Libertad).

In 2012, B2Gold merged with ASX-listed company CGA Mining and acquired the Masbate mine in the Philippines. With 3 operating mines producing a total of 350-400,000 ounces of gold per year, B2Gold is now a mid-sized gold producer and is starting to take on more challenging capital projects to develop and build its own mines. The first mine developed by B2Gold was the Otjikoto mine in Namibia, acquired through a deal with Auryx Gold in 2011.

In 2014, B2Gold also acquired ASX-listed Papillon Resources, which owns the Fekola project in Mali. If I remember correctly, Fekola was a controversial project at the time, and some analysts at Bay Street expressed doubts about B2Gold’s ability to successfully complete the development of a large tier-one Fekola mine producing 350-400k ounces per year.

However, B2Gold was able to complete Fekola’s development on time and on budget, and by 2018 the company’s production had surged to approximately 1 million ounces.

In 2019, B2Gold sold its Nicaraguan mines to Caliber Mining, a move that many investors and analysts speculated was intended to recycle funds from small Nicaraguan mines into potentially larger/newer development assets.

For a while, investors (myself included) believed that a logical acquisition for B2Gold would be the Twin Hills project in Namibia, owned by Osino Resources (OSI:CA), as that project was being advanced by the same management team that sold Otjikoto to B2Gold, and have very similar geology and operations.

Another possibility is to expand its mining operations in Mali by acquiring nearby deposits and injecting them into the Fekola complex. B2Gold’s get ASX-listed company Oklo Resources is an example of this strategy.

However, B2Gold surprise Attract investors through the 2023 acquisition of Sabina Gold and its massive Back River project in Nunavut, Canada.

B2Gold meets new challenges

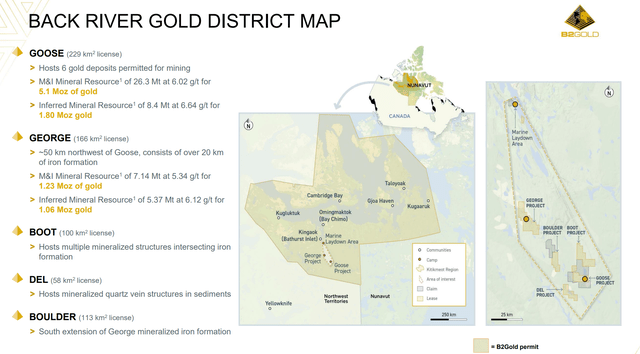

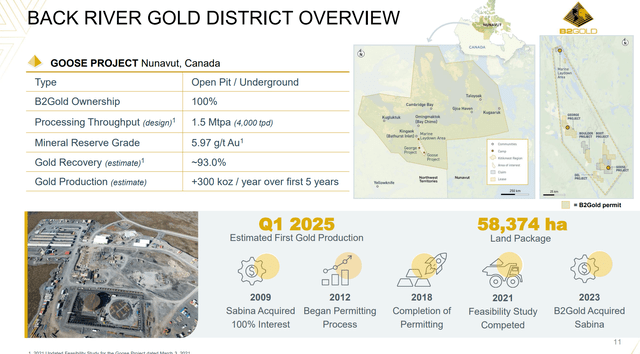

There is no doubt that Back River is a regional gold project with mineral resources of over 9 million ounces of gold in 2 deposits (Goose and George) and virtually unlimited exploration potential (Figure 2).

Figure 2 – Overview of Houhe River (BTG investor introduction)

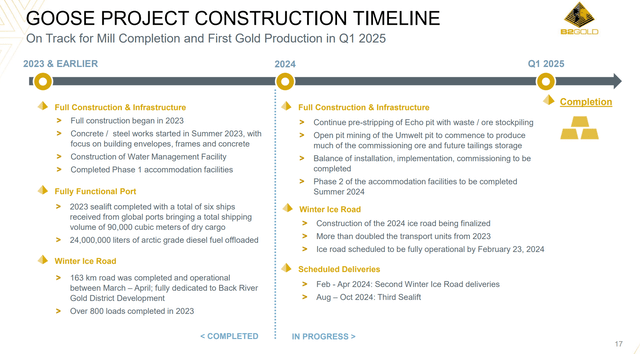

A challenge for Back River in realizing its full potential has been the project’s remote location, as it is located in Nunavut, Canada’s northernmost territory. investor geology A good overview of the challenges of working here, but as an example B2Gold had to build their own harbor and winter ice road before construction of the actual project could begin (Figure 3).

