f11photo/iStock via Getty Images

introduce

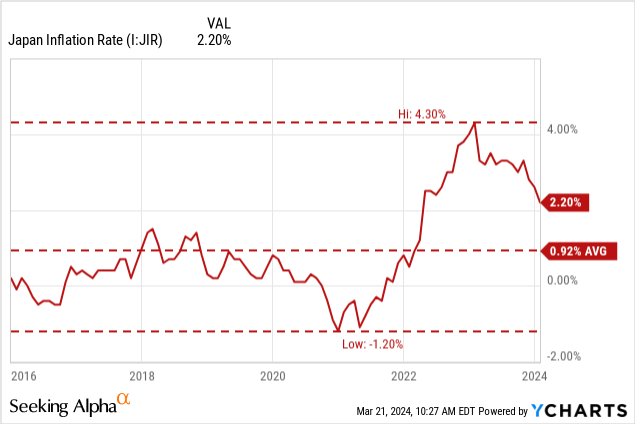

The Bank of Japan (BOJ) finally ended its experiment with negative interest rates this week. Since 2016, Nichigin has kept key interest rates below 0% in an effort to create synthetic inflation, effectively charging deposit fees.The purpose of this is to provide Consumers spend more and save less.

This approach continued for several years, with the yen experiencing positive inflation, until the global stagflation crisis in 2021-2022 caused the yen to fall back into negative inflation territory.

Japan’s currency has historically been under deflationary pressure, which has created a culture of stagnant prices and domestic companies have been hesitant to raise prices amid the threat of a consumer backlash.

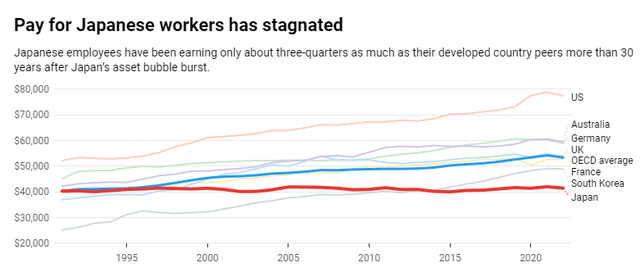

Breaking the salary stagnation

For a long time, there has been no real growth in wages for Japanese workers.what increase They do believe in keeping with inflation. The chart below depicts real wages, i.e. wages that take inflation/deflation into account.

figure 1 (OECD)

In a statement on why it ended its experiment with negative interest rates, Nichigin said they expected the trend to end.Japan’s unions have been pushing for pay increases after inflation surged in 2023, and they is winning.

This should lead to an increase in consumer spending, which is one factor in persistent inflation over the long term. Nichigin wants to stay at 2%, and to achieve that, consumer spending needs to increase.

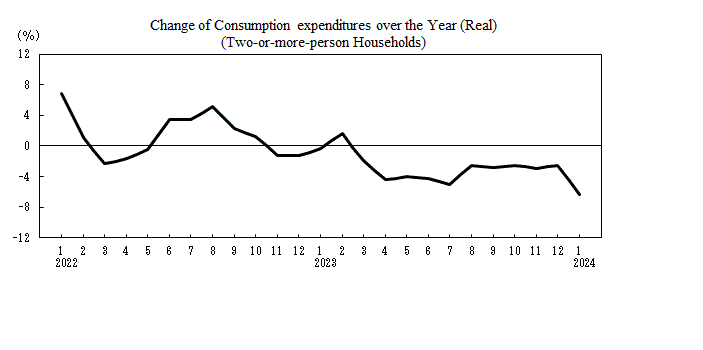

Consumer spending decreases due to the inflation mentioned earlier. The Bank of Japan believes that wage increases will reverse this trend.

figure 2 (Statistics Bureau of Japan)

result

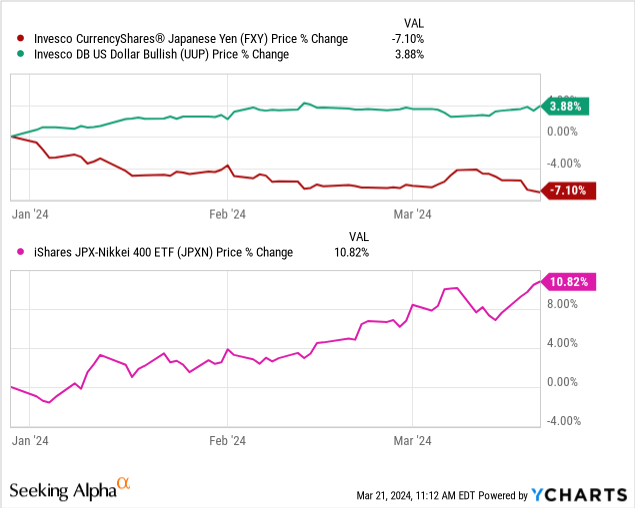

Japan could have Avoiding a technical recession earlier this month. This, along with the Bank of Japan’s statement, pushed Japanese markets to new heights and pushed the yen lower against the dollar.

