Suriyapong Thongsawang/Moment via Getty Images

Fund Overview

BlackRock Resources & Commodity Strategies Trust (NYSE: BCX) is a stock closed-end fund.The fund invests in stocks of companies operating in the commodities sector and the distribution below is based on the latest reports Provided by BlackRock (Reports as of September 30, 2023). These allocations will be updated on December 31, 2023, when the Fund releases its annual report at the end of February 2024.

|

% of fund |

|

|

Chemicals |

7.5% |

|

Containers and packaging |

3.1% |

|

Energy equipment and services |

1.5% |

|

food products |

6.8% |

|

mechanical |

5.2% |

|

Metals and Mining |

32.7% |

|

Petroleum and natural gas |

40.2% |

|

Paper and forest products |

1.4% |

|

total inventory |

98.4% |

The remaining 1.6% of assets are held in various corporate bonds and money market accounts.

Have an in-depth understanding of the funds and the assets they hold funds, I will start making a thesis for buying BCX long term.

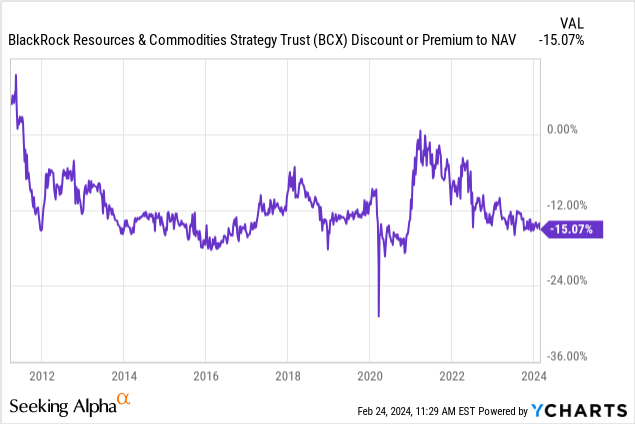

NAV discount

BCX is trading at a steep 15% discount to its net asset value (NAV), providing investors with an excellent opportunity (as of February 24, 2024). In this case, NAV represents the total market value of all stocks held in the fund’s portfolio. By purchasing BCX shares at a significant discount to net asset value, investors effectively gain exposure to the fund’s entire basket of underlying securities at a lower price. This is similar to finding your favorite line of merchandise at a deeply discounted price.

Closed-end funds like BCX occasionally experience discrepancies between market price and NAV. Market dynamics and investor sentiment may cause these temporary fluctuations. Historically, NAV discounts have tended to narrow as market conditions change or investors realize the intrinsic value of the discounted CEFs. This could result in capital appreciation for BCX holders, in addition to potential gains from the underlying shares themselves.

yield

BCX’s 7.00% dividend yield is highly attractive to income-seeking investors. While the fund’s net expense ratio does reduce the net yield to 5.9%, that’s still attractive in the current interest rate environment. However, it is necessary to consider the risks inherent in stocks compared to risk-free Treasuries.

The key to further realizing this potential lies in the changing monetary policy landscape. BCX’s revenue stream could gain even more traction as the Federal Reserve moves toward cutting interest rates later this year.ArgonRecent CNBC investigation This highlights market expectations for a 75 basis point (0.75%) interest rate cut. If this reduction translates directly into lower Treasury yields, BCX could provide a significantly enhanced income advantage compared to these traditionally “safe” assets.

Notably, this rate cut scenario could create two tiers of potential returns for income-oriented investors in BCX:

-

Yield Advantage: As Treasury yields fall, BCX’s fixed yield becomes proportionately more attractive.

-

NAV Appreciation: Lower interest rates generally increase the valuation of dividend stocks, including those held by the fund. This could result in a narrowing of the NAV discount, resulting in capital gains for BCX shareholders.

weighted consensus estimate

The third and final catalyst for BCX’s rise is the weighted consensus estimate for the fund’s shares. Using fund allocations available in prospectuses as of September 30, 2023 (the latest available report at this time) and the average analyst price target provided by Seeking Alpha, this contributes to an asset-weighted upside of 19% for BCX holdings. Here are BCX’s top 10 holdings, comparing current stock performance to consensus analysis estimates.

|

stock ticker |

Share price as of February 23, 2024 |

Consensus Analyst Target |

Update/(down)% |

|

Sher |

$63.93 |

$74.02 |

15.8% |

|

Thermocouple |

$64.51 |

$75.83 |

17.5% |

|

XOM |

$103.84 |

$124.18 |

19.6% |

|

CVX |

$154.66 |

$178.05 |

15.1% |

|

BHP Billiton |

$58.31 |

$62.38 |

7.0% |

|

blood pressure |

$35.38 |

$42.68 |

20.6% |

|

FCX |

$38.96 |

$46.21 |

18.6% |

|

WPM |

$39.86 |

$57.07 |

43.2% |

|

SMFTF* |

$41.00 |

not applicable |

not applicable |

|

CF |

$80.41 |

$86.05 |

7.0% |

(Note: No consensus estimate is provided for SMFTF)

generalize

BCX’s compelling discount to NAV, respectable dividend yield, and potential for underlying asset appreciation make it a strong contender for investment consideration. The current discount offers the opportunity to acquire a diversified portfolio of commodities-focused stocks at bargain prices. At the same time, the income stream provides a cushion that – especially in times of market volatility – could become more attractive relative to Treasuries once expected rate cuts materialize.

For income-oriented investors, BCX offers a potential alternative to traditional fixed income assets, especially in a falling interest rate environment. The combination of interest rate cuts and BCX yields could create a compelling income advantage. Additionally, lower interest rates could act as a catalyst for a narrowing of the NAV discount, potentially resulting in additional returns for BCX shareholders.