sculpies/iStock via Getty Images

My most successful findings in the stock market are companies that have suffered significant losses but have improved significantly but have not yet been recognized by investors. I call it transformation. BITZER HOME USA, LLC (NYSE: BZH)Is a Best example. Unlike many turnarounds in my investments, the turnaround here is essentially complete. However, despite similar future prospects, it still trades at a significant discount to its peers.

I usually do a peer comparison at the end of the article. But since peer comparison is at the heart of this article, we’ll discuss it directly.

Peer comparison

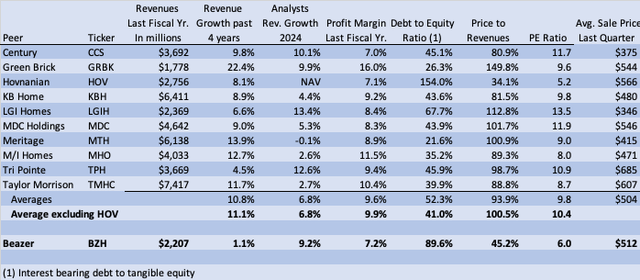

For the peer group, I used all homebuilders in Value Line’s regular and small-cap versions with revenue of $1-10 billion in the last fiscal year, as well as four years of publicly traded performance. Ten comparable objects were found.

value Line, Yahoo Finance, SEC filings

Looking at peers (excluding struggling Hovnanian), Beazer has grown revenue at a much slower pace over the past four years, has higher leverage and slightly lower margins. The company’s price-to-earnings ratio is also 55% lower than its peers. If you look at the P/E ratio, you’ll see it’s 42% lower.

At first glance, you might say that Beazer deserves a much lower valuation based on historical growth, leverage, and margins.

To explain why I think this is no longer the case, let’s start with some history. The 2007-2009 recession was brutal for all homebuilders except NVR. All of them lost money and saw revenue plummet. By the mid-2010s, all but two companies had returned to stable profitability. Those two people were Bitzer and Hovnanian. Hovnanian was and is in worse shape, and remains more leveraged. From 2015 to 2020, Beazer had small profits or losses. The company focused on improving profit margins at the expense of revenue growth.

Fast forward to today and things have changed.

- Beazer’s margins have expanded to near peer levels.

- Analysts expect Beazer’s revenue to grow faster than its peers this year and similarly in the future

- While their leverage is higher than that of their peers, it has reached a level that no longer limits them in any way

Leverage is only a problem if it limits the firm’s ability to take advantage of opportunities or significantly increases interest costs. With interest-bearing debt of less than half its inventory (completed homes, homes under construction, and land), Bitzer could easily pay it down if they wanted to. Beazer’s leverage is actually below historical averages, not just for Beazer but for the industry as a whole. It’s just that the industry has been so strong for almost a decade that peers (except Hovnanian) have healthy balance sheets. Management expects to continue reducing debt.

background

Beazer is a large homebuilder based in Atlanta. Its operations are primarily in the fastest-growing states. In 2023, 61% of their revenue will come from Western markets, namely Arizona, California, Nevada, and Texas. Arizona, Nevada and Texas are among the fastest growing states. California, while growing slowly, remains a good market for homebuilders. Their Southeast market accounted for 19% of sales last year. These states include Florida, Georgia, North Carolina and South Carolina, all of which are growing rapidly. Their Eastern region also accounts for 19% of sales, but in slower-growing states such as Delaware, Indiana, Maryland, New Jersey, Tennessee and Virginia.

Operating results

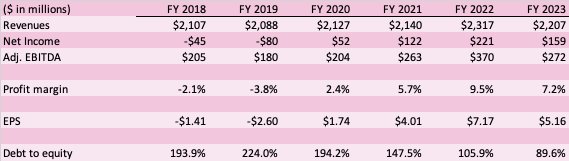

Operating performance for the past six fiscal years (ending September 2023) is as follows.

SEC Filings

As shown above, revenue has been essentially flat over the past six years, while its peers have grown significantly. In fiscal 2019, California saw a $107 million impairment on land that would otherwise have been a profit for the year. Instead of focusing on revenue growth, the company focused on improving profit margins, and it succeeded. It is also working to improve its balance sheet. During this period, the ratio of interest-bearing debt to tangible equity fell from 194% to 90%. Management is committed to further reducing this ratio.

Revenue for the quarter ended December 31, 2023 was $387 million, down 13% from the same period a year earlier. EPS was $0.70, down from $0.80 a year ago. Last quarter was a down quarter for the industry due to high interest rates, which peaked during the quarter and has declined since then. Management also said on the earnings call that their mismatched competitors are running heavy promotions. They also noted that problems with a title insurance provider resulted in a closing of approximately $20 million this quarter. Finally, they noted that the industry has seen fewer discounts so far this quarter and that margins are improving.

guide

On February 1, 2024, management provided the following guidance.

- Earnings per share for the current quarter are expected to be $0.90.

- The number of housing units delivered in fiscal year 2024 will exceed 4,700 units, an increase of at least 10%

- Average selling price was $510,000, unchanged from fiscal 2023

- Gross profit margin in fiscal year 2024 is 21.5% to 22%

- EBITDA in fiscal year 2024 is US$260-280 million, the same as in fiscal year 2023

- Earnings per share of at least $4.50 in fiscal 2024

As mentioned earlier, the guided revenue growth number exceeded peer analyst expectations. This is probably the thing investors missed the most…the company is apparently no longer playing defense. They are now committed to growing at or above the level of their peers.

catalyst

In addition to a valuation disconnect from its peers, Beazer has a number of catalysts for improved operating performance. These are shown below.