Figure 3-Houhe Construction Timetable (BTG investor introduction)

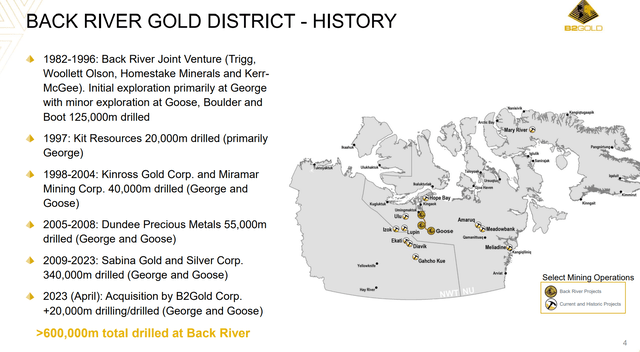

This is why, although the Back River gold zone was discovered in 1982, it was never fully developed until B2Gold acquired Sabina and approved the project (Figure 4).

Figure 4-History of Houhe (BTG investor introduction)

Once completed in the first quarter of 2025, Back River is expected to produce over 300,000 ounces of gold within the first five years (Figure 5).

Figure 5 – Houhe Yield Estimation (BTG investor introduction)

Cost overruns are my biggest concern

While many analysts and investors have been talking up B2Gold’s dividend and “bounce back potential” for months, I’ve been more cautious due to the risks involved in developing the Back River project. As a long-term resources investor, I understand how challenging building a mine can be even under the best of circumstances. However, in B2Gold’s case, it also has to contend with extreme weather and inflationary pressures in Canada’s Far North.

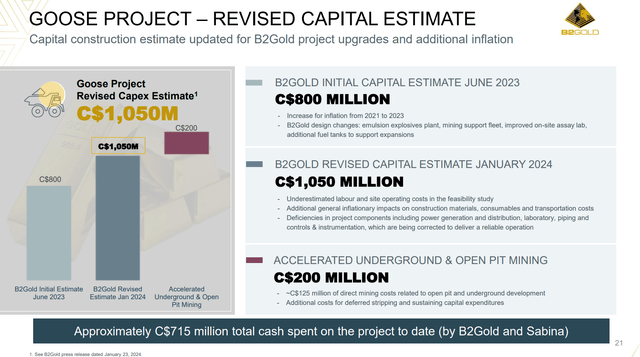

My fears became reality when B2Gold recently raised its project cost estimate by $450 million (+56%) from last June’s estimate of $800 million (Figure 6).

Figure 6 – Back River’s revised capital estimates (BTG investor introduction)

While I’m hopeful that the final cost will be within B2Gold’s revised estimate of $1.25 billion, investors also need to be prepared because that number could climb significantly as construction develops in the coming quarters.

To get a sense of how severe construction inflation could become, investors can examine TC Energy’s (TRP) Coastal GasLink project in the relatively mild climate of British Columbia. When the project was initially approved several years ago, Coastal GasLink estimated Costing CAD 6.6 billion.However, Coastal GasLink’s cost to date has soared to C$14.5 billion (February 2023 estimate), with the final consistent That number is likely to be even higher as construction drags on into 2024.

Back River expected to outperform once costs are finalized

While history doesn’t repeat itself, it often rhymes. Investors currently considering B2Gold can learn about the reasons for its recent poor performance by studying the stock’s history.

B2Gold underperformed the VanEck Gold Miners ETF (GDX) from June 2015, when the Fekola mine was sanctioned, until March 2016, when the company arranged financing to fully fund Fekola construction (Figure 7).

Figure 7 – BTG underperformed GDX between June 2015 and March 2016 (Seeking Alpha)

Incidentally, B2Gold also uses forward gold sales to fund Fekola. Once funding is secured, we could see B2Gold significantly outperforming its peers on a future basis (Figure 8).

Figure 8 – After Fekola received financing, BTG outperformed the market (Seeking Alpha)

Currently, for B2Gold, it has been underperforming GDX since acquiring Sabina in April 2023, as the market did not believe the company’s original cost estimates (Figure 9). Unfortunately, the market was proven correct when B2Gold recently released significantly higher cost estimates.

Figure 9 – BTG has lagged GDX since April 2023 (Seeking Alpha)

If the recent cost increases are the final result, we may see a bottom in B2Gold’s share price. Otherwise, B2Gold may continue to underperform.

Despite challenges, B2Gold weathers the storm

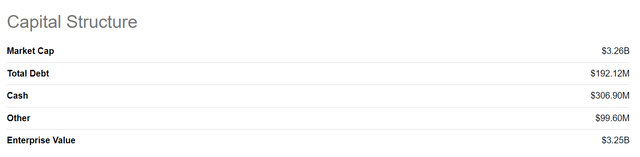

However, despite the capital cost challenges, I do expect B2Gold to eventually pull through and complete the Back River project. B2Gold currently has a pristine balance sheet with debt of only US$190 million and LTM operating cash flow (“CFO”) of US$715 million (Figure 10).

