z1b

Barrick Gold Stock (NYSE: Gold) has recently fallen sharply due to two major headwinds:

- There are rumors that the Russian-backed military regime in Mali may seize control of GOLD’s Loulo-Gounkoto mining complex, one of the world’s largest gold producers, It is also one of the lowest-cost mines in GOLD.

- GOLD recently reported preliminary first-quarter production figures that were lower than expected.

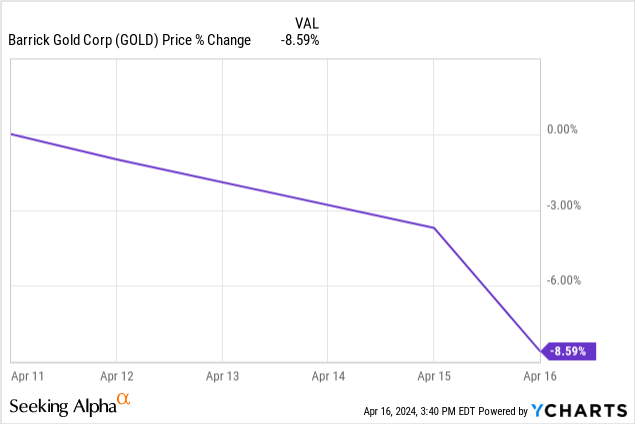

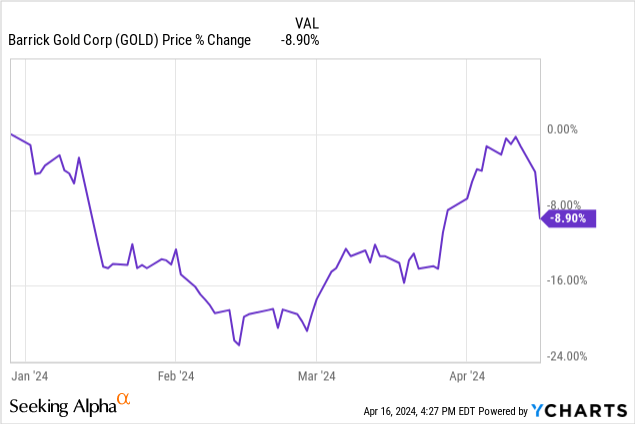

However, the stock’s 8.6% retracement seems a bit extreme:

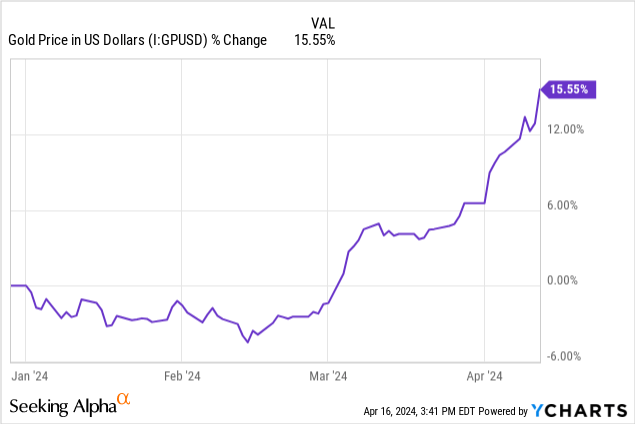

This is especially true given gold’s (GLD) strong gains so far this year:

In this article, I’ll discuss the impact of GOLD’s two major headwinds currently and whether the stock is a buy ahead of its first-quarter earnings release.

Gold Stock Headwind #1: Mali Mine

The Loulo-Gunkoto complex is one of GOLD’s best integrated assets because it AISC is expected to be approximately US$1,200/oz (well below GOLD’s current company-wide AISC guidance of US$1,473/oz), and near-term production is expected to account for more than one-tenth of GOLD’s company-wide production. Furthermore, its production life is quite long as currently proven and probable gold reserves are estimated at 6.7 million ounces and measured and indicated gold resources are estimated at 9.1 million ounces, which is approximately 10x and 13x respectively, and it will be in 2023 What is produced in the year.

There is also reason to be concerned, as the Mali government has recently targeted the mining industry with new mining regulations and industry audits, and the Intahaka gold mine has been confiscated with the support of Russia, raising concerns that Loulo-Gounkoto could be overrun. Rumors. Having said that, there is some good news for gold on this front.as recently X post revealedthe articles spreading these rumors use obscure sources, and there are many reasons to believe that the Malley government will not seize the asset:

- GOLD continues to invest fairly aggressively in the country, seeking more – CEO Mark Bristow said – “High-priority targets with the potential to enable the next generation of major discoveries.”

- Russia’s Wagner Group had previously pushed the Mali government to nationalize the country’s mining industry in the hope of entering these industries, but has recently decided to accept cash payments from the Mali government.

- The Secretary-General of the Ministry of Mines of Mali recently point out There is “space for everyone” in Mali Mining and is not focused on taking over existing operations from international mining companies.

- A large part of Mali’s income comes from the mining industry. If the government wants to confiscate GOLD’s assets in the country, it is likely to prevent Mali from continuing to invest, thus significantly reducing the country’s income.

- The Mali government already owns a significant portion of the Loulo-Gounkoto mining complex (20%, which may increase to 35% under the new mining law), so confiscating the asset will not increase the government’s revenue as much as initially thought, especially Because they may not be able to operate as efficiently as the world’s leading miners like GOLD.

Therefore, while the mine’s valuation deserves a significant discount due to geopolitical uncertainty in the country, we believe the likelihood of GOLD’s assets being nationalized remains well below 50%.

Gold Stock Headwind #2: Poor Production Performance

Gold production and copper output were flat year over year, and overall output was lower than expected, exacerbating the lack of trust and respect from Mr. Market after the company missed its 2023 production guidance. For a company known for having a great CEO and reportedly owning some of the best assets in the world, its recent execution has been pretty poor.

That being said, gold is only slightly behind the pace needed to achieve full-year production guidance, which management did reiterate that it expects to achieve full-year production guidance. Additionally, gold and copper prices have been firm so far this year, which should more than make up for slightly lagging production levels.

Gold Stocks Season 1 Preview

What this means for GOLD’s Q1 report and outlook for the remainder of the year is that profits should be materially higher due to higher margins at current gold and copper prices and higher output and efficiency for the remainder of the year due to increased production increase.

It’s also not surprising (and most welcome) to hear management discussing the prospect of executing a share buyback, as GOLD’s NAV per share has soared this year thanks to rapidly rising gold prices, even though the share price has actually fallen:

Investor Focus: Are Gold Stocks Good to Buy on Dips?

Investors must accept gold’s geopolitical risks if they want to invest in the stock. Despite the Marley rumors and the fundamentally troubling political situation, it still seems unlikely that GOLD will lose its assets in the country, and management is investing capital accordingly.

However, my challenge with the GOLD investment thesis is that while GOLD is significantly riskier geopolitically than blue-chip stocks like Newmont (NEM) and Agnico Eagle Mines (AEM), it should offer returns, a discounted share price, and a higher Asset and management quality.

So far, Bristow has done a good job of not pursuing high-priced acquisitions (compared to NEM), but GOLD’s operating performance leaves a lot to be desired. As a result, the stock price remains heavily discounted and stuck in display mode.

The sheer cheapness of the stock relative to historical averages and some of its peers, along with concerns that Mali may be overblown, make gold a buy during its recent decline, however – until it can prove to Mr. Market that it can deliver on its production guidance and start Generate and return more free cash flow to shareholders – it will likely still be subject to penalties.