Darren 415

Welcome to another installment of our weekly BDC market review, where we work from the bottom up, highlighting individual news and events, as well as the top down, providing a broader market overview.

We also try to add some historical context and relevant themes that appear to be driving the market or that investors should be aware of. This update covers the third week of February.

market action

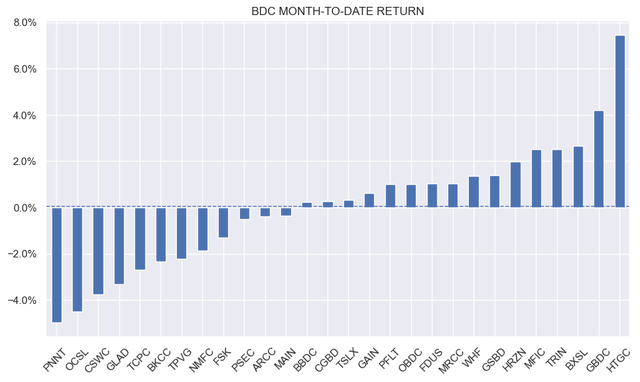

BDC recovered from a bout of weakness this week with a total return of 2%. Higher-than-expected inflation data and its knock-on impact on the Federal Reserve’s policy rate, as well as good industry profits, are supporting prices. The industry has been pretty flat so far this month.

systematic income

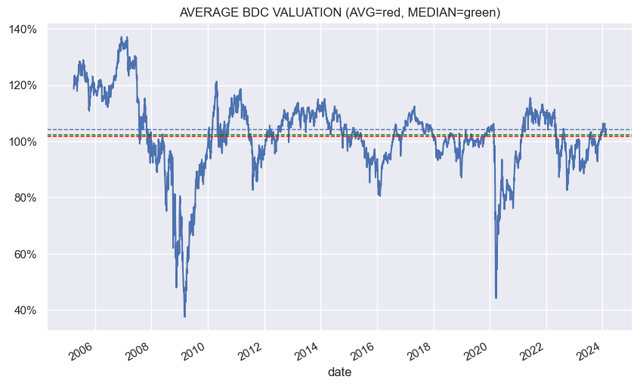

The average valuation is slightly higher than historical average.

systematic income

market theme

As BDC investors know, the key drivers of company performance are investment income from loans and occasional fees and equity appreciation on exits through IPOs.

However, there are several other sources of key performance that are less common and less common in BDCs. It’s important to pay close attention to these factors because they can continually improve a given company’s performance relative to its peers.

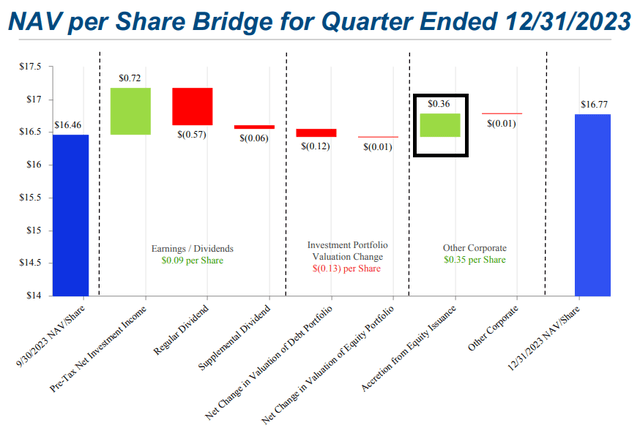

A common additional source of performance is issuing shares at a premium to the share price. The higher the issue price is above the net asset value, the greater the increase in the net asset value. Capital Southwest (CSWC) is a leader in this source of performance, typically growing its NAV by 1-2% each quarter. This source of performance is conditional on the stock price remaining above net asset value. The risk here is that if the price remains at or below NAV, the company’s performance will take a hit, potentially keeping its valuation at a modest level, thereby removing the performance pillar it has been enjoying.

CSWC

Other more sustainable sources of performance are structural features such as low fees or low debt costs, whether through higher credit quality or through opportunistic refinancing and issuance. These can be relatively sustainable, as companies are unlikely to raise their fees (in fact, as we discussed in the most recent week, fees have been falling for existing and new BDCs). Low-fee or internally managed BDCs such as GBDC or BXSL, as well as high-quality BDCs with relatively low interest charges (such as ARCC, etc.) are relatively simple and sustainable ways for BDCs to maintain their performance above their peers.

Some BDCs enjoy relatively risk-free returns, unlike the industry which derives most of its returns from riskier loans. For example, Main Street Capital (MAIN) has an advisory business that charges asset management fees by running outside portfolios. These fees may disappear if the consulting relationship ends, but as long as they continue, they are a risk-free annuity to MAIN.

Other sustainability advantages include borrowing from the U.S. Small Business Administration (SBA), which provides cheap, long-term loans to BDCs through the SBIC bond program. These loans are free to advance and do not count toward regulatory leverage, adding significant flexibility to BDC capital structures. Companies like NMFC, FDUS, CSWC, etc. have availed of this scheme.

The takeaway here is that in addition to common sources of return such as investment income, fees and equity appreciation, investors should also consider other, less common sources of return that are more sustainable and less risky to create for a specific BDC Competitive Advantage.

Market comments

BBDC joined the club of 2024 BDC bond issuers with the issuance of $300 million of 7% 2029 bonds. Interestingly, the company has no maturity date in 2024, so there’s nothing to refinance. What it does have is a relatively high proportion of secured debt, and as usual, that’s on a floating-rate basis. The company currently pays an interest rate of 7.3% on this line of credit, so it is slightly higher than the 7% it pays on the bonds. In addition to lowering its current overall interest expense (by replacing part of the credit facility with bonds), it may also reduce the number of covenants it is subject to on the facility. Its net debt-to-equity ratio of 1.18x is slightly above average and has been rising over the past few quarters compared to most other BDCs. The offering will push it higher.

BDC PSEC had a poor fourth quarter, with a return on total net asset value of -1.7%, the first of the BDCs we cover to post a negative fourth quarter so far. NAV fell 3.6%, but non-accruals and net realized losses performed well, which seems odd. Total NAV return over the past year was -3.1% – difficult to explain in the context of a median BDC of +10%. The company’s portfolio of large-cap affiliate REITs and CLO Equity has less transparency, making it difficult to have a strong positive belief in it, which is one reason its valuation is so low.

Positions and Points

Based on the above discussion, we pay close attention to some sustainable sources of performance. For example, we like GBDC because it has the lowest fee structure, and FDUS because of timely refinancing and no floating rate debt, which results in lower debt costs. Obviously, these return streams don’t override strong investment income, but they complement strong long-term returns.