pablorebo1984/iStock Editorial via Getty Images

introduce

I looked at it last time bankinter, south australia (OTCPK:BKIMF) (OTCPK:BKNIY) is in the midst of the coronavirus pandemic, and I’m not too optimistic about its operations.Now, almost Four years later, things are obviously completely different. While U.S. banks have had to contend with declining net interest margins, European banks have actually generally seen widening net interest margins, leading to outsized returns.

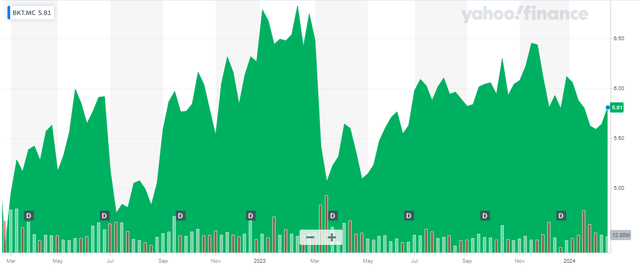

Yahoo Finance

Bankinter’s main listing is on the Madrid Stock Exchange and trades under the ticker BKT.and average daily trading volume With over 3.2 million shares, interested investors should definitely use the main listing. There are currently 899 million shares outstanding, giving a market capitalization of €5.2B based on the current share price of €5.81 per share.

Loan loss provisions remain Up, but high net interest income steals the show

banks international corp. report The highest recurring net profit in the bank’s history, net profit increased by 51%. The excellent performance was mainly due to very strong net interest income performance.

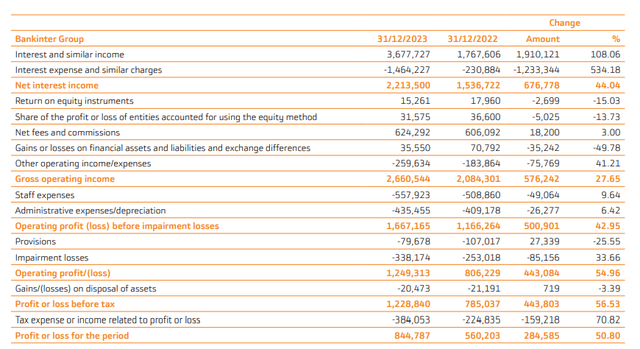

As shown below, total net interest income grew approximately 44% from 2022. Interest expense exceeded six times, total interest income grew by nearly 110%. In absolute terms, this means that interest income increased by €1.9B, while interest expense increased by “only” €1.2B. This represents an increase in total net interest income of more than €676 million.

Bankinter Investor Relations

Bankinter was also able to keep other expenses relatively in line with expectations, which resulted in total operating income of €2.66B, approximately 28% higher than total operating income in 2022. The bank recorded provisions of about 80 million euros and impairment losses of 338 million euros, and although this figure is higher than in 2022, it is clear that the impact on net profit is very small: profit before tax increased by almost 57%, while Net profit rose just under 51% to 845 million euros. With nearly 899 million shares currently outstanding, earnings per share are €0.91. You expected earnings per share of €0.94, but there was a negative impact of around €30 million due to the payment of convertible preference shares, meaning net profit attributable to Bankinter ordinary shareholders was just over €815 million. Bankinter announced a dividend of 0.45 euros per share, with a dividend yield of 7.75% and a dividend yield of approximately 50%.

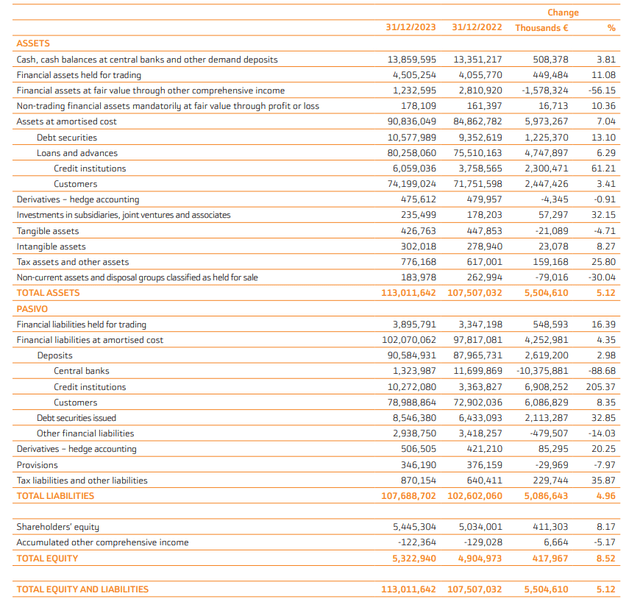

It also means the bank retains more than €400 million of equity on its balance sheet, which helps maintain fairly strong capital ratios. As shown below, the balance sheet expanded by €5.5B in 2023, of which €418M was accrued equity and €5.09B related to the increase in liabilities. This means that despite an expanded balance sheet and an increase in total risk-weighted assets, Bankinter’s capital ratios remain strong.

Bankinter Investor Relations

As you can see above, the balance sheet contains approximately €91B of debt securities and loans, and in 2020 I was a little worried about the loan book, but now, in 2024, things appear to be completely under control. As shown below, only €4.55B of loans are in Stage 2 and Stage 3, while banks have allocated approximately €1.02B of provisions to Stage 3 loans, giving a coverage ratio of over 50%.