Figure 10-BTG Enterprise Value (Seeking Alpha)

Even if Back River capital costs are overrun by hundreds of millions of dollars, B2Gold should be able to borrow the money and complete the project without putting a strain on its balance sheet.

As an example of B2Gold’s financing capabilities, the company recently announced that following the end of 2023, it conducted a series of prepaid gold sales, receiving an upfront payment of $500 million from July 2025 in exchange for 264,775 ounces of gold to In June 2026, the forward price of gold was approximately $2,191 per ounce. This represents approximately 10% of the company’s projected annual gold production in 2025 and 2026, and should adequately fund the aforementioned Back River capital overruns without diluting shareholders.

The future is indeed bright for B2Gold

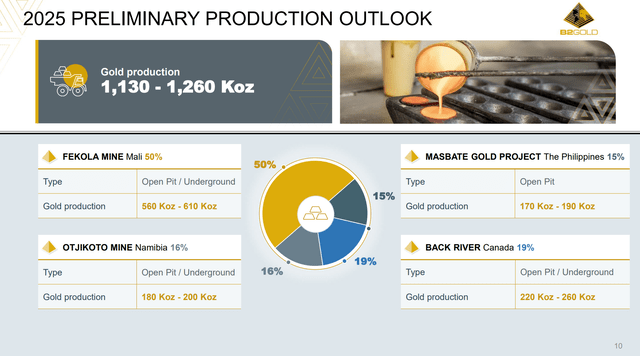

Once Back River is completed, annual B2Gold production should be approximately 1.2 million ounces (Figure 11).

Figure 11 – BTG expected production in 2025 (BTG investor introduction)

Current enterprise all-in sustaining costs (“AISC”) estimates are approximately US$1,400/oz in 2024, assuming a realized gold price of US$2,000 (Figure 12).

Figure 12 – BTG Production Cost Guidance (BTG investor introduction)

Note that this FCF number may be conservative due to Back River’s 2021 Feasibility Study show Cash cost is US$679/oz and AISC is US$775/oz. Even though costs have risen significantly since 2021, Back River’s costs should still be below B2Gold’s current corporate average.

Company is wildly successful, but investor returns are subpar

Taking a step back, B2Gold might be a perfect example of how tough the gold mining business can be. In many ways, B2Gold has been a huge success, as the company grew production from 0 to approximately 1 million ounces in 20 years through shrewd M&A deals and state-of-the-art mine construction.

However, an investor who purchased the IPO at CAD$2.50 would only achieve a total return of 66%, or a CAGR of 3.2% (Figure 13).

Figure 13 – B2Gold’s CAGR since IPO is only 3.2% (Seeking Alpha)

That’s why, for most investors who don’t have the time to understand the nuances of specific projects and companies, I recommend they stick with royalty companies like Wheaton Precious Metals (WPM) or through the SPDR Gold Shares ETF (GLD) Wait for bullion trusts to buy the commodities themselves. .

Simply “buy gold stocks at a 6% yield” is unlikely to work if you don’t understand what’s driving stocks down.

Risks faced by B2Gold

B2Gold’s biggest recent risk remains cost overruns at Back River. As mentioned above, B2Gold is unlikely to gain investor support until costs are finalized, no matter how “cheap” it looks on paper.

Another risk for B2Gold relates to its current production. As the company noted in its most recent earnings report, 2024 production is expected to be 860-940,000 ounces, down from previous guidance and estimates due to “lower production from the Fekola complex due to delays in obtaining the Fekola mining license” in Mali The government issued regional news delaying the shipment of 80,000 to 100,000 ounces of ore that was due to be trucked to the Fekola plant in 2024 and processed over the life of the mine.”

Geopolitical risks, such as Malley permit delays, are difficult to estimate and plan for. Coupled with ongoing guerrilla attacks, Fekola’s production could be further reduced with little notice.

On the bright side, as a gold producer, B2Gold will clearly benefit if gold prices rise. If gold prices rise significantly, B2Gold stock should definitely do well.

in conclusion

To be clear, if you buy B2Gold here, I believe you are betting that Back River’s costs are realistic now and will not rise further. If this is indeed the case, B2Gold should outperform its peers going forward.

I personally think that given B2Gold’s track record in developing and building mines, people can start making this bet, so I rate B2Gold speculative buying. Readers can judge for themselves.