1. Leverage reduce – Leverage is actually an opportunity, as continued earnings growth should lead to lower debt levels. This means lower interest payments in the future.

2. Growth markets – Beazer is found in most of the fastest growing states, including Florida, Texas, Arizona, Nevada and the Carolinas.

3. Lower interest rates – The biggest obstacle to new home sales right now is high interest rates. The Fed is guiding for three rate cuts later this year. This will make homes more affordable and increase demand.

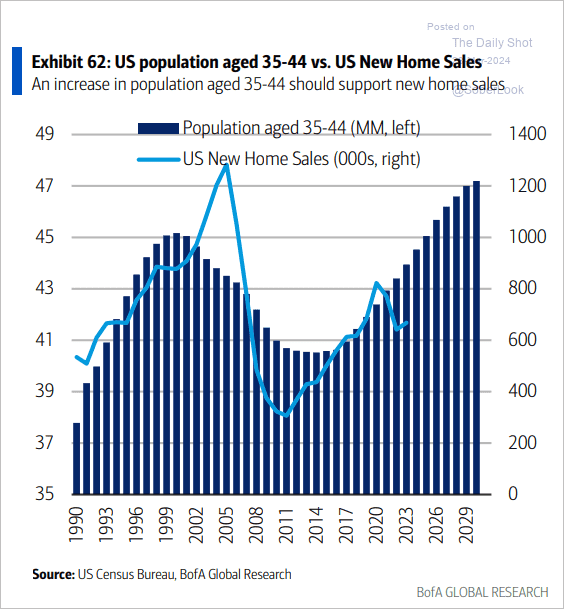

4. Pent-up demand – U.S. News January estimates Pent-up demand for new homes ranges from 1.5 million to 3.9 million units. Freddie Mac also in January, The housing gap is estimated at 3.8 million units. The chart below shows one measure of pent-up demand.

U.S. Census Bureau, Bank of America

5. Land holdings and number of communities – Requires increased land holdings and number of communities to increase capacity. As of December 31, 2023, the number of active communities was 136, an increase of 14% compared with the same period last year. Management’s goal is to have more than 200 active communities by the end of fiscal 2026, September 30, 2026. The annual growth rate exceeds 15%. As of September 30, 2023, land holdings were $910 million, up 19% from a year ago. As of December 31, 2023, the total was $977 million, an increase of another 7% in three months. There’s no clearer sign that the company is pursuing strong growth than these numbers.

worry

1. Economic recession – The residential construction industry has a cyclical history. However, if a recession occurs this year or next, this could be partially or fully offset by lower interest rates and pent-up demand.

2. Lower interest rates – This, while listed as an advantage, is actually a two-edged sword. Lower interest rates will bring a large number of homes onto the market. Many people looking to sell are holding off because they don’t want to trade the current interest rates below 4% for rates closer to 7% to buy the home they move into. The increased supply of existing homes is weighing on prices and making some buyers less likely to consider purchasing a new home.

Valuation

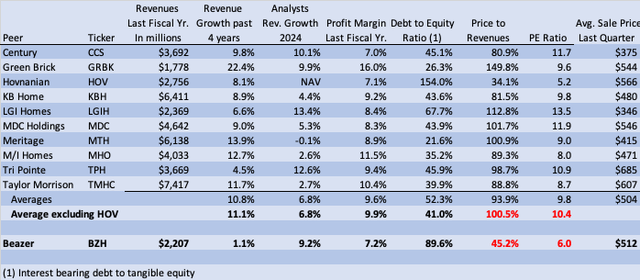

For valuation purposes, I’ve reproduced the peer comparison chart at the beginning of this article.

Value Line, Yahoo Finance, SEC filings

Beazer’s price-to-earnings ratio is 55% lower than its peers (excluding Hovnanian). If you look at the P/E ratio, you’ll see that it’s trading 42% lower. Combining these two measures, peers are trading at roughly twice the price Beazer is trading at.

So, the question people have to ask is, is Beazer really that bad? Obviously the answer is no. Lower margins are more of a tailwind (opportunity) going forward. Beazer and analysts expect Beazer’s revenue growth this year will exceed the industry average. The only areas where they’re really lagging are in their leverage and EPS guidance for the year. Leverage is falling rapidly and no longer limits their plans. They expect earnings of at least $4.50 per share, which, while in line with analysts’ expectations, would be a 13% decline from fiscal 2023 if it hits that mark. Analysts believe seven of nine peers will post earnings per share growth this year. To me, this is the main area where it underperforms compared to its peers and does require some discounting. Based on these factors, my price target adopts a P/E ratio of 10, which is the same as its peers. Management expects fiscal 2024 earnings per share to be at least $4.50. That’s ten times the price of $45. This is 41% higher than the closing price of $31.88 on March 27, 2024. This assumes they have just met or are close to their guidelines. If they exceed guidance, then it could rise even higher.

By the way, Hovnanian is also taken into account here. They’re no longer in financial distress, and the upside could be even higher. I prefer Beazer because there is much less risk in a recession.

take away

Beazer nearly went bankrupt after the 2007-2009 recession. It has struggled for about a decade since then while its peers have soared. This caused investors to turn a blind eye. But the company has now proven that the recovery is real, with three years of strong performance and a big growth plan they can easily finance. Wall Street sentiment is just starting to change, and I expect the stock to move higher.