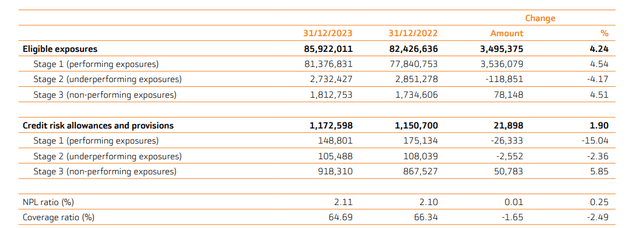

Bankinter Investor Relations

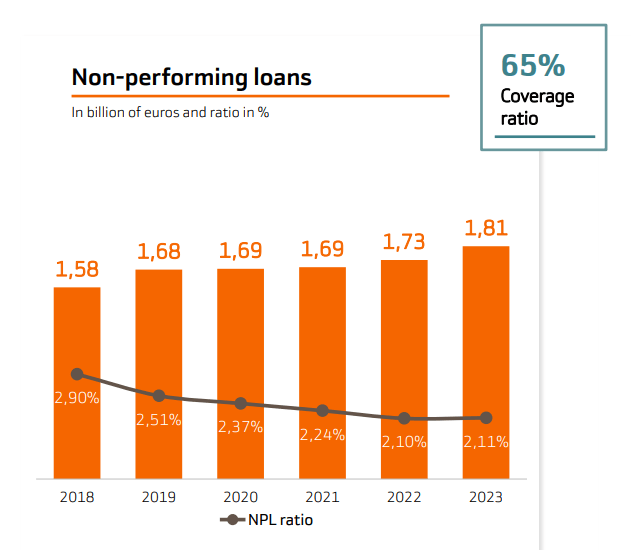

Although total non-performing loans increased in absolute terms, they actually remained stable (compared to 2022) and have declined over the past few years. By the end of 2023, “only” 2.11% of loan book Classified as “Bad”.

Bankinter Investor Relations

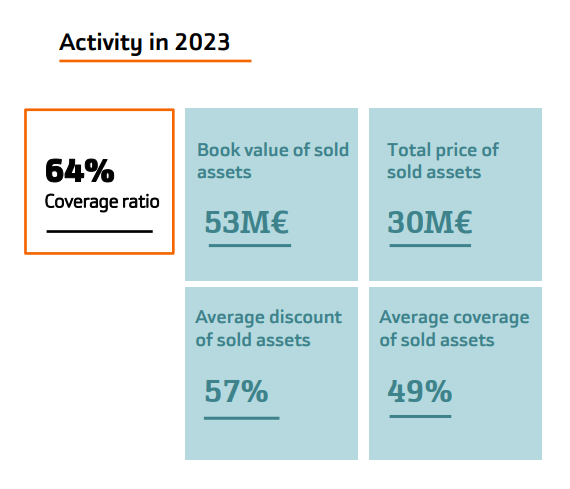

You might be worried about coverage being less than 100%, but you don’t have to worry. The bank provided more details on properties in foreclosure in 2023. As shown below, the monetization process resulted in a 43% discount to the asset’s book value, which obviously does not mean that the entire investment is lost when the loan becomes non-performing.

Bankinter Investor Relations

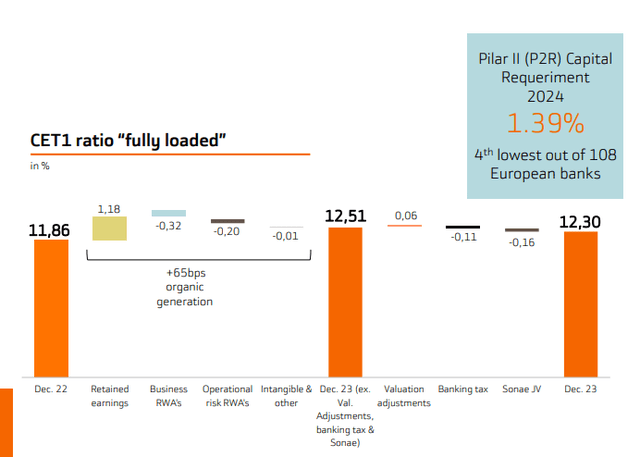

At the same time, the bank’s CET1 ratio remains strong. As shown below, Bankinter’s CET1 ratio as of 2023 is 12.30%. This is significantly higher than the 11.86% at the end of 2022, mainly due to a 118 basis point contribution from retained earnings.

Bankinter Investor Relations

While Bankinter’s CET1 ratio is 12.30%, the mandatory minimum ratio required by the European Central Bank is only 7.8%. This means the bank’s CET capital ratio is about 450 basis points higher than the ECB’s requirement. Since Bankinter’s total risk-weighted assets are €39B and CET1 capital is €4.8B, being 450 basis points above the minimum required amount means that the bank has approximately €1.75B of “excess” capital above the CET1 requirement. This is equivalent to €2 per share. This obviously doesn’t mean Bankinter will distribute excess capital to shareholders, it’s just a useful safety net to protect the balance sheet in tough times.

investment thesis

Bankinter’s 2023 results are sure to exceed expectations thanks to strong growth in net interest margin, which increased to 3.00% in 2023 compared with 2.05% in 2022 and 1.82% in 2021. This margin expansion will undoubtedly help the bank’s profits, and management is optimistic that “2024 will be better than 2023 in terms of net profit.” That’s a bold statement, and it’s part of Bankinter’s appeal, as it means the bank still trades at just over 6 times earnings, while the dividend yield could increase to 8% this year (assuming EPS increases and payouts The interest rate is a stable 50%)). The bank’s tangible book value per share at the end of 2023 was 5.59 euros, which will increase to more than 6 euros per share by the end of this year due to the bank’s ability to retain most of its earnings.

I don’t currently have a position in Bankinter, but its strong performance in 2023 definitely means I’ll be keeping an eye on its near-term performance.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.