Brett Hondo

generalize

My previous rating was Buy (December 2023) because Bath & Body Works (NYSE:BBWI) continues to show very strong execution, as demonstrated by its performance in Q3 ’23, and I expect this to continue into 2024.I’m modifying my rating Switching from buy to hold as I am concerned about BBWI’s ability to meet fiscal 2024 guidance. The stock now trades at a price-to-earnings ratio of 14 times, and expectations are much different than they were just a few months ago. If BBWI fails to meet guidance, I’m afraid the market will punish the stock by lowering its valuation.

Finance/Valuation

Overall sales in the fourth quarter of 2023 (February 29, 2024) increased by 0.8% to US$2.91 billion, higher than market expectations of US$2.84 billion. Sales growth was driven by a 4% increase in U.S. and Canadian store sales, but was offset by a 1% decline in international sales and an 8% decline in e-commerce sales. Gross profit margin exceeded expectations by 116 EBIT margin was 45.9%, and despite a 130 basis point increase in operating expenses from last year, EBIT of $696 million (23.9% EBIT margin) beat consensus estimates of $641 million and $2.26 billion % profit margin. This also resulted in a big jump in earnings per share, which came in at $2.06 compared to $1.88. The key takeaway is that despite modest growth, BBWI has been able to show a very positive performance in terms of profitability. As fiscal 2023 ends, management is guiding for fiscal 2024 net sales growth in the range of -3% to flat, which is below consensus estimates and well below my fiscal 2025 forecast (5% growth). The EPS guidance is quite discouraging compared to my expectations, as it implies earnings of approximately $734 million compared to my expectations of $929 million.

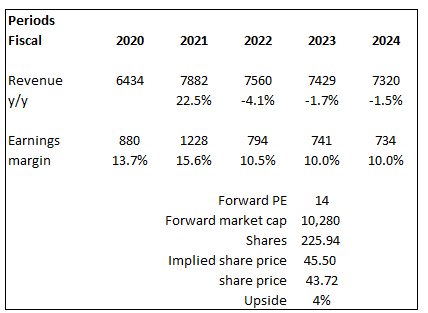

Based on the author’s own mathematical calculations

As I discuss below, I have concerns about BBWI’s ability to meet fiscal 2024 guidance if industry demand continues to slow. In the model above, I expect BBWI’s revenue to decline 1.5% in fiscal 2024 (the midpoint of management’s guidance) and margins to be flat at 10% (also management’s guidance), resulting in revenue of $7.32 billion and earnings of $734 million Dollar. The stock’s valuation has also risen to 14x, meaning a lot of expectations are being injected into the stock compared to six months ago. Therefore, even if BBWI meets its FY2024 guidance, its upside potential is not attractive at all (just 4%).

Comment

BBWI reports strong Q4’23 performance, sending shares up to ~$48 (over 10% from my previous coverage price of $43.72), demand is showing signs of softening, and management’s guidance for FY24 results is quite disappointing Disappointed and trading at a valuation of 14x forward earnings (above average), I’m now switching my stance from Buy to Hold.

Particularly the view on signs of weakness, that worries me a lot because a big part of my bullish view is that demand is going to recover. However, the 4Q23 performance showed signs of softening demand, and I’m not very optimistic about that. If we look at the trends and outlook for each category in the fourth quarter of 2023, it’s quite mixed compared to the positive scenario I expected. Looking at Q4 2023, the body care category grew by a low single digit (LSD) percentage, driven in part by men (this is BBWI’s fastest growing body care category, so growth is natural). However, home fragrance LSD declined, while growth in BBWI’s largest product categories – candles – and disinfectants continued to slow. The good news is that BBWI has managed to retain market share in both categories, but I worry that further declines at the industry level will drag down BBWI’s performance. The weak demand environment also does not appear to be on track for any strong recovery in 1Q24, as BBWI noted traffic pressure in February and noted that its initial floor set-up was not performing as expected. Management also stated that sales will continue to normalize going forward and will only improve between the March 4 quarter of 2024. This basically means that in the short term, the biggest headwinds will persist.

A large part of BBWI’s margin outperformance was driven by AUR growth, which grew 2% in the fourth quarter of fiscal 2023, driven primarily by higher prices in fiscal 2023. AUR expansion drove commodity margin growth by 290 basis points compared to the fourth quarter of 2022. I appreciate the margin improvement, but given that industry demand levels are slowing, I’m concerned that this pricing advantage is unlikely to materialize in 2024. This is a very bad situation for BBWI because:

- If they raise prices, profits will go up, but they may lose market share because consumers may switch to cheaper products on the shelves (note that BBWI products are not the cheapest; there are many others that are cheaper choose).

- If they don’t raise prices, they’ll start to face stiff competition compared to last year, and the lack of margin expansion coupled with weak demand could really hurt stock sentiment. Remember when BBWI stock went from $27 to $48 in less than 6 months? There’s a lot of optimism in stock prices today.

I think option 2 is more likely to happen, as we can tell from management’s comments that they face “limits” to organic price increases. As mentioned, they have “price-sensitive consumers” and expect moderate AUR expansion in FY2024 and flat AUR growth in Q1 2024.

We do have a very price-conscious consumer. So we just make sure that we’re meeting their needs while using our very flexible operating model, where we’re constantly testing the best options.Source: 4Q23 Earnings

Additionally, if we look at the guidance, a large portion of it is measuring 2CH24 performance, which poses a significant risk in terms of expectations. For Q1 2024, BBWI is guiding for net sales of -4.5% to -2.0%, which is a very poor performance (at the low end, it means 40 basis points more decline than fiscal 2023). To hit fiscal 2024 guidance, BBWI essentially needs to see sequential improvement in each quarter or substantial growth in 2CH24. My take is that yes, this may be possible as management will focus on newer categories (note these are new categories so it’s hard to be confident about growth prospects), but I think it’s better to see First understand the demand trends of the entire industry in 2Q24, and then determine whether the FY24 guidance is likely to be achieved and what are the expectations for 2H24. Because if demand continues to underperform in Q2 2024 and there are no signs of recovery by July, this will set a very bad tone for Q3 2024 and investors may think that Q3 2024 will perform Not good, which means having high expectations for what Season 4 will actually do in 2024 to keep up with demand. FY24 Guidance. When that happens, I’m not willing to take the risk that BBWI fails to live up to the ever-increasing expectations. If we look at the forward P/E range at which BBWI trades, it’s now near the high end of that range (14x today versus the typical range of 8.5x to 16.5x). I can totally imagine BBWI missing fiscal 2024 guidance, resulting in a significant rating downgrade to 8.5x, a drop of nearly 50%. BBWI went from $27 to $48 in 6 months, which means it could also fall to around $20 in 6 months if my concerns are confirmed.

The way I monitor industry demand is by tracking management’s comments (specifically details on store traffic) and how management prices its products.For the latter, if BBWI can continue to maintain the current price and If you see an improvement in traffic volumes, it could be a sign that demand is recovering or remains healthy, as current price levels are not structurally hurting traffic volumes.

in conclusion

I recommend a Hold rating on BBWI. Despite good 4Q23 results, signs of softening demand have raised concerns about BBWI’s ability to meet FY24 guidance. Management’s comments about poor traffic conditions in February suggest that the demand environment remains weak in Q1 2024 (and possibly Q2). On top of that, the current forward P/E ratio of 14x reflects higher expectations, so the upside potential is limited. Therefore, I think the move here is to wait and watch the industry demand trends in 1H24 before reassessing the outlook.