This policy shift makes me bullish on the Japanese economy and markets, as the longer the inflation narrative continues, the more pricing power domestic companies gain. If the Bank of Japan is right that the yen will regain some strength, that means consumers will also gain more purchasing power for imported goods.

trade

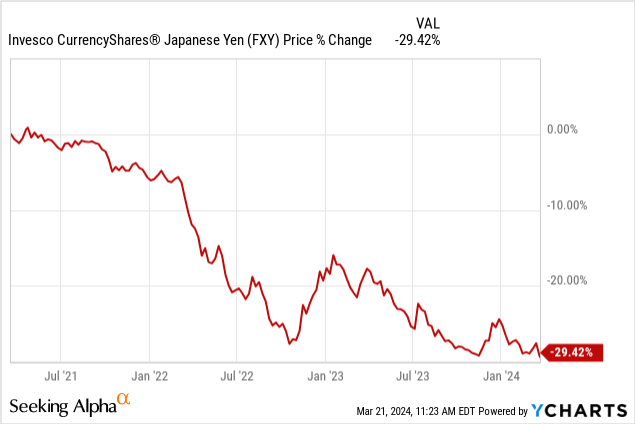

First, investors can consider investing in Nichigin’s argument that the yen will strengthen and continue to inflate. This will allow yen positions to be held through funds such as the Invesco Currency Equity Yen Trust ETF (NYSE:FXY) As we wait for the Bank of Japan’s inflation narrative to play out, here are the trade ideas for the next two to three years.

I view this statement from Nichigin as a “bottom” for the yen, and I believe investors could see yen trading against the dollar recovering the 30% losses of the past three years over the next three years.

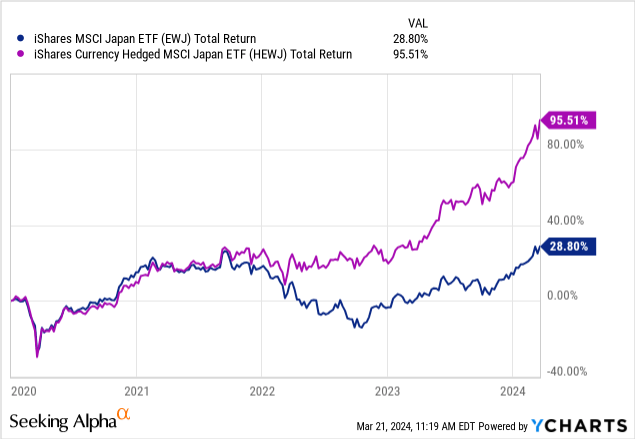

In a world where the yen strengthens, I believe the dollar will follow suit. This means that currency hedging exposure can be beneficial to U.S. investors because they can profit from the interest rate differential between the two.

This can be accomplished through the iShares Currency Hedged MSCI Japan ETF (HEWJ) or the WisdomTree Japan Hedge Equity Fund ETF (DXJ), which eliminate currency risk while still providing exposure to the Japanese market.

There is some resistance to this hedging strategy, but I believe the disparity in returns speaks for itself.

risk

We should consider that the Bank of Japan may be wrong. If we don’t see meaningful growth in consumption, we may see a return of the deflationary pressures that have led to stagnant real wages over the past three decades.

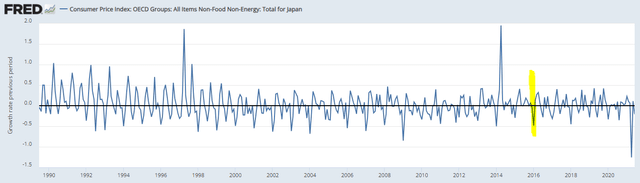

image 3 (Fred)

The chart above is “core-to-core inflation,” which is minus food and energy. The highlighted section is where the negative interest rate experiment begins.

Note that this rate has not changed in any meaningful way since the policy was implemented. It didn’t work because negative inflation still persisted.

If the bank’s new plan is as effective as the last one, we may not see returns on the yen. This is why, despite the bullish yen, I still advocate currency hedging risks.

in conclusion

The Bank of Japan finally announced the end of its seven-year experiment with negative interest rates, creating a buying opportunity for the yen and Japanese stocks. I believe this is the “call from the bottom” of the Bank of Japan.

I am expanding my exposure to Japan, but am wary of adding too much currency risk to my portfolio, so I still recommend hedging exposure for now.

thanks for